BUDGET BILL 2021 – PUBLIC DEBT

The Budget Bill for the year 2021 estimates an interest expense for the national government of AR$665.95 billion for 2020 and AR$661.18 billion for 2021, including interest payable to entities within the national government. If government-owned companies, trust funds and other entities are considered, the estimated interest expense of the National Non-Financial Public Sector is equivalent to 2.5% of GDP in 2020 and 1.8% in 2021.

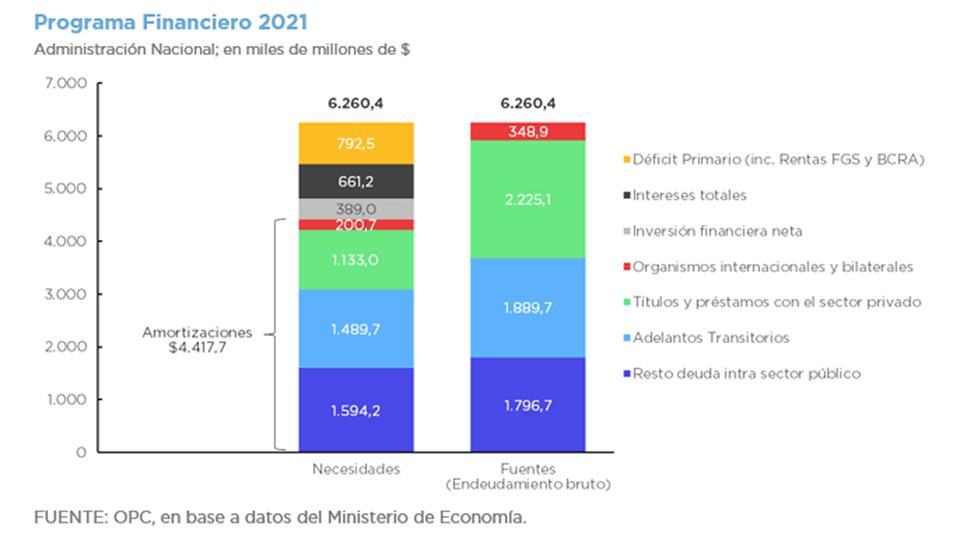

For 2021, the Budget Bill foresees financing needs for a total of AR$6.26 trillion (16.7% of GDP) which is assumed to be financed with new debt with entities of the national public sector for a total of AR$3.68 trillion (including temporary advances from the BCRA – Central Bank of the Argentine Republic), issuance of domestic debt securities to the private sector for AR$2.22 trillion and disbursements from international and bilateral entities for AR$348.9 billion.

Regarding BCRA’s financial assistance to the Treasury, the Budget Bill anticipates a net financing through Temporary Advances for AR$400 billion in 2021 (1.1% of GDP). In addition, profit transfers from the BCRA to the Treasury are estimated at AR$800 billion (2.1% of GDP).

Sections 42, 28 and 50 of 2021 Budget Bill establish limits to the gross amounts of securities issuance and loans maturing after the closing of fiscal year 2021 with a total authorized amount equivalent to AR$6.57 trillion. On the other hand, Sections 43 and 44 authorize the use of short-term credit (maturing within the same fiscal year), establishing limits on the outstanding amounts of such instruments for a total of AR$1.75 trillion.