by Juan Fourcaud | Dec 14, 2020 | Budget Execution

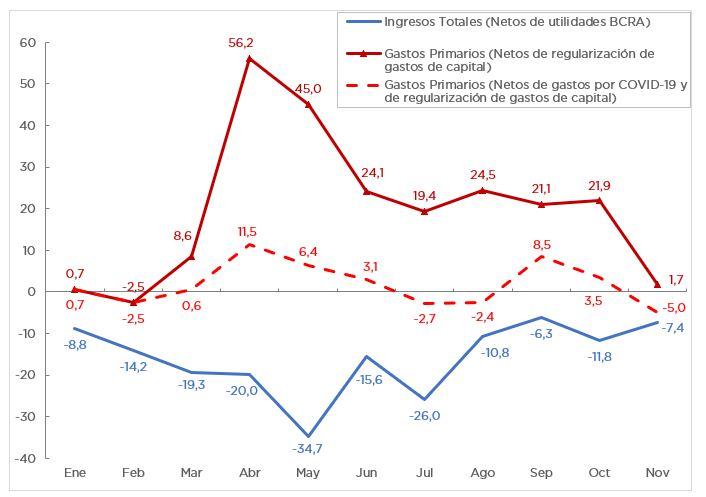

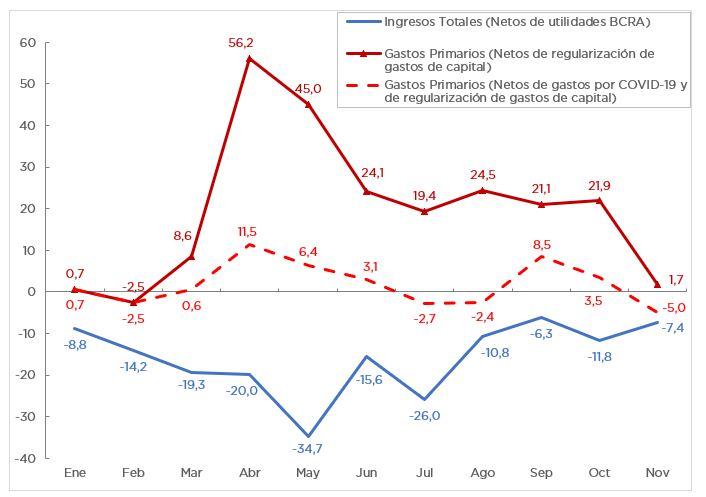

During the month of November, total revenues of the National Government showed an expansion in real terms of 27.0% year on year (YoY) because of the transfer of profits from the Central Bank of Argentina (BCRA) to the National Treasury in the amount of AR$150 billion. If these resources are excluded, total revenues would have fallen by 7.4% YoY.

Tax revenues fell 6.0% YoY, and the 31.1% YoY increase in Income Tax revenues failed to offset the drop in VAT (4.5% YoY) and Export Duties (46.0% YoY).

Primary expenditures (after adjustment of capital expenditures executed in previous years) had, for the first time since March, a variation of less than two digits (1.7% YoY).Considering debt interest (-39.6% YoY), total expenditures in November fell by 18.4% YoY.

By the end of November, AR$32.8 billion of expenditures related to COVID-19 were recorded.

The primary balance shifted from a deficit of AR$105.5 billion in November 2019 to a monthly surplus of AR$57.1 billion in November 2020. The negative financial balance decreased from AR$186.6 billion to AR$9.8 billion.

However, if exceptional revenues, such as transfer of profits from the Central Bank to the Treasury, and expenditures recorded in 2019 that belong to previous fiscal years are not included, November’s primary deficit is equivalent to AR$92.9 billion, which implies a 77.4% deterioration compared to the one recorded in the same period of 2019.

The Pensions item had a contraction of 5.2% YoY due to the decrease in the number of beneficiaries of the system and the benefit mobility policy.

Economic subsidies (AR$60 billion) had a real YoY increase of 19.6%, basically due to those related to energy.

The initial budget for the fiscal year increased by AR$2,7 trillion and 62.9% of this amount was allocated to reinforce social benefits.

Executed expenditure as of November 30 represents 80.6% of current budget appropriation.

by Juan Fourcaud | Oct 27, 2020 | Budget Execution

In the first nine months of the year, national government revenue grew by 5.0% YoY in real terms, while expenditure grew by 9.4% YoY, mainly driven by expenditures to mitigate the consequences of the pandemic.

- Excluding the profits transferred by the Central Bank (BCRA), which totaled AR$1.17 trillion as of September, total resources contracted by 17.6% YoY in real terms compared to the previous year.

- Primary expenditures increased by 21.9% YoY, basically to mitigate the health crisis.

- As of September, approximately AR$723.2 billion of expenditures related to COVID-19 were accrued, without which primary expenditure would have expanded by 2.4% YoY in real terms.

- The primary balance up to September 30, 2019, excluding BCRA profits, went from a surplus of AR$75.9 billion to a deficit of AR$1.4 trillion in the same period of 2020.

- Social programs registered an execution of AR$85.1 billion in the first nine months of 2019 and AR$671.9 billion in the term January-September 2020, which means an increase of 447.0% YoY in real terms.

- The initial budget for the year increased by $2.7 trillion and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | Jul 15, 2020 | Budget Execution

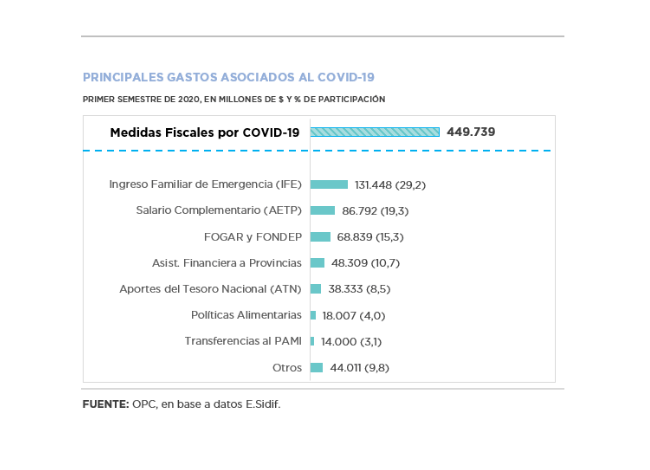

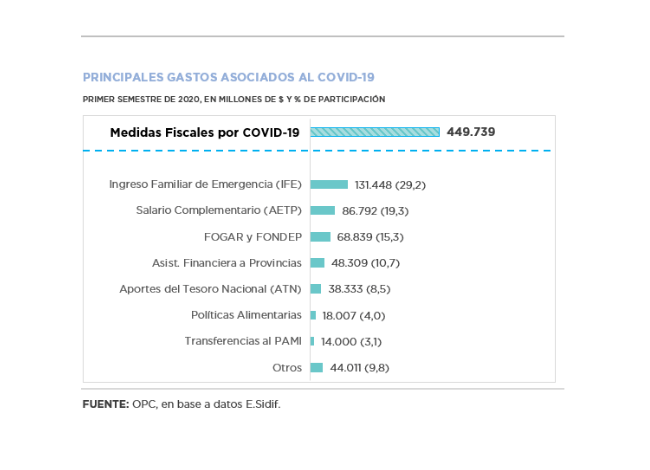

- During the first half of the year, the national government recorded a primary deficit of AR$911.12 billion due to the increase in expenditures and the decrease in revenues, both conditioned by the health crisis. his deficit was financed with profits from the Central Bank of Argentina.

- In the first half of the year, primary expenditures increased 22.3% YoY in real terms. This variation is almost entirely explained by the fiscal measures adopted by the national government within the framework of the COVID-19 emergency and the social isolation measures. Meanwhile, given the year-on-year drop in debt interest (-38.7% YoY), the increase in total expenditures had a more moderate expansion of 0.9% YoY.

- The programs implemented to face the health challenge implied an expenditure of around AR$449.73 billion, without which primary expenditure would have grown by 3.2% in real terms compared to the first half of the previous year.

- Through twelve amendments, the initial Budget for the fiscal year increased by AR$845.41 billion, 67.6% of which was allocated to reinforce social benefits.

- In June, pensions and retirement benefits fell in real terms for the first time in the semester (1.4%), but supplementary bonuses caused lower pensions to increase 11.7% above inflation.

- The 71.8% drop in expenditure on housing and urban development was partly offset by the increase in expenditures on Potable Water and Sewerage, which rose 142.0% YoY, and on Financial Assistance for the Construction of Emergency Modular Hospitals, within the framework of COVID-19 ($4.38 billion).

by Nicolas Perez | Feb 19, 2020 | Budget Execution

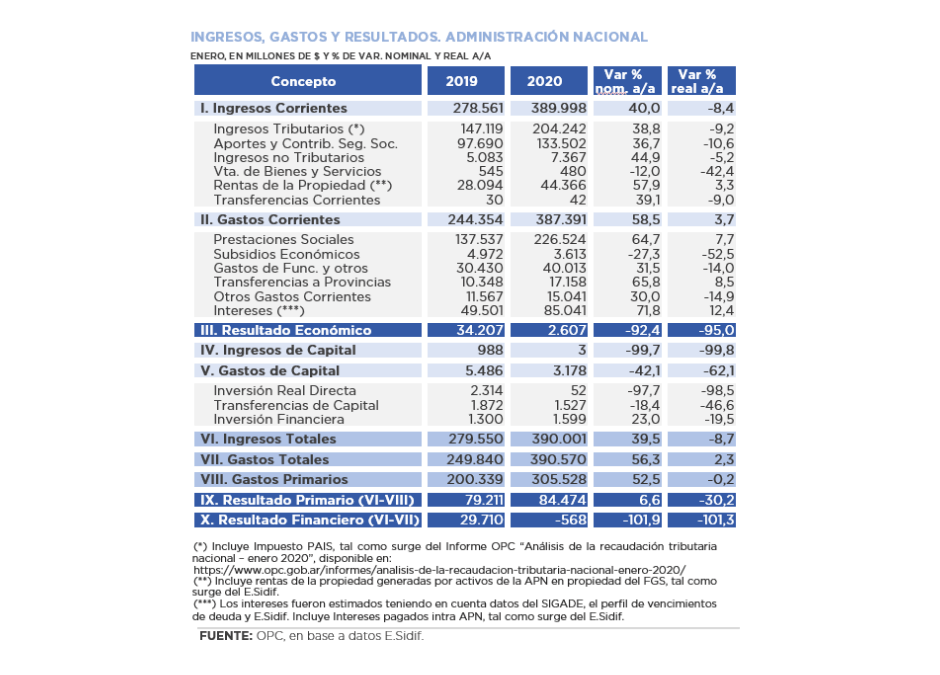

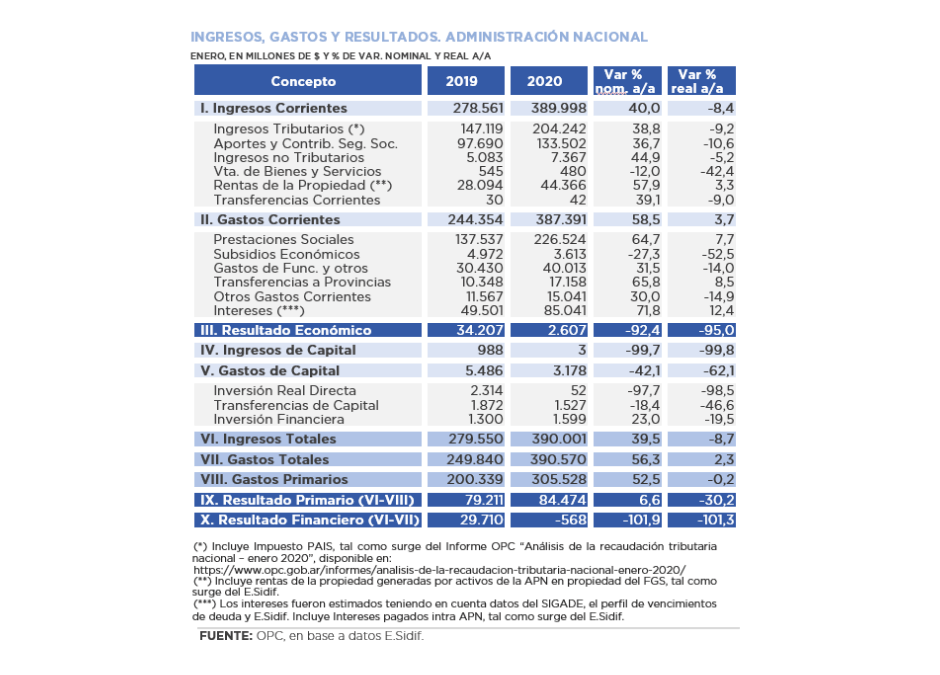

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.

by Nicolas Perez | Jan 15, 2020 | Budget Execution

Fiscal year 2019 ended with a real increase in resources of 2.1% with respect to the previous year and with a contraction in expenditure of 6.4% YoY, spread across the main components, apart from debt interest, which increased by 10.7% YoY in real terms.

The combination of these behaviors resulted in a financial deficit of AR$845.99 billion, equivalent to 3.9% of the Gross Domestic Product, 1.7 percentage points below that of the previous year. The primary balance showed a surplus of AR$75.49 billion, an improvement compared to 2018.

The evolution of Export Duties was decisive in the increase in tax revenues, which had a real jump of 164.4% year-on-year because of the increase in tax rates, the devaluation of the exchange rate and the higher quantities exported by the soybean sector.

This scenario offset the fall in other tax items and the resources of the social security system, affected by the lower economic activity and the reduction of taxable wages.

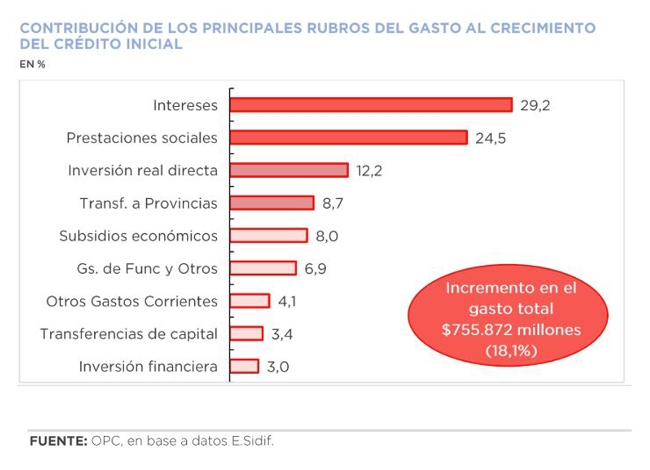

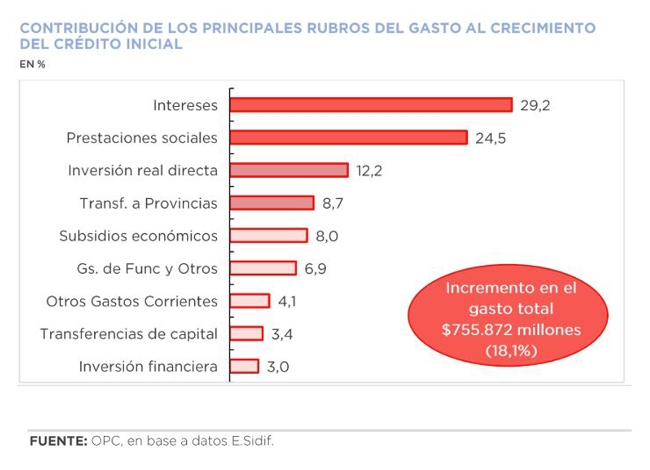

In 2019, national government expenditure reached AR$4.74 trillion, which implies an execution level of 96.2% of the allocated budget. The initial approved appropriation increased by 18.1%, with debt interest being the item that most contributed to such variation (29.2%).

by Nicolas Perez | Dec 11, 2019 | Budget Execution

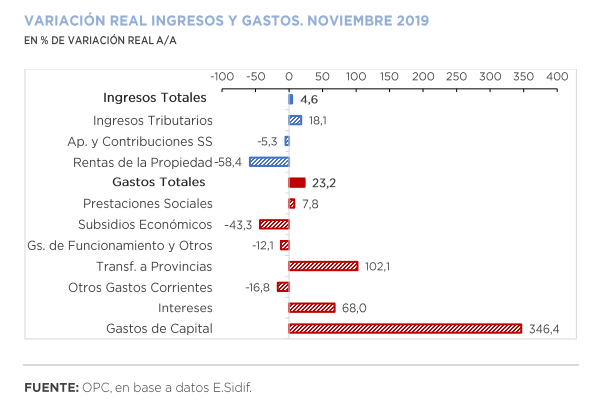

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

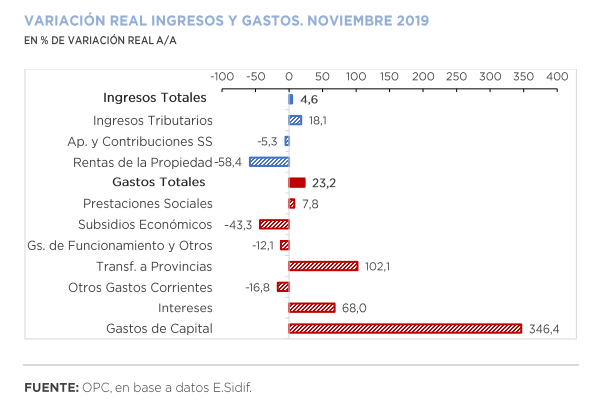

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.