by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

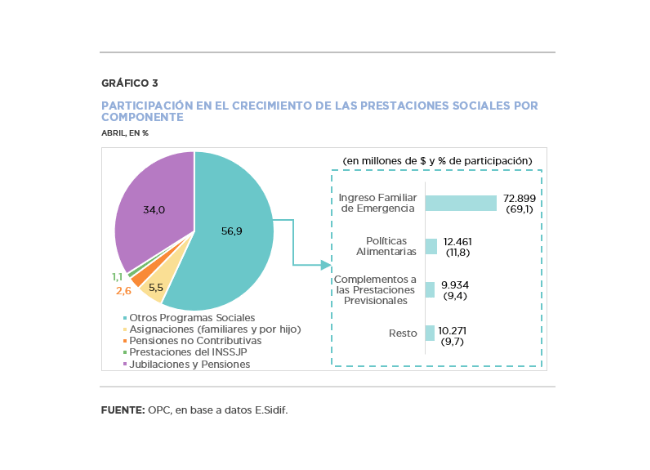

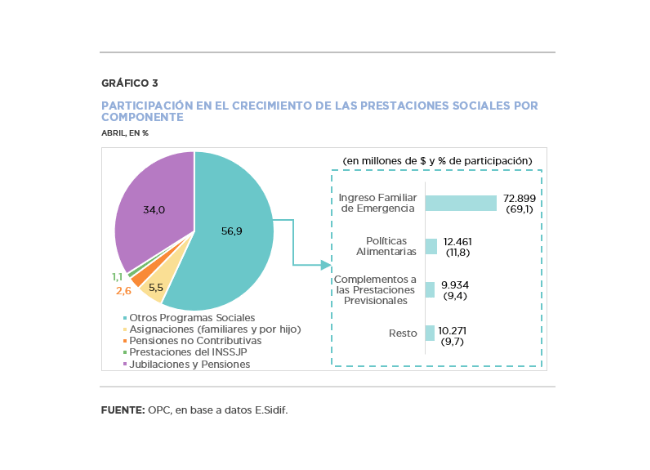

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).

by Nicolas Perez | May 11, 2020 | Tax Revenue

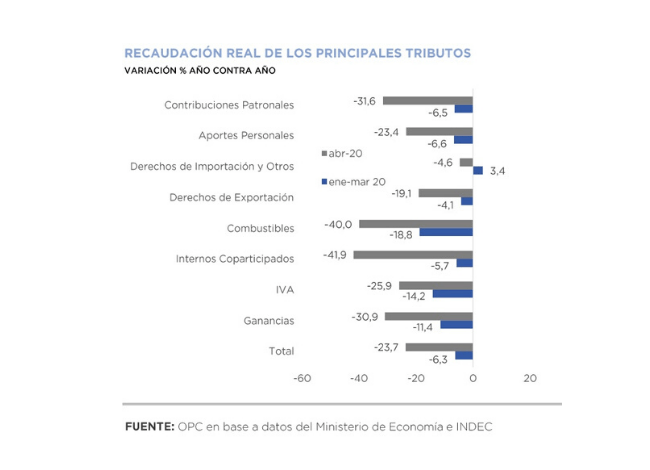

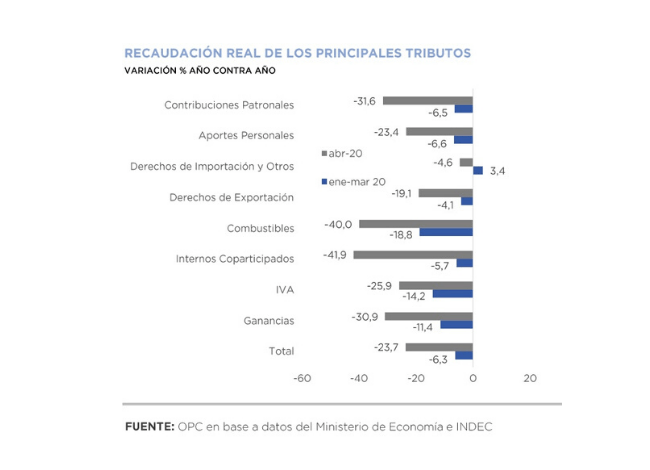

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.

by Nicolas Perez | Apr 25, 2020 | Public Debt

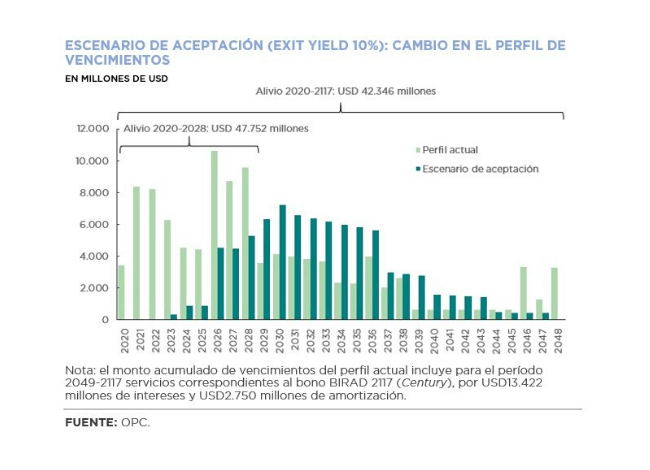

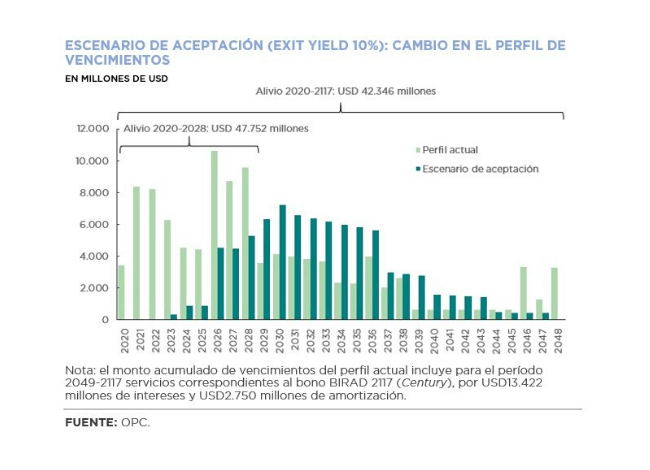

The Government submitted its proposal for the restructuring of bonds issued under foreign legislation. The swap proposal covers 21 series of bonds, issued under New York and UK legislation, and denominated in dollars, euros, and Swiss francs, totaling USD65.62 billion.

The proposal includes the swap of the eligible bonds for ten new bonds (five in dollars and five in euros), repayable in annual payments, maturing in 2030, 2036, 2039, 2043, and 2047.

Acceptance of the offer would imply a reduction of principal of 5.4%. The stock of bonds issued under foreign legislation would be reduced by USD3.67 billion (from USD65.62 billion to USD61.95 billion).

The maturity schedule would be significantly modified, due to a combination of interest coupon reduction, grace period and maturity extension. The average maturity would increase from 5.9 to 11 years.

Throughout the bonds’ life, the interest burden would be reduced by USD38.67 billion (from USD59.67 billion to USD20.99 billion). By adding the reduction of principal, a net reduction of US$42.34 billion in total servicing would be obtained. The relief would be concentrated in the first years, accumulating USD47.75 billion in the term 2020-2028.

by Nicolas Perez | Mar 17, 2020 | Other Publications

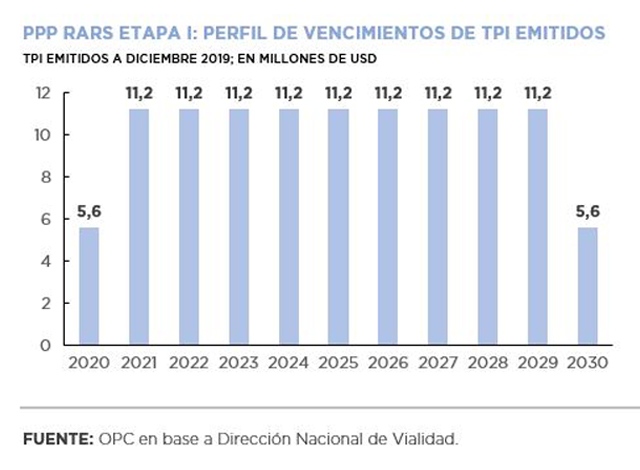

Several projects were authorized in the 2018 and 2019 Budgets under the Public Private Participation (PPP) modality for sectors such as transportation, energy, water and sewage, housing, and health.

However, in a context of high economic and financial volatility, added to the uncertainty derived from the judicial investigations of corruption in the public works sector, there has been a significant delay in the PPP program.

To date, only six road projects have been awarded for Phase I of the Network of Safe Highways and Routes (RARS). In addition, a call for tender was announced for an electricity transmission project. The rest of tenders showed no progress.

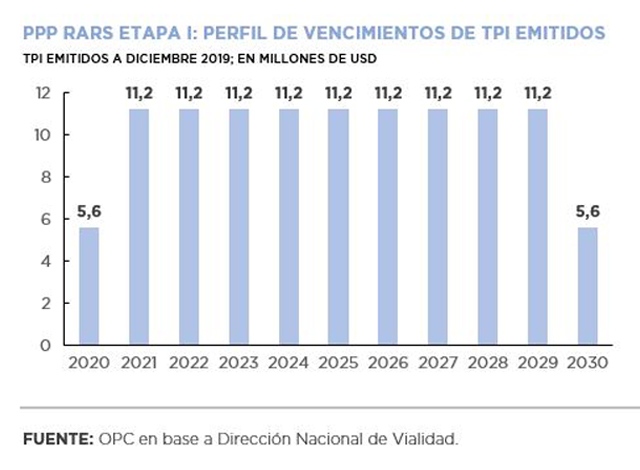

In July 2019, the contractors of the six awarded road corridors and the National Road Authority (Dirección Nacional de Vialidad) signed an addendum to the contracts that postponed schedule for the development of the main works and extended the deadline for financial closure. As of October 31, 2019, the works showed an average progress of 1.18%, generating payment obligations to the public sector in the form of Investment Securities (TPI) for USD112 million.

by Juan Fourcaud | Mar 4, 2020 | Tax Policy and Fiscal Federalism

A review of the country’s fiscal federalism reveals the complexity of its parameters and the difficulties to establish a definitive consensus-based regime between the national government and the provinces, a constitutional mandate that has been pending for 23 years.

The federal tax co-participation regime was established by Law No.12,139 of 1935. The regulatory dispersion continued until the integration set forth in Law No.20,221 in force until 1984, recurrently infringed.

Among the decisions that infringed that law was the unilateral transfer of education and health functions to the provinces, without the respective financial allocations. This was the origin of the National Treasury contributions, an arbitrary mechanism to remedy problems as those caused by that discretionality. In 1980 pre-co-participations were introduced when it was decided that a portion of the VAT would be use for Social Security.

At the beginning of 1988, Law No.23,548 established a temporary distribution regime still in force. The secondary distribution scheme is not based on objective criteria and the original primary distribution, which reserved 54% to the provinces, was permanently altered.

The 1994 constitutional reform included co-participation in the National Constitution and provided for the enactment of a framework law before the end of 1996.

This mandate has not yet been accomplished and the most concrete legal approach was the series of fiscal pacts signed since 1992, whose interpretation and implementation led to legal disputes: federalism of concertation in our country lacks legal certainty.

by Nicolas Perez | Feb 19, 2020 | Budget Execution

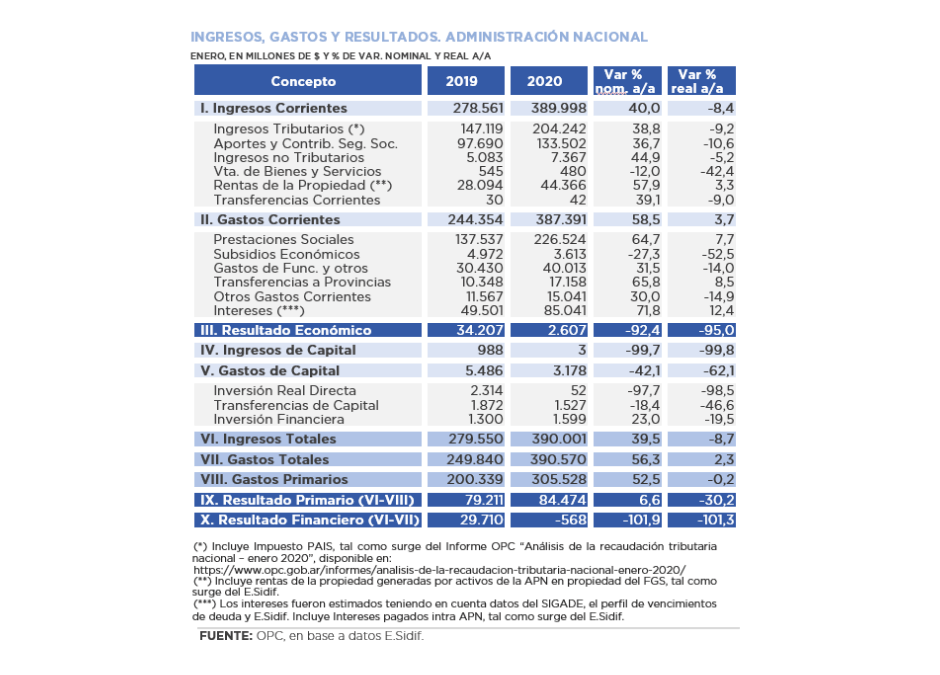

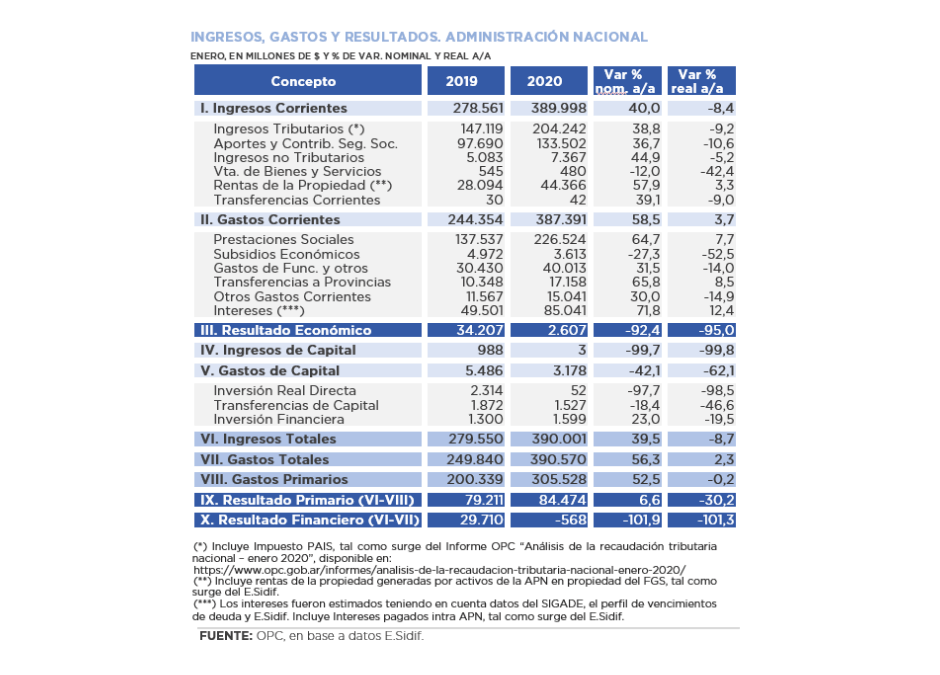

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.