- At the end of September, the Executive Branch submitted to Congress a Bill for the inclusion of Collective Action Clauses in sovereign bonds under domestic law. The Bill does not include a restructuring proposal but establishes the basis for such restructuring. It would affect domestic marketable government securities issued under Argentine law, which represent 24% of the gross public debt and of which it is estimated that at the end of September 2019 there was about USD27 billion in face value held by private creditors.

- Further measures were announced to cover the financial program in the last quarter of the year, and the ban on public credit operations to finance operating expenses was suspended for the rest of the year.

- During September, there were placements of securities and disbursements for the equivalent of USD291 million and principal and interest payments totaling USD3.25 billion, of which 64% were amortizations. Interest payments totaled USD1.18 billion, of which 69% were made in pesos.

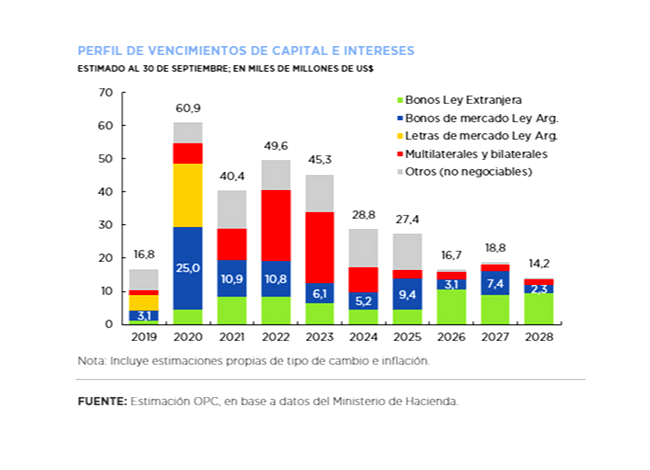

- For the last quarter of the year, debt maturities are expected to be approximately USD16.75 billion between amortizations (USD11.46 billion) and interest (USD5.29 billion), of which 62% will be paid in pesos. The approval of the fifth review of the IMF Stand-By program and the respective disbursement is still pending.