by Nicolas Perez | Jul 14, 2020 | Public Debt Operations

An amendment to the proposal to restructure the bonds issued under foreign legislation was formally submitted on July 7. With respect to the original offer submitted on April 22, principal reductions are lowered, interest accruals are brought forward, coupon rates are increased, the delivery of a bonus in recognition of accrued interest on eligible bonds is added, and the average life of the new bonds is reduced.

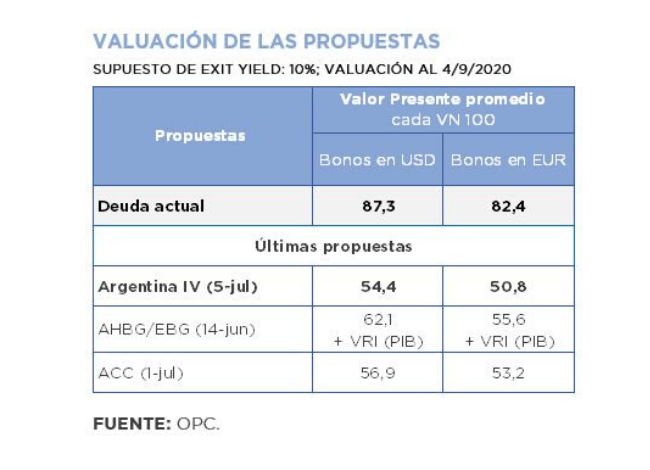

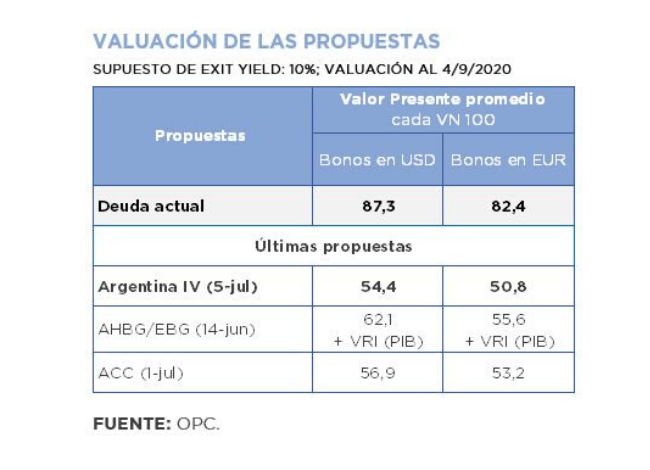

In addition, the new bonds maturing in 2038 and 2041 are issued under Indenture 2005, and a minimum participation threshold is introduced as a condition for the effectiveness of the swap. The proposal has an stimated average value of USD54.4 for the dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest creditor proposals are between USD57 and USD62.

In June, there were placements of securities and loan disbursements for the equivalent of USD5.1 billion, of which AR$221.95 billion (USD3.2 billion) were obtained through marketable securities auctions.

During the month, the payment of interest coupons on the BIRAD 2117 (6/28) and DISCOUNT bonds in dollars under foreign legislation (6/30), for a total of USD328 million, was defaulted.

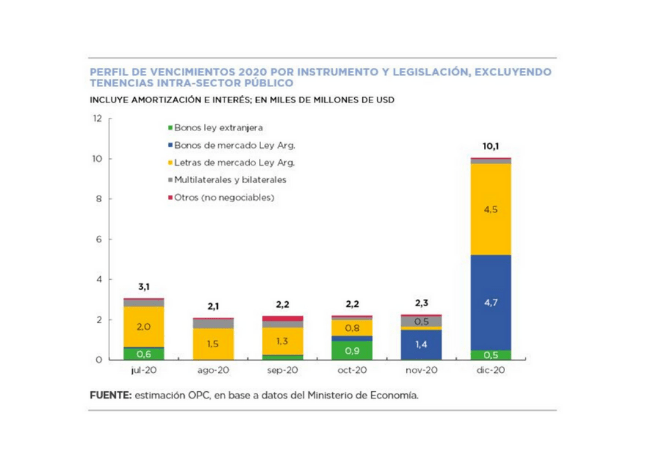

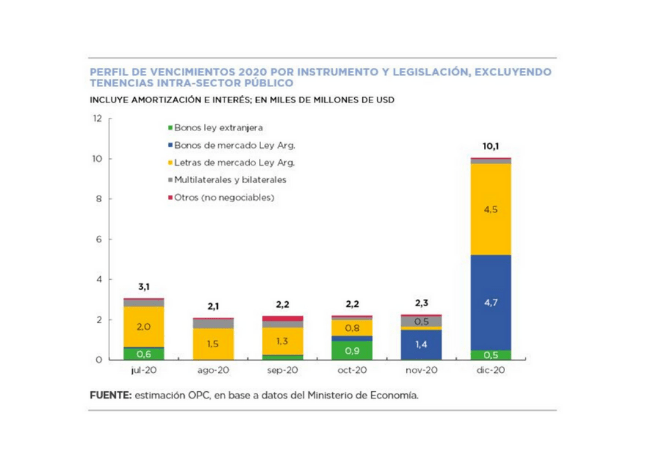

Debt service payments for the equivalent of US$3.86 billion (US$3.07 billion excluding holdings within the public sector) are expected for July, amounting to US$40.2 billion by the end of the year.

by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.

by Juan Fourcaud | Jun 19, 2020 | Cost Estimates

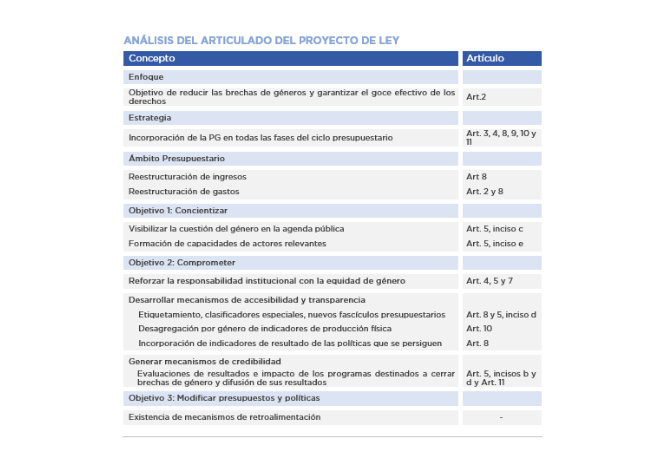

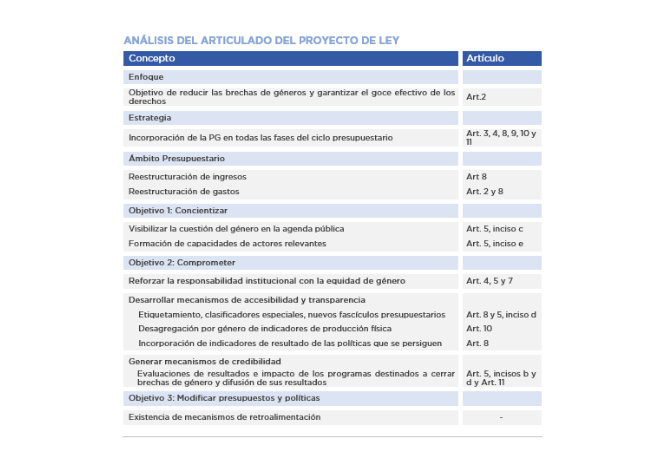

Gender Responsive Budgeting (GRB) provides a vehicle for determining the effect that government policies have on the achievement of gender equality and thus provides valuable information to policymakers.

To that effect, Bill S-0268/2020 provides for the implementation of gender perspective in public budgets. To review the Bill a two-level approach is made: on the one hand, the main conceptual and methodological aspects to be considered when implementing gender perspective in public budgets, and on the other hand, technical suggestions for amendments to Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector.

by Nicolas Perez | May 14, 2020 | Public Debt Operations

The government submitted its proposal for the restructuring of bonds issued under foreign legislation in April. The proposal covers twenty-one series of bonds totaling US$65.62 billion, eligible for swap into ten new securities (five denominated in dollars and five in euros), with annual payments, maturing in 2030, 2036, 2039, 2043, and 2047. The deadline for creditors to submit their consent, which was due on Friday, May 8, was extended to May 22.

Within the course of the negotiation, the payment of the interest coupons of the BIRAD 2021, 2026 and 2046 bonds (which are part of the bonds eligible for the swap) for a total amount of USD503 million, due on April 22, was not made. The grace period to make the payment runs until May 22, after which a default will occur.

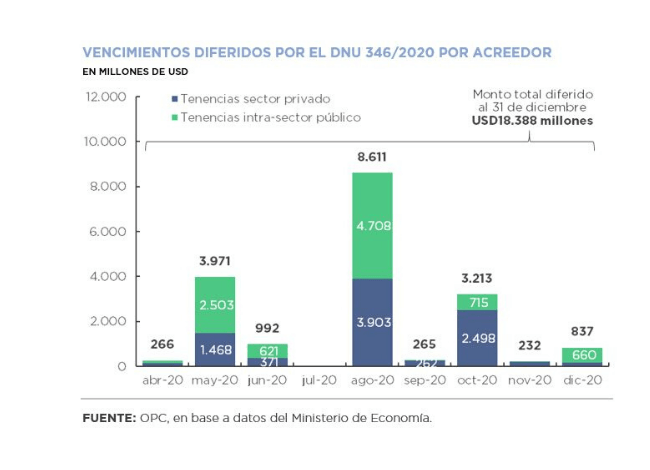

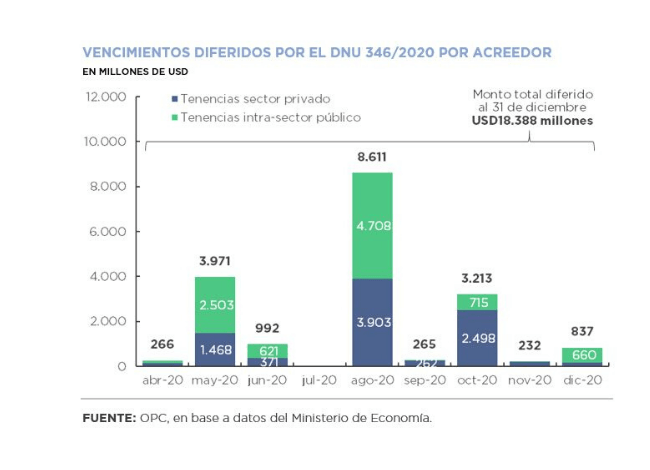

Necessity and Urgency Decree (DNU) 346/2020 postponed to December 31 the payments of interest and amortization of public debt securities in dollars issued under domestic legislation. As a result, payments of USD18.38 billion were deferred until the end of the year, USD9.01 billion of which were held by private investors.

Six auctions were held during the month, resulting in the placement of AR$435.97 billion in securities in pesos, including AR$314.07 billion as part of a swap transaction of the BONCER TC20. In addition, financing was obtained from the Central Bank through the placement of USD171 million in Bills and Temporary Advances (TA) for AR$80 billion.

by Nicolas Perez | Apr 25, 2020 | Public Debt

The Government submitted its proposal for the restructuring of bonds issued under foreign legislation. The swap proposal covers 21 series of bonds, issued under New York and UK legislation, and denominated in dollars, euros, and Swiss francs, totaling USD65.62 billion.

The proposal includes the swap of the eligible bonds for ten new bonds (five in dollars and five in euros), repayable in annual payments, maturing in 2030, 2036, 2039, 2043, and 2047.

Acceptance of the offer would imply a reduction of principal of 5.4%. The stock of bonds issued under foreign legislation would be reduced by USD3.67 billion (from USD65.62 billion to USD61.95 billion).

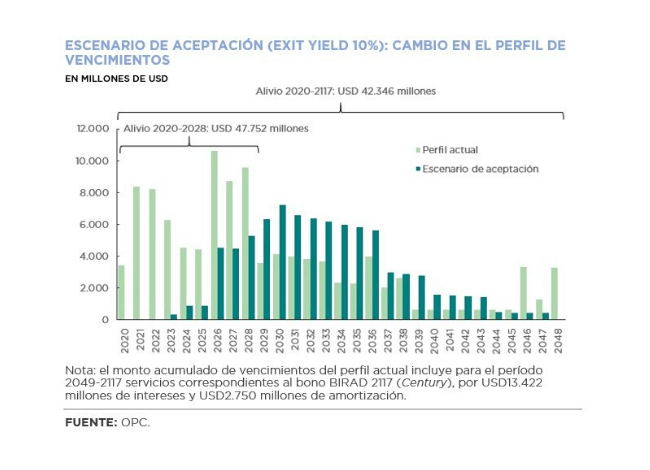

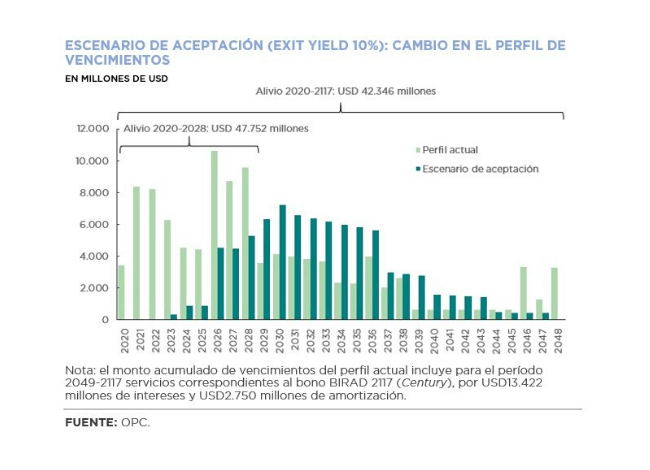

The maturity schedule would be significantly modified, due to a combination of interest coupon reduction, grace period and maturity extension. The average maturity would increase from 5.9 to 11 years.

Throughout the bonds’ life, the interest burden would be reduced by USD38.67 billion (from USD59.67 billion to USD20.99 billion). By adding the reduction of principal, a net reduction of US$42.34 billion in total servicing would be obtained. The relief would be concentrated in the first years, accumulating USD47.75 billion in the term 2020-2028.

by Juan Fourcaud | Apr 22, 2020 | Gender

Women and men have differentiated positions in the economic and social reality, which means that crises, such as the current one caused by Covid-19, will have different impacts.

The informal sector of the economy will be the most affected with job losses and a substantial loss of income. Within this sector, domestic service (that generates a similar number of jobs as construction) takes a prominent place, since it represents 25% of unregistered jobs. The decline in activity in this sector, because of social distancing measures, directly affects women, who represent 97% of those employed in private homes.