This document is prepared at the request of the Budget and Finance Committee of the Honorable Chamber of Deputies of...

This document is prepared at the request of the Budget and Finance Committee of the Honorable Chamber of Deputies of...

The purpose of this study is to continue with the evaluation of the consolidated tax burden on a group of economic...

The exemption from Income Tax for registered employees under law 27,617 implies a reduction of ARS56.6 billion in...

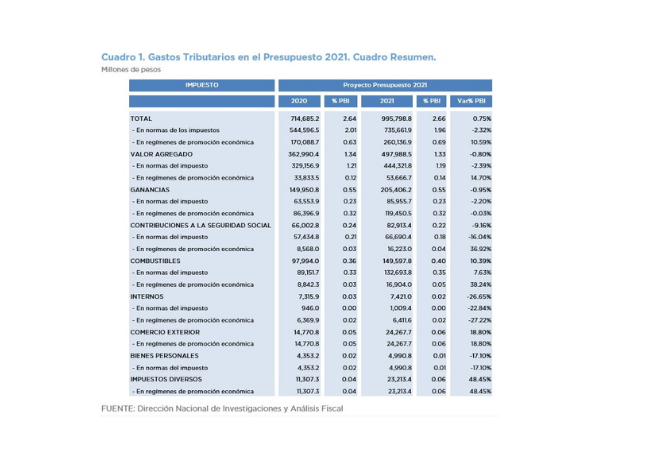

Due to tax exemptions and promotional regimes, the Budget Law estimates that next year's tax expenditure will be...

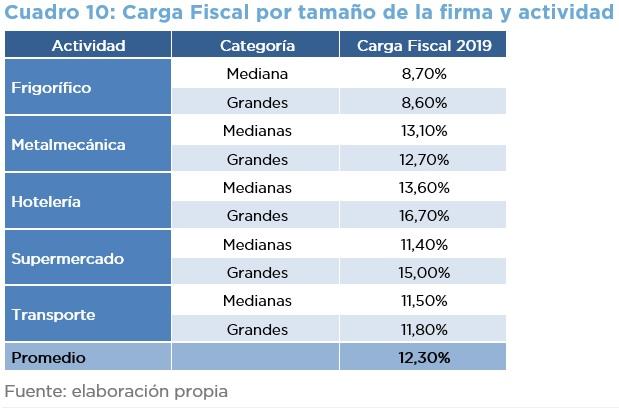

The purpose of this report is to evaluate the consolidated tax burden on the meatpacking, metal-mechanic, supermarket,...

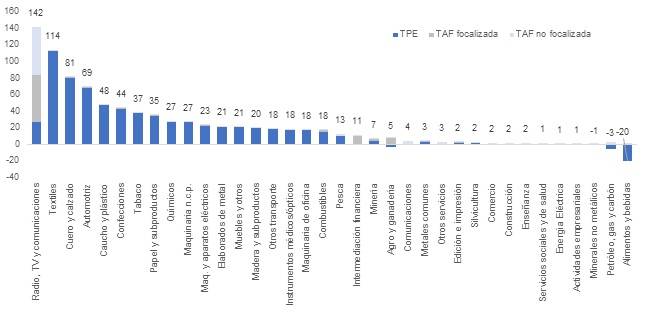

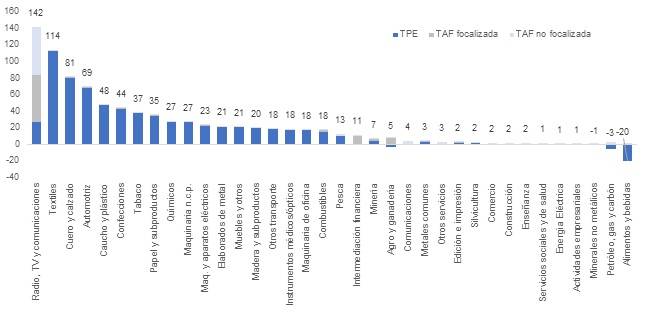

The OPC is developing a project to analyze the tax burden on a set of economic activities at national, provincial, and...

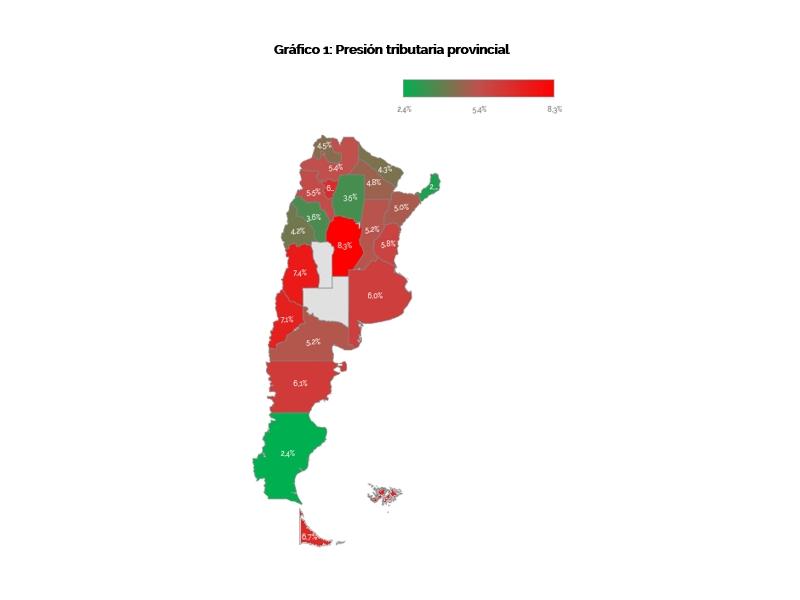

A review of the country's fiscal federalism reveals the complexity of its parameters and the difficulties to establish...

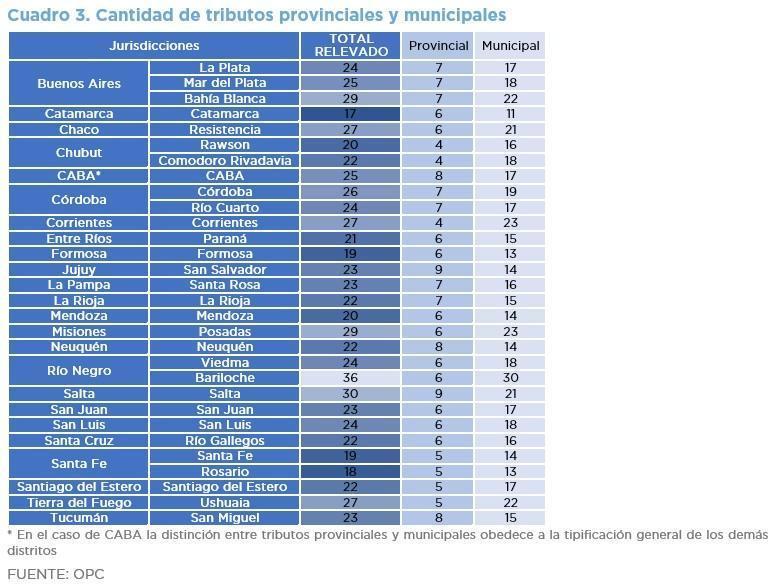

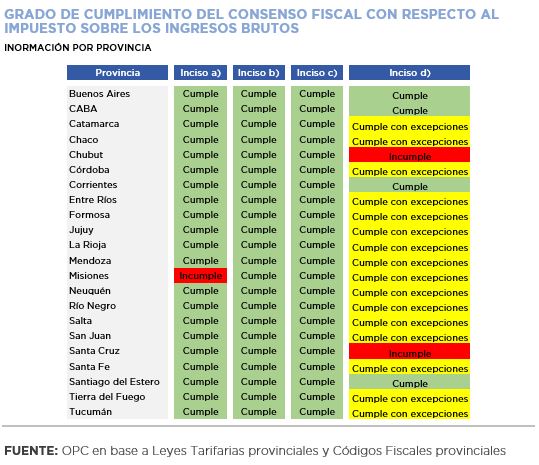

Con un comportamiento dispar por jurisdicciones, hubo avances en los tributos provinciales contemplados en el acuerdo de Consenso Fiscal 2017, de impacto dispar en la recaudación.

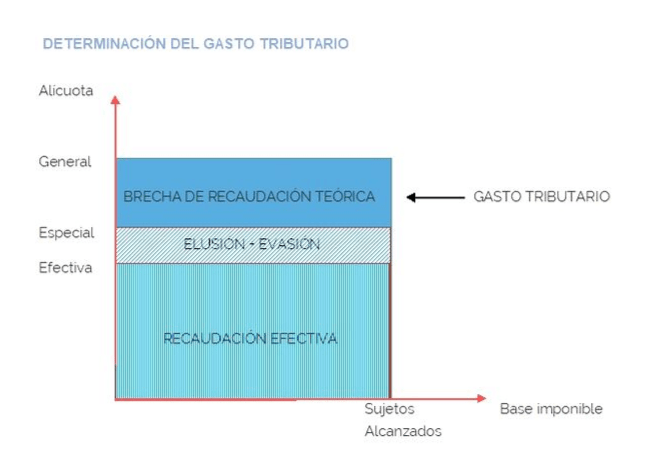

La Oficina de Presupuesto del Congreso (OPC) propone una metodología para calcular y evaluar el gasto tributario, producto de regímenes impositivo particulares

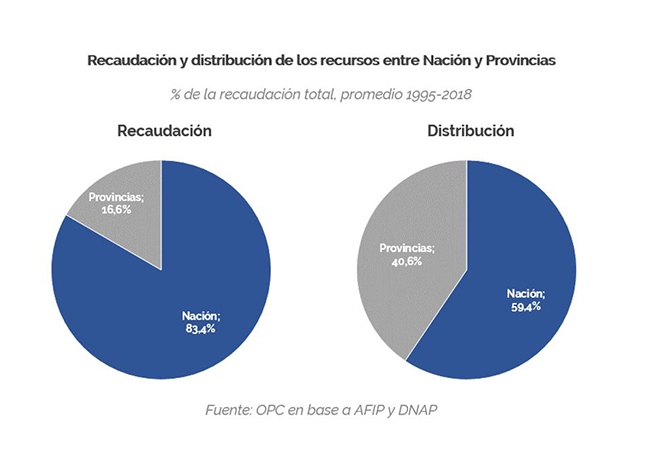

The analysis of the fiscal relations of the Nation and the provinces between 1993 and 2018 reveals a significant...

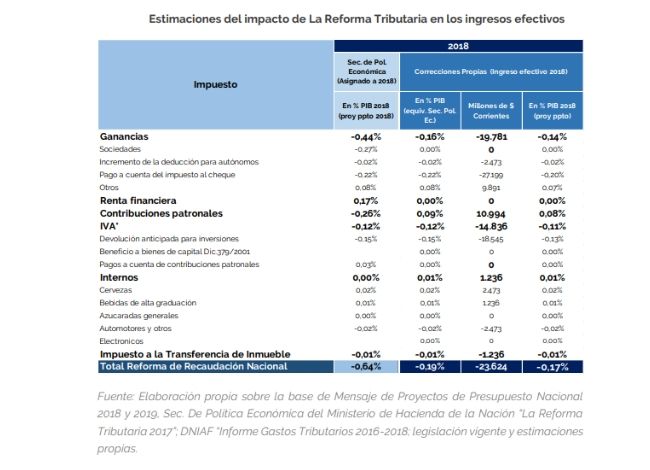

The tax reform provided for by Law 27,430 would have a lower effect on tax revenue in 2018 than officially estimated...

The Executive Branches of the Nation, of twenty-two provinces and of the Autonomous City of Buenos Aires (CABA) signed...