by Nicolas Perez | Dec 28, 2018 | Other Publications

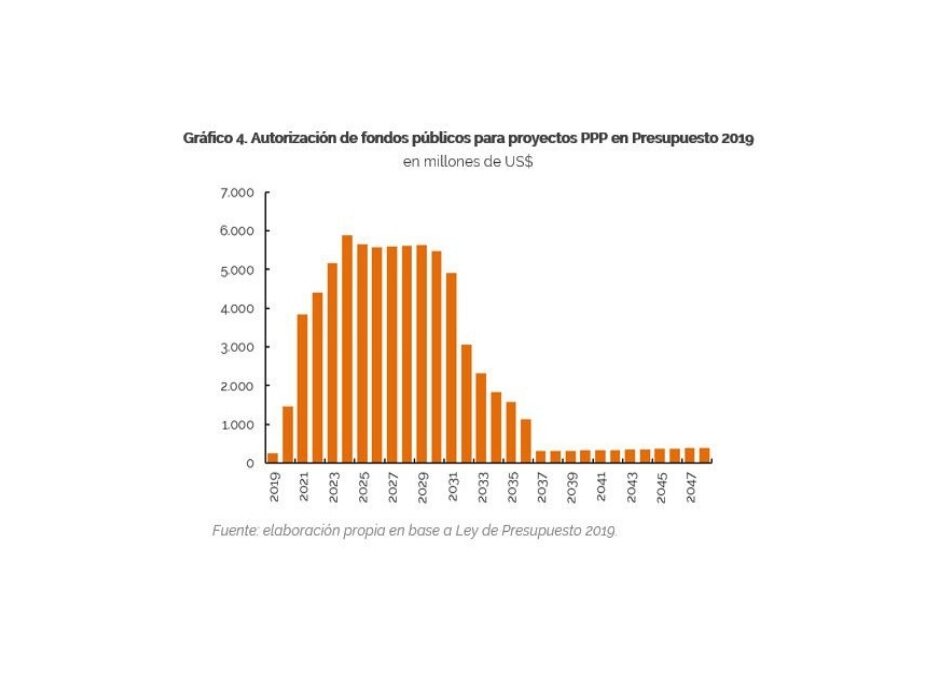

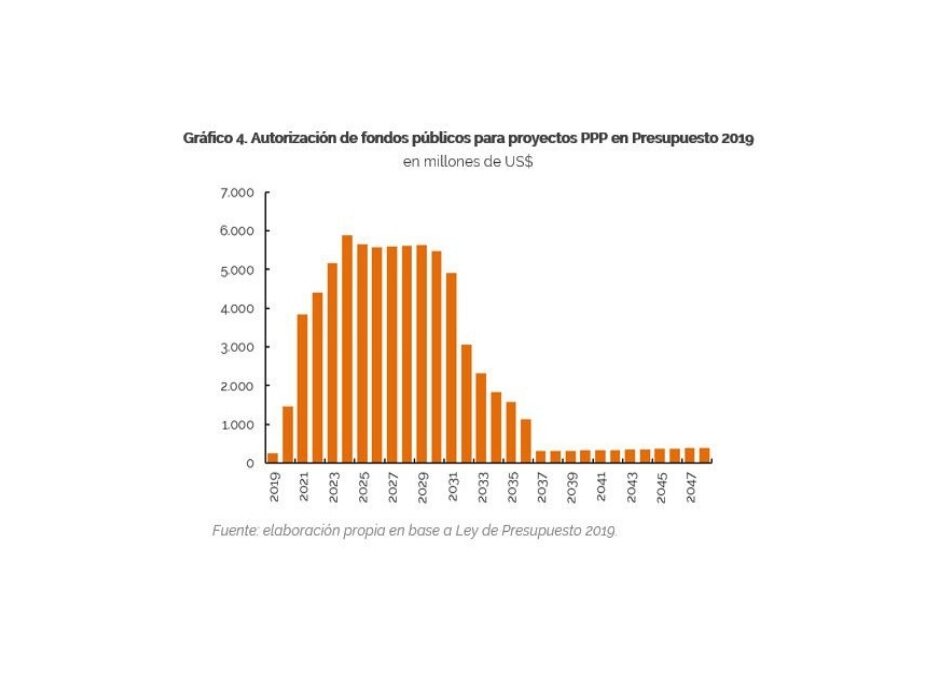

Budget Law 2019 includes eighty projects to be financed through the Public-Private Partnership (PPP) scheme that, if executed, would involve USD73.52 billion of public funds between 2019 and 2048. These projects may generate direct and contingent liabilities for the National Government that will affect the future fiscal performance.

During 2019, the progress of the works is not expected to be recorded as a capital expenditure but as a financial investment (below the line), so it will not have an impact on the balance of the respective fiscal year. Investment Securities (TPI, by its initials in Spanish), issued by the Trusts of each project, are not considered public debt, although they have common features to sovereign bonds and their repayment involves mainly public funds.

Following the best practices in the matter, a methodology for the valuation of contingent liabilities related to PPP projects should be developed, a task on which the Executive Branch is already working.

by Nicolas Perez | Dec 27, 2018 | Tax Policy and Fiscal Federalism

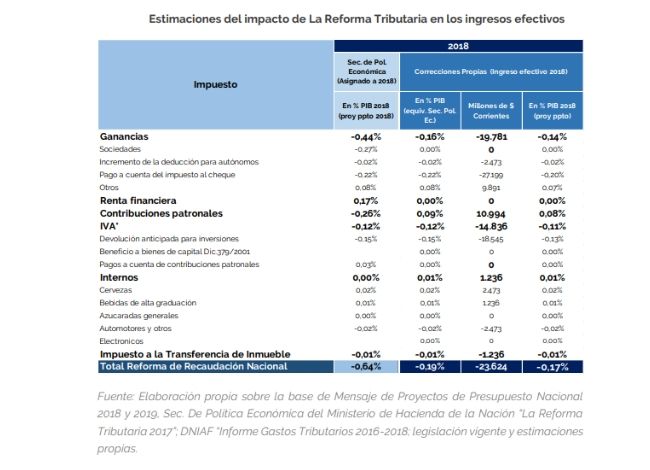

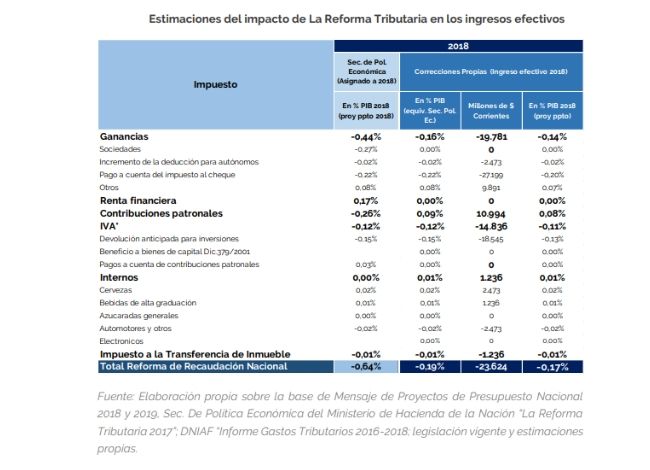

The tax reform provided for by Law 27,430 would have a lower effect on tax revenue in 2018 than officially estimated to date due to the delay in the regulation and implementation of the measures adopted within this framework.

At the end of this year, this reform would result in a decrease in tax revenue of nearly AR$23.5 billion, equivalent to 0.2% of GDP, only one third of the 0.6% of GDP estimated by the Secretariat of Economic Policy.

The impact will be greater as the changes are consolidated, but the volatility of the tax system and its sensitivity to macroeconomic situations makes it difficult to give a precise estimate of the future.

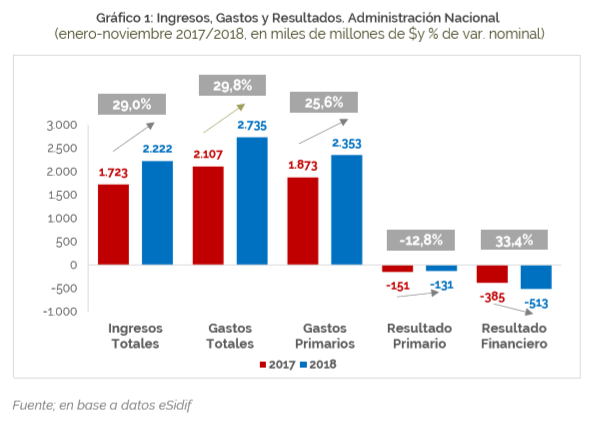

by Nicolas Perez | Dec 18, 2018 | Budget Execution

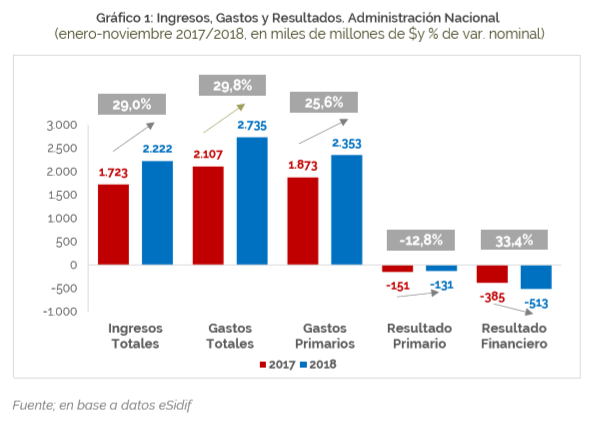

In November, the National Government primary deficit was AR$ -39.8 billion, 240% higher than in the same month of the previous year, while the financial deficit reached AR$ -55.6 billion, increasing by 70% the negative performance with respect to November 2017.

Total expenditure grew 8.3 percentage points above total revenues, basically boosted by a rise in economic subsidies.

In the cumulative of the first eleven months of the year, the negative primary balance was 34% lower in real terms than that recorded in the same period of the previous year, while the financial balance increased by 0.4%. At the end of November, the initial budget appropriation increased by 20% by virtue of Necessity and Urgency Decrees and Administrative Decisions.

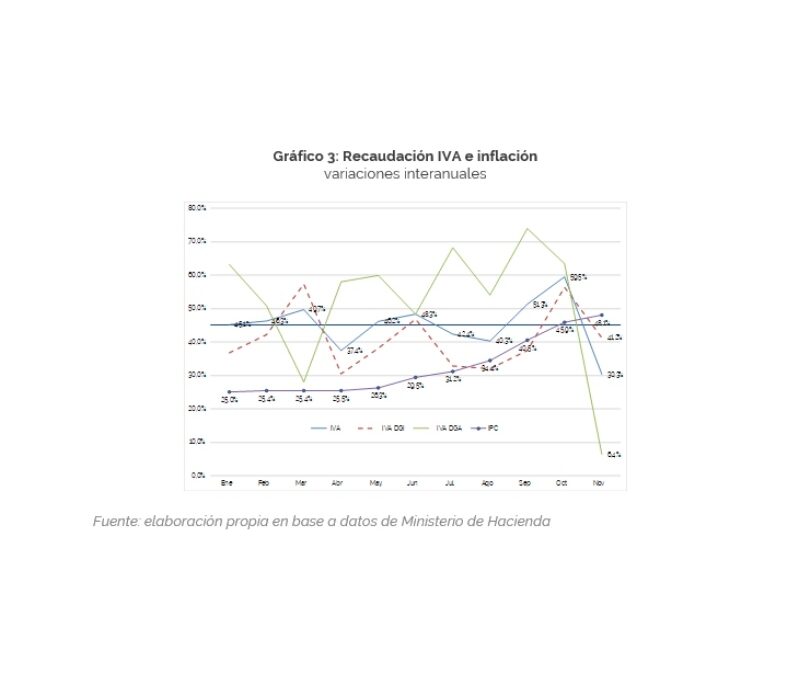

by Nicolas Perez | Dec 13, 2018 | Tax Revenue

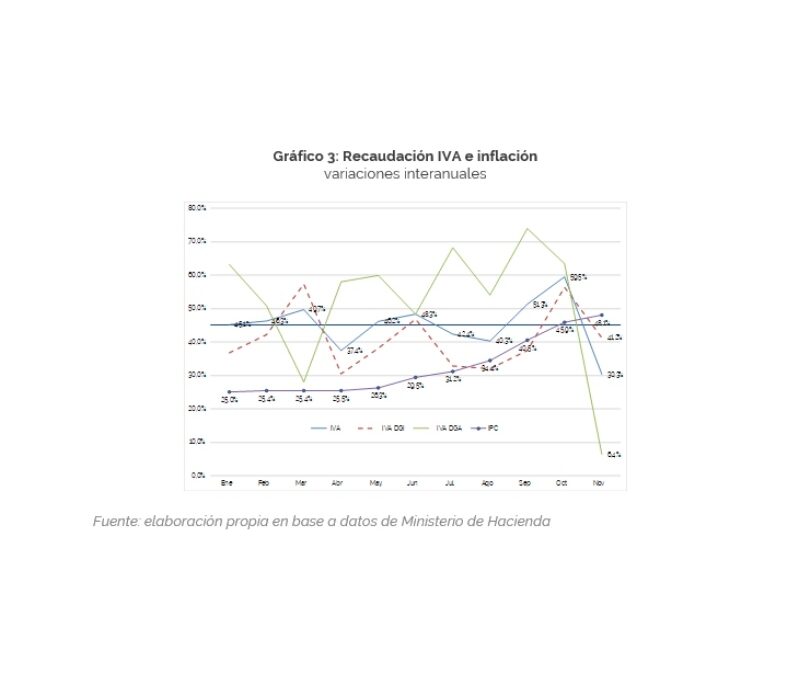

National tax revenue fell by 1.6% in real terms as of November 30. Analyzing the closing of the year, we estimate a low probability of reaching the figure included in the introductory statement of the 2019 Budget Bill of AR$3.47 trillion against an 11-month cumulative amount of AR$3.06 trillion.

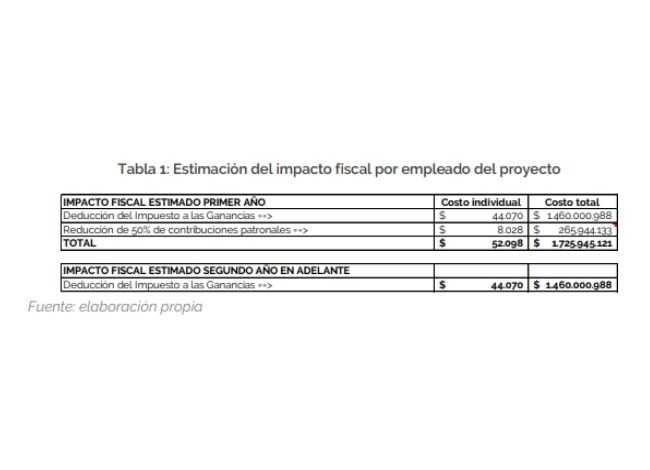

by Nicolas Perez | Nov 23, 2018 | Cost Estimates

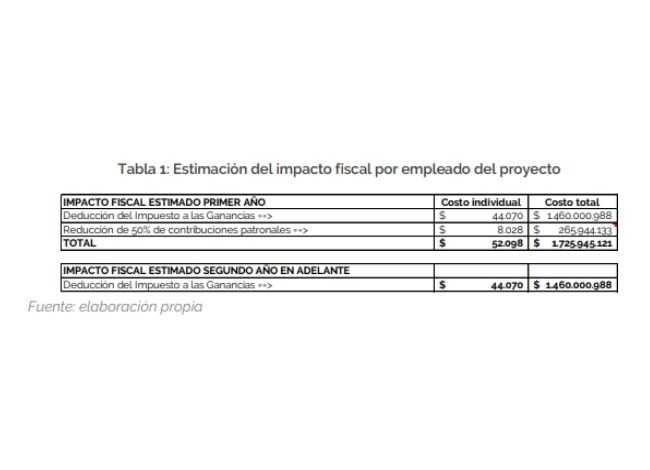

Tax benefits for employers, included in the Bill on a Federal Regime for Socio-labor insertion for People with Disabilities, would cause an estimated negative fiscal impact of AR$1.72 billion in the first year and AR$1.46 billion in the following years.

The benefit of paying half of the employer’s contributions will be in force only for the first year. Throughout the employment relationship, the employer will be able to deduct the entire amount of the wages subject to the Income Tax regime.

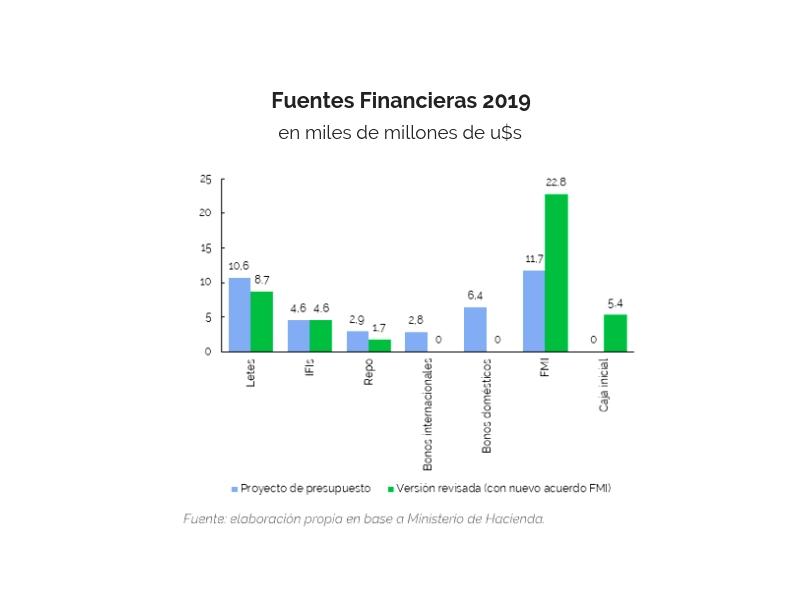

by Nicolas Perez | Nov 6, 2018 | Public Debt

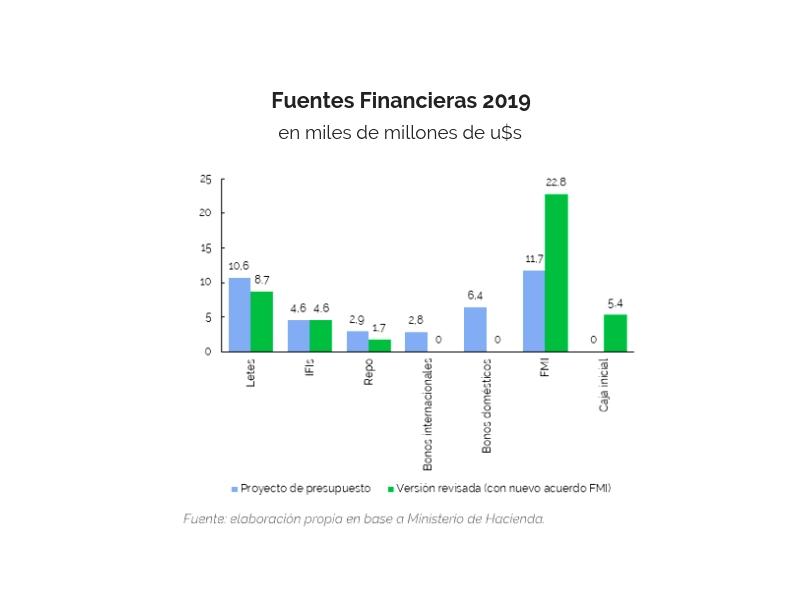

The renegotiation of the stand-by arrangement with the International Monetary Fund (IMF) resulted in a reformulation of the 2019 Financial Program with respect to the version included in the Budget Bill.

With the new arrangement, the IMF will increase its disbursements by USD7.6 billion this year and USD11.1 billion next year. The IMF assistance will cover 54% of next year’s financial needs, a figure that will drop to 14.7% in 2020.