- With the financial markets facing an episode of extreme volatility, the Executive Branch announced in August a rescheduling of the maturities of Treasury bills held by institutional holders.

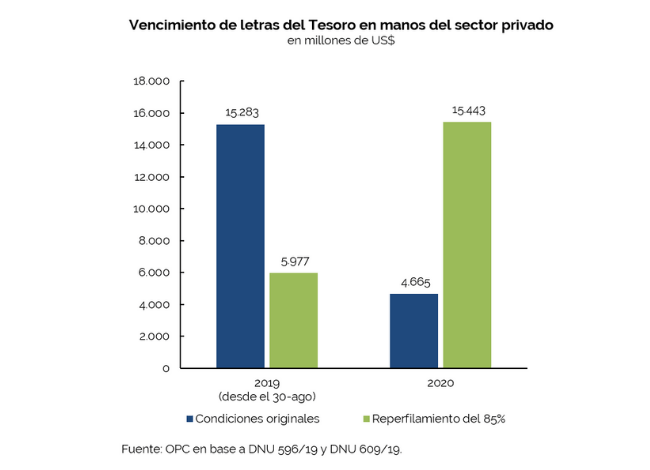

- The rescheduling reversed the maturity burden: under the original terms, 77% of the payments were to be made this year. But under the new schedule, 72% will be cancelled in 2020. Estimated maturities for 2019 are reduced by USD9.3 billion, but because of the extension of maturities, an additional USD1.47 billion of interest will accrue with respect to the original payment schedule.

- Placements of securities and loan disbursements for the equivalent of USD1.8 billion were recorded in August, mainly with transactions within the public sector.

- Principal and interest cancellations for USD17.06 billion were made during the month, of which 96% were for repayments of principal. The major amortizations for the month were the cancellation of bonds issued as collateral for repo transactions.