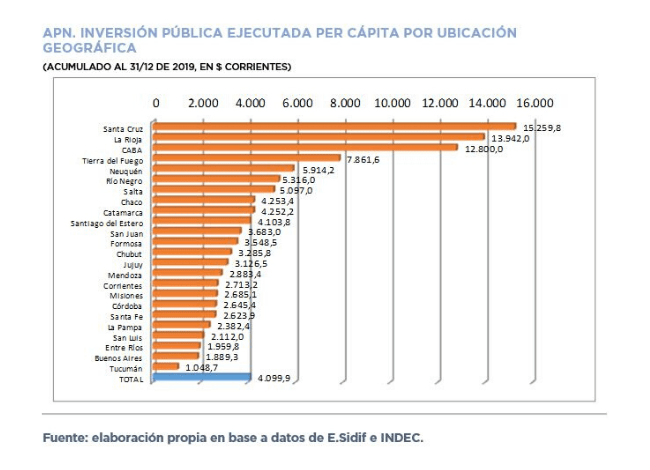

Public Investment executed during 2019 totaled AR$251.52 billion which, after adjusting for AR$67.28 billion of advances to suppliers included last year asset adjustment of Real Direct Investment, amounted to AR$184.24 billion (-29.7% real variation YoY). This is explained by the reduction of capital transfers (-39.7% YoY), which could not be offset by the increase in Real Direct Investment (2.1% YoY) so public investment measured as a proportion of total expenditure (3.94%) and GDP (0.85%) dropped in 2019.

The current appropriation was 15.6% lower than budgeted in real terms, execution level was at 82.8%, and the average value was AR$4,100 per capita, implying a drop compared to 2018 in real terms.

Expenditure on Real Direct Investment totaled AR$ 87.06 billion in 2019, of which 89.5% were investment projects and 10.5% acquisition of capital goods, with an implementation level of 79.7% and 64.0%, respectively. The drop in Real Direct Investment was of -13.8% YoY in real terms, compared to 2018, given that the decrease in the acquisition of capital goods (-62.9%) could not be offset by the increase of investment projects (+2.1%).

Last year ended with 782 projects with positive current appropriation for AR$97.75 billion, 50% of which were concentrated in 14 projects (1.8%). Only one work comprised 96.5% of them and the rest contained multiple works bringing the total to 840.

The 50 most important works accounted for 72.3% of current appropriations and the financial investment reached 79.4%, a level comparable to the average. The physical execution of these 50 works was highly variable, as the initial programming ranged from 0% to 100%, with an average of 34.9%, while the executed works ranged from 0% to 81.1%, with an average of 17.4%. Of the 840 investment projects under execution, 43.7% showed a minimum degree of physical progress and 19.8% showed a high degree of progress.

On the other hand, 70.4% of works have started in previous years, and 10.8% started in 2019, and the projected duration of works is on average 5.9 years, although concentrated in the range of projects of 5 to 6 years and 1 to 3 years.

In 2019, there were 250 investment projects for the Plan Belgrano with a current appropriation of AR$14.8 billion (-26.3% real variation YoY) and expenditures for AR$16.76 billion, of which 57.7% were incurred by the Northwest region and 42,3% by the Northeast region.