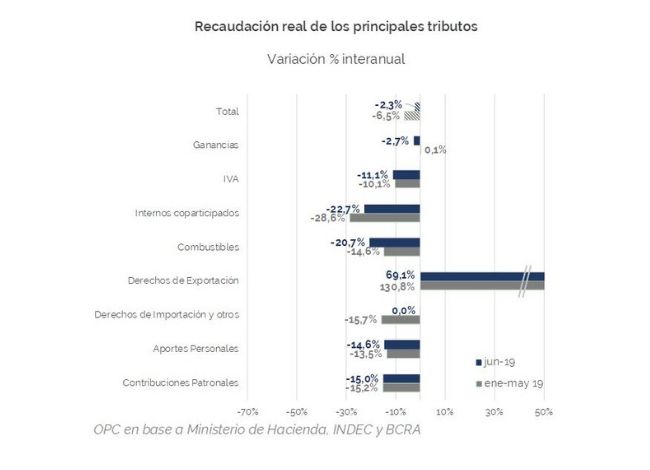

In June, National Public Sector revenues grew 52.1% in nominal terms compared to the same period of the previous year but fell 2.3% in real terms. The same pattern was observed for the first half of the year.

The decline in taxes such as Value Added Tax and Income Tax continued, and the most significant increase in the month was the 69.1% rise in Export Duties, although it was the lowest increase so far this year.

Due to regulatory amendments and the economic situation, VAT and Social Security revenues lost relative weight, among other reasons, because of the fall of the wage bill in real terms that has been recorded since June 2018.

It is estimated that the tax revenue for the first half of 2019 was AR$134.6 billion below the Budget forecast. This is a deviation of -5.6% with respect to the expected amount. However, duties and fees on Foreign Trade and tax on Current Account Credits and Debits showed a better performance.

The overall performance of tax revenue confirms that the decline slowed and could be an indication that economic activity is showing a similar trend.