by Nicolas Perez | May 10, 2019 | Budget Execution

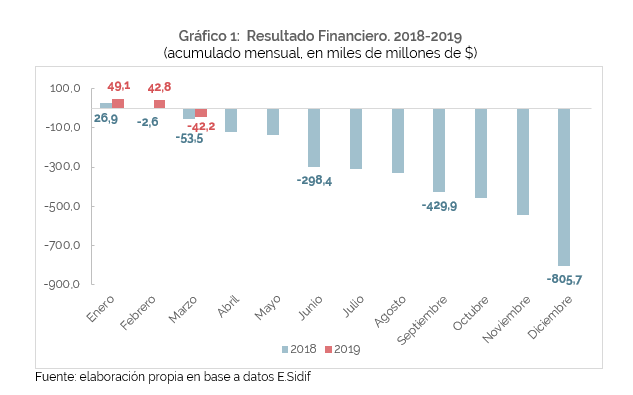

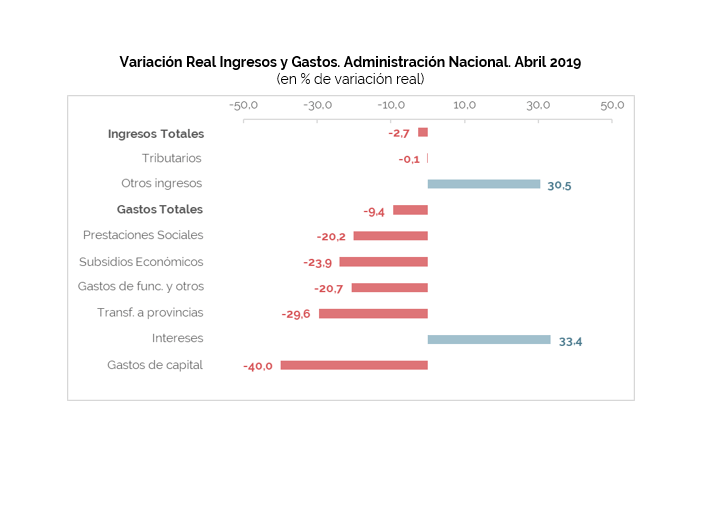

In April, the nominal increase in national government total revenues was higher than that of expenditures, which helped to generate a primary surplus of AR$36.83 billion and to reduce the financial deficit, which totaled AR$76.36 billion.

The most dynamic expenditure item continues to be the payment of interest on the debt, while the most dynamic revenue item is export duties: total revenue grew last year almost as much as inflation but, excluding withholdings, this increase is reduced by 17.5 percentage points.

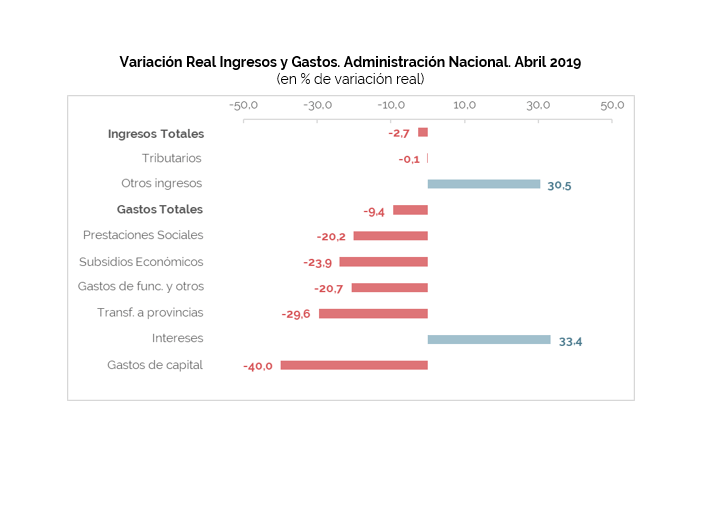

Both total revenues and total expenditures fell by 2.7% and 9.4%, respectively.

-

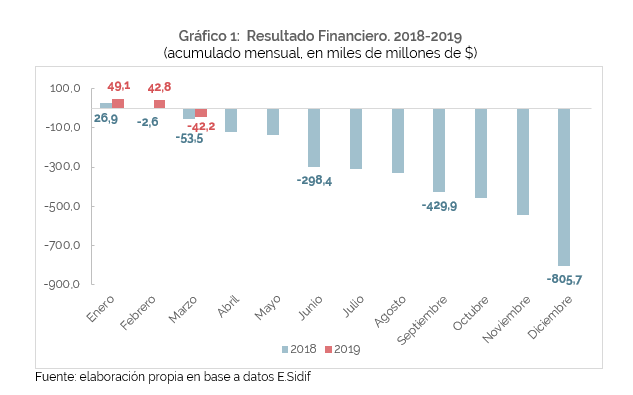

The cumulative financial balance for the first four months of the year recorded a deficit of AR$138.75 billion. In real terms, this implies an improvement of 24.2% YoY compared to the same period of the previous year (-AR$119.65 billion).

-

Tax revenues increased 56.5% YoY in the month, in line with inflation (-0.1% YoY in real terms).

-

Current expenditures increased by 44.7% YoY, while capital expenditures contracted by 6.0% YoY.

-

Interest on debt was the component with the highest growth (108.9% YoY), accounting for 60% of the increase in current expenditure.

-

As of April 30, the initial budget appropriation increased by AR$56.93 billion, AR$34.57 billion through Necessity and Urgency Decrees – DNU (61%) and AR$22.35 billion through Administrative Decisions – DA (39%).

-

The execution of total expenditure was 27.4% in the four-month period.

by Nicolas Perez | Apr 25, 2019 | Cost Estimates

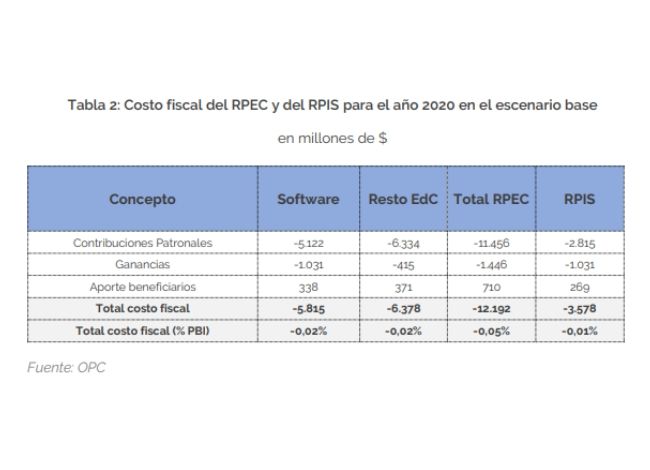

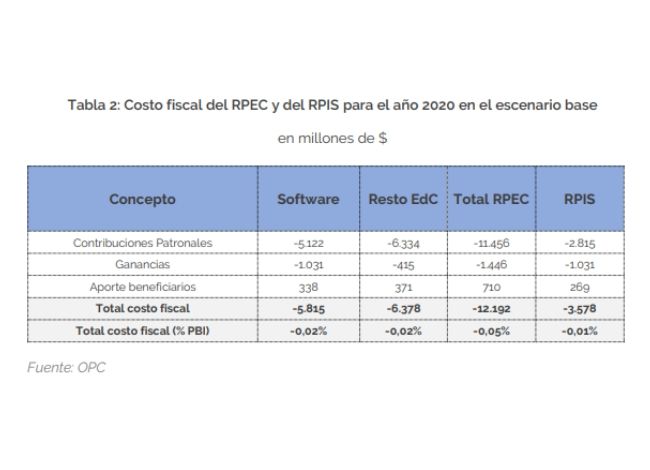

Tax benefits for the economic activities included in what the bill defines as Knowledge Economy, would result in a fiscal cost of AR$12.19 billion during 2020. This represents approximately 0.05% of the projected GDP for the year.

Among the tax exemptions proposed are the early implementation of the non-taxable minimum applicable to the payment of Employer Contributions, the granting of a tax credit certificate equivalent to 1.6 times the amount of such contributions applicable to the payment of other national taxes, the reduction of the Income Tax rate and the non-applicability of withholdings or collections of Value Added Tax. The duration of this promotion regime is established as from 01/01/2020 until 12/31/2029.

by Nicolas Perez | Apr 12, 2019 | Public Debt Operations

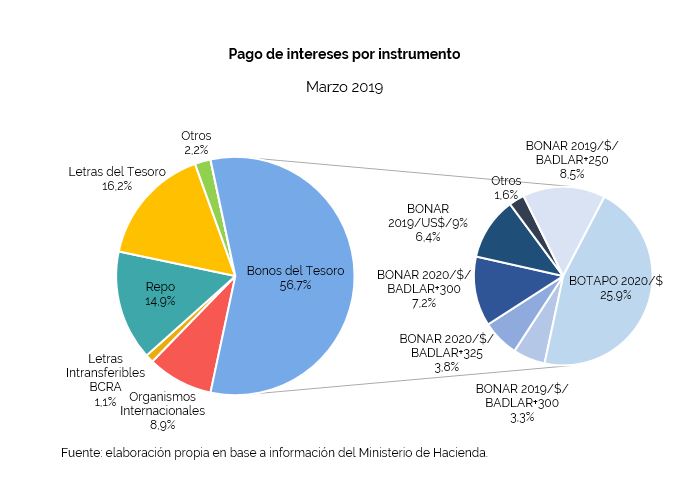

In March, there were placements of securities and loan disbursements for AR$5.4 billion, of which 92% consisted of placements of government securities. The rollover ratio resulting from the auctions held during the first quarter of 2019 was higher than projected in the Financial Program.

On the other hand, debt services for a total of USD8.92 billion were paid during the month, of which 85% (USD7.59 billion) were principal payments. The main amortizations of the month were the cancellation of the BONAR in dollars 2019 for USD1.9 billion, which was held by the Sustainability Guarantee Fund (FGS), and the maturities of LETES for USD1.67 billion and LECAP for AR$45.89 billion (USD1.06 billion).

Payments of loans with multilateral and bilateral credit organizations totaled USD273 million which, considering disbursements, implies a net cancellation of USD126 million.

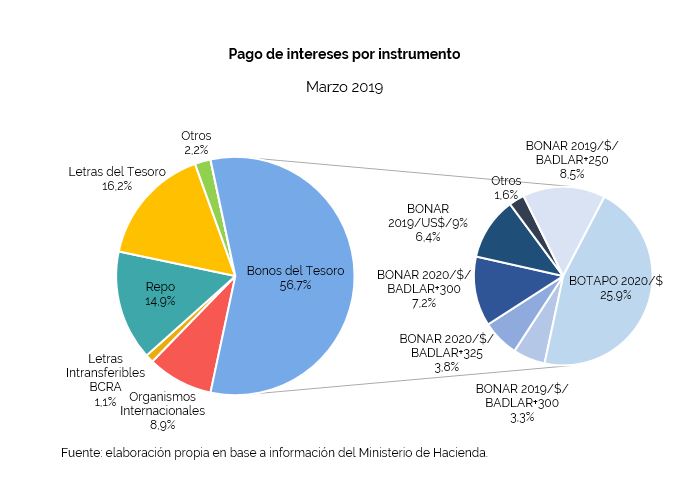

Interest payments totaled USD1.32 billion, of which 68% were made in domestic currency.

by Nicolas Perez | Apr 11, 2019 | Budget Execution

In a context of economic downturn, in March the national government had a better performance compared to the same month of the previous year, but liquefied the surplus recorded in the first two months of the year.

-

The National Government recorded in the first quarter a financial deficit of AR$42.19 billion, which implies a real drop of 47.9% compared to the same period of 2018.

-

Total revenues increased 39.4% YoY, and expenditures increased 34.0% YoY.

-

Export duties increased by 477.0.% YoY, becoming the most dynamic source of resources in the period.

-

Interest payments on public debt rose 65.1% YoY and economic subsidies doubled (107% YoY).

-

Capital expenditure remains at the same levels as a year ago, which means a fall in real terms of 33.7% YoY.

-

As of March 31, the initial budget appropriation was increased by AR$40.32 billion, AR$34.57 billion by Necessity and Urgency Decrees – DNU (86%) and AR$5.73 billion by Administrative Decisions – DA (14%).

-

The level of total expenditure implementation in the quarter was 19.1%.

by Nicolas Perez | Apr 11, 2019 | Tax Revenue

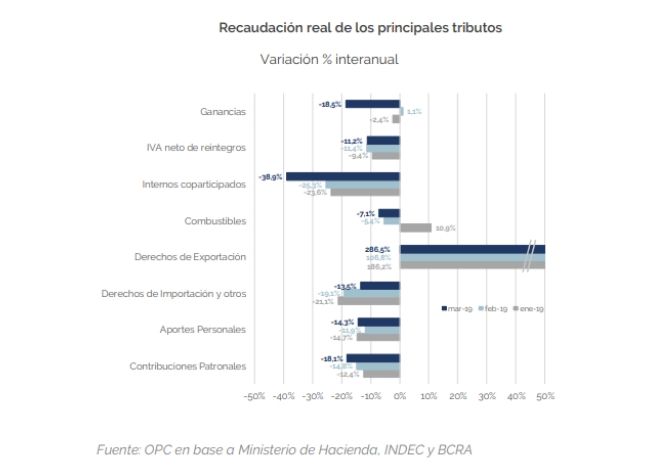

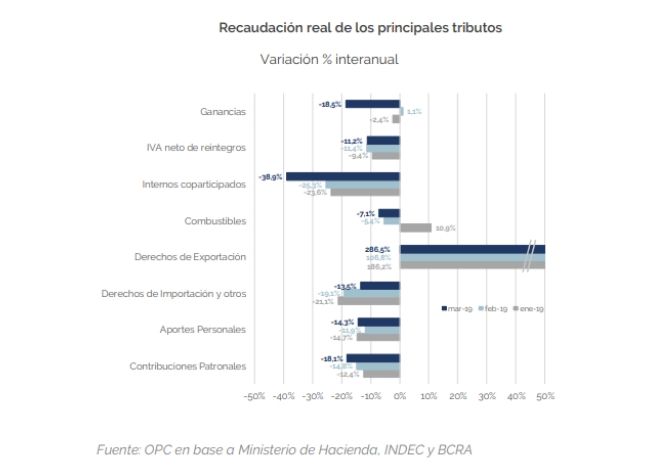

In the third month of the year, national public sector revenues grew by 37.3% in nominal terms compared to the same period of the previous year but fell by 10.5% in real terms. Similar behavior was observed in the first quarter of the year.

This performance also entails a decline compared to previous months and reaffirms that government revenues are strongly linked to the level of economic activity, as shown by the VAT DGI, which fell 7.3%.

Income Tax contracted by 18.5%, partly due to the deferral of some maturities. The significant growth in Export Duties allowed mitigating the fall in the most important taxes of the national tax structure (VAT, Income Tax and Social Security Contributions).

by Nicolas Perez | Mar 13, 2019 | Budget Execution

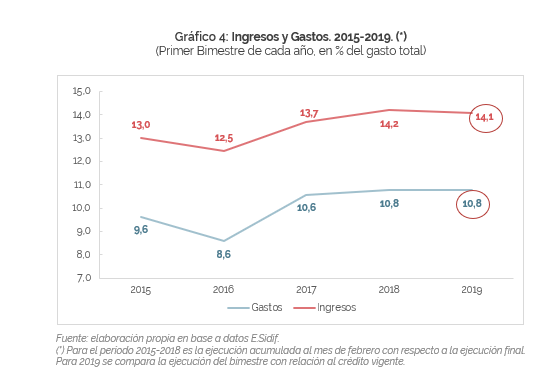

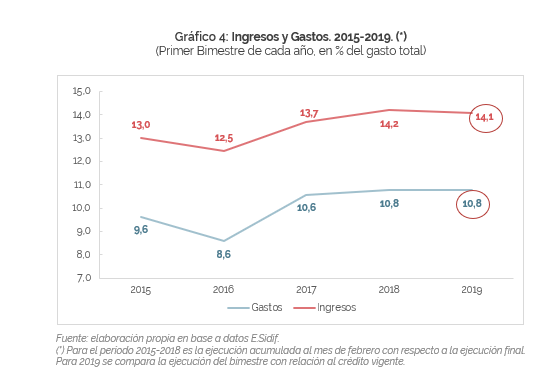

In February, the national government had a primary surplus of AR$14.74 billion, as revenues increased nominally by 43.6%, while expenditures increased by 22.8%, 19 points lower. The financial balance was also positive by AR$1.43 billion, which also implies an improvement in relation to the deficit recorded a year ago.

During the second month of the year, tax resources increased nominally by 39.5% year-on-year (-7.5% YoY real), largely driven by export duties, which increased by 374.7% YoY, because of both amendments to legislation and changes in the exchange rate.

However, in real terms, the total resources of the national government lost against inflation, recording a drop of -7.5%. Although the drop was lower than in the previous two months, Social Security contributions fell -10.9% year-on-year.

Total expenditure amounted to AR$223.97 billion in February, an increase of 20.1% year-on-year. Current expenditures grew 22.8%, while capital expenditures contracted 17.8%.

Property Income was eight times higher than in the same month of the previous year and totaled AR$45.83 billion in the first two months of the year.

The 46% increase in allocations as of March 1 will imply a higher expenditure of AR$16.08 billion, equivalent to 0.1% of GDP in 2019.