by Juan Fourcaud | Feb 4, 2020 | Other Publications

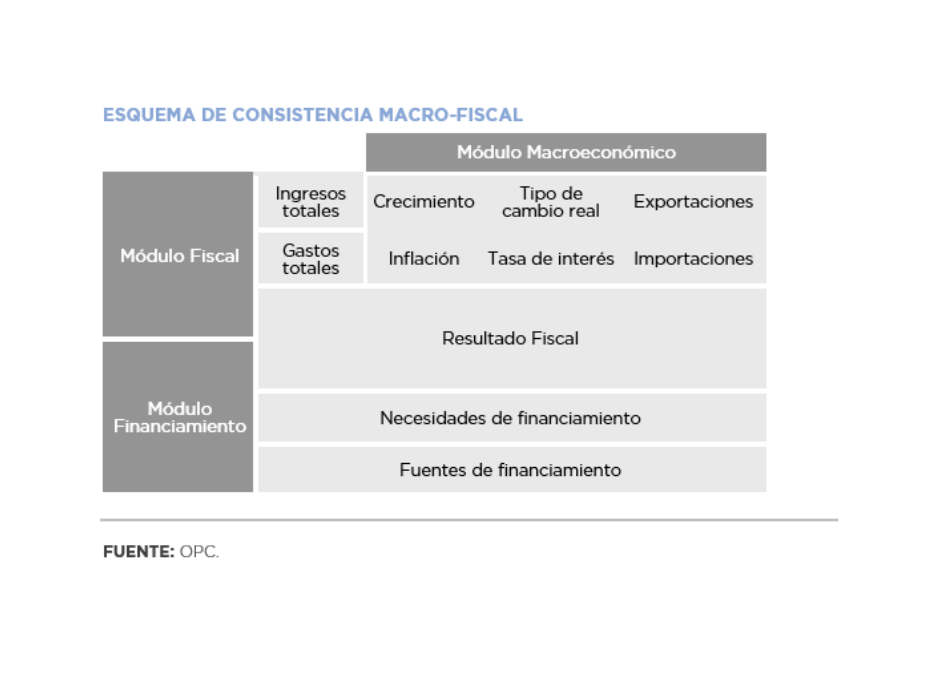

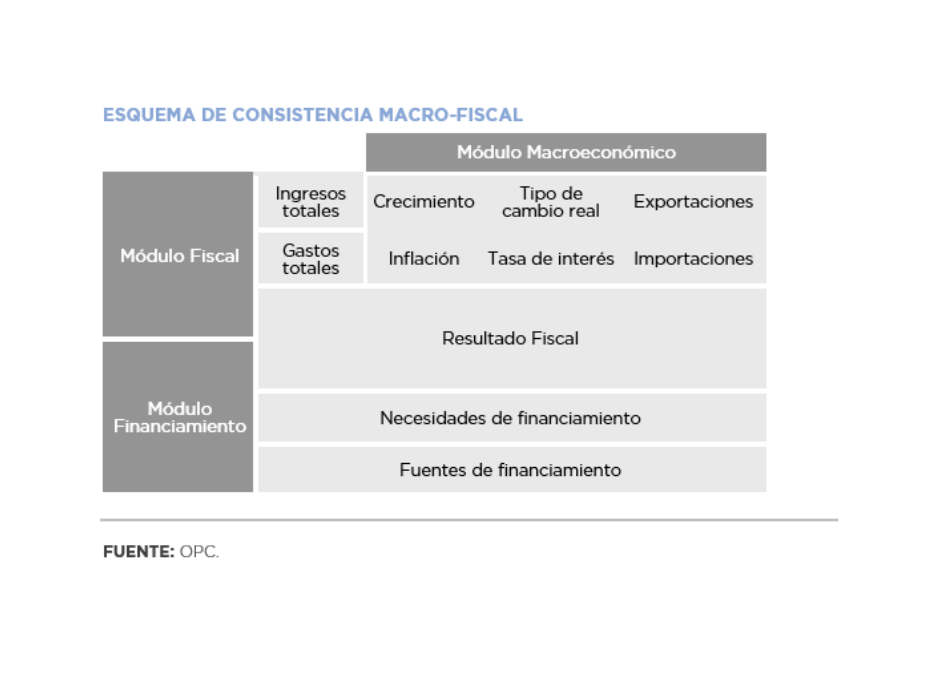

The purpose of this document is to outline the main methodological aspects and the technical tools used for the preparation of the macroeconomic scenario adopted by the OPC in the framework of the report “Revised Estimates – 2020 Budget Bill”.

The approaches included in this document are not intended to specify a closed macroeconomic model, to investigate the causal processes of the phenomena under study or to provide certainty for future budgetary outcomes. Rather, it seeks to contribute to the analysis of how the argentine economy and public budget will evolve if the current economic policy and the same conditions are to remain unchanged.

Macroeconomic variables play a fundamental role in the design of budgetary policy as they are closely linked to the revenues and spending estimates (and financing needs) included in the Budget Bill.

Making short, medium, and long-term projections of significant national macroeconomic variables allows, among other things, producing independent analyses of the impact of these variables on the public sector balance sheet, forecasting their future evolution for multi-year horizons, as well as conducting studies on the intertemporal sustainability of the national public debt.

by Nicolas Perez | Jan 15, 2020 | Budget Execution

Fiscal year 2019 ended with a real increase in resources of 2.1% with respect to the previous year and with a contraction in expenditure of 6.4% YoY, spread across the main components, apart from debt interest, which increased by 10.7% YoY in real terms.

The combination of these behaviors resulted in a financial deficit of AR$845.99 billion, equivalent to 3.9% of the Gross Domestic Product, 1.7 percentage points below that of the previous year. The primary balance showed a surplus of AR$75.49 billion, an improvement compared to 2018.

The evolution of Export Duties was decisive in the increase in tax revenues, which had a real jump of 164.4% year-on-year because of the increase in tax rates, the devaluation of the exchange rate and the higher quantities exported by the soybean sector.

This scenario offset the fall in other tax items and the resources of the social security system, affected by the lower economic activity and the reduction of taxable wages.

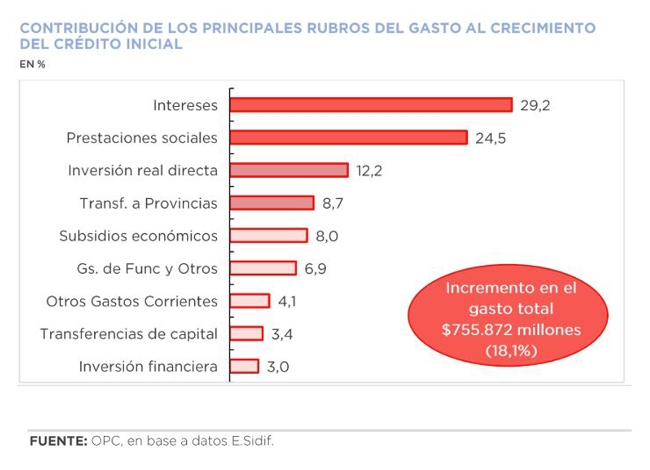

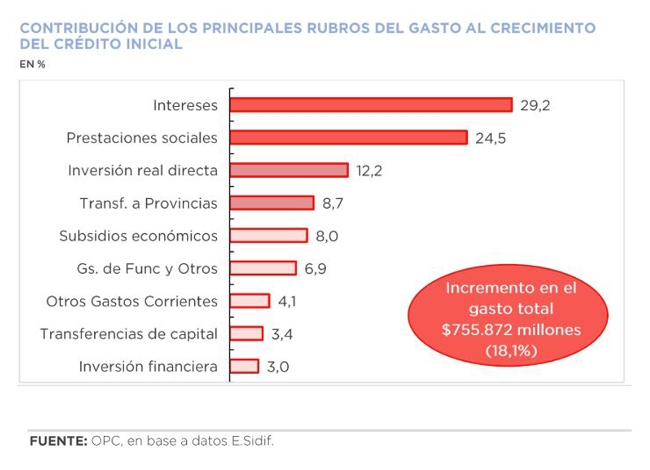

In 2019, national government expenditure reached AR$4.74 trillion, which implies an execution level of 96.2% of the allocated budget. The initial approved appropriation increased by 18.1%, with debt interest being the item that most contributed to such variation (29.2%).

by Nicolas Perez | Jan 10, 2020 | Sustainable Development Goals

Sustainable Development Goal (SDG) number 17, “Partnerships for achieving the goals”, seeks to promote synergies between governments and civil society, both nationally and internationally, to facilitate the fulfillment of purposes set forth in the program conceived under the umbrella of the United Nations.

Argentina adopted six of the nineteen goals set by the UN relating to: technology, capacity building, multi-stakeholder partnerships and data, monitoring and accountability.

Among other global goals, this adhesion commits the country to having reliable data, providing sustainable development indicators, and increasing the population’s access to technologies such as the Internet, with definitive goals for 2030 and some others prior to that. Due to methodological issues or lack of baseline data, this monitoring is not always feasible to carry out under the required conditions.

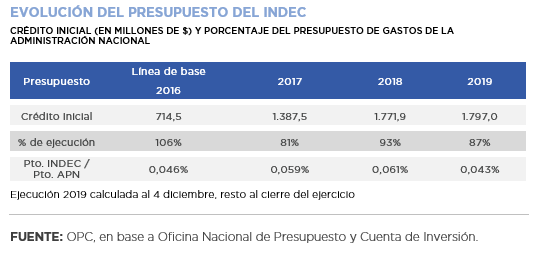

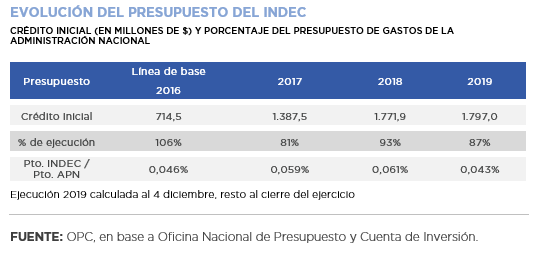

The general analysis of the available indicators shows, among many other points, that Argentina is waiting for a new National Statistical Plan, part of a legislative bill to modernize the system developed by INDEC (National Institute of Statistics and Censuses). According to an official study conducted in 2016 with the support of UNICEF, there is a 3.8% of under-recording of births and no accurate record of all deaths, also an under implementation of the actions related to the National Plan for the eradication of gender violence in the scope of INAM (National Institute for Women).

Direct expenditure projected for 2019 totaled $3.28 billion (39% higher than in 2018) and as of November its execution was 110%.

by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

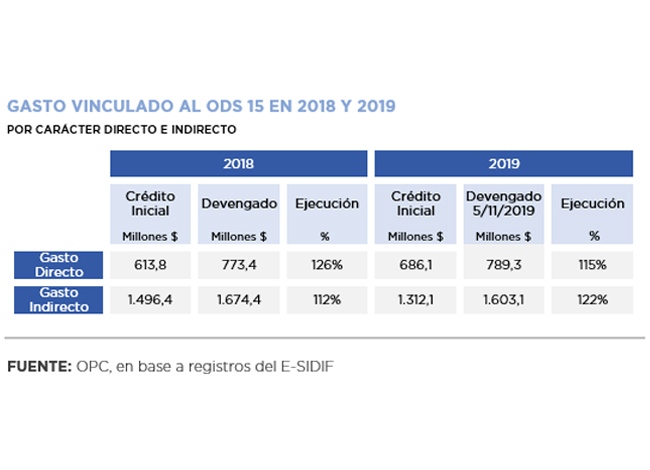

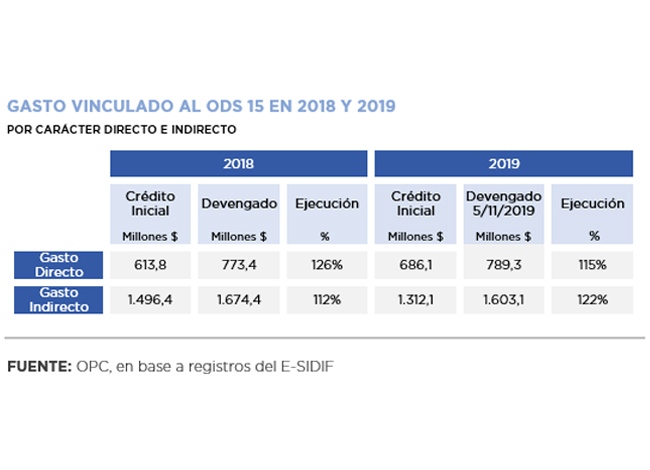

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 19, 2019 | Budget Law

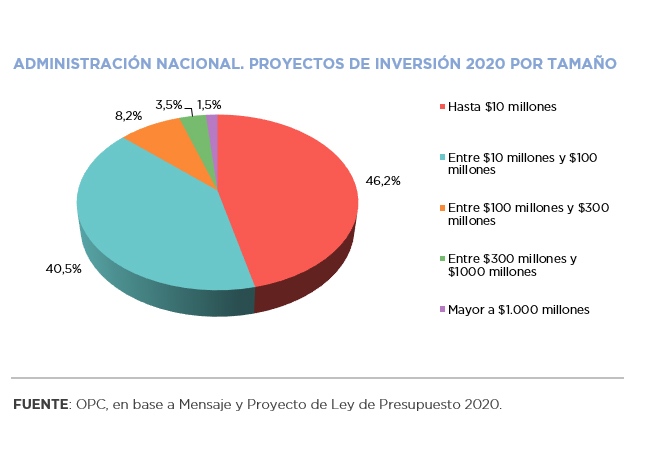

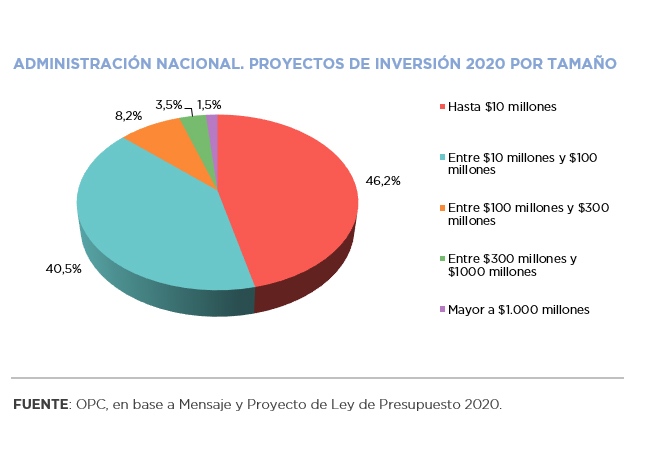

The Budget Bill submitted to Congress in September 2019 estimates a public investment amount for the national government at AR$232.21 billion, with an estimated nominal increase of 19.6% year-on-year with respect to the 2019 closing projection made by the Ministry of Finance.

Public investment of the entire National Public Sector (NPS) -including government-owned companies, trust funds and other entities- would amount to AR$318.02 billion, according to the Message 2020, which is equivalent to 4.9% of the total expenditure of the NPS. This implies a drop of 10.9% year-on-year in relation to what was projected for this year.

The largest increase is in capital transfers made by the national government to other entities or jurisdictions to carry out works or purchase goods, which increased 32.4%. Real direct investment (works projects and equipment acquisition) only increased by 6.1% YoY.

The geographical breakdown of these transfers shows a concentration in the Pampas Region, basically in the Province of Buenos Aires (18%) and in the Autonomous City of Buenos Aires (10.3%), jurisdictions in which half of the real direct investment is concentrated.

The Bill provides for the execution of 995 projects to be carried out by the national government for an average amount of AR$80 million each. The total amount shows a decline since 2011: from 0.68% of GDP in 2011 to 0.25% in 2020.

The largest amounts are allocated to railway works, such as the improvement of the Belgrano Cargas Railway, which involves several jurisdictions and would demand AR$5 billion, and to the laying of highways, including Route 19 connecting San Francisco with Córdoba or Route 8 connecting Pilar with Pergamino.

In the rest of the Public Sector, the main direct investments would be carried out by government-owned companies: Nucleoeléctrica Argentina S.A. (36.9% of the total), and Integración Energética Argentina S.A. – Ex- ENARSA (30.3%).

by Nicolas Perez | Dec 12, 2019 | Tax Policy and Fiscal Federalism

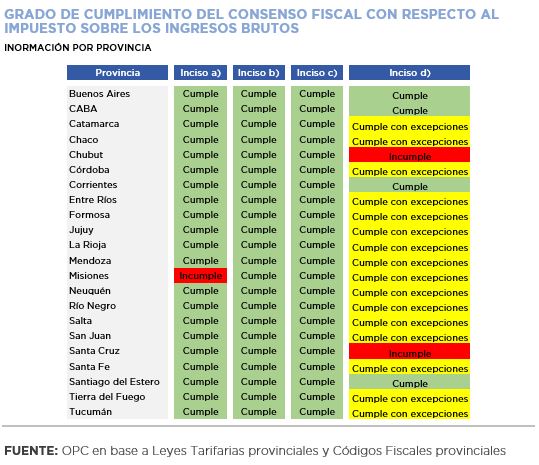

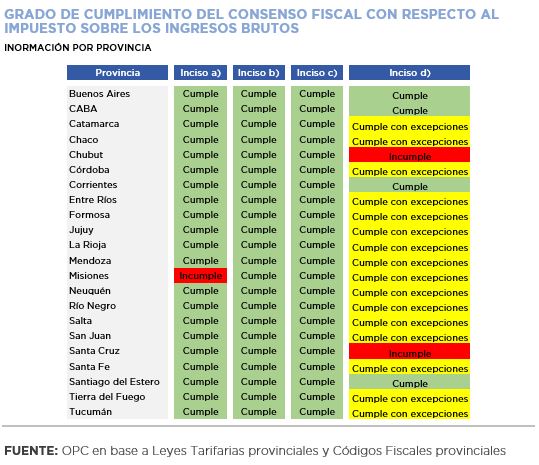

Although with variations by jurisdictions, progress was made in the amendments to the provincial taxes included in the 2017 Fiscal Consensus.

There is a high level of compliance with the commitments assumed to lighten the burden of Gross Income Tax and to homogenize it.

All provinces involved made progress in excluding exports from the scope of this tax which, however, in some jurisdictions a higher rate was applied to certain commercial activities.

There was also a high level of compliance with the commitments related to the Stamp Tax, which eliminates differentiated treatments, prevents the raising of rates for certain activities and foresees a reduction schedule, which was finally suspended.

Tax revenue in the committed provinces did not have a significantly different dynamic. Gross Income tax rose 10 percentage points above the nominal growth recorded in the jurisdictions that did not adhere, but Stamps and Property Taxes, on the other hand, grew less.