by Nicolas Perez | Sep 15, 2020 | Cost Estimates

The purpose of Bill S-1566/20 is to guarantee Internet access to children and adolescents who

are beneficiaries of the AUH (Universal Child Allowance) through the granting of 5GB (mobile

data) per month by the companies providing mobile telephone service for cell phone lines

whose holder is a beneficiary of the AUH.

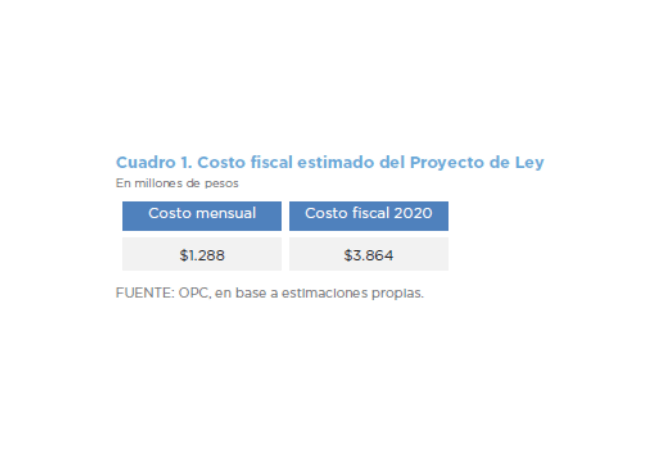

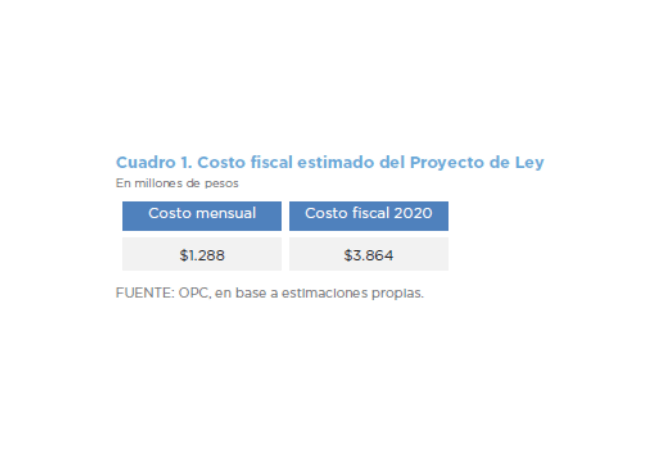

It is estimated that the Bill will have a fiscal cost of AR$1.28 billion per month.

Assuming that the benefit will be effective as from October of the current year and will remain in

force until December 31 (in accordance with the provisions of the Bill), the total cost of the

measure would amount to AR$3.86 billion in 2020.

by Nicolas Perez | Sep 14, 2020 | Cost Estimates

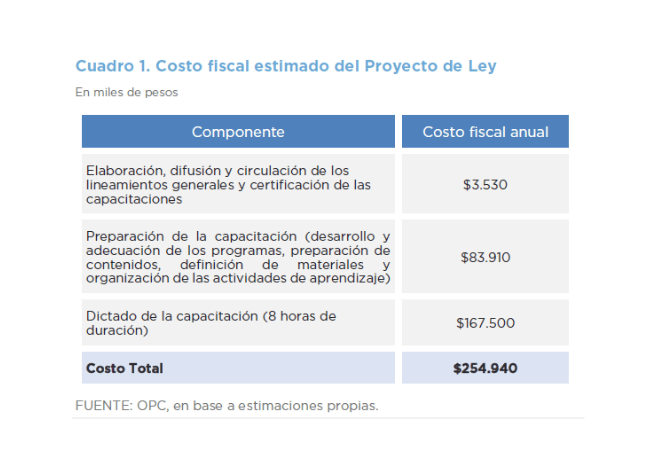

The purpose of the Bills, jointly known as Ley Yolanda, is to guarantee comprehensive

environmental training, with a sustainable development perspective and emphasis on climate

change, for people working in the public sector, based on the merger of the guidelines

established by Bills S-1120/20 and S-1216/20.

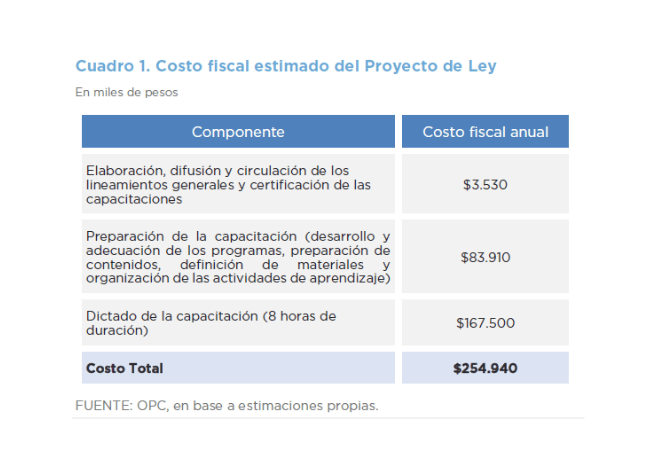

The fiscal cost related to the implementation of the proposed training is estimated by calculating

the costs of three sets of actions:

- Development, dissemination and distribution of the general guidelines and

training certification.

- Training preparation (development and adaptation of programs, preparation

of contents, definition of materials and organization of learning activities).

- Provision of training to agents of the National Non-Financial Public Sector

(NFPS).

Based on the above, it is estimated that the fiscal cost of this measure would amount to

AR$254.9 million.

by Nicolas Perez | Sep 11, 2020 | Cost Estimates

The national scope of the Bill being promoted to establish a Single Electronic Medical Record System (EMR) involves cultural, organizational, technical, and professional challenges to be overcome in the eHealth path in which our country, like most of the countries of the region and the world, finds itself.

The design, development and implementation strategy adopted to carry out this Single EMR System will determine the requirements in terms of human resources, infrastructure, and technological equipment, as well as those related to the management of any necessary

changes within the health institutions, and the population, in their capacity as holders of their Electronic Medical Record.

Once these aspects have been addressed, it will be possible to evaluate the fiscal impact of the Bill being promoted, considering that the experiences in other countries and in some institutions in our country show that guaranteeing sustainability and continuity of the initiative over time represents a great challenge.

by Nicolas Perez | Aug 13, 2020 | Budget Execution

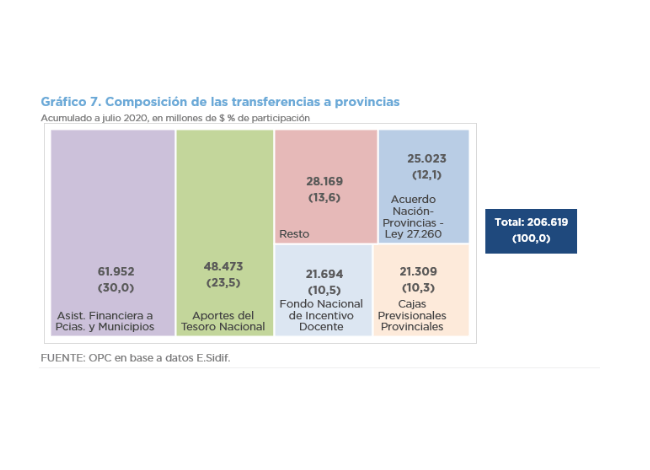

- National government primary deficit amounted to AR$43.4 billion, due to the increase in expenditures and the decrease in revenues, both conditioned by the health crisis. Meanwhile, if interest on the debt is included, the financial deficit widens to AR$74.12 billion.

- Primary expenditures for the month increased by 19.2% YoY in real terms, mainly due to the measures adopted by the national government within the framework of the COVID-19 health emergency.

- The programs implemented to face the health challenge resulted in an expenditure of approximately AR$96 billion, without which primary expenditure would have fallen by 2.8% in real terms compared to July of the previous year.

- Total revenues dropped 8.3% YoY in real terms due to the contraction of all their components, except for property income, which included the transfer of profits from the Central Bank of Argentina (BCRA) for AR$100 billion.

- Through thirteen amendments, the initial budget for the year increased by AR$864.29 billion, 66.2% of which was allocated to strengthen social benefits.

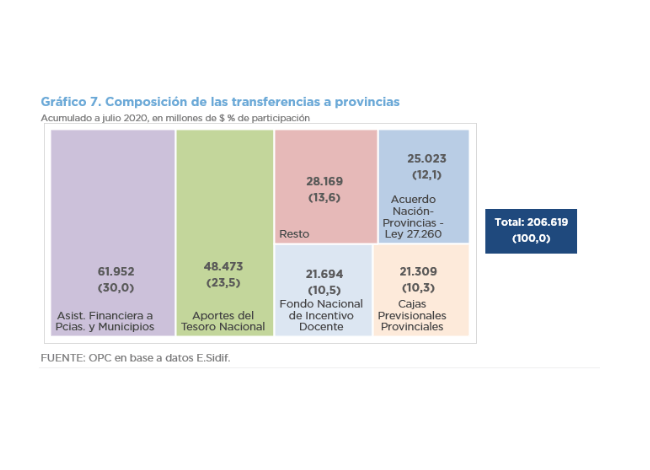

- The cumulative execution of the existing expenditure budget as of July totaled 65.9%, mainly due to current expenditures. All expenditure components recorded high levels of execution, except for debt interest and capital expenditures.

by Nicolas Perez | Aug 12, 2020 | Public Debt Operations

Placements of securities and loan disbursements were recorded for the equivalent of USD9.8 billion, of which AR$528.15 billion (USD7.7 billion) consisted of auctions of marketable securities in pesos.

In addition, the equivalent of USD7.37 billion of principal payment was made, mainly due to a voluntary swap of securities in dollars for new instruments in pesos carried out on July 17.

During the month, interest coupons were not paid on several foreign-legislation BIRAD bonds totaling USD584 million. As of July 31, outstanding interest coupons on bonds issued under foreign legislation totaling USD1.67 billion remain unpaid, which are expected to be recognized as part of the restructuring process of such securities currently underway.

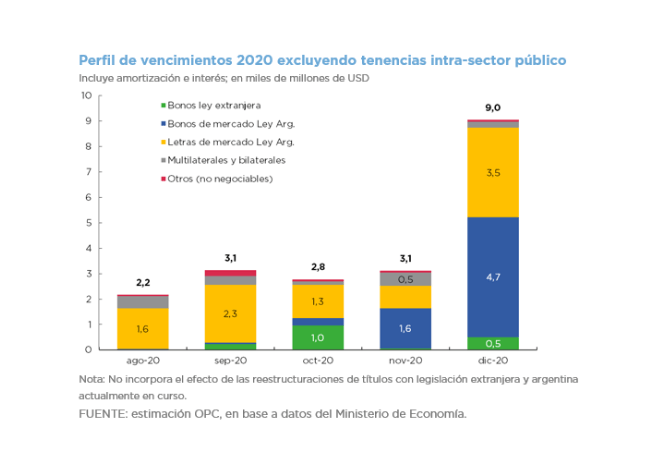

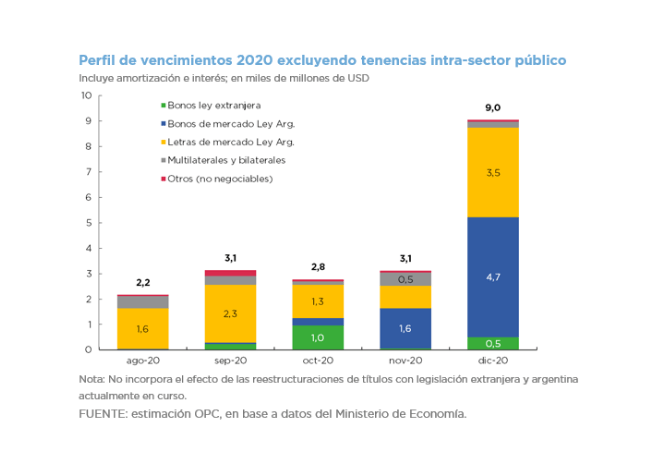

We estimate debt service maturities for the equivalent of USD3.13 billion for August, amounting to USD35.53 billion by the end of the year (approximately USD20.29 billion excluding holdings within the public sector).

On August 4, the government announced an agreement with the main groups of creditors for the restructuring of bonds issued under foreign legislation. The deadline for creditors to accept the revised proposal was extended until August 24, while the settlement date of the transaction is September 4. At the same time, Law 27,556 on the restructuring of government bonds in dollars issued under Argentine legislation with the same conditions as the bonds under foreign legislation was enacted.

by Nicolas Perez | Jul 21, 2020 | Public Debt

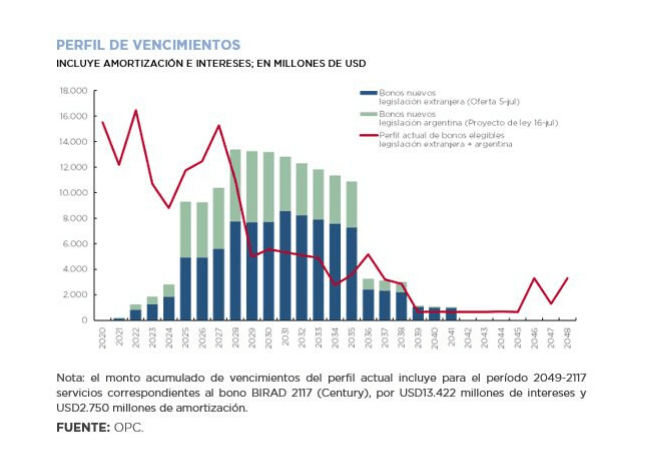

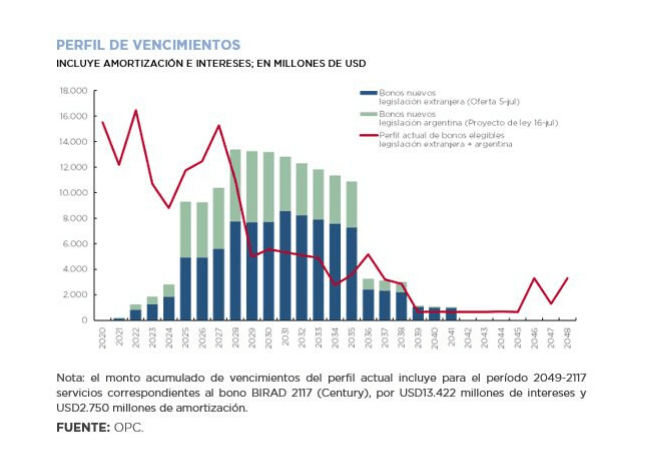

On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.