by Nicolas Perez | Nov 8, 2019 | Tax Revenue

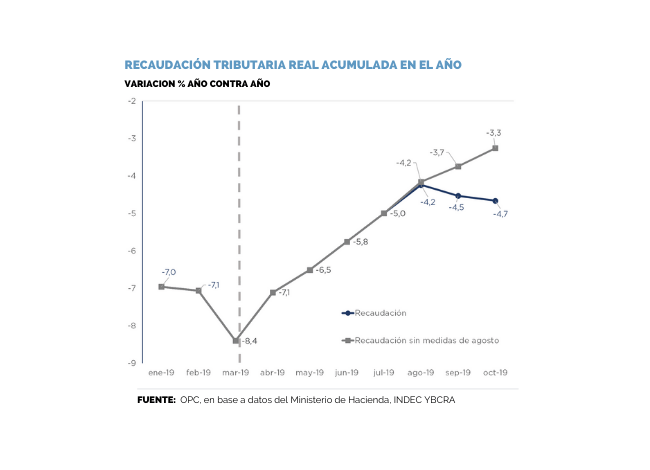

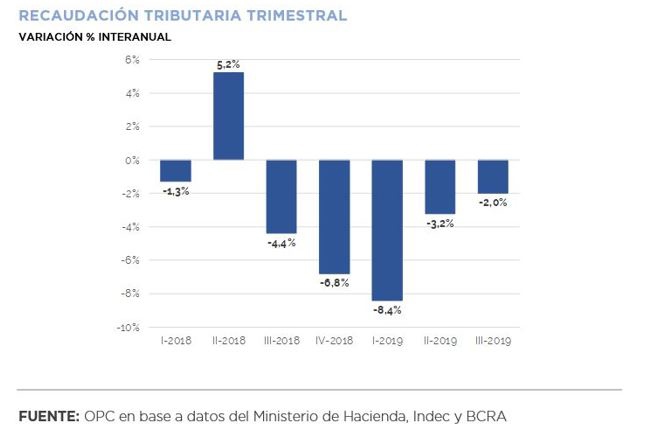

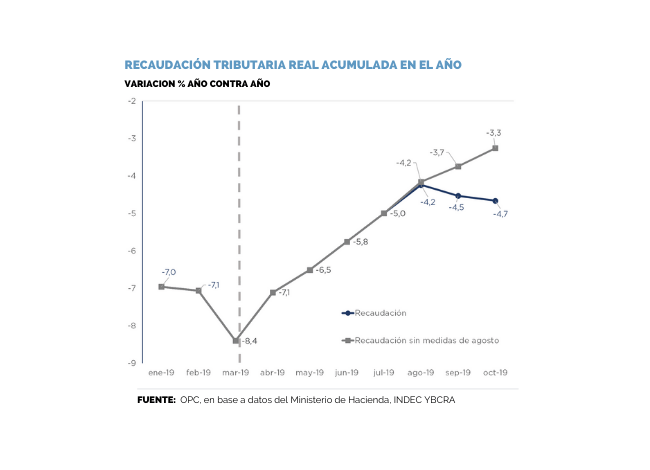

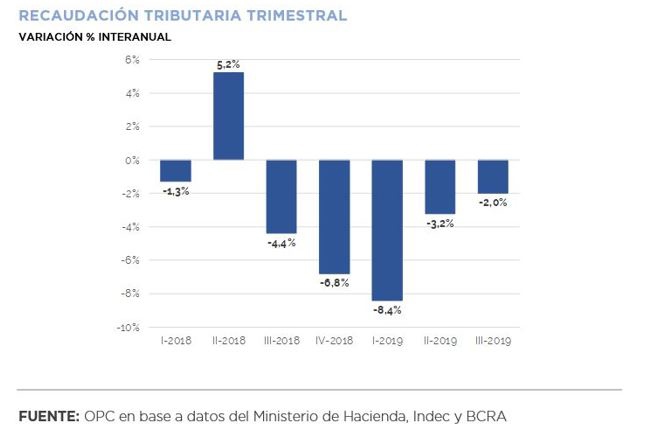

In October, tax revenue totaled AR$446.17 billion, which implied a growth of 42.8% YoY. In the annual cumulative figure as of October, tax resources of the National Public Sector show a 46.8% YoY growth. Revenue decreased by 5.9% YoY in real terms in the tenth month of the year.

October revenues were reduced by the impact of the fiscal stimulus measures announced by the National Executive Power during the month of August. According to OPC estimates, those measures caused a loss of resources of around AR$35 billion last month. Excluding this effect, nominal revenue would have grown 53.9% YoY, and 1.4% YoY in real terms.

The measures mentioned above particularly affected the collection of Income Tax, Social Security and VAT. On the other hand, Export Duties increased in October with respect to the previous month because of a higher number of tons for export.

by Nicolas Perez | Oct 11, 2019 | Public Debt Operations

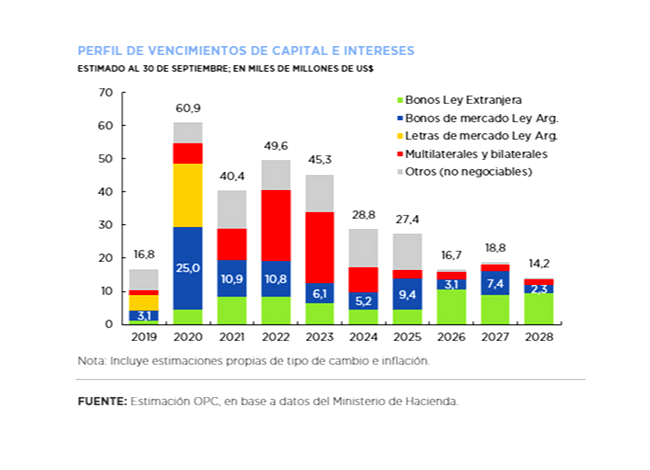

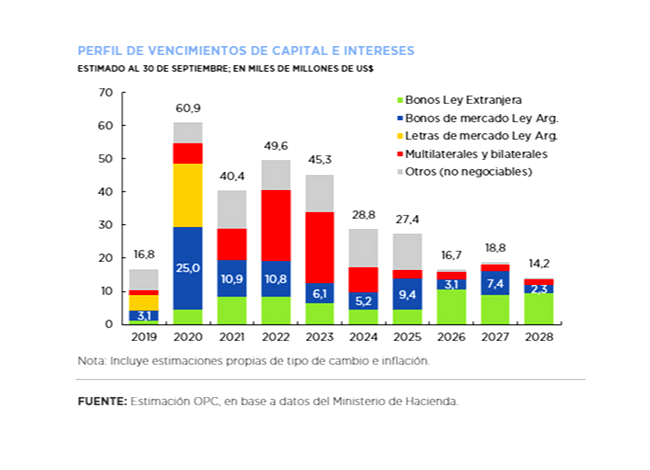

- At the end of September, the Executive Branch submitted to Congress a Bill for the inclusion of Collective Action Clauses in sovereign bonds under domestic law. The Bill does not include a restructuring proposal but establishes the basis for such restructuring. It would affect domestic marketable government securities issued under Argentine law, which represent 24% of the gross public debt and of which it is estimated that at the end of September 2019 there was about USD27 billion in face value held by private creditors.

- Further measures were announced to cover the financial program in the last quarter of the year, and the ban on public credit operations to finance operating expenses was suspended for the rest of the year.

- During September, there were placements of securities and disbursements for the equivalent of USD291 million and principal and interest payments totaling USD3.25 billion, of which 64% were amortizations. Interest payments totaled USD1.18 billion, of which 69% were made in pesos.

- For the last quarter of the year, debt maturities are expected to be approximately USD16.75 billion between amortizations (USD11.46 billion) and interest (USD5.29 billion), of which 62% will be paid in pesos. The approval of the fifth review of the IMF Stand-By program and the respective disbursement is still pending.

by Nicolas Perez | Oct 10, 2019 | Tax Revenue

Although in nominal terms September’s tax revenue grew 42.2%, the benefits announced in August, added to the macroeconomic deterioration, caused revenue to contract by 7% in real terms compared to the same month of the previous year.

The measures announced by the government last month resulted in an estimated revenue loss of AR$31.22 billion during September. Without these measures, the decrease in tax revenues in the ninth month of the year would only have been 0.1%.

The reduction of Personal Contributions was the main cause of the decline in Social Security resources, which reached 25.9%, equivalent to about AR$10 billion: Social Security is losing relative weight in the fiscal structure due to stimulus measures and the deterioration of the labor market.

The fall during September in main taxes such as VAT -which decreased by AR$6 billion due to the exclusion of taxation on certain food products-, Income Tax, and Social Security Contributions, is likely to continue in October, since the conditions that depress collection will persist: fiscal stimulus measures and economic deterioration.

Due to the large number of Foreign Sales Affidavits and, to a lesser extent, the improvement in the exchange rate, Export Duties rose 58.7% year-on-year. However, there was no increase in revenue measured in dollars.

by Nicolas Perez | Oct 9, 2019 | Budget Execution

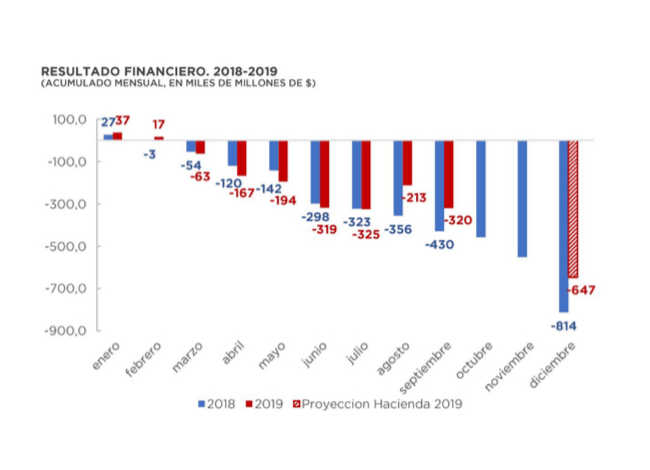

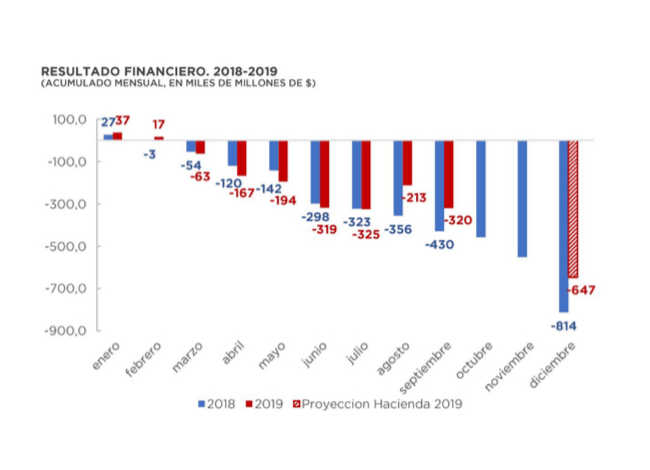

In September, public expenditure grew below inflation once again, registering eleven consecutive months of year-on-year decline in real terms. In a context of financial deficit, debt interest recorded the highest growth in current expenditure, while capital expenditure showed a slower growth. Energy subsidies will increase this year by AR$80.5 billion compared to the previous year.

- The cumulative financial balance for the first nine months of the fiscal year showed a deficit of AR$320.4 billion, which implies an improvement of 51.6% YoY in real terms with respect to the same period of the previous year (-AR$429.9 billion).

- National government revenues recorded a year-on-year increase of 41.0% YoY, while expenditures grew at a rate of 42.2% YoY, below inflation, although reversing four consecutive months of growth below revenues.

- Revenues were favored by the increase in Export Duties (130.5% YoY), which partially offset the drop in property income (-13.2% YoY) and the slowdown in Value Added Tax collection.

- Interest on debt was the component with the greatest expansion (80.4% YoY), while at the other extreme, economic subsidies showed a contraction of 13.7% YoY.

- As of September 30, the initial budget appropriation increased by AR$122.19 billion, AR$43.68 billion by Necessity and Urgency Decrees (35.8%) and AR$78.5 billion by Administrative Decisions (64.2%).

- The level of execution of total expenditure was 73.9% as of September 30.

by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

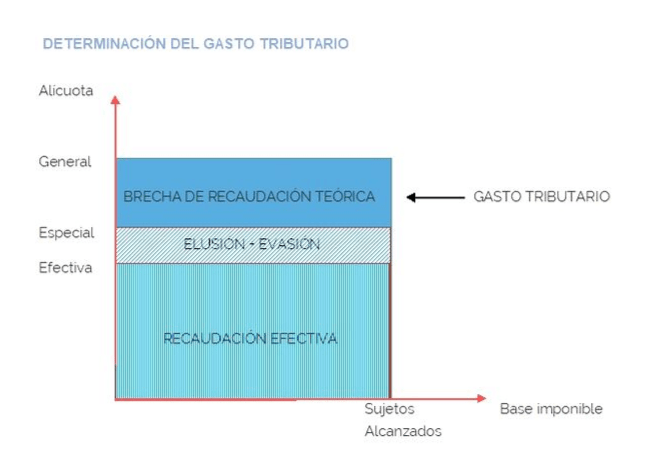

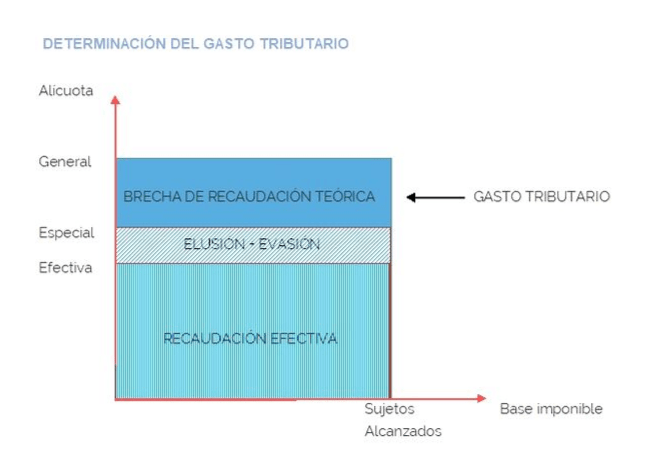

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.

by Nicolas Perez | Oct 2, 2019 | Gender

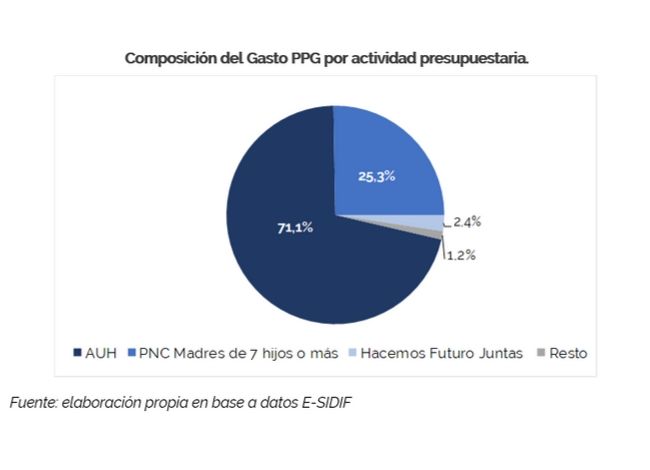

Progress in the preparation of a Gender Responsive Budget (GRB) in the country is focused on labeling budgetary activities with an impact on the gender gap from their design, without considering others that may also have that impact, although they have not been conceived for that purpose.

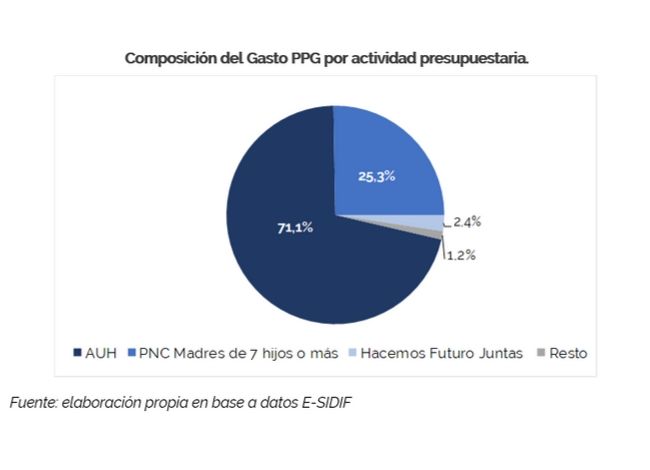

This report analyzes the implementation of activities with a gender perspective from January to August 2019: twenty-six budgetary actions that represent 3.7% of the public expenditure budgeted for the current fiscal year.

Expenditure is focused on initiatives that seek to strengthen the economic autonomy of women through direct monetary transfers and that privilege the mother status of the recipients. In fact, the Universal Child Allowance for Social Protection (AUH) represents more than 70% of GRB expenditure.

These activities show a lower level of implementation than total expenditure (56.5% compared to 62.9%) and great disparity among them.

The Gender Awareness, Visibility and Training dimension shows the highest level of execution (64.9%) as opposed to the Gender Violence and Sexual and Reproductive Health dimensions, whose accrued expenditure represented less than 10% for the first and little more than a third of the allocated appropriation for the second.