FISCAL IMPACT OF BILL 6960-D-2020 TO MODIFY THE INCOME TAX REGIME FOR INDIVIDUALS

This report analyzes the proposed modification of the fourth category income tax and evaluates the potential impact on public sector revenue.

The proposal includes an increase in special exemptions to leave without effect taxation for gross monthly salaries lower than AR$150,000 and reduce the tax burden for those higher than AR$150,000 and lower than AR$173,000.

With respect to pensions based on personal work, it is proposed to modify the specific exemptions, increasing it from 6 to 8 guaranteed minimum salaries.

The Bill includes the delegation of powers to the Executive Branch with respect to the interpretation of subsection c) of Section 30 of the Income Tax Law.

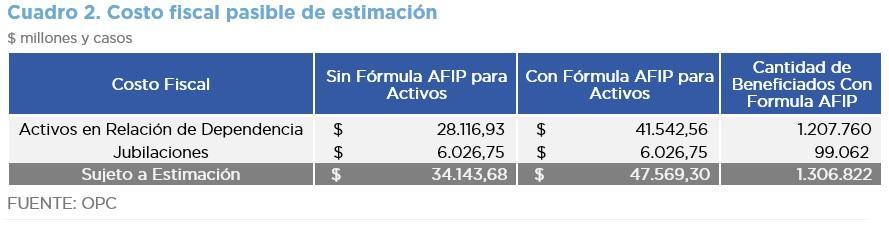

According to OPC’s estimate, the fiscal impact of what is explicitly specified in the Bill would imply a reduction in income tax revenue of AR$34.14 billion which, if a formula introduced by AFIP in the informative meetings of the Budget and Finance Committee of the Chamber of Deputies were to be applied for more than 225,000 taxpayers with salaries between AR$150,000 and AR$173,000, would increase to AR$47.57 billion.