by Nicolas Perez | Oct 14, 2020 | Budget Law

The National Budget Bill for 2021 foresees for next year a decrease in deficits due to the partial

recovery of the economy, with an increase in public investments and a reduction in the payment

of interest on the debt.

- According to the macroeconomic estimates of the Bill, the Gross Domestic Product

(GDP) will suffer a real fall of 12.1% this year, the nominal exchange rate will be AR$81.4

per dollar at the closing of the fiscal year, and the YoY inflation rate will be 32%. Next

year’s GDP is expected to rise 5.5% in real terms, with a nominal exchange rate of

AR$102.4 per dollar in December, and an inflation rate of 29% YoY.

- Resources will increase by 9.7% YoY in real terms and total expenditure will fall by

10.4% YoY.

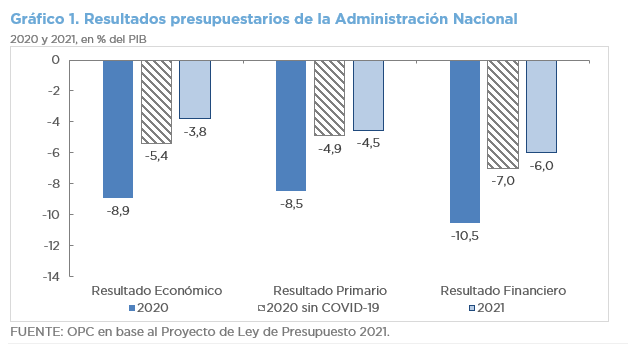

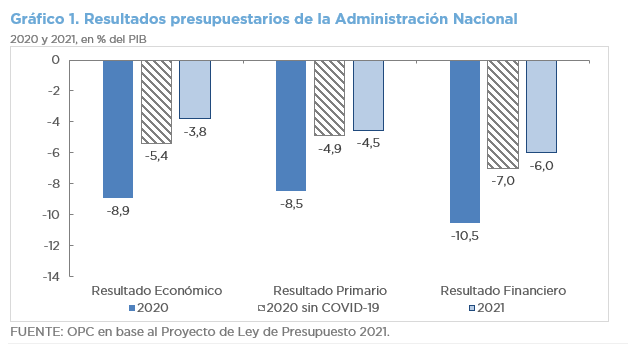

- This dynamic between revenue and spending will lead to an improvement in the primary

balance in 2021, which would go from a deficit of 8.5% of GDP in 2020 to a deficit of

4.5% in 2021. The same applies to the financial balance, which would vary from a deficit

of 10.5% of GDP in 2020 to a deficit of 6.0% in 2021.

- Capital expenditures will have the largest real increase and debt interest the sharpest

decline.

- Gross financing needs in the next fiscal year will be AR$6.4 trillion (17.2% of GDP). The

Central Bank will contribute AR$800 billion to the Treasury, 62.2% less than this year.

- Exports are expected to recover from a 14.2% YoY decline this year to a 10.4% YoY

increase next year.

- The Budget Bill does not provide neither financial allocations for Emergency Family

Income – IFE (Ingreso Familiar de Emergencia) nor for assistance for the payment of

private salaries (ATP), but it does provide a 24.1% increase in resources for vaccines

(AR$45.4 billion), including the purchase of doses against COVID-19 (AR$13.69 billion).

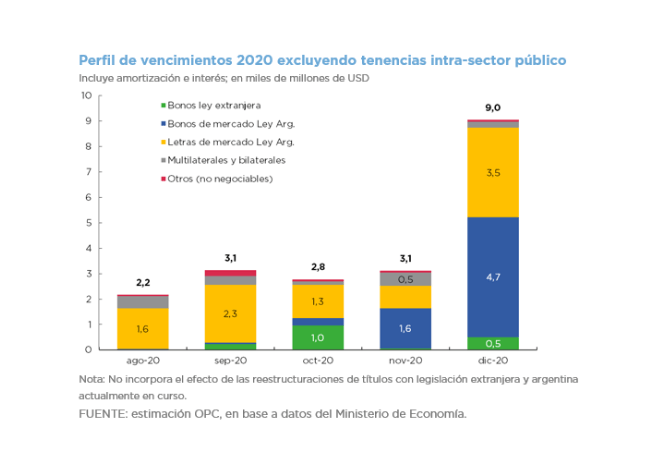

by Nicolas Perez | Oct 14, 2020 | Public Debt Operations

In September, the restructuring operations of foreign currency securities issued under foreign

legislation (Law 27,544) and local legislation (Law 27,556) were settled, which involved

cancellations of eligible securities for USD108.1 billion and placements of new bonds for

USD110.9 billion.

Excluding these operations, there were placements of securities and loan disbursements for the

equivalent of USD4.7 billion, of which AR$252.8 billion (USD3.4 billion) were auctions of

marketable securities in pesos. On the other hand, the equivalent of USD3.1 billion of principal

was paid, mainly due to maturities of Treasury bills in pesos. Likewise, interest payments were

made for the equivalent of USD447 million, of which 76% were in pesos.

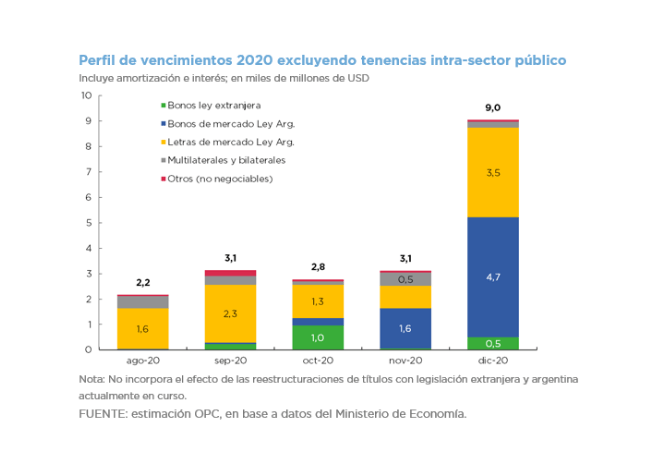

Debt service maturities for the equivalent of USD3.86 billion are estimated for October, totaling

USD17.06 billion until the end of the year (approximately USD8.4 billion if holdings within the

public sector are excluded).

by Nicolas Perez | Sep 16, 2020 | Employment and Social Security

The Law of Social Solidarity and Productive Reactivation within the framework of the Public

Emergency provides for a review of the special pension regimes to formulate a proposal for

amendment to the National Congress.

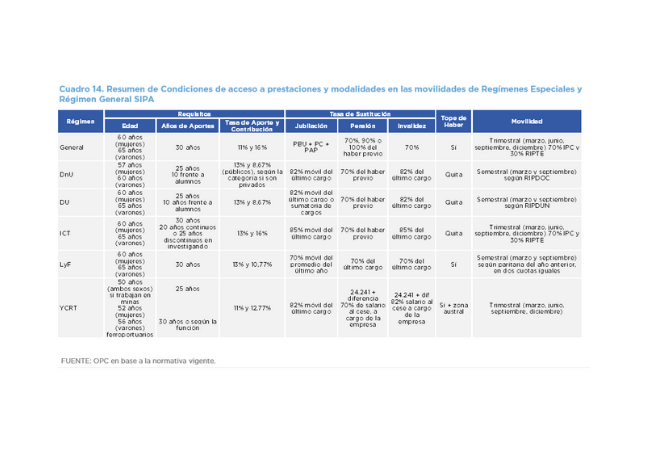

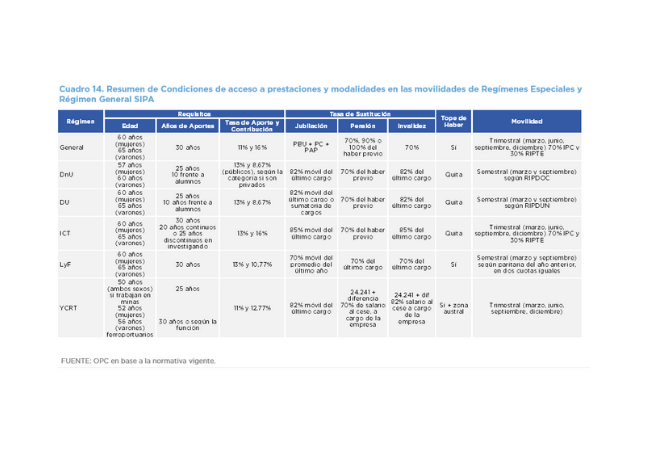

The analysis of five of the seven special pension regimes (non-university teachers; university

teachers; researchers and scientists; workers of Yacimientos Carboníferos Fiscales and of Luz

y Fuerza) shows that their average benefit is significantly higher than the general average and

explains the 27% of the contributory pension deficit, although they accounted for only 10% of

the pension expenditure in March 2020.

- These special regimes belong to the public sphere and their mobility is linked to the

evolution of the current salary with less prevalence of inflation as is the case in the

general regime. For this reason, in the last two years, the deficit of the general regime

has gained relative weight compared to the others.

- However, all Special Regimes included in this projection would be increasing their

contributory deficit during 2020.

- The benefit of non-university teachers doubles the general regime’s average. That of

researchers and workers of Yacimientos Carboníferos Fiscales quadruples it.

- The pension benefits guarantee between 70% (Luz y Fuerza) and 85% (researchers and

scientists) of the salary at the time of retirement, but the different adjustment formulas

only guarantee the stability of this parameter in some regimes.

- Special benefits should be reduced between 29 and 41% to have the same equivalence (salary replacement) of the general regime.

- From 2018 to last June, all regimes analyzed show a negative real mobility, ranging from a 10.92% decrease in the general regime, to a 23.69% drop for benefits for Luz y Fuerza.

Since the government is the one who employs and covers the deficit, to close this gap it would

not be useful to increase employer contributions or the retirement age, a measure that usually

takes effect only in the medium term. A possible more immediate fiscal impact could be

achieved by raising personal contributions or establishing a ceiling equivalent to the maximum

amount of the general regime.

by Nicolas Perez | Sep 15, 2020 | Cost Estimates

The purpose of Bill S-1566/20 is to guarantee Internet access to children and adolescents who

are beneficiaries of the AUH (Universal Child Allowance) through the granting of 5GB (mobile

data) per month by the companies providing mobile telephone service for cell phone lines

whose holder is a beneficiary of the AUH.

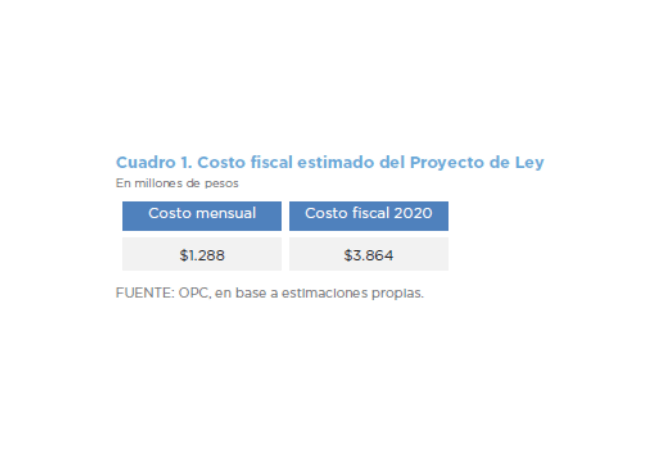

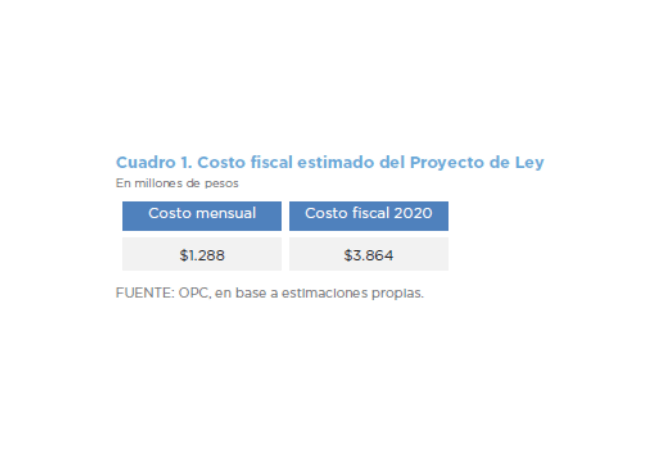

It is estimated that the Bill will have a fiscal cost of AR$1.28 billion per month.

Assuming that the benefit will be effective as from October of the current year and will remain in

force until December 31 (in accordance with the provisions of the Bill), the total cost of the

measure would amount to AR$3.86 billion in 2020.

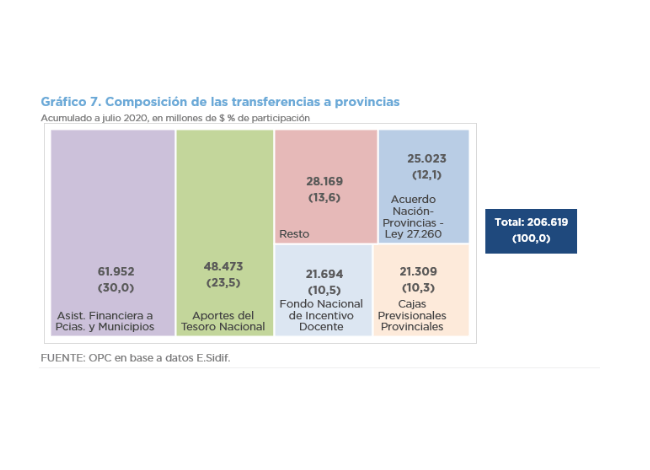

by Nicolas Perez | Aug 13, 2020 | Budget Execution

- National government primary deficit amounted to AR$43.4 billion, due to the increase in expenditures and the decrease in revenues, both conditioned by the health crisis. Meanwhile, if interest on the debt is included, the financial deficit widens to AR$74.12 billion.

- Primary expenditures for the month increased by 19.2% YoY in real terms, mainly due to the measures adopted by the national government within the framework of the COVID-19 health emergency.

- The programs implemented to face the health challenge resulted in an expenditure of approximately AR$96 billion, without which primary expenditure would have fallen by 2.8% in real terms compared to July of the previous year.

- Total revenues dropped 8.3% YoY in real terms due to the contraction of all their components, except for property income, which included the transfer of profits from the Central Bank of Argentina (BCRA) for AR$100 billion.

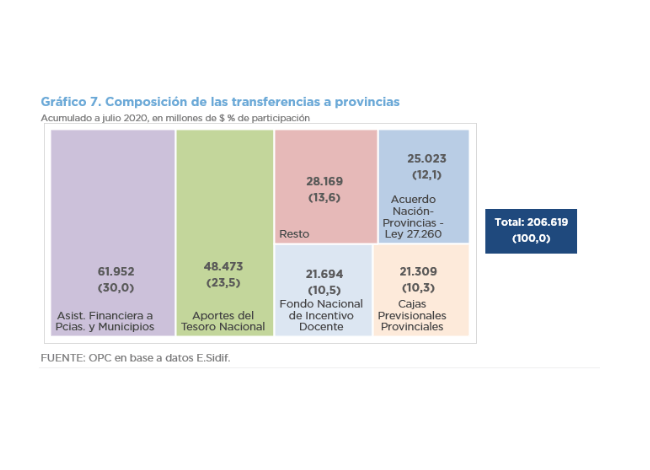

- Through thirteen amendments, the initial budget for the year increased by AR$864.29 billion, 66.2% of which was allocated to strengthen social benefits.

- The cumulative execution of the existing expenditure budget as of July totaled 65.9%, mainly due to current expenditures. All expenditure components recorded high levels of execution, except for debt interest and capital expenditures.

by Nicolas Perez | Aug 12, 2020 | Public Debt Operations

Placements of securities and loan disbursements were recorded for the equivalent of USD9.8 billion, of which AR$528.15 billion (USD7.7 billion) consisted of auctions of marketable securities in pesos.

In addition, the equivalent of USD7.37 billion of principal payment was made, mainly due to a voluntary swap of securities in dollars for new instruments in pesos carried out on July 17.

During the month, interest coupons were not paid on several foreign-legislation BIRAD bonds totaling USD584 million. As of July 31, outstanding interest coupons on bonds issued under foreign legislation totaling USD1.67 billion remain unpaid, which are expected to be recognized as part of the restructuring process of such securities currently underway.

We estimate debt service maturities for the equivalent of USD3.13 billion for August, amounting to USD35.53 billion by the end of the year (approximately USD20.29 billion excluding holdings within the public sector).

On August 4, the government announced an agreement with the main groups of creditors for the restructuring of bonds issued under foreign legislation. The deadline for creditors to accept the revised proposal was extended until August 24, while the settlement date of the transaction is September 4. At the same time, Law 27,556 on the restructuring of government bonds in dollars issued under Argentine legislation with the same conditions as the bonds under foreign legislation was enacted.