by Nicolas Perez | Feb 7, 2019 | Tax Revenue

This report analyzes tax revenues for the first month of the year and outlines the scenario for the whole of 2019.

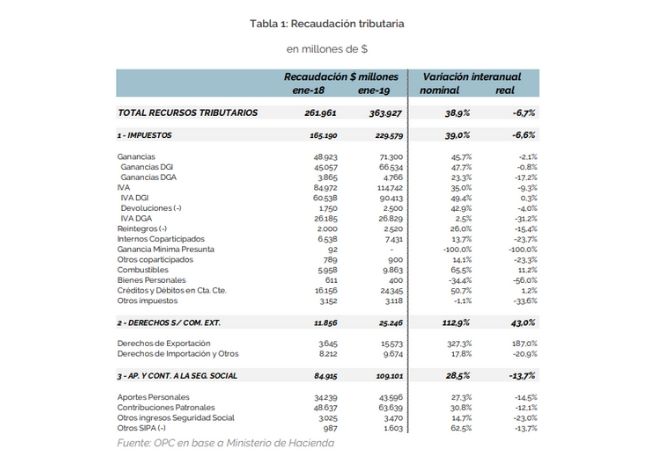

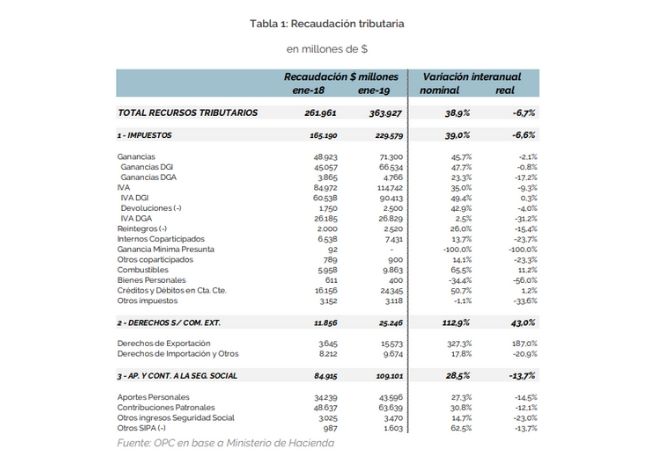

National tax revenue in January 2019 totaled AR$363.92 billion, showing a year-on-year increase of 38.9% in nominal terms, which implied a drop of 6.7% in real terms.

As for the projection for the year, after the submission of the 2019 Budget, three regulatory amendments were introduced with a significant impact on the national tax revenue for 2019.

These amendments have an almost neutral net impact on the projected revenue: a reduction of AR$3.83 billion, which is equivalent to 0.1% of the total projected amount.

by Nicolas Perez | Dec 28, 2018 | Other Publications

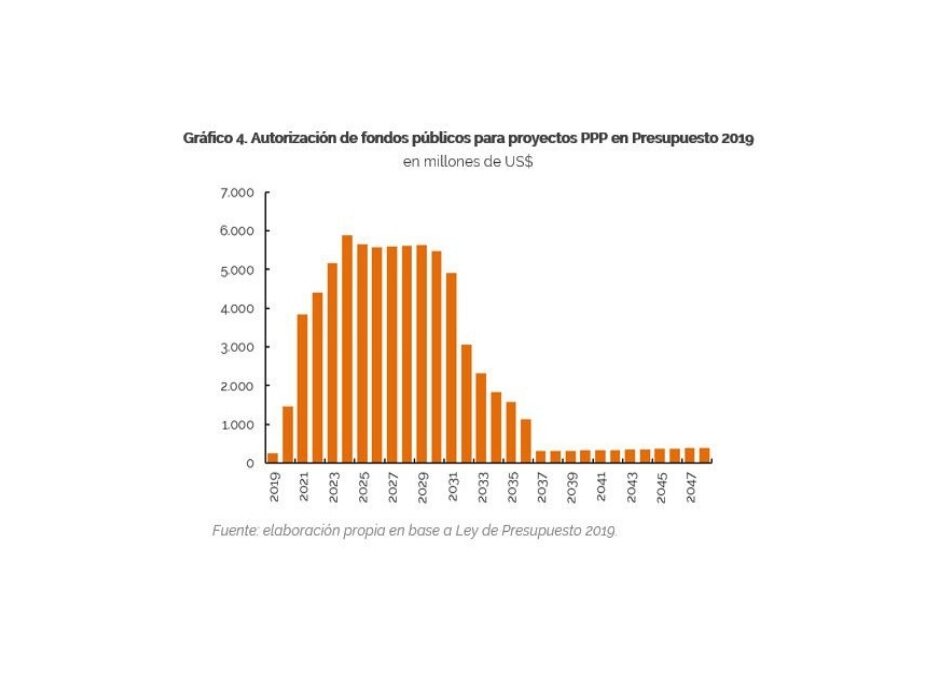

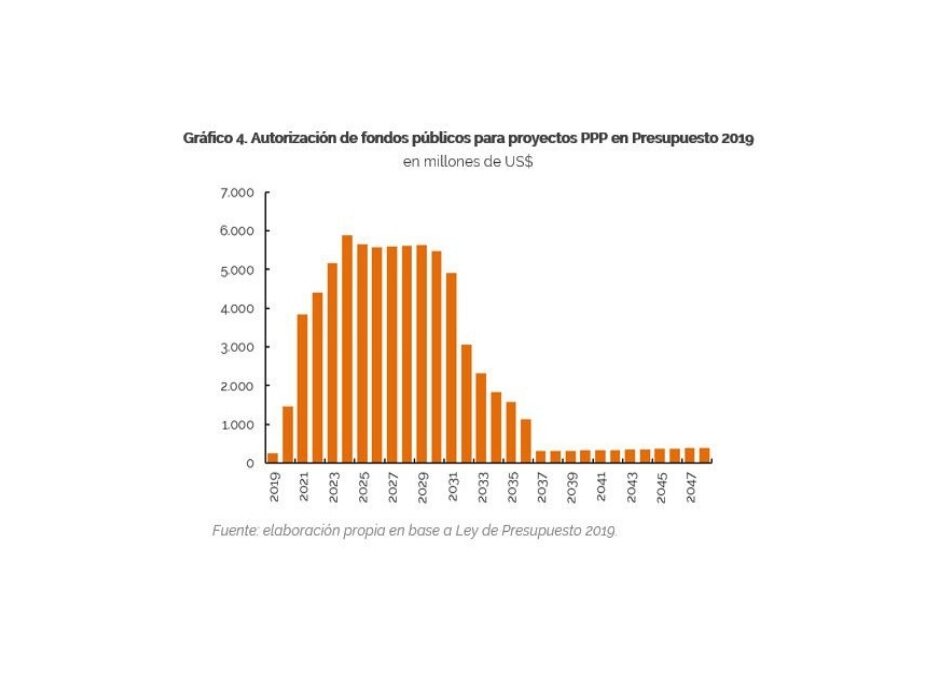

Budget Law 2019 includes eighty projects to be financed through the Public-Private Partnership (PPP) scheme that, if executed, would involve USD73.52 billion of public funds between 2019 and 2048. These projects may generate direct and contingent liabilities for the National Government that will affect the future fiscal performance.

During 2019, the progress of the works is not expected to be recorded as a capital expenditure but as a financial investment (below the line), so it will not have an impact on the balance of the respective fiscal year. Investment Securities (TPI, by its initials in Spanish), issued by the Trusts of each project, are not considered public debt, although they have common features to sovereign bonds and their repayment involves mainly public funds.

Following the best practices in the matter, a methodology for the valuation of contingent liabilities related to PPP projects should be developed, a task on which the Executive Branch is already working.

by Nicolas Perez | Dec 13, 2018 | Tax Revenue

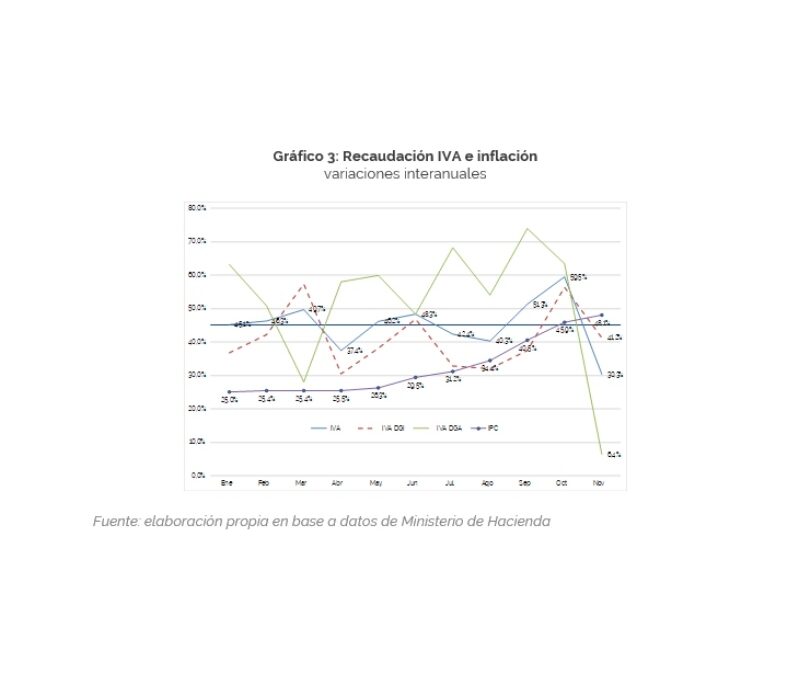

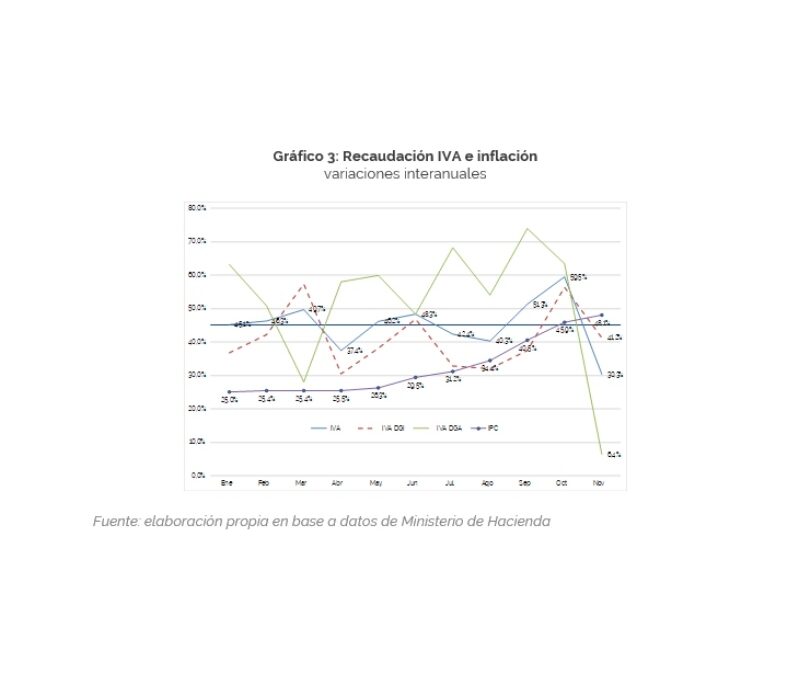

National tax revenue fell by 1.6% in real terms as of November 30. Analyzing the closing of the year, we estimate a low probability of reaching the figure included in the introductory statement of the 2019 Budget Bill of AR$3.47 trillion against an 11-month cumulative amount of AR$3.06 trillion.

by Nicolas Perez | Oct 10, 2018 | Budget Law

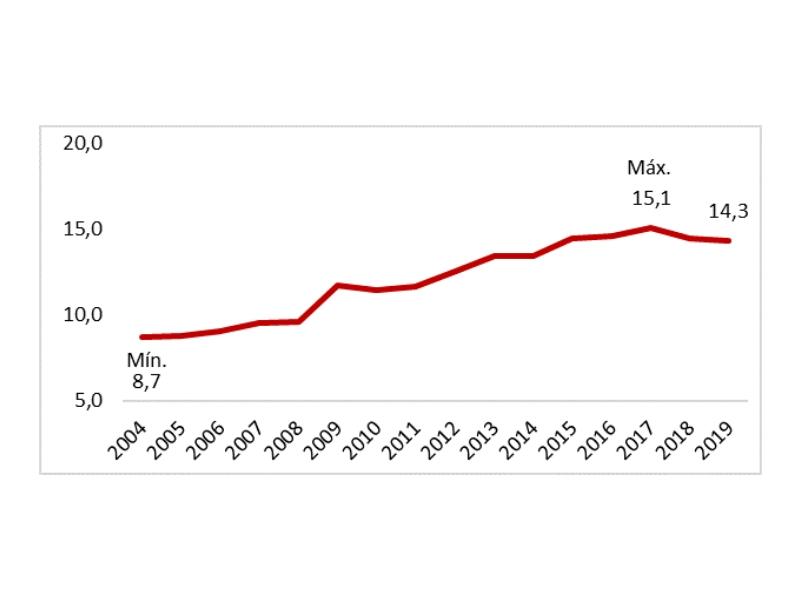

This report analyzes the public social spending included in the 2019 National Budget Bill, from a financial and physical perspective.

For this purpose, public social spending is defined as the set of expenditures made by the National Government classified in purpose 3 as Social Services, which include expenditures related to the provision of health services, social promotion and assistance, social security, education and culture, science and technology, labor, housing and urban planning, drinking water and sewage and other urban services.