by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

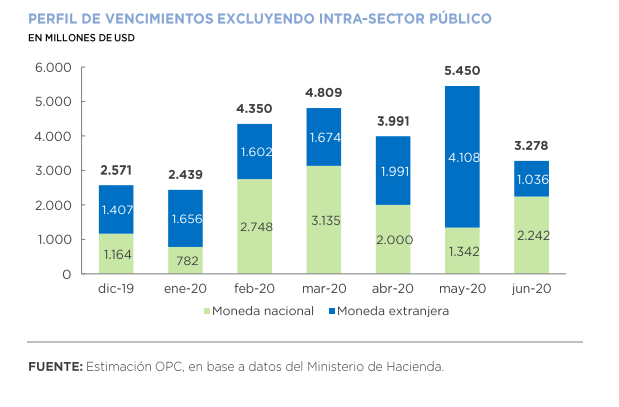

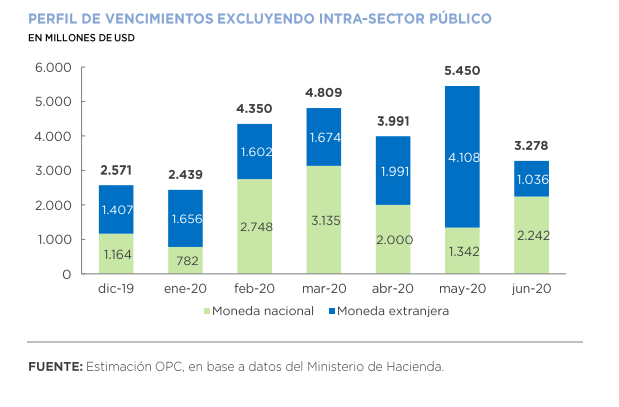

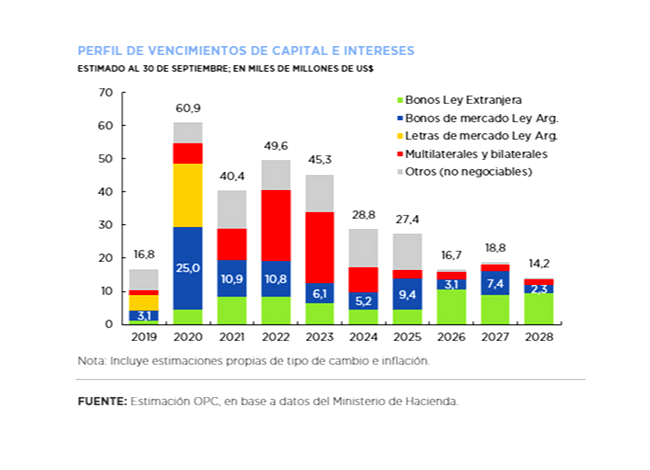

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.

by Nicolas Perez | Dec 11, 2019 | Budget Execution

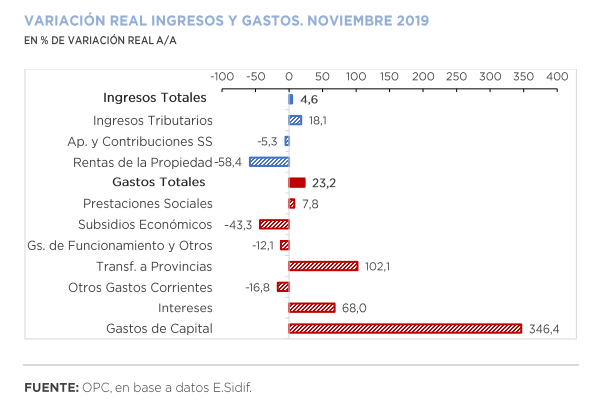

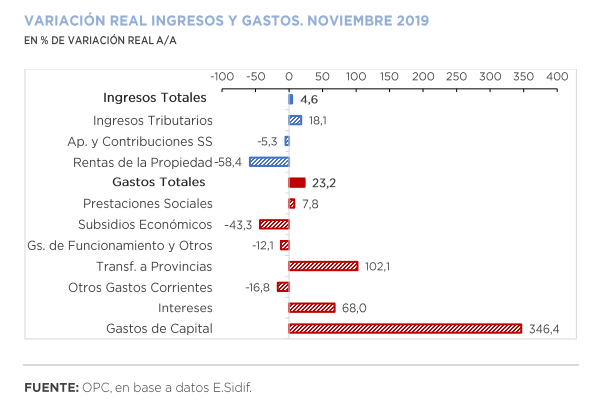

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Dec 5, 2019 | Employment and Social Security

The OPC analysis consists of a description as of April 30, 2019 of government employment in the jurisdictions and entities that make up the National Public Administration (APN), government-owned companies and other entities of the National Non-Financial Public Sector (SPNNF), excluding universities.

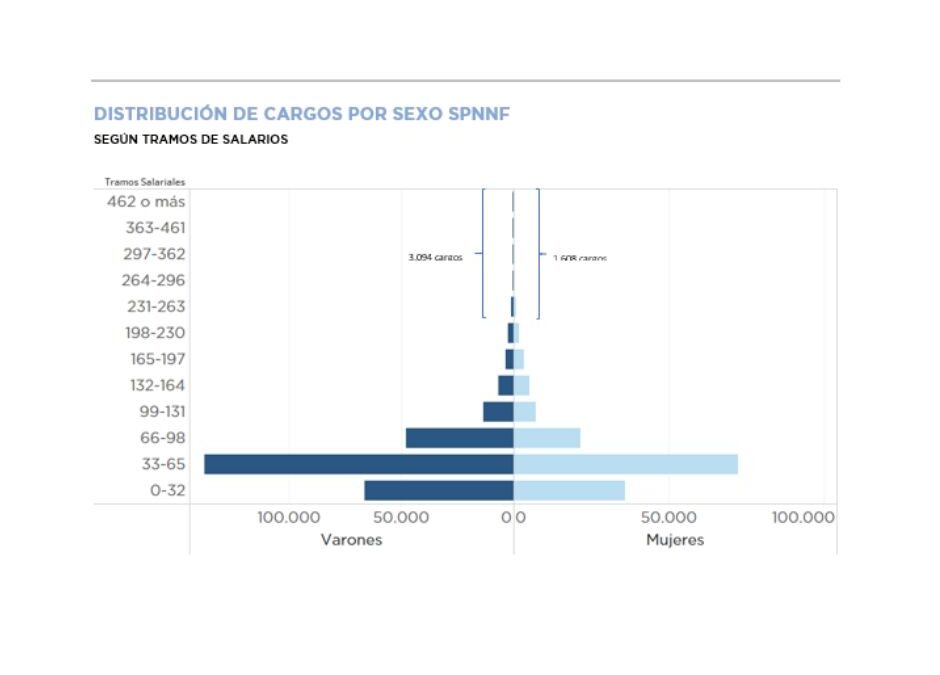

This is a universe of 449,797 positions, of which 385,189 belong to APN, 34,239 to Other Entities (non-business but financially autonomous public organizations) and 30,319 to the thirteen government-owned companies for which information is available. Eighty-nine percent are employed by the National Executive Branch. In addition, there are about twenty legal regimes and more than 120 specific scales with different levels of employment.

From a historical viewpoint, while between 2010 and 2015 a sustained growth of employment was identified (with an increase of more than 20% in that term); between 2016 and 2018 the overall trend has been downward, exhibiting a decrease of close to 8% in the National Executive Branch.

Eighty percent comprise the permanent staff, 26% have a university degree -predominantly positioned in decentralized agencies- and the employment is concentrated in two age groups: 20-34 years old and 35-49 years old, both being over 75% of the total.

The average gross general salary in this universe is AR$60,748, but most of the employment is below this level (64.2%). In fact, the median of the distribution is AR$48,463. Average salaries are higher in companies and decentralized organizations and contrary to the general level, the Foreign Service of the Nation, the Judiciary and Collective Labor Agreements have a high percentage of their staff with average salaries above AR$66,000.

There is an inverse effect between the level of employment and the average salary. Those regimes with a higher level of employment have average salaries below the general average and those with lower relative employment have salaries above the general average.

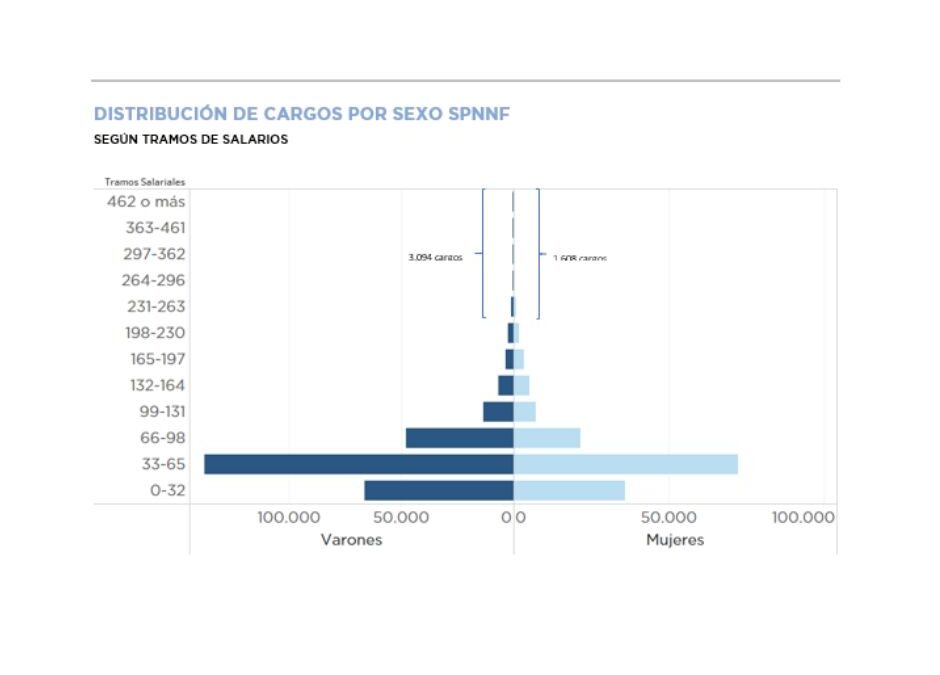

An analysis by sex shows that 35.0% of total employment are women and 65.0% are men, a proportion affected by the high relative weight of the armed and security forces. The average salary of women is lower than that of men at all levels of education and, in line with this bias, there is greater representation of men in the higher income segments.

by Nicolas Perez | Oct 11, 2019 | Public Debt Operations

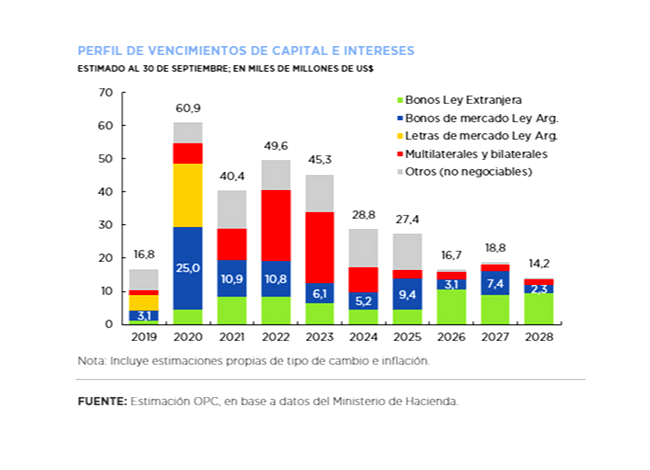

- At the end of September, the Executive Branch submitted to Congress a Bill for the inclusion of Collective Action Clauses in sovereign bonds under domestic law. The Bill does not include a restructuring proposal but establishes the basis for such restructuring. It would affect domestic marketable government securities issued under Argentine law, which represent 24% of the gross public debt and of which it is estimated that at the end of September 2019 there was about USD27 billion in face value held by private creditors.

- Further measures were announced to cover the financial program in the last quarter of the year, and the ban on public credit operations to finance operating expenses was suspended for the rest of the year.

- During September, there were placements of securities and disbursements for the equivalent of USD291 million and principal and interest payments totaling USD3.25 billion, of which 64% were amortizations. Interest payments totaled USD1.18 billion, of which 69% were made in pesos.

- For the last quarter of the year, debt maturities are expected to be approximately USD16.75 billion between amortizations (USD11.46 billion) and interest (USD5.29 billion), of which 62% will be paid in pesos. The approval of the fifth review of the IMF Stand-By program and the respective disbursement is still pending.

by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

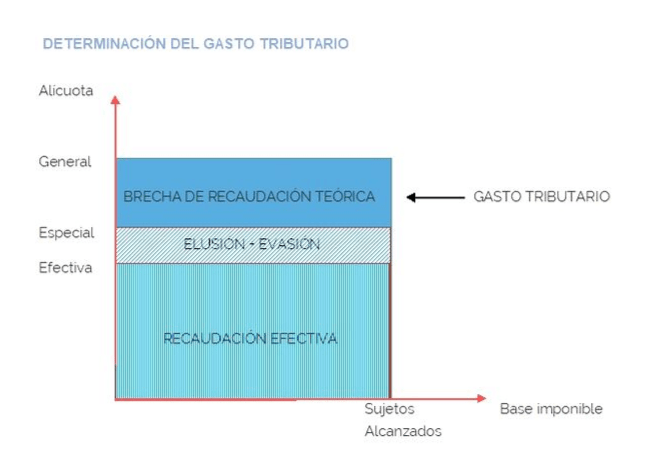

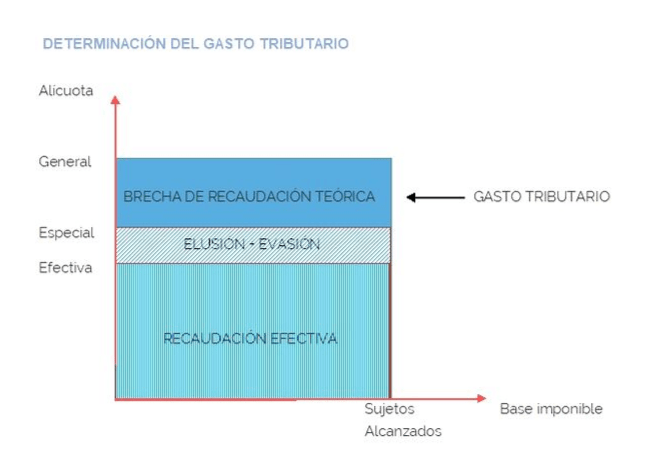

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.

by Nicolas Perez | Sep 23, 2019 | Sustainable Development Goals

This is the first in a series of reports to be prepared by the Argentine Congressional Budget Office (OPC) to analyze Argentina’s progress in achieving the United Nations Sustainable Development Goals from a budgetary perspective. As there is no international consensus on the SDG budget evaluation methodology, the OPC used its own tool.

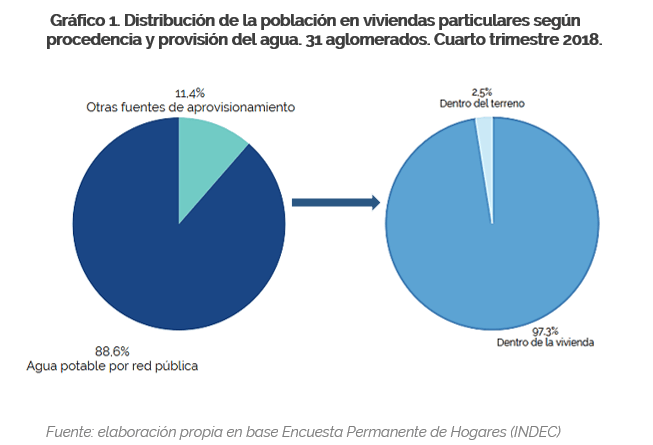

The focus is on SDG 6, Clean Water and Sanitation, and SDG 7, Affordable and Clean Energy. In accordance with the provisions of the current year’s Budget Law, the actions to be carried out by Argentina related to the SDG 6 will require AR$25.48 billion, while those related to energy issues have an initial appropriation of AR$212.01 billion.

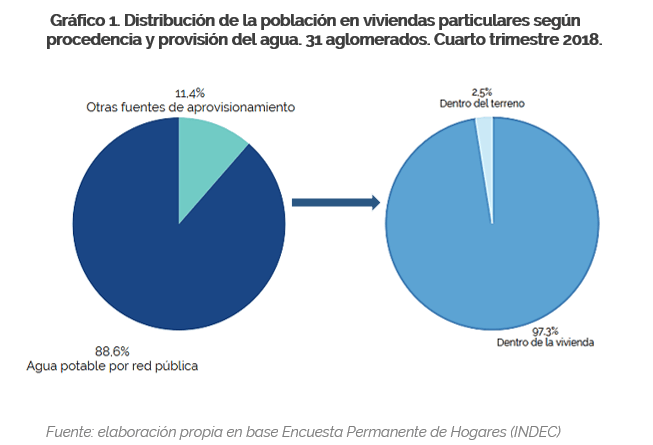

By 2023, Argentina has committed to universal access to drinking water service through the public network, which would imply, according to INDEC population projections, the addition of 9.5 million people. As for the sewage network, the commitment to universalization was set for the year 2030, bringing the number of citizens to be included up to that year to 26.4 million.

Argentina adopted three targets linked to SDG 7. That of “universalizing access to affordable, reliable and modern energy services” implies meager increases in coverage, since according to the latest available data 98.8% of households had access to electricity and 97.2% to clean fuels for cooking; that of “significantly increasing the proportion of renewable energy” implies using 10.9% of green sources to supply total consumption this year; the most challenging is to increase energy efficiency (total energy vs. GDP), changing the trend shown in recent years.