by Nicolas Perez | Apr 11, 2019 | Tax Revenue

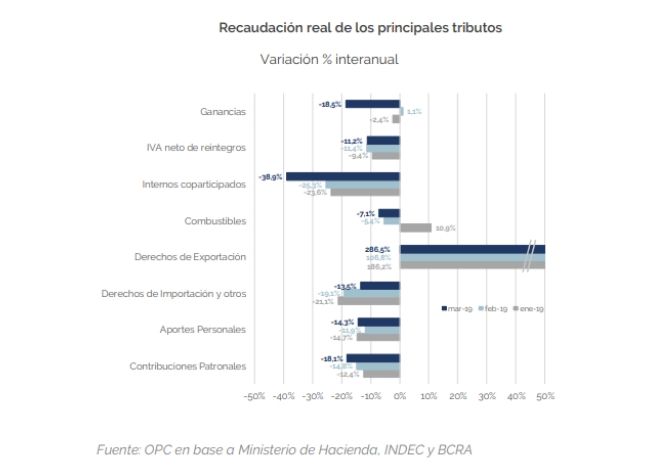

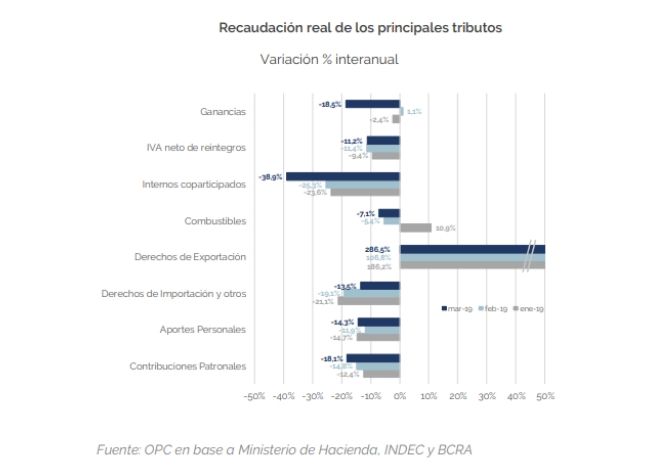

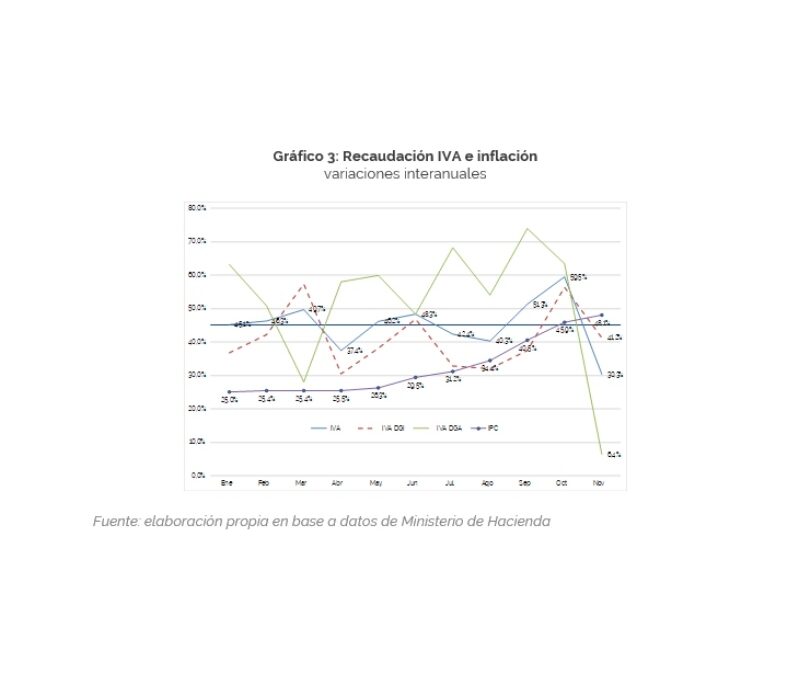

In the third month of the year, national public sector revenues grew by 37.3% in nominal terms compared to the same period of the previous year but fell by 10.5% in real terms. Similar behavior was observed in the first quarter of the year.

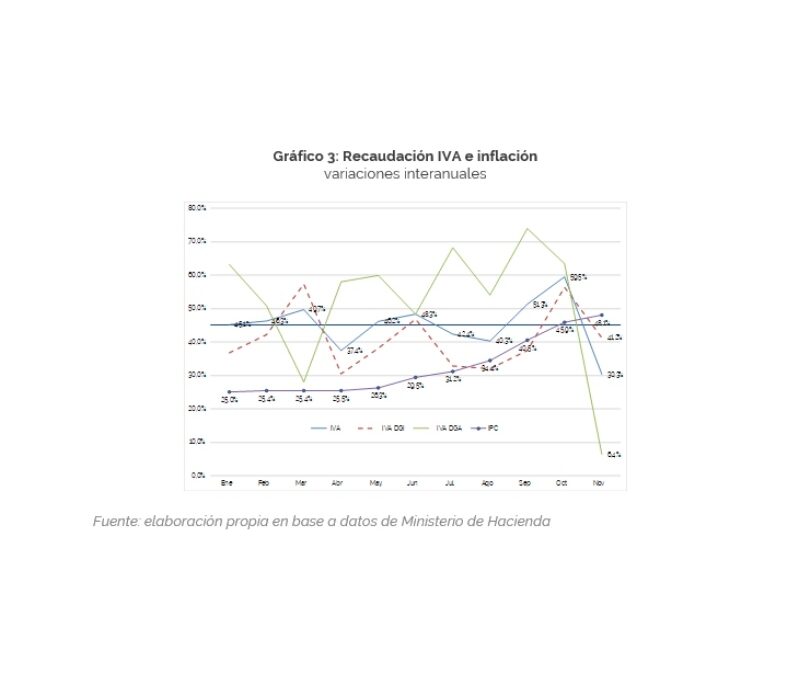

This performance also entails a decline compared to previous months and reaffirms that government revenues are strongly linked to the level of economic activity, as shown by the VAT DGI, which fell 7.3%.

Income Tax contracted by 18.5%, partly due to the deferral of some maturities. The significant growth in Export Duties allowed mitigating the fall in the most important taxes of the national tax structure (VAT, Income Tax and Social Security Contributions).

by Nicolas Perez | Mar 12, 2019 | Tax Revenue

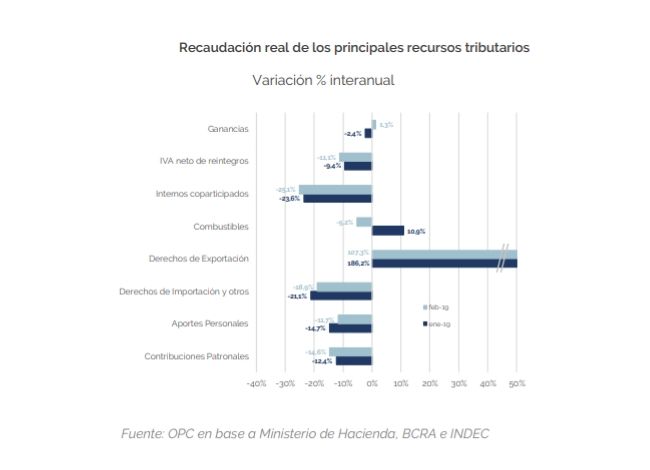

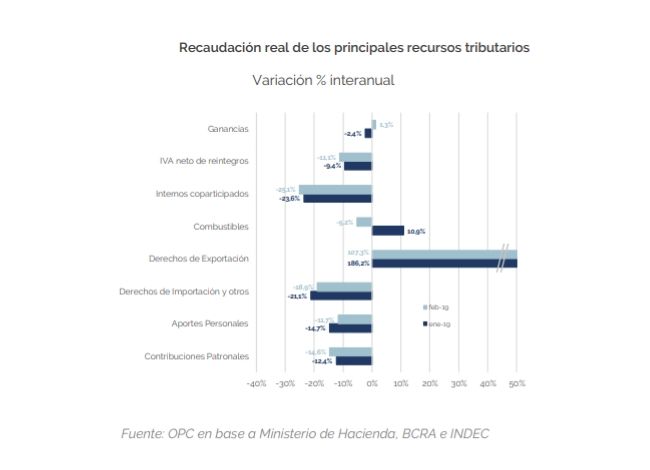

February tax revenue totaled AR$330.89 billion, which implied a nominal year-on-year increase of 40.4% and of 39.6% with respect to the first two months of last year.

In real terms, it declined 6.9% against February 2018, although the fall in inflation-adjusted tax resources was softened as of December.

Income Tax had a real recovery of 1.3%, and together with Wealth Tax and Export Duties, were the ones with the highest year-on-year increase.

Value Added Tax recorded a year-on-year decline of 11.5%, basically due to the fall in imports and the reduction of some taxes on foreign purchases and the lower level of activity.

by Nicolas Perez | Jan 31, 2019 | Tax Revenue

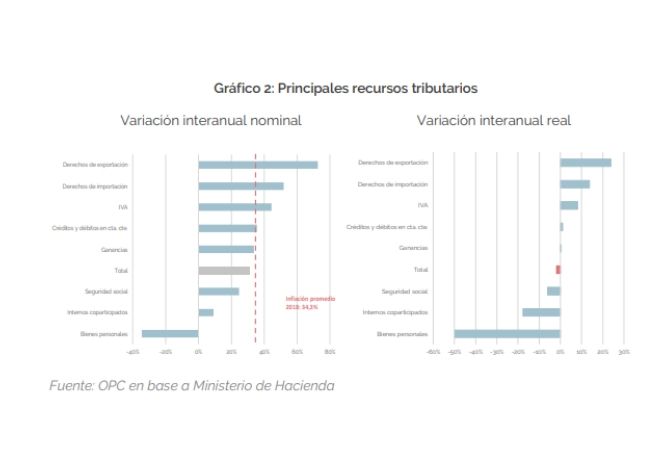

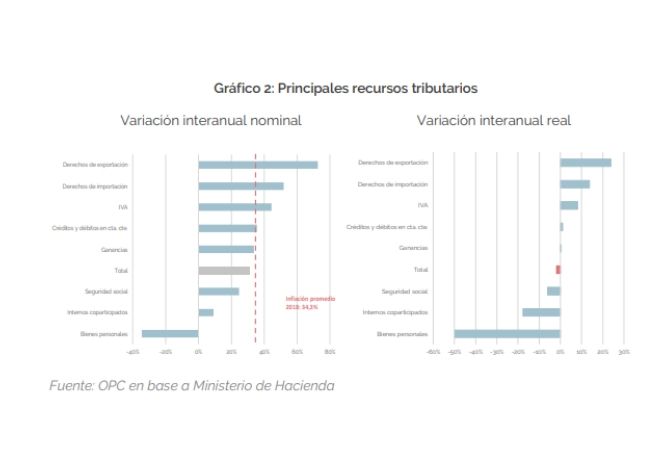

National tax revenue totaled $3.82 trillion in 2018, an increase in nominal terms of 31.2% with respect to 2017.

In terms of inflation-adjusted revenue, there was a drop of 1.8% year-on-year, the third consecutive year showing this trend.

Measured in terms of Gross Domestic Product, revenue was 24.1% of GDP, 0.3 percentage points below that recorded in 2017, continuing the trend started in 2016.

As for the allocation of tax revenue, the national government and the social security system received less resources for the equivalent of 0.3% of GDP each, which contrasts with the increase of 0.4% of GDP that was allocated to the provinces.

by Nicolas Perez | Dec 28, 2018 | Other Publications

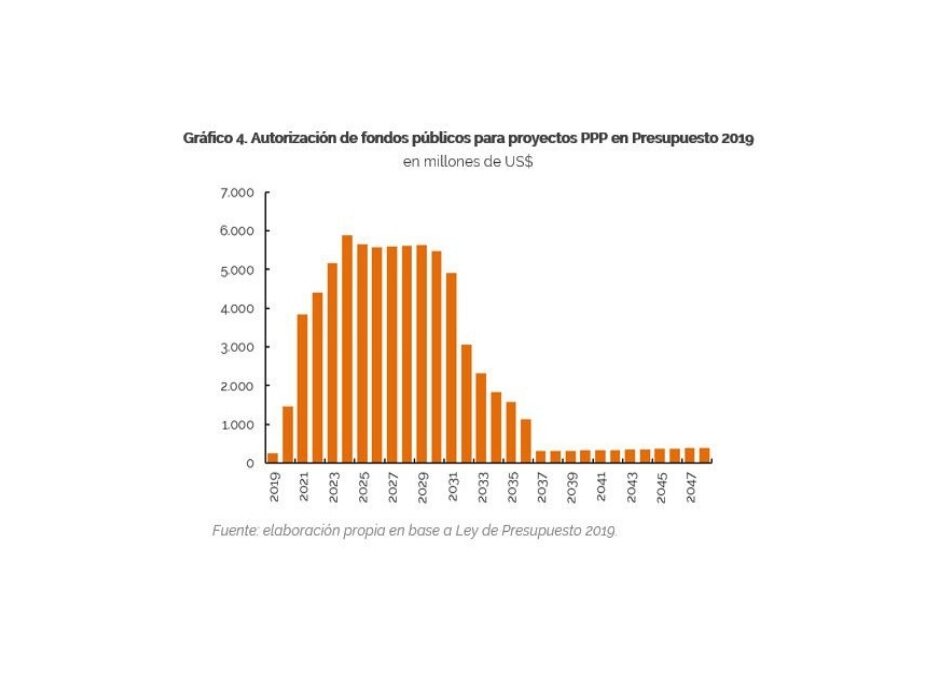

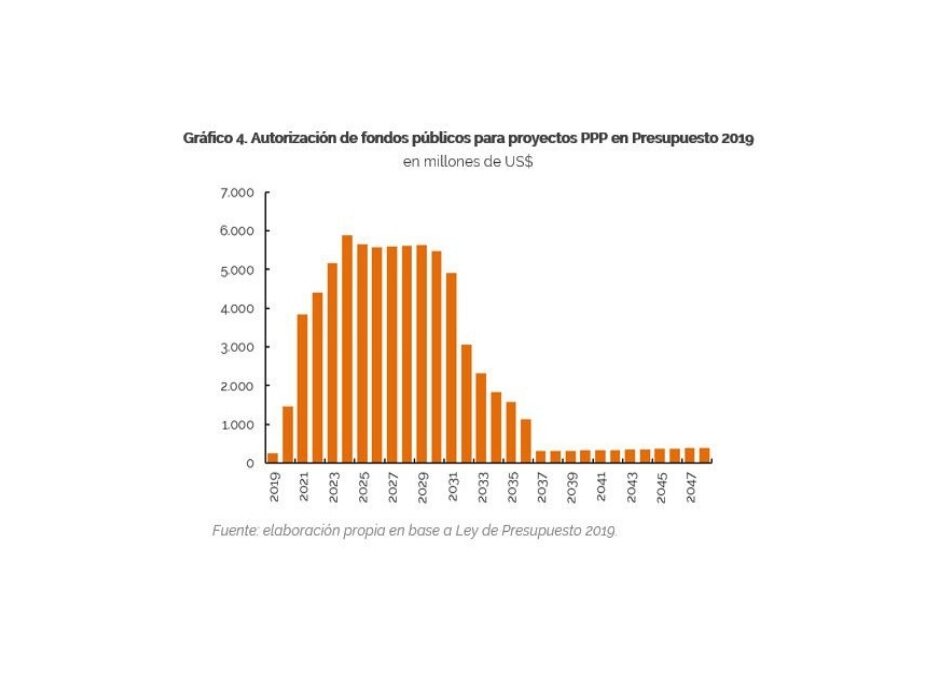

Budget Law 2019 includes eighty projects to be financed through the Public-Private Partnership (PPP) scheme that, if executed, would involve USD73.52 billion of public funds between 2019 and 2048. These projects may generate direct and contingent liabilities for the National Government that will affect the future fiscal performance.

During 2019, the progress of the works is not expected to be recorded as a capital expenditure but as a financial investment (below the line), so it will not have an impact on the balance of the respective fiscal year. Investment Securities (TPI, by its initials in Spanish), issued by the Trusts of each project, are not considered public debt, although they have common features to sovereign bonds and their repayment involves mainly public funds.

Following the best practices in the matter, a methodology for the valuation of contingent liabilities related to PPP projects should be developed, a task on which the Executive Branch is already working.

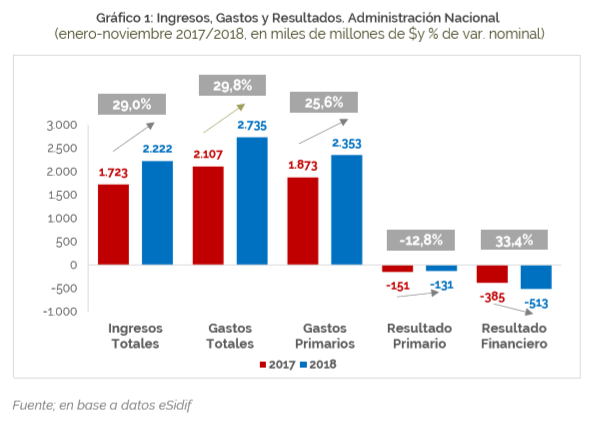

by Nicolas Perez | Dec 18, 2018 | Budget Execution

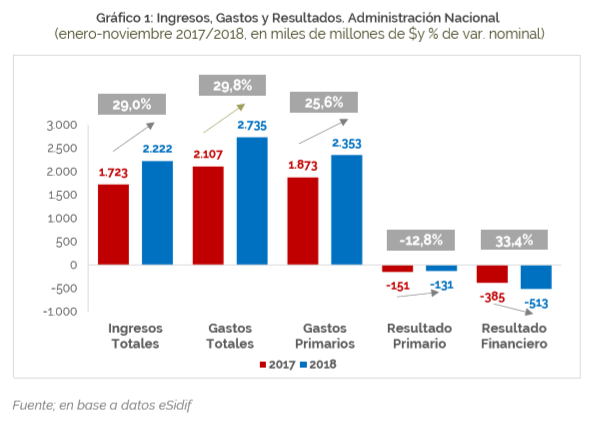

In November, the National Government primary deficit was AR$ -39.8 billion, 240% higher than in the same month of the previous year, while the financial deficit reached AR$ -55.6 billion, increasing by 70% the negative performance with respect to November 2017.

Total expenditure grew 8.3 percentage points above total revenues, basically boosted by a rise in economic subsidies.

In the cumulative of the first eleven months of the year, the negative primary balance was 34% lower in real terms than that recorded in the same period of the previous year, while the financial balance increased by 0.4%. At the end of November, the initial budget appropriation increased by 20% by virtue of Necessity and Urgency Decrees and Administrative Decisions.

by Nicolas Perez | Dec 13, 2018 | Tax Revenue

National tax revenue fell by 1.6% in real terms as of November 30. Analyzing the closing of the year, we estimate a low probability of reaching the figure included in the introductory statement of the 2019 Budget Bill of AR$3.47 trillion against an 11-month cumulative amount of AR$3.06 trillion.