FISCAL IMPACT OF BILL ON COMPREHENSIVE PROTECION TO PREVENT, SANCTION, AND ERADICATE VIOLENCE AGAINST OLDER PERSONS – S-2729/19

The purpose of the Bill on Comprehensive Protection to Prevent, Sanction, and Eradicate Violence against Older Persons (S-2729/19) is to eliminate all practices that constitute violence against older persons to guarantee the rights recognized in the Inter-American Convention on the Protection of the Human Rights of Older Persons, particularly those referring to the physical and moral integrity and to the development of a dignified life in old age.

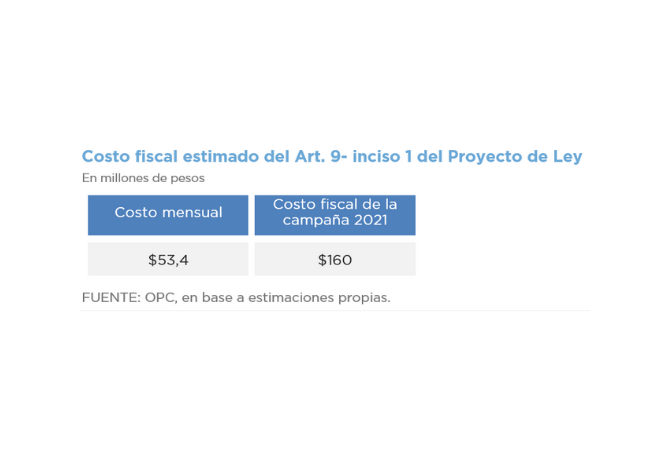

Based on the analysis carried out, the measures with fiscal impact for the national government would be those related to the dissemination campaigns (Section 9.1) and the financial assistance programs for older persons (Section 9.4).

For the dissemination campaigns, an average monthly cost of AR$53.4 million is estimated. It has not been possible to estimate the fiscal impact of the financial assistance programs since information on the scope and modality of the benefit is required.