ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – SEPTEMBER 2020

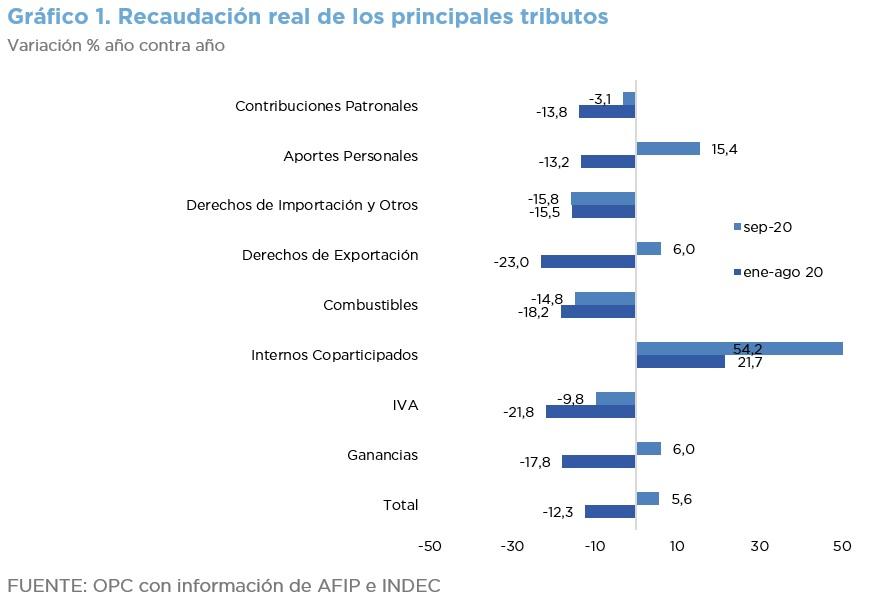

In the first nine months of the year, national government revenue grew by 5.0% YoY in real terms, while expenditure grew by 9.4% YoY, mainly driven by expenditures to mitigate the consequences of the pandemic.

- Excluding the profits transferred by the Central Bank (BCRA), which totaled AR$1.17 trillion as of September, total resources contracted by 17.6% YoY in real terms compared to the previous year.

- Primary expenditures increased by 21.9% YoY, basically to mitigate the health crisis.

- As of September, approximately AR$723.2 billion of expenditures related to COVID-19 were accrued, without which primary expenditure would have expanded by 2.4% YoY in real terms.

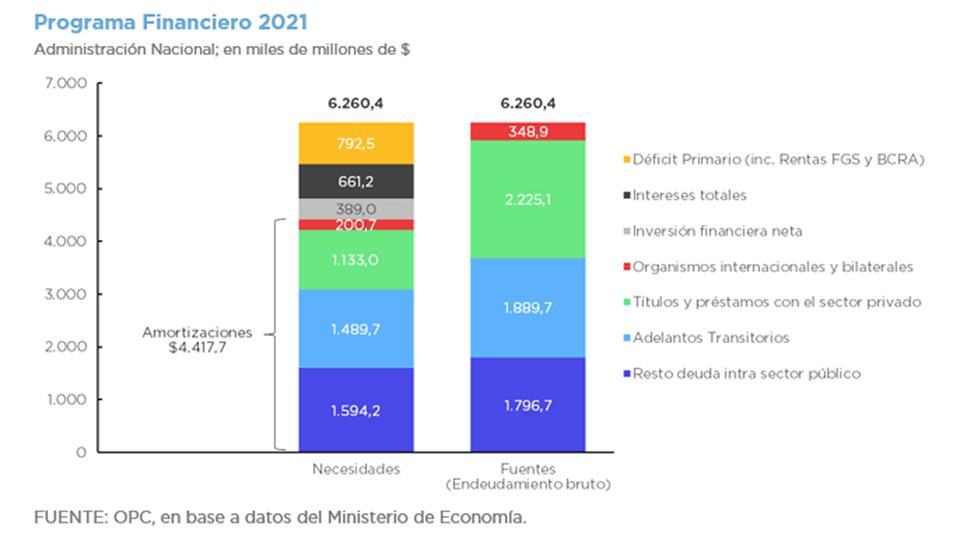

- The primary balance up to September 30, 2019, excluding BCRA profits, went from a surplus of AR$75.9 billion to a deficit of AR$1.4 trillion in the same period of 2020.

- Social programs registered an execution of AR$85.1 billion in the first nine months of 2019 and AR$671.9 billion in the term January-September 2020, which means an increase of 447.0% YoY in real terms.

- The initial budget for the year increased by $2.7 trillion and 62.7% of this increase was allocated to reinforce social benefits.