by Nicolas Perez | Sep 12, 2019 | Public Debt Operations

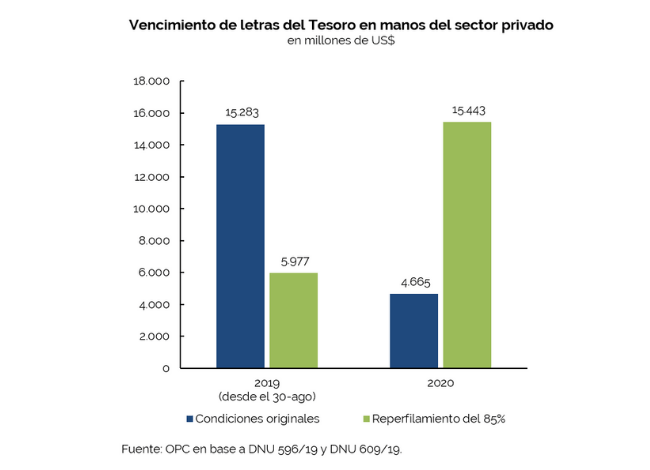

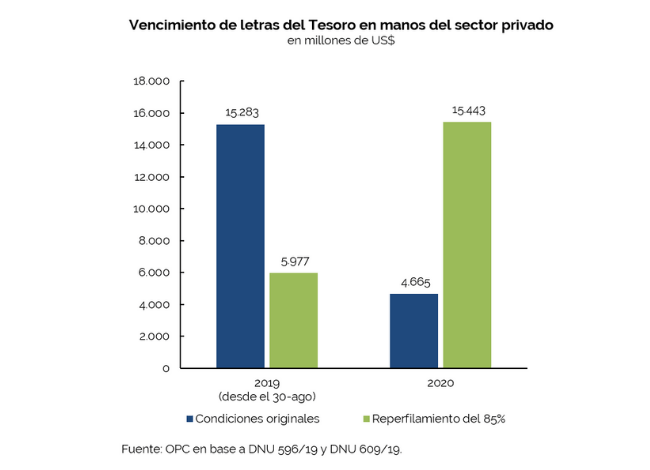

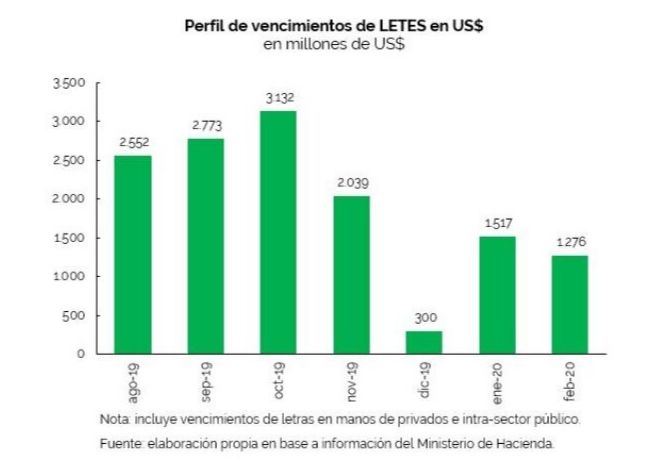

- With the financial markets facing an episode of extreme volatility, the Executive Branch announced in August a rescheduling of the maturities of Treasury bills held by institutional holders.

- The rescheduling reversed the maturity burden: under the original terms, 77% of the payments were to be made this year. But under the new schedule, 72% will be cancelled in 2020. Estimated maturities for 2019 are reduced by USD9.3 billion, but because of the extension of maturities, an additional USD1.47 billion of interest will accrue with respect to the original payment schedule.

- Placements of securities and loan disbursements for the equivalent of USD1.8 billion were recorded in August, mainly with transactions within the public sector.

- Principal and interest cancellations for USD17.06 billion were made during the month, of which 96% were for repayments of principal. The major amortizations for the month were the cancellation of bonds issued as collateral for repo transactions.

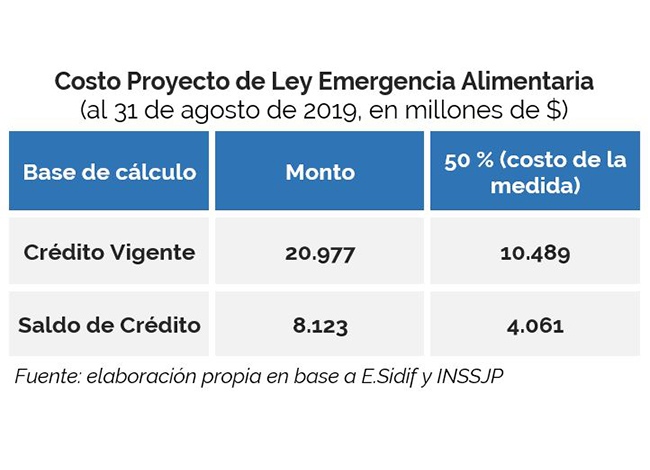

by Nicolas Perez | Sep 11, 2019 | Cost Estimates

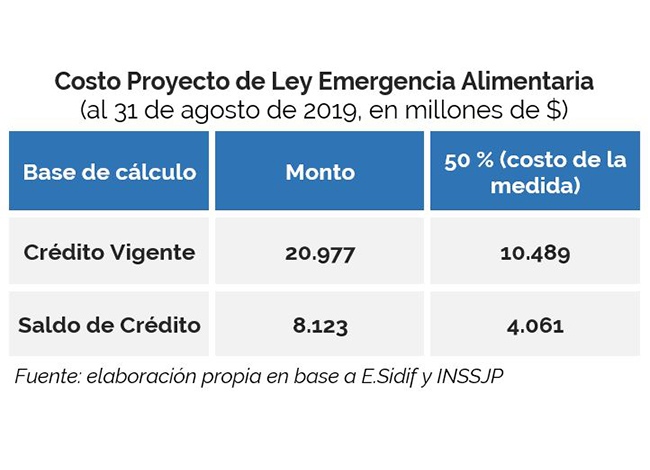

Currently, national public policies on food and nutrition are implemented through the Food Policies and National Social Protection Plan programs, both of the Ministry of Health and Social Development, as well as through the Pro Bienestar program of the National Institute of Social Services for Pensioners and Retirees.

Two possible scenarios for the estimation of a fiscal cost arise from the Bill:

- if the increase is estimated based on the appropriations in force for the identified programs as of August 31, the cost would amount to AR$10.5 billion.

- If the increase is estimated based on the appropriations not executed in the identified programs as of August 31, the cost would amount to $4.06 billion.

by Nicolas Perez | Aug 13, 2019 | Public Debt Operations

Placements of government securities and loan disbursements for USD13.1 billion were recorded during July. The International Monetary Fund (IMF) made the fourth disbursement under the Stand-By Arrangement for USD5.39 billion.

- Treasury Bills in pesos and dollars for the equivalent of USD5.57 billion were placed through three auctions.

- During the month, debt services amounted to USD9.2 billion, USD6.57 billion in payments of principal and USD2.64 billion in interest.

- On July 1, approximately USD1.01 billion of interest were paid on the Discount and Cuasipar bonds.

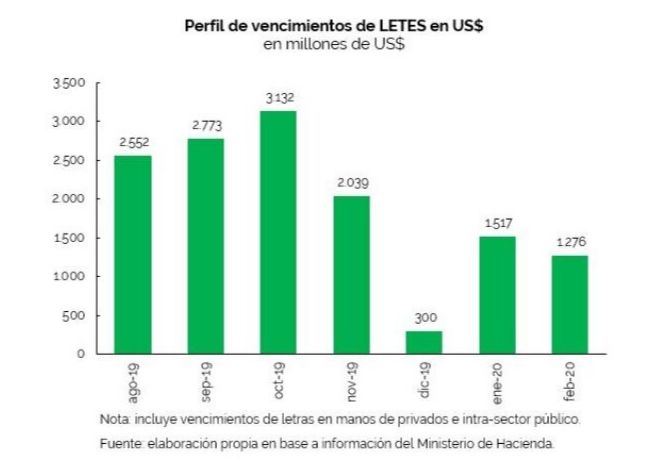

- The main maturities scheduled for August are Treasury bills in pesos and dollars. In addition, interest payments to the IMF for USD240 million are expected to be made.

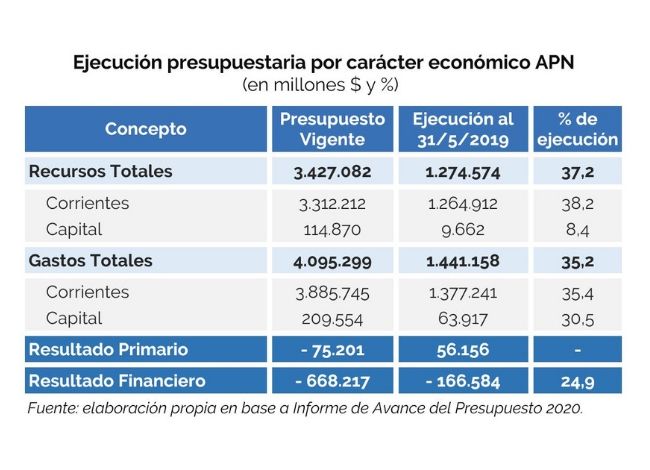

by Nicolas Perez | Aug 8, 2019 | Budget Execution

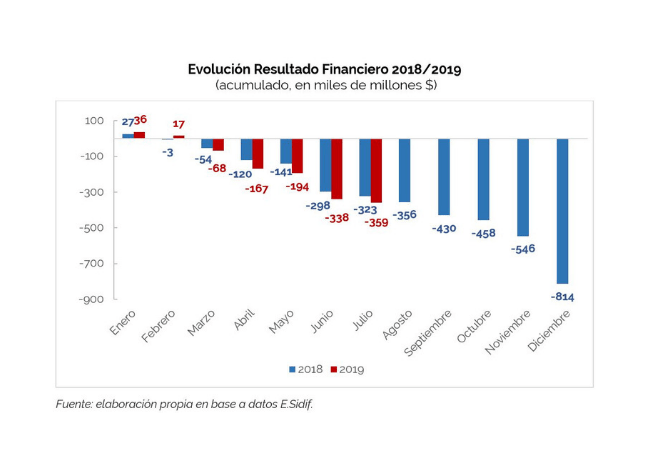

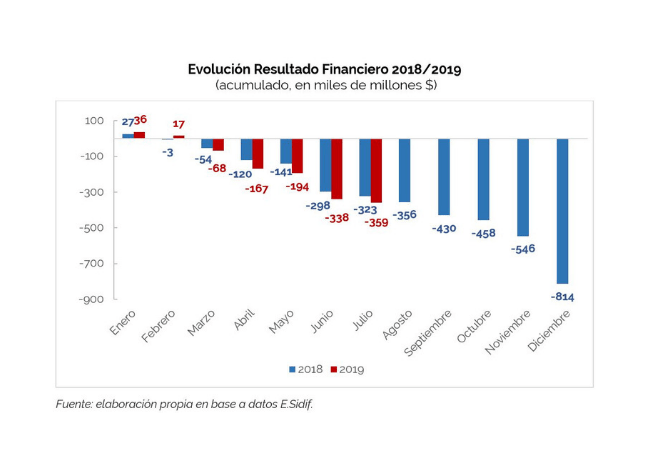

A surplus of AR$43.42 billion was recorded in July, a considerable improvement over the previous year’s figure (-AR$1.9 billion). The financial balance is negative by AR$21.04 billion but implies a drop of 44.4% in real terms in the year-on-year comparison. Transfers to provinces showed a monthly year-on-year drop for the first time this year.

- The increase in resources slowed down in July, although they grew again above expenditures (55.9% vs. 49.0%).

- Tax revenues (58.8%) led total revenue growth, while debt interest (186.4%) and capital expenditures (152.9%) were the fastest growing components of public expenditure.

- In the first seven months of the year, the financial balance was negative by AR$359.1 billion, an increase of 11.2% with respect to the same period of the previous year. In real terms, this represents a reduction of 27.9%.

- During the first seven months of the year, 57.0% of total expenditure was accrued, identical to the level recorded in the same period a year ago.

- From the beginning of the fiscal year to the end of July, the initial budget was increased by AR$88.3 billion, that is, 2.1%. The 39.2% of the amendments were implemented through the Necessity and Urgency Decree 193, while the remaining 60.8% were implemented through four Administrative Decisions.

by Nicolas Perez | Jul 31, 2019 | Budget Law

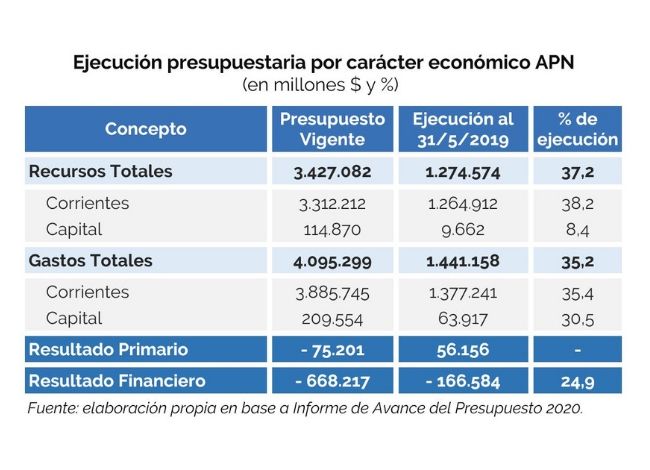

The Progress Report on the Draft Budget for 2020 estimated that 2019 will close with a 0.8% drop in the Gross Domestic Product and a stable primary balance, records that will improve next year.

For the following fiscal year, the government document predicts a strong increase of 3.5% of GDP and a primary surplus of 1%, although without specifying the expected variations in consumption, investment, and imports.

According to the government’s estimate, in both years there will be an increase in exports and the financial deficit will persist, but declining.

Inflation would be reduced to 26.1% by 2020, but the projection does not include values for the exchange rate or the interest rate.

Net public debt will fall in relation to GDP from 49.4% this year to 45.9% next year.

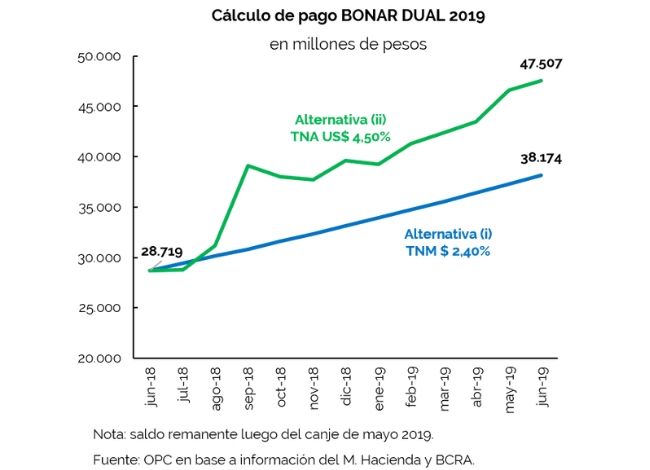

by Nicolas Perez | Jul 17, 2019 | Public Debt Operations

- During June, placements of government securities and loan disbursements totaled USD7.72 billion. The issuance of Treasury bills and bonds totaled USD7.3 billion.

- As a result of three public auctions, Treasury bills in pesos and dollars for the equivalent of USD4.72 billion and bonds for USD885 million were placed.

- Debt service amounted to USD7.54 billion in June, with USD6.27 billion in principal payments and USD1.27 billion in interest payments.

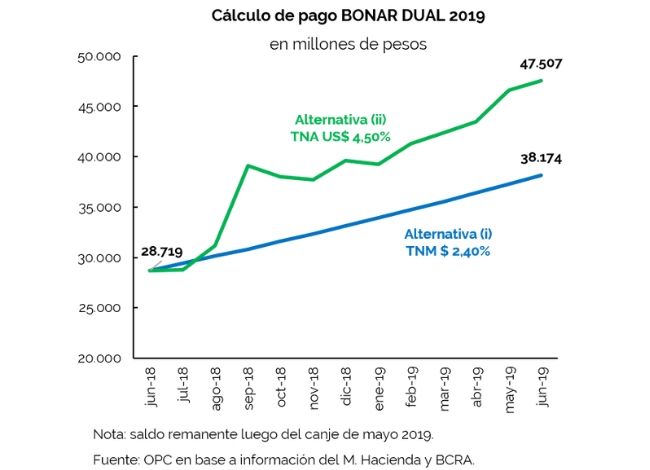

- At the end of the month, the BONAR DUAL 2019 was cancelled for a total of AR$47.5 billion, including AR$45.46 billion of principal and AR$2.04 billion of interest.

- Main maturities scheduled for the month of July are Treasury bills in pesos and dollars. In addition, there will be interest payments on DISCOUNT bonds and different BONARs in dollars whose coupons matured on June 30.