REPORT ON NATIONAL PUBLIC INVESTMENT BUDGET EXECUTION – Second quarter 2019

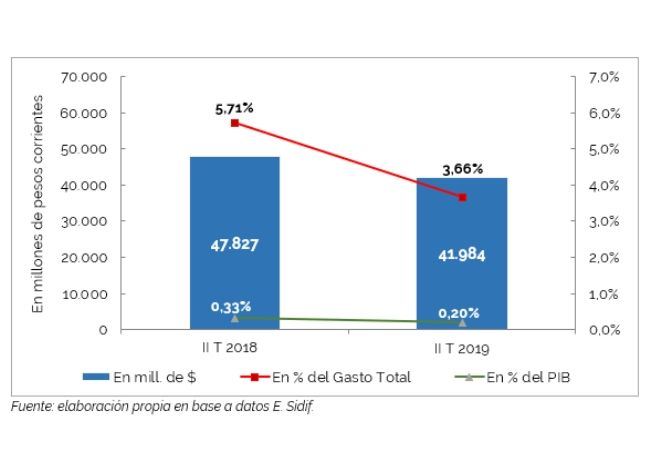

During the second quarter of 2019, public investment totaled AR$41.98 billion, showing a drop in its relative allocation, both as a proportion of total expenditure (5.71% to 3.66%) and in terms of GDP (0.33% to 0.20%).

The composition by geographic region shows a heterogeneous pattern, with a high concentration in the Pampas region (50.0% of the total). The investment “without specified region” accounts for an additional 16.9% – due to the significance of the Inter-provincials -, followed by the Northwest Region (13.5%), the Patagonian Region (8.0%), the Northeast (7.1%) and Cuyo Region (4.5%).

In terms of physical progress, 50.8% of the works show a minimum degree of progress (less than 20%), 5.3% show a low degree of progress (between 20% and 40%), 10.3%, medium-low progress (between 40% and 60%), 6.3%, medium-high progress (between 60% and 80%) and another 16.6%, high progress (greater than 80%), while there are 10.7% of works for which no physical execution data are available.