by Nicolas Perez | Jul 31, 2019 | Budget Law

The Progress Report on the Draft Budget for 2020 estimated that 2019 will close with a 0.8% drop in the Gross Domestic Product and a stable primary balance, records that will improve next year.

For the following fiscal year, the government document predicts a strong increase of 3.5% of GDP and a primary surplus of 1%, although without specifying the expected variations in consumption, investment, and imports.

According to the government’s estimate, in both years there will be an increase in exports and the financial deficit will persist, but declining.

Inflation would be reduced to 26.1% by 2020, but the projection does not include values for the exchange rate or the interest rate.

Net public debt will fall in relation to GDP from 49.4% this year to 45.9% next year.

by Nicolas Perez | Jul 17, 2019 | Public Debt Operations

- During June, placements of government securities and loan disbursements totaled USD7.72 billion. The issuance of Treasury bills and bonds totaled USD7.3 billion.

- As a result of three public auctions, Treasury bills in pesos and dollars for the equivalent of USD4.72 billion and bonds for USD885 million were placed.

- Debt service amounted to USD7.54 billion in June, with USD6.27 billion in principal payments and USD1.27 billion in interest payments.

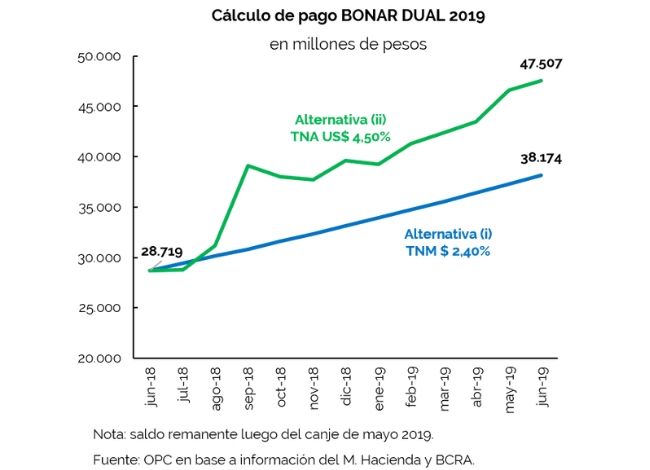

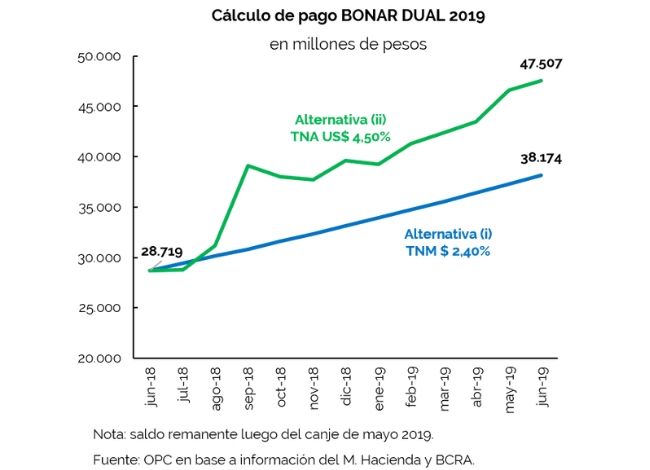

- At the end of the month, the BONAR DUAL 2019 was cancelled for a total of AR$47.5 billion, including AR$45.46 billion of principal and AR$2.04 billion of interest.

- Main maturities scheduled for the month of July are Treasury bills in pesos and dollars. In addition, there will be interest payments on DISCOUNT bonds and different BONARs in dollars whose coupons matured on June 30.

by Nicolas Perez | Jul 10, 2019 | Budget Execution

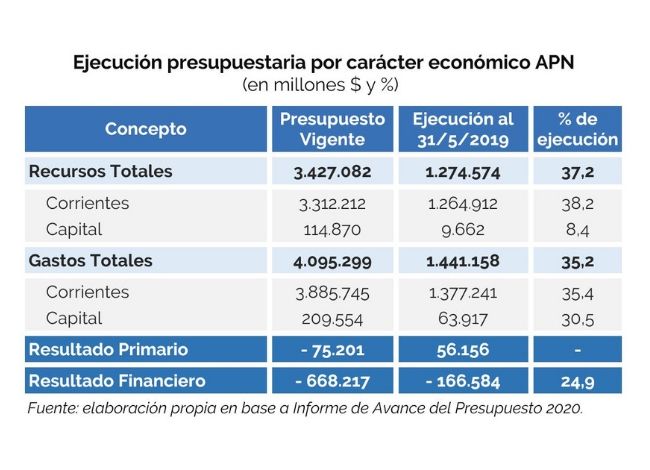

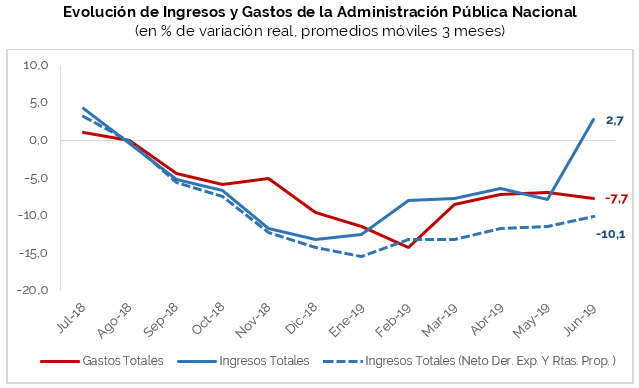

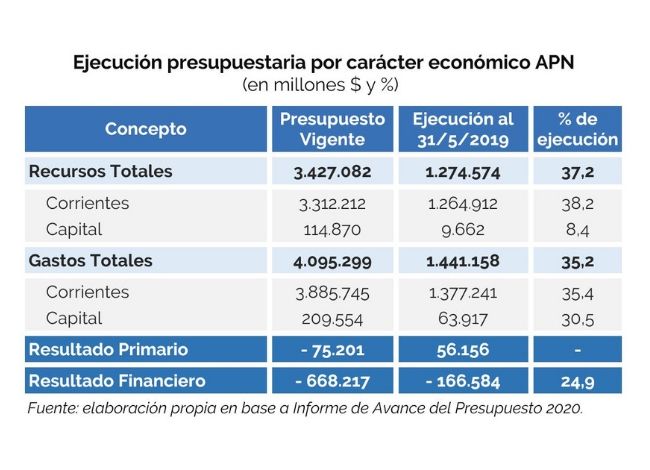

Due to an exceptional increase in resources and a new contraction in expenditures, June’s financial balance improved with respect to that of a year ago, both in nominal and real terms, although it was in deficit by AR$130.07 billion.

In the first half of the year, a primary surplus of AR$104.62 billion was recorded, which implies an improvement of 260.2% compared to the same month of the previous year. Likewise, the financial deficit for the same semester amounted to AR$324.32 billion, 8.7% higher than that of the same period of the previous year, but 29.5% lower in real terms.

The level of budget execution was similar to that of 2018 and only the payment of interest on the debt and transfers to the provinces were above average.

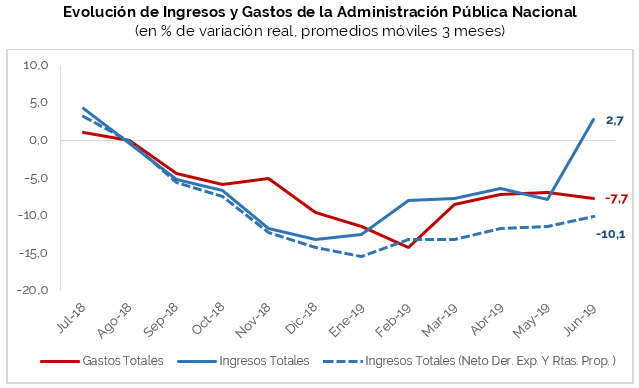

If Property Income -exceptionally high in the month- and Export Duties -with good performance in the last months- were excluded from total revenues, total resources would reflect a real contraction of 10.1% year-on-year.

The approved Budget increased by AR$70.53 billion at the end of the first semester (1.7% of the initial appropriation). Forty-nine percent of these increases were implemented through Administrative Decisions, while the remaining 51% were implemented through a Necessity and Urgency Decree.

by Nicolas Perez | Jul 5, 2019 | Tax Revenue

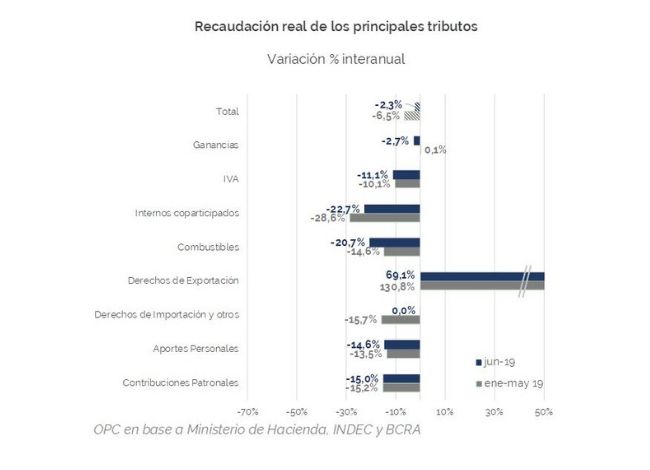

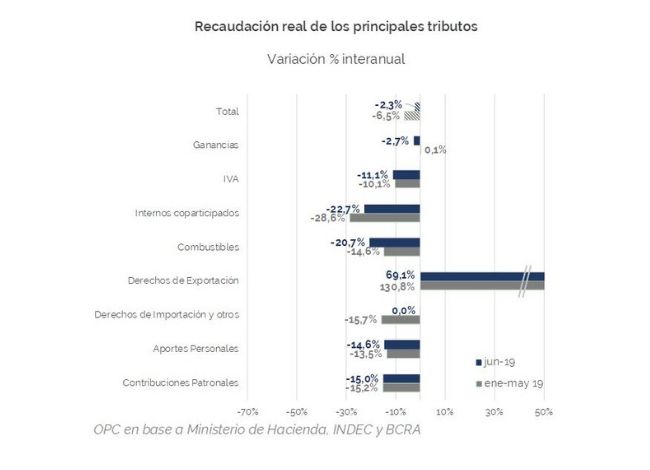

In June, National Public Sector revenues grew 52.1% in nominal terms compared to the same period of the previous year but fell 2.3% in real terms. The same pattern was observed for the first half of the year.

The decline in taxes such as Value Added Tax and Income Tax continued, and the most significant increase in the month was the 69.1% rise in Export Duties, although it was the lowest increase so far this year.

Due to regulatory amendments and the economic situation, VAT and Social Security revenues lost relative weight, among other reasons, because of the fall of the wage bill in real terms that has been recorded since June 2018.

It is estimated that the tax revenue for the first half of 2019 was AR$134.6 billion below the Budget forecast. This is a deviation of -5.6% with respect to the expected amount. However, duties and fees on Foreign Trade and tax on Current Account Credits and Debits showed a better performance.

The overall performance of tax revenue confirms that the decline slowed and could be an indication that economic activity is showing a similar trend.

by Nicolas Perez | Jun 25, 2019 | Budget Law

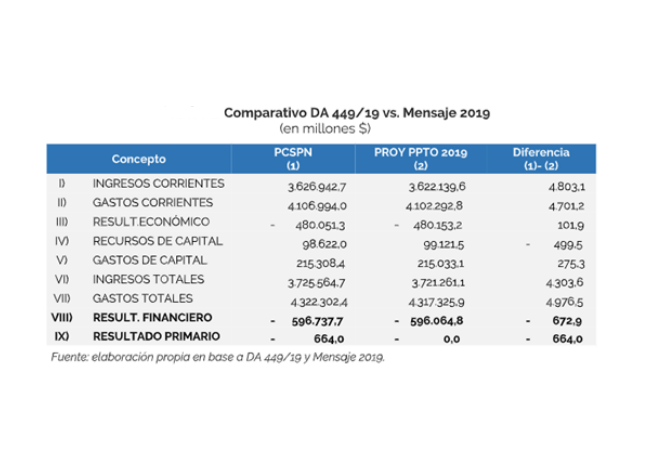

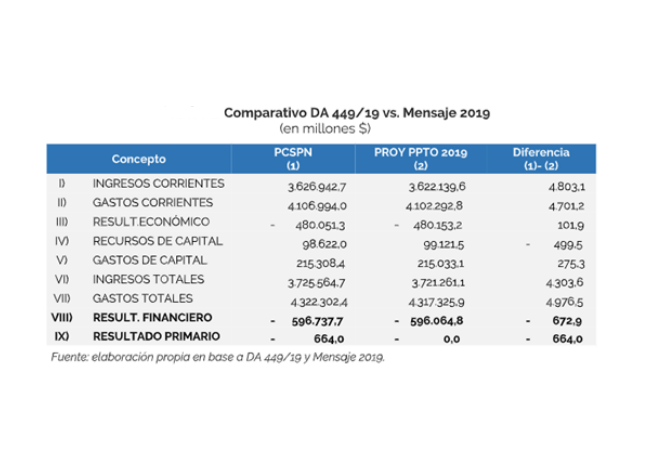

Administrative Decision No. 449/19 approved the Consolidated Budget of the National Public Sector for Fiscal Year 2019, in compliance with the provisions of Article 55 of Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector, as amended. Said article provides that the National Budget Office must prepare the consolidated budget annually and submit it to the National Executive Branch before March 31 of the year in which it is in effect. Once approved, it is submitted to the National Congress.

The Consolidated Budget of the National Public Sector represents the integration of the economic transactions carried out by the different agencies of the National Public Sector, which provides information on the total public expenditure and revenue and the effect on the rest of the economic system.

by Nicolas Perez | Jun 13, 2019 | Public Debt Operations

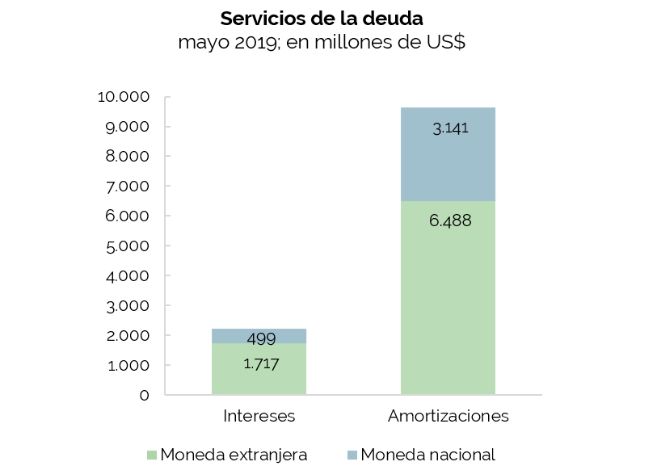

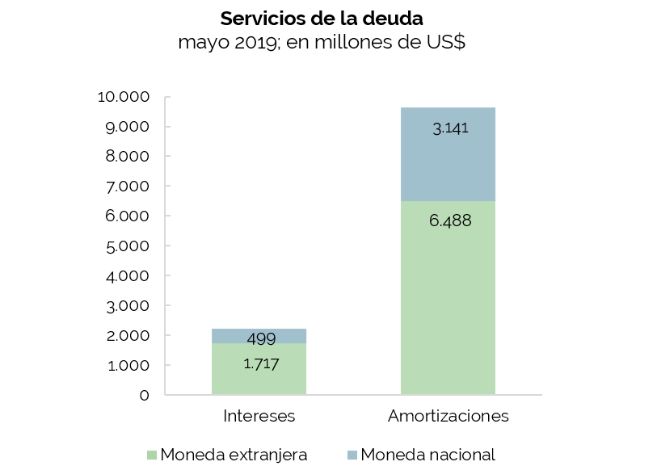

- During May, placements of government securities and loan disbursements totaled USD6.5 billion, mainly through the issuance of treasury bills and bonds.

- As a result of five public auctions, the equivalent of USD5.48 billion in treasury bills and USD131 million in bonds were placed during the month.

- A voluntary swap of BONAR DUAL for new dollar-linked bills (LELINK) for USD964 million was carried out on May 23.

- Debt service for the month totaled the equivalent of USD11.85 billion, of which USD9.63 billion were principal repayments and USD2.21 billion were interest payments.

- At the end of the month, the fifth payment of principal and interest on the loans derived from the 2014 Renegotiation Agreement with the Paris Club was paid. The payment was for USD1.55 billion of principal and USD325 million of interest.

- Main maturities scheduled for the month of June are DISCOUNT bonds, different BONARs in dollars, BONAR Badlar and BOTAPO.