The Bill provides for the creation of a Solidarity and Extraordinary Contribution with the purpose of generating tax funds to implement measures aimed at mitigating the economic effect of the Covid-19 pandemic.

It proposes a tax applicable to individuals who declared assets for more than AR$200 million for the fiscal year 2019, with progressive rates raging from 2% to 5.25%.

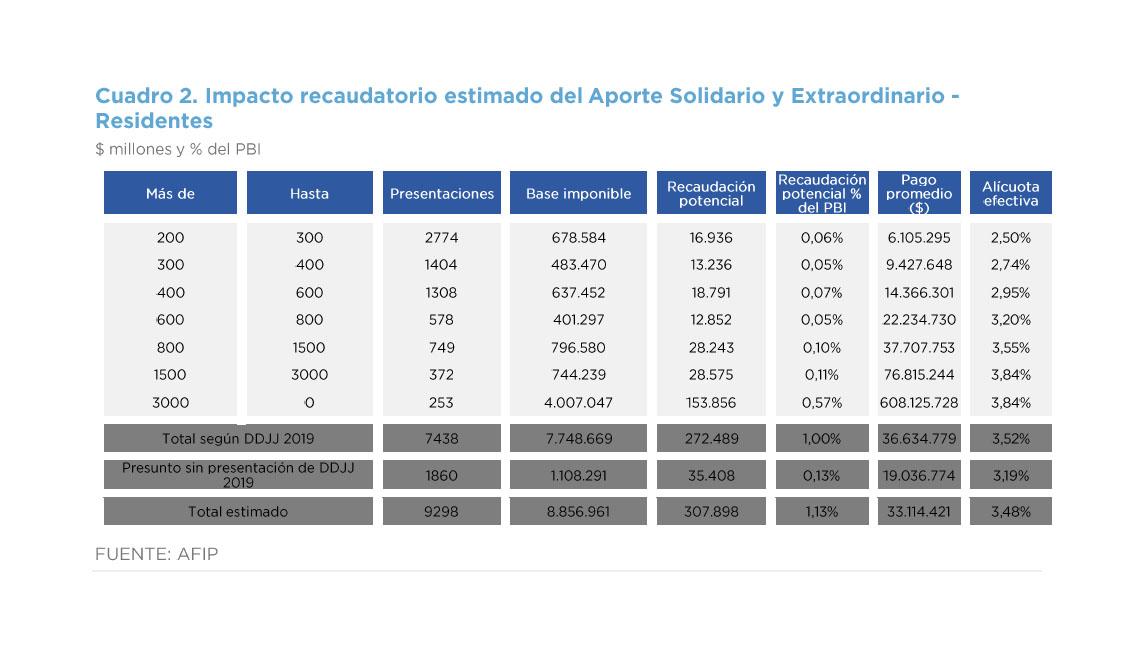

According to AFIP (Federal Administration of Public Revenues), collection could reach AR$307.9 billion, equivalent to 1.1% of current year’s GDP, given that the taxable base would be AR$8.85 trillion (41.1% GDP).

The inclusion of assets excluded from Wealth tax (mainly bank deposits, government securities and rural property) makes the taxable base under analysis approximately 4 times higher than that of Wealth tax.