by Nicolas Perez | Jun 10, 2019 | Budget Execution

In May, the national government recorded a primary surplus of AR$23.99 billion but a financial deficit of AR$22.38 billion, within a framework of an acceleration in the fall of revenues in real terms. Expenditures, also in contraction, had the seventh month of decline measured against inflation.

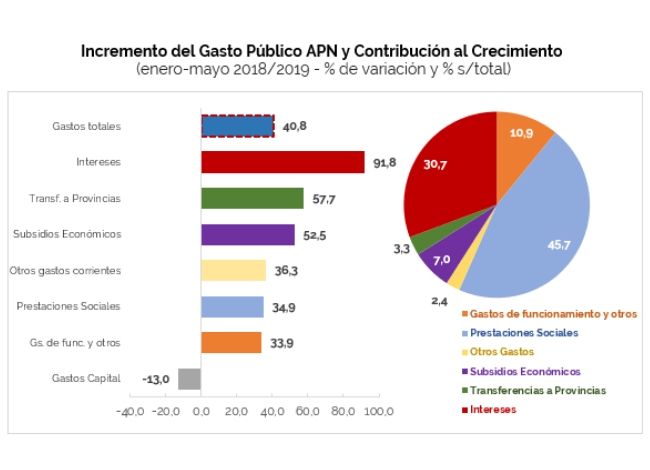

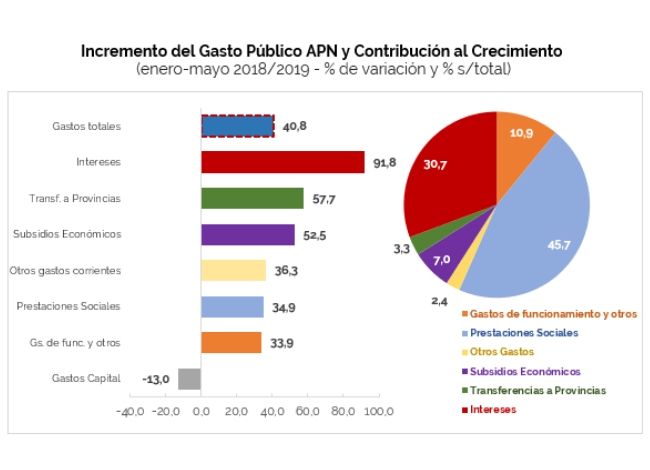

In the term January-May, expenditures increased 40.8% year-on-year. Interest on debt, transfers to provinces and economic subsidies recorded the largest expansions in the period with 91.8%, 57.7% and 52.5% YoY, respectively. Social benefits (34.9% YoY), operating expenses (33.9% YoY) and capital expenditures (-13.0% YoY) were below the increase in total expenditure.

Social benefits account for 45.7% of the increase in total expenditure, while interest payments account for 30.7%. Both explain 76.4% of the increase in expenditure in the period under analysis.

- National government revenues (40.5% YoY) again grew above expenditures (36.9% YoY), although the differential is reduced to 3.6 percentage points (p.p.) (5.2 p.p. in April).

- Personnel expenditure recorded a real fall of 14.6% YoY, in line with the retraction experienced in the salaries of several sectors (SINEP).

- After the first five months of the year, the financial balance is in deficit by AR$180.51 billion, reflecting a real reduction of 17.0% compared to the same period of the previous year.

- So far this year, the expenditure components that grew the most were Debt Interest (91.8% YoY), Transfers to Provinces (57.7% YoY) and Economic Subsidies (52.5% YoY). At the other extreme, capital expenditure contracted 13.0% YoY in nominal terms.

- The 76.3% of national government expenditure is rigid.

- At the end of May, the execution level of total expenditure reached 35.4% with respect to the current appropriation, higher than the level observed during the same period of the previous year, which reached 32.3%.

by Nicolas Perez | Jun 7, 2019 | Tax Revenue

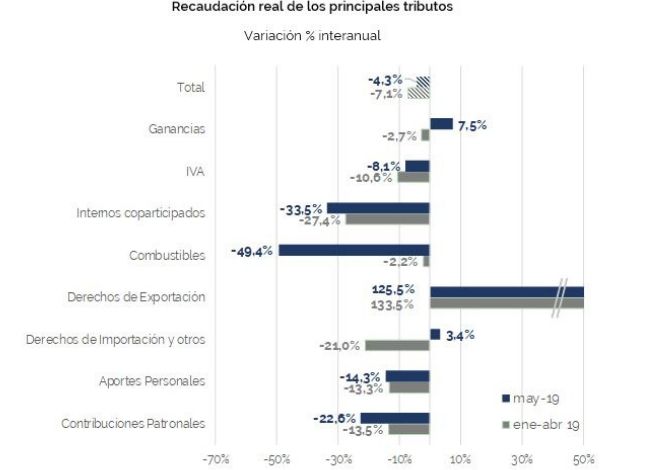

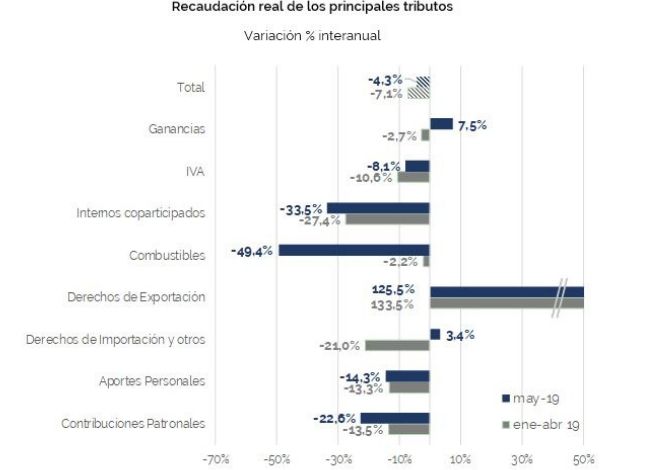

In May, tax revenue grew 50.4% in nominal terms with respect to the same month of the previous year but declined 4.3% in real terms during the same period. This decline deepens to 6.5% when considering the first five months of the year.

Overall tax revenue has been declining in real terms for eleven consecutive months, although it began to reduce the rate of decline.

In this context, Income Tax exceeded the collection expectations for the month with an increase of 7.5% year-on-year in real terms. Together with taxes on foreign trade, it is one of the taxes whose growth exceeded inflation.

VAT contracted by 8.1% in May, although this record implies a deceleration of the falls of the last seven months.

The decline in Social Security resources deepened because of the deterioration of the labor market and the changes in the employer contributions system. However, in the fifth month of the year, Social Security resources might have found its lowest level, and in the following months the trend may consolidate.

by Nicolas Perez | Jun 3, 2019 | Gender, Other Publications

Gender-responsive budgeting aims at contributing to social equity by providing information that helps policymakers to consider the impact of these decisions on different groups of people.

This report describes the main methods for including this perspective in the budget cycle, both in terms of spending and resources, with an analysis of what has taken place in Australia, Austria, Bolivia, Brazil, Canada, South Korea, Ecuador, El Salvador, France, Japan, and Mexico.

Argentina has been working on the development of a methodology to analyze the budget from a gender perspective since last year, and the 2019 Budget Law has already targeted 23 activities in different programs related to this issue.

Public policies can help to dismantle dynamics that produce patterns of inequality and there has been progress in the world to understand the impact that budgets have on gender. However, there is still room for improvement in terms of accountability of political officials and in terms of amending policies.

by Nicolas Perez | May 17, 2019 | Cost Estimates

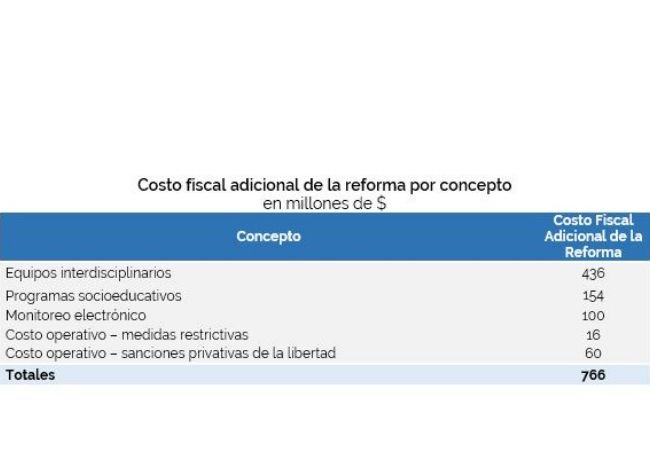

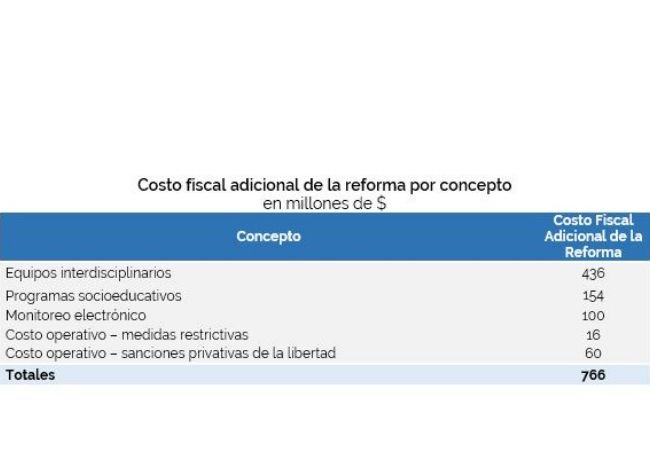

The estimated annual fiscal cost of the Bill to reform the Juvenile Criminal Regime and create the Juvenile Criminal Responsibility System amounts to AR$766 million.

In accordance with the provisions of the Bill, the implementation of the system will be progressive, so that the estimated cost would not fall entirely on the first year of its entry into force.

Likewise, this additional cost would not be fully financed by the National Budget. Although it is not explicitly stated in the Bill, part of the cost should be financed with resources from provincial Budgets, based on the powers of the jurisdictions.

by Nicolas Perez | May 16, 2019 | Other Publications

In 2015, Argentina adhered to the 2030 Agenda for Sustainable Development of the United Nations (UN), which identifies 17 central goals expressed in 169 targets agreed by member states.

Of these, Argentina adopted 89 with priority in food security, health, education, economic growth, and infrastructure development.

The national government is one of the key actors in the achievement of these goals and the budget, organized through programs, is a fundamental tool for the implementation of domestic policies that honor the commitments made with the UN.

The Argentine Congressional Budget Office (OPC) makes a preliminary methodological proposal to assess the achievement of the SDGs through the budgetary implementation of policies, which involves identifying the expenditures effectively related to these purposes.

by Nicolas Perez | May 15, 2019 | Public Debt Operations

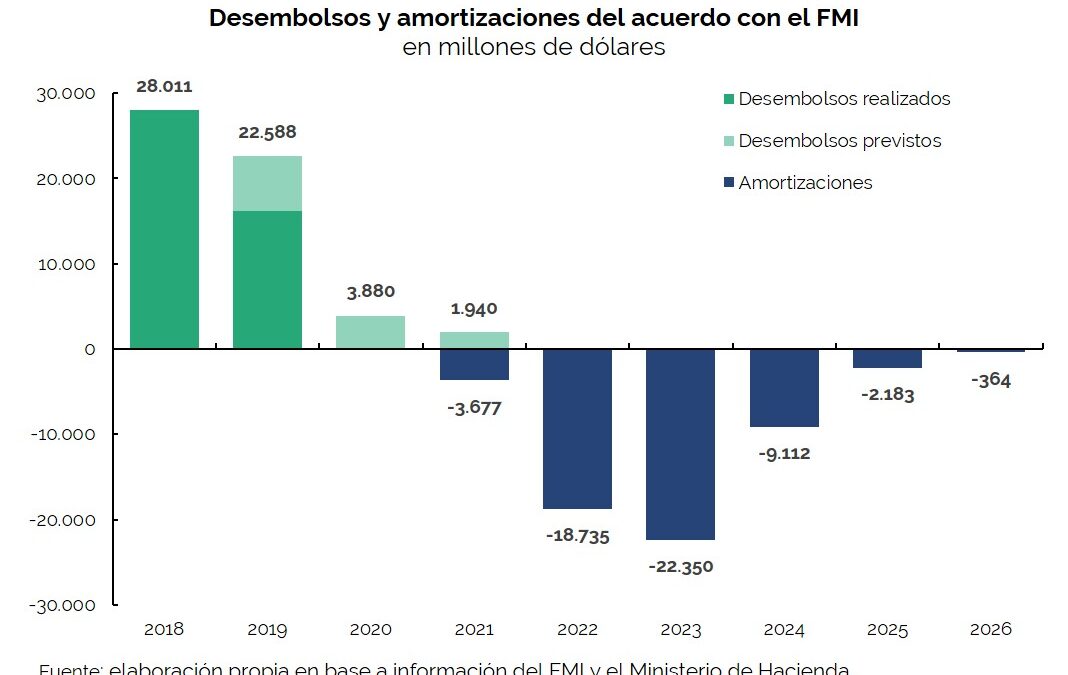

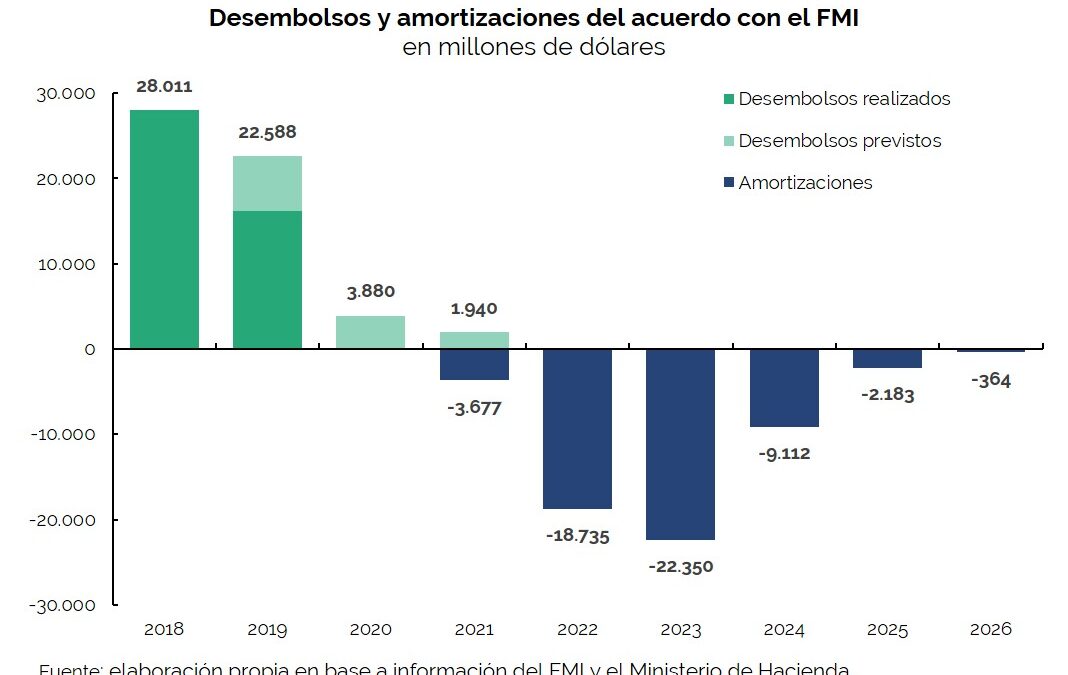

Placements of securities and loan disbursements for USD18.52 billion were recorded during the month of April, of which 58% (USD10.83 billion) consisted of the fourth disbursement from the International Monetary Fund (IMF) within the framework of the Stand-By Arrangement (SBA). Debt service payments during the period totaled USD11.46 billion, of which 82% (USD9.38 billion) were principal payments.

In a context of high volatility, a higher yield was validated in LETES placements, whose refinancing ratio fell to 64% from 87% in April.

During the month, new bonds in dollars for USD1.5 billion were placed to cancel a debt remaining from natural gas production stimulus plans, and securities for USD369 million to satisfy a ICSID arbitration award in favor of the former concessionaire of Aguas Argentinas. On April 22, the first securities issued under the agreement with “holdout” creditors for USD2.75 billion matured.

On May 31, the fifth payment of principal and interest of the loans renegotiated with the Paris Club is due: if the minimum principal established in the agreement is paid, such payment will amount to USD 1.87 billion.