by Nicolas Perez | Mar 12, 2019 | Tax Revenue

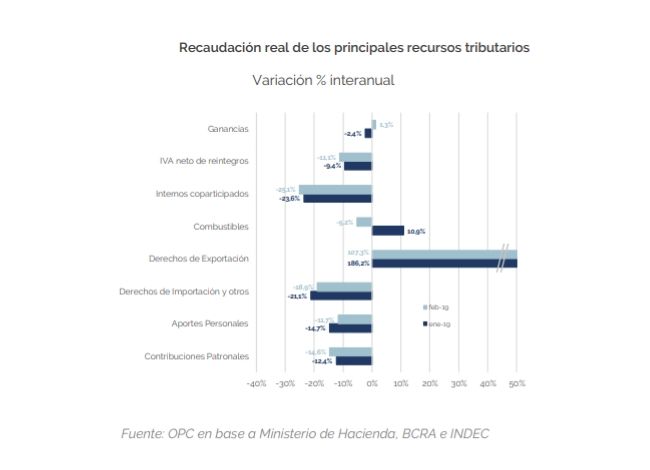

February tax revenue totaled AR$330.89 billion, which implied a nominal year-on-year increase of 40.4% and of 39.6% with respect to the first two months of last year.

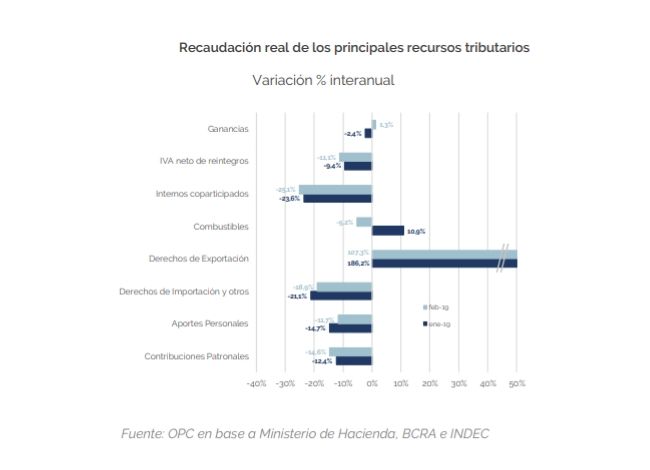

In real terms, it declined 6.9% against February 2018, although the fall in inflation-adjusted tax resources was softened as of December.

Income Tax had a real recovery of 1.3%, and together with Wealth Tax and Export Duties, were the ones with the highest year-on-year increase.

Value Added Tax recorded a year-on-year decline of 11.5%, basically due to the fall in imports and the reduction of some taxes on foreign purchases and the lower level of activity.

by Nicolas Perez | Feb 14, 2019 | Budget Execution

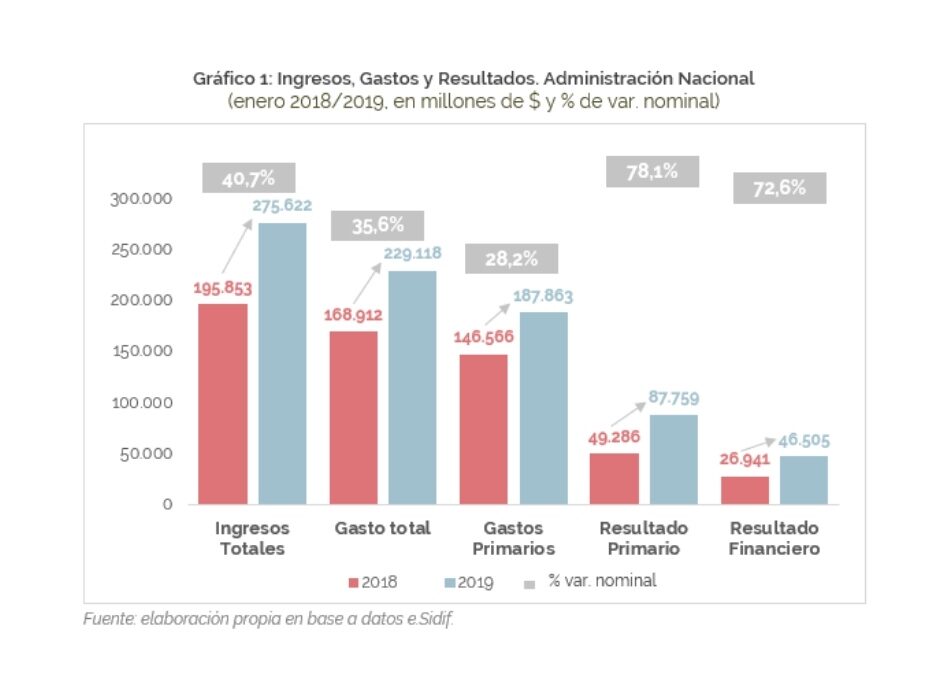

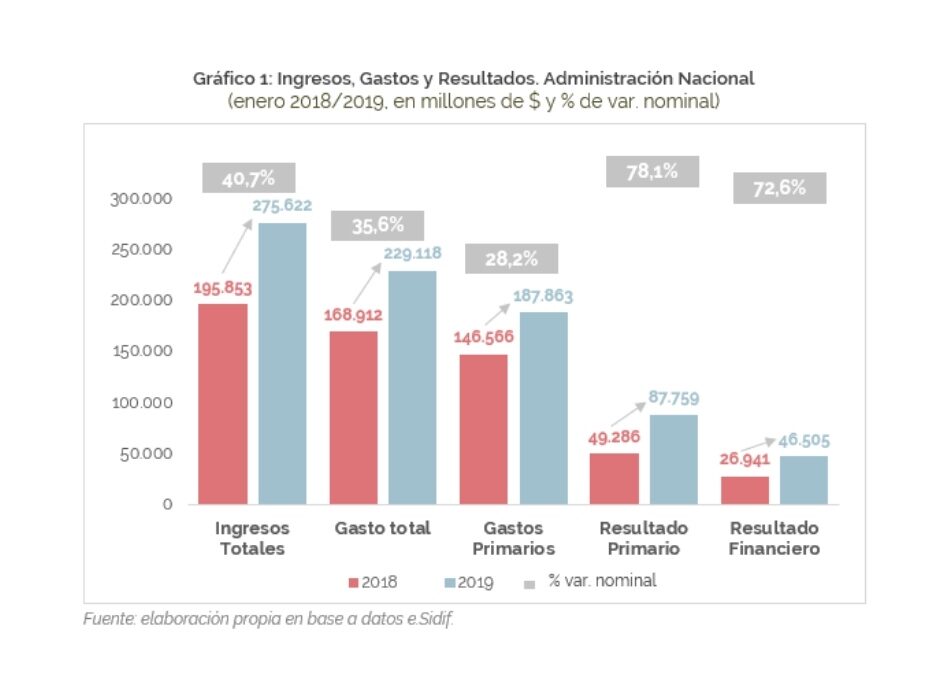

During January, the national government had a financial surplus of AR$87.76 billion, 19.7% higher in real terms than in 2018. Compared to inflation, both total revenues and total expenditures decreased during the month.

Revenues showed a drop -in real terms- in all items, except for property income and capital revenues.

Expenditures showed some exceptions to this pattern. Debt interest payments increased 84.6% YoY (+24.1% in real terms) and economic subsidies grew by 143% (+63.9% YoY in real terms).

Total accrued expenditures accounted for 5.5% of the total item, current expenditures for 5.6% and capital expenditures for 3.0%.

by Nicolas Perez | Feb 7, 2019 | Tax Revenue

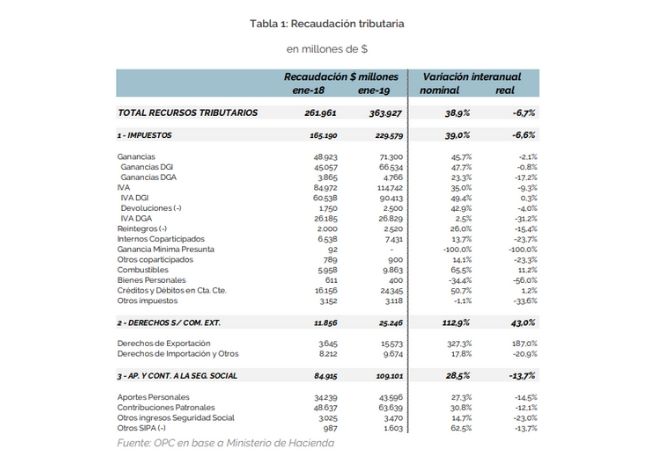

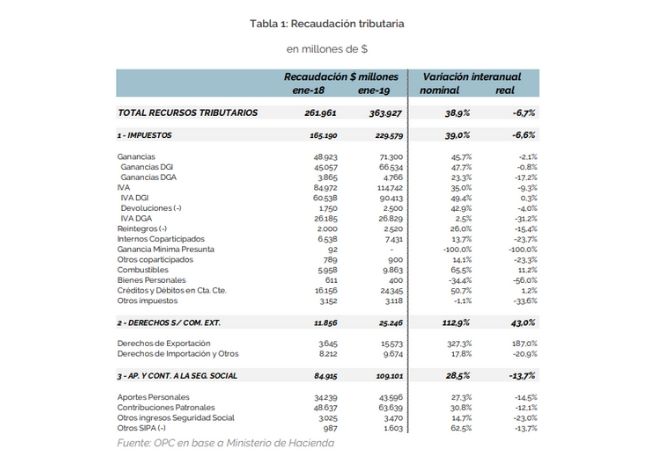

This report analyzes tax revenues for the first month of the year and outlines the scenario for the whole of 2019.

National tax revenue in January 2019 totaled AR$363.92 billion, showing a year-on-year increase of 38.9% in nominal terms, which implied a drop of 6.7% in real terms.

As for the projection for the year, after the submission of the 2019 Budget, three regulatory amendments were introduced with a significant impact on the national tax revenue for 2019.

These amendments have an almost neutral net impact on the projected revenue: a reduction of AR$3.83 billion, which is equivalent to 0.1% of the total projected amount.

by Nicolas Perez | Jan 31, 2019 | Tax Revenue

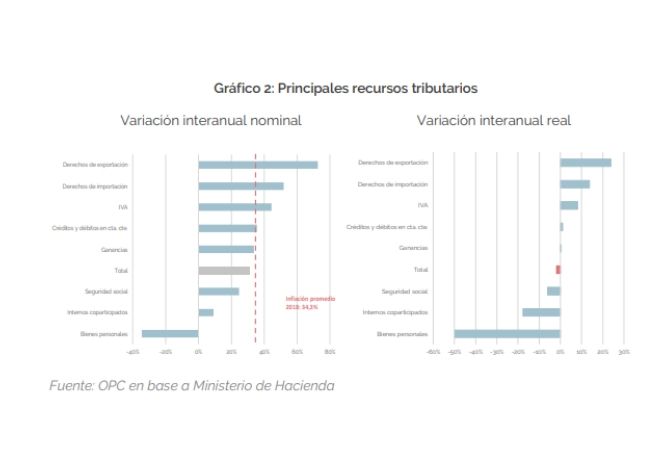

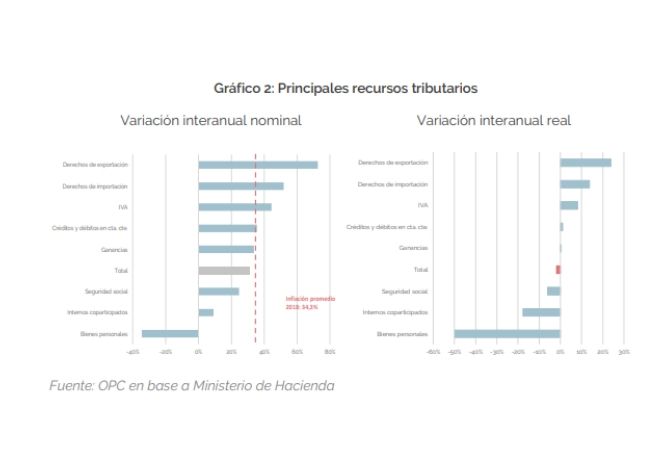

National tax revenue totaled $3.82 trillion in 2018, an increase in nominal terms of 31.2% with respect to 2017.

In terms of inflation-adjusted revenue, there was a drop of 1.8% year-on-year, the third consecutive year showing this trend.

Measured in terms of Gross Domestic Product, revenue was 24.1% of GDP, 0.3 percentage points below that recorded in 2017, continuing the trend started in 2016.

As for the allocation of tax revenue, the national government and the social security system received less resources for the equivalent of 0.3% of GDP each, which contrasts with the increase of 0.4% of GDP that was allocated to the provinces.

by Nicolas Perez | Jan 23, 2019 | Budget Execution

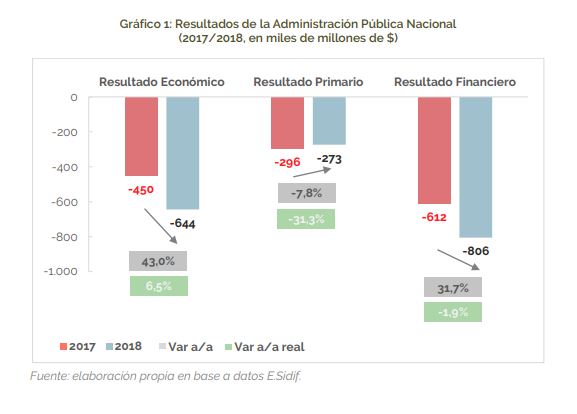

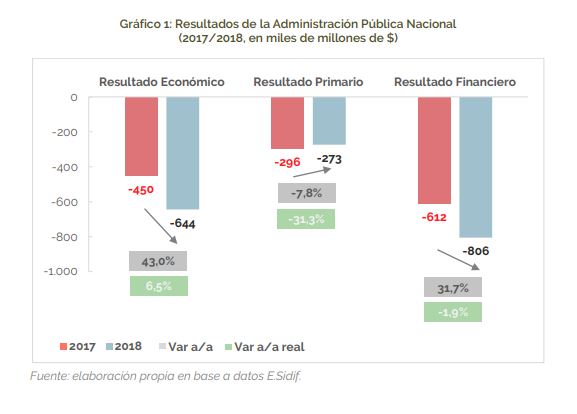

In 2018, the national government recorded a financial deficit of AR$805.69 billion, equivalent to 5.7% of GDP, and a primary deficit of AR$273.27 billion, 1.9% of GDP.

Both figures are reduced in terms of GDP with respect to the previous year, the financial deficit is down 0.1 percentage points (p.p.) and the primary deficit dropped 0.9 p.p. However, these deficits would have increased to 6.1% and 2.3% of GDP, respectively, if the AR$44.79 billion of works carried out under the Priority Investment Program had been recorded as capital expenditures.

Total revenues fell by 4.1% in real terms and expenditures dropped by 3.5%. This was basically due to a reduction in current expenditure of 2.3% YoY and a contraction in capital expenditure of 20.3% YoY, doubled by the fall in real direct investment.

Within Current Expenditures, the 68.9% YoY increase in Debt Interest -the item that showed the highest real growth- and the 40.9% YoY increase in Economic Subsidies stand out.

by Nicolas Perez | Jan 19, 2019 | Budget Law

Administrative Decision (AD) 12/19 kept the level of total expenditures and revenues, as well as the financial sources and appropriations provided for in the Budget Law 27,467. Of the additional AR$24.2 billion that Congress authorized the Chief of Cabinet of Ministers to allocate, the AD allocated AR$1.8 billion, 7.4% of the total.

From the analysis of the provisions, more restrictions for the hiring of personnel in relation to the 2018 fiscal year emerge.

This AD is an operational instrument to effectively use the appropriations allocated in the Budget Law, detailing expenditures to the maximum possible level.