NATIONAL GOVERNMENT FINANCIAL REPORT 2019

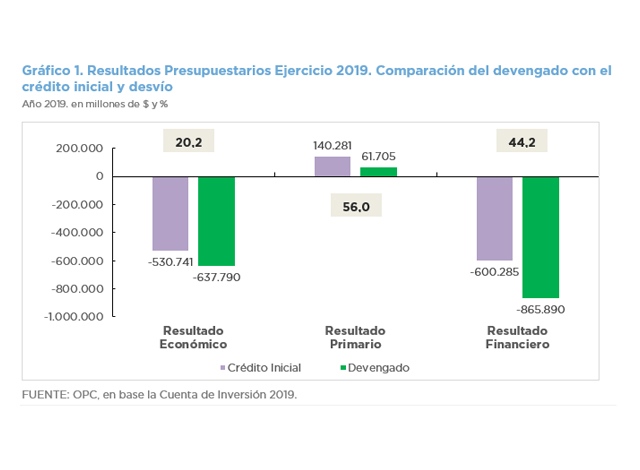

National government budget execution showed an operating surplus of AR$61.7 billion but resulted in a financial deficit of AR$865.9 billion when debt interest is added, which implies a deviation of 44.2% compared to the initial budget forecasts for the year 2019.

Total expenditure increased more than total revenue compared to the budget forecast (14.1% vs. 9.1%), mainly because of transfers to the provinces and energy sector; and to the remission of profits from the Central Bank to the Treasury for AR$204.24 billion during the year, respectively.

If the profits remitted from the Central Bank had not entered the National Treasury, the primary result of fiscal year 2019 would have gone from a surplus of AR$61.7 billion to a deficit of AR$142.54 billion, and the financial balance from a deficit of AR$865.9 billion to a deficit of AR$1.07 trillion.

- In 2019, the execution of debt interest exceeded the initial appropriation by 25.3% ($187.03 billion).

- Within tax revenues, the increase of Export Duties, of 164.5% YoY in real terms, compared to 2018, stands out.

- Revenues from the Sustainability Guarantee Fund increased 35.5% YoY in real terms compared to 2018.

- Government wages dropped 11.7% YoY in real terms and Social Security benefits dropped 6.1% YoY.

- The increase in the initially approved budget was of AR$755.87 billion, 93.6% of which was covered with emergency decrees (DNU).

- As of December 31, 2019, the stock of national public debt totaled USD321.67 billion, showing a decrease of USD8.9 billion over the year. In terms of GDP, debt increased 4% to reach 89.0% of GDP.

- Measured in pesos, the debt stock showed an increase of AR$6.8 trillion during the year.

- A primary deficit of 1.9% of GDP in 2018 turned into a surplus of 0.3% in 2019. Debt interest raised from 3.7% to 4.3% compared to GDP. It is observed that the financial balance went from a deficit of 5.6% of GDP in 2018 to a deficit of 4.0% in 2019.