by Juan Fourcaud | Dec 14, 2020 | Budget Execution

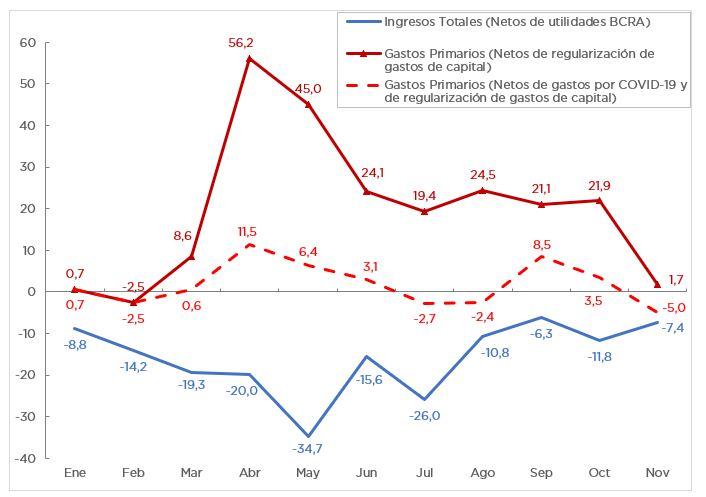

During the month of November, total revenues of the National Government showed an expansion in real terms of 27.0% year on year (YoY) because of the transfer of profits from the Central Bank of Argentina (BCRA) to the National Treasury in the amount of AR$150 billion. If these resources are excluded, total revenues would have fallen by 7.4% YoY.

Tax revenues fell 6.0% YoY, and the 31.1% YoY increase in Income Tax revenues failed to offset the drop in VAT (4.5% YoY) and Export Duties (46.0% YoY).

Primary expenditures (after adjustment of capital expenditures executed in previous years) had, for the first time since March, a variation of less than two digits (1.7% YoY).Considering debt interest (-39.6% YoY), total expenditures in November fell by 18.4% YoY.

By the end of November, AR$32.8 billion of expenditures related to COVID-19 were recorded.

The primary balance shifted from a deficit of AR$105.5 billion in November 2019 to a monthly surplus of AR$57.1 billion in November 2020. The negative financial balance decreased from AR$186.6 billion to AR$9.8 billion.

However, if exceptional revenues, such as transfer of profits from the Central Bank to the Treasury, and expenditures recorded in 2019 that belong to previous fiscal years are not included, November’s primary deficit is equivalent to AR$92.9 billion, which implies a 77.4% deterioration compared to the one recorded in the same period of 2019.

The Pensions item had a contraction of 5.2% YoY due to the decrease in the number of beneficiaries of the system and the benefit mobility policy.

Economic subsidies (AR$60 billion) had a real YoY increase of 19.6%, basically due to those related to energy.

The initial budget for the fiscal year increased by AR$2,7 trillion and 62.9% of this amount was allocated to reinforce social benefits.

Executed expenditure as of November 30 represents 80.6% of current budget appropriation.

by Juan Fourcaud | Nov 11, 2020 | Budget Execution

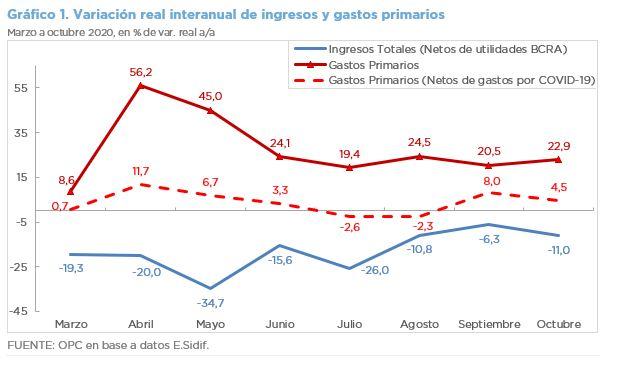

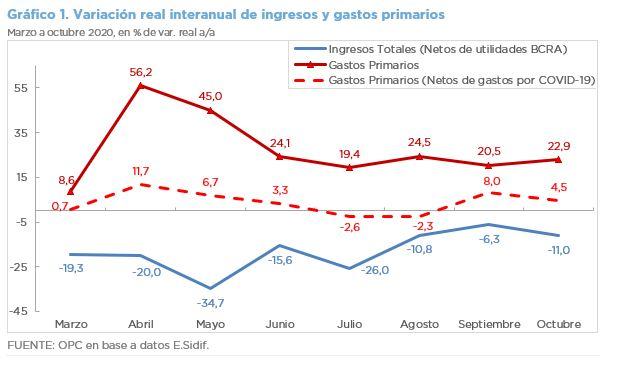

Excluding the profits transferred by the Central Bank to the Treasury, the revenues of the national government fell in October by 11.0% in real terms with respect to the same month of the previous year, while primary expenditures grew by 22.9%, mainly due to the health emergency. The primary deficit totaled AR$75.1 billion.

- The BCRA (Central Bank of Argentina) transferred $30 billion in profits during October, which explains the 5.5% increase in Property Income.

- The national government allocated approximately AR$77 billion to mitigate the economic effects of the COVID-19 crisis in October and for the seventh consecutive month, primary expenditures grew by double digits. Without this allocation, they would have grown at a slower rate of 4.5%.

- Debt interest of AR$31.1 billion was accrued, 73.1% less than last October. This explains why total expenditures only grew by 2.1% in the month.

- The financial balance went from a deficit of AR$54.8 billion in October last year to a deficit of AR$106.2 billion in October this year.

- The slight real improvement of 0.5% YoY in current revenues was driven by Income Tax and Wealth Tax, which partially offset the fall in other taxes.

- Civil service personnel expenditure fell by 9.0% YoY, while pensions increased by 1.9% YoY.

- Energy subsidies totaled AR$24.4 billion, an increase of 42.8% YoY.

- Capital transfers to government-owned companies in the transportation sector had a real growth of 351.9% YoY, basically for the urban railroads and the Belgrano Cargas.

- The initial budget for the year increased by AR$2.7 trillion – 56.5% with respect to the initial appropriation – and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

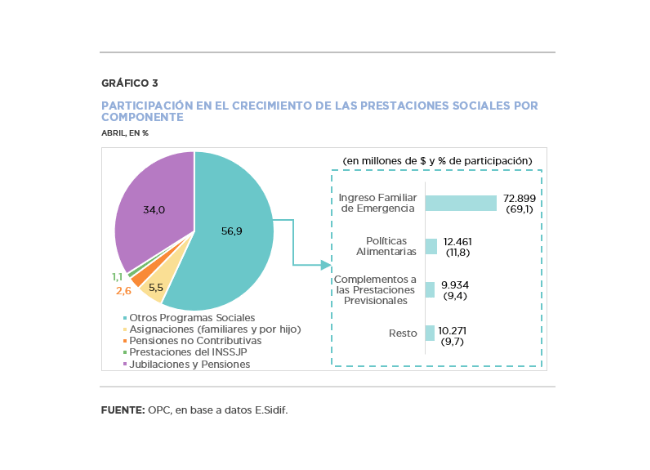

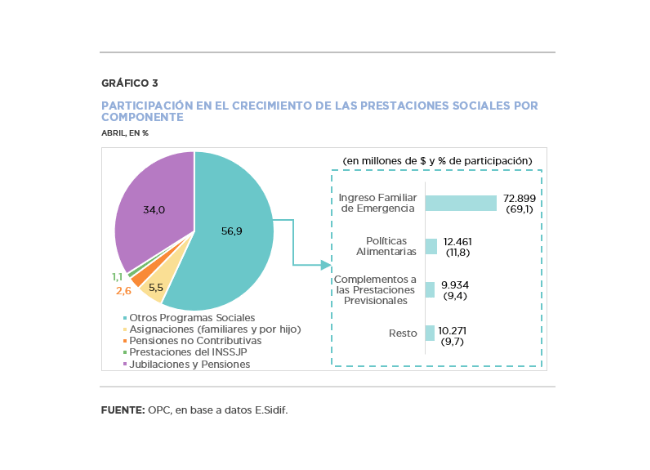

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).