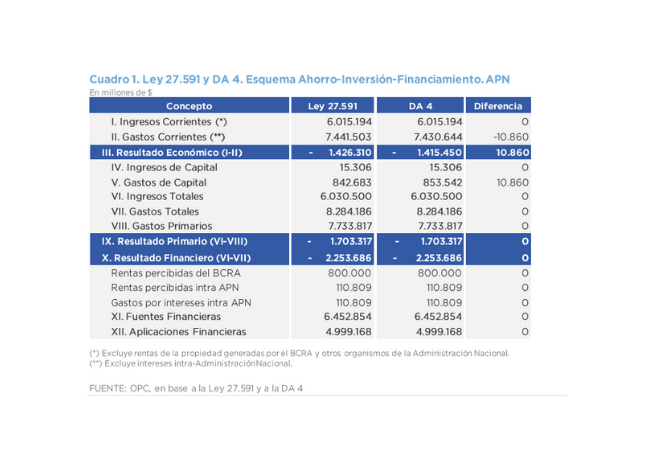

ANALYSIS OF ADMINISTRATIVE DECISION ON THE DISTRIBUTION OF BUDGET LAW No. 27,591 FOR THE FISCAL YEAR 2021

The Chief of Cabinet of Ministers published Administrative Decision No. 4 by which it distributes the budgetary appropriations for the year 2021 in accordance with the provisions of the Budget Law.

The amendments introduced by the National Congress to the bill sent by the Executive Branch required reallocations for AR$ 97.82 billion but did not entail an increase in the total spending approved by law, but rather compensations, basically due to the reduction of Treasury liability items.