by Juan Fourcaud | Nov 12, 2020 | Public Debt Operations

Placements of securities were made, and loan disbursements received for the equivalent of USD6.76 billion in October, of which AR$148.24 billion (USD2.09 billion) were for auctions for marketable securities in pesos. For the first time this year, dollar-linked bonds were auctioned, resulting in the placement of new instruments for USD3.43 billion.

On the other hand, the equivalent of USD4.87 billion of principal was canceled, mainly due to maturities of Treasury bills in pesos. There was a net cancellation of BCRA (Central Bank of the Argentine Republic) Temporary Advances for AR$125.78 billion (US$1.6 billion), of which AR$100 billion were a pre-cancellation made in the last week of the month.

Debt service maturities for November and December are estimated at the equivalent of US$13.2 billion, which is reduced to approximately US$7.7 billion if holdings within public sector are excluded.

Following a request from Argentina, talks with the IMF formally began to negotiate a new program to refinance the debt with the IMF for approximately US$45 billion.

by Nicolas Perez | Oct 14, 2020 | Public Debt Operations

In September, the restructuring operations of foreign currency securities issued under foreign

legislation (Law 27,544) and local legislation (Law 27,556) were settled, which involved

cancellations of eligible securities for USD108.1 billion and placements of new bonds for

USD110.9 billion.

Excluding these operations, there were placements of securities and loan disbursements for the

equivalent of USD4.7 billion, of which AR$252.8 billion (USD3.4 billion) were auctions of

marketable securities in pesos. On the other hand, the equivalent of USD3.1 billion of principal

was paid, mainly due to maturities of Treasury bills in pesos. Likewise, interest payments were

made for the equivalent of USD447 million, of which 76% were in pesos.

Debt service maturities for the equivalent of USD3.86 billion are estimated for October, totaling

USD17.06 billion until the end of the year (approximately USD8.4 billion if holdings within the

public sector are excluded).

by Nicolas Perez | Feb 19, 2020 | Budget Execution

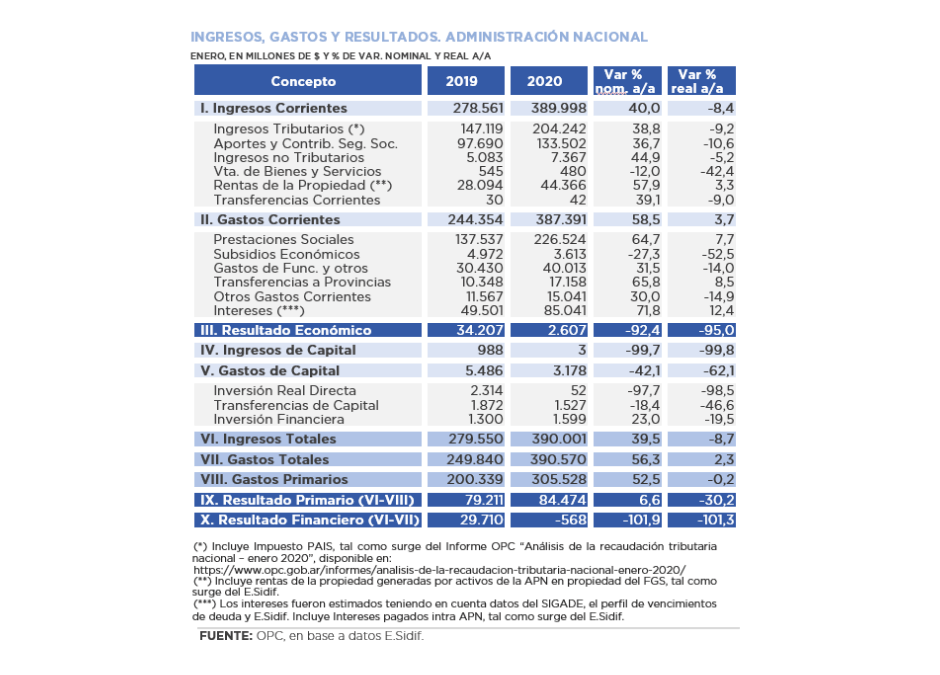

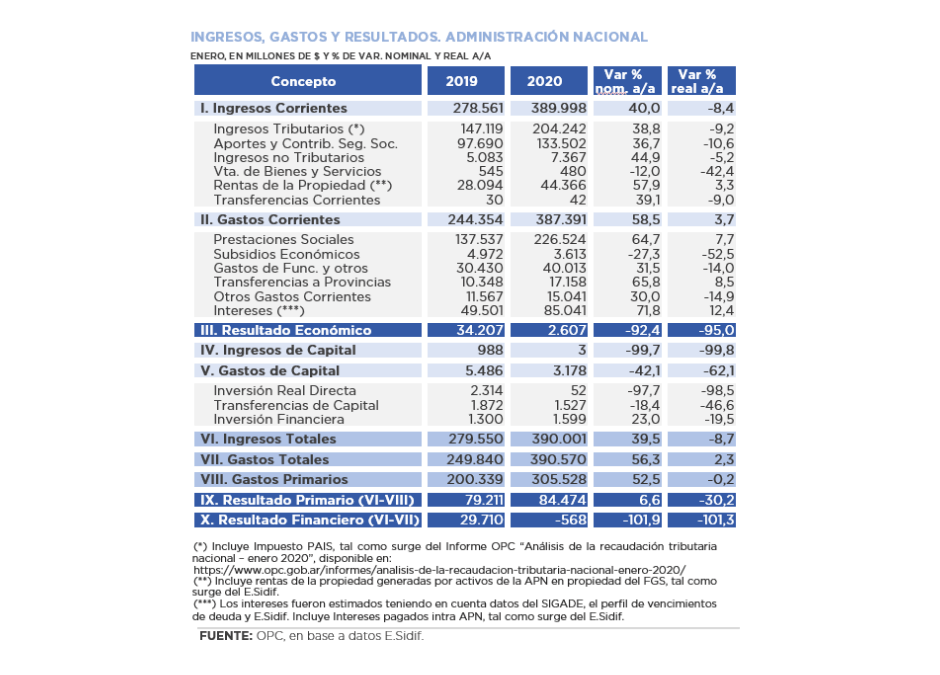

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.

by Nicolas Perez | Jan 15, 2020 | Budget Execution

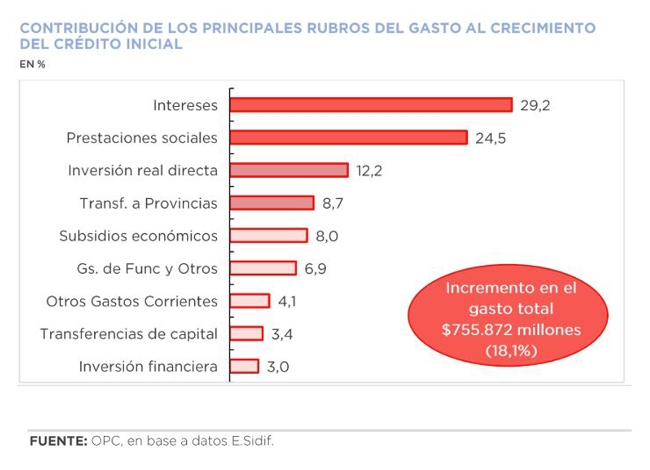

Fiscal year 2019 ended with a real increase in resources of 2.1% with respect to the previous year and with a contraction in expenditure of 6.4% YoY, spread across the main components, apart from debt interest, which increased by 10.7% YoY in real terms.

The combination of these behaviors resulted in a financial deficit of AR$845.99 billion, equivalent to 3.9% of the Gross Domestic Product, 1.7 percentage points below that of the previous year. The primary balance showed a surplus of AR$75.49 billion, an improvement compared to 2018.

The evolution of Export Duties was decisive in the increase in tax revenues, which had a real jump of 164.4% year-on-year because of the increase in tax rates, the devaluation of the exchange rate and the higher quantities exported by the soybean sector.

This scenario offset the fall in other tax items and the resources of the social security system, affected by the lower economic activity and the reduction of taxable wages.

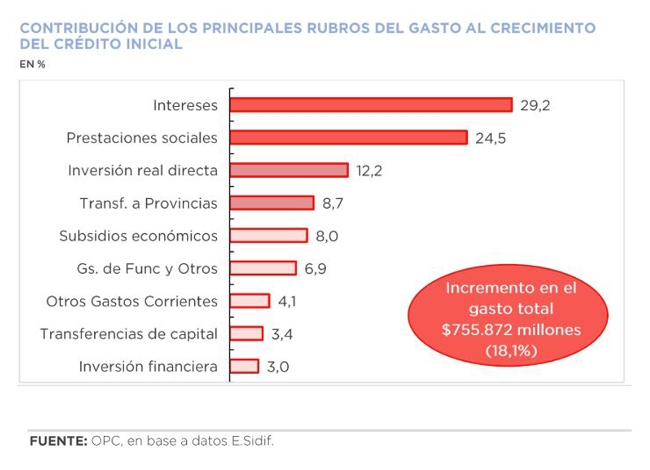

In 2019, national government expenditure reached AR$4.74 trillion, which implies an execution level of 96.2% of the allocated budget. The initial approved appropriation increased by 18.1%, with debt interest being the item that most contributed to such variation (29.2%).

by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

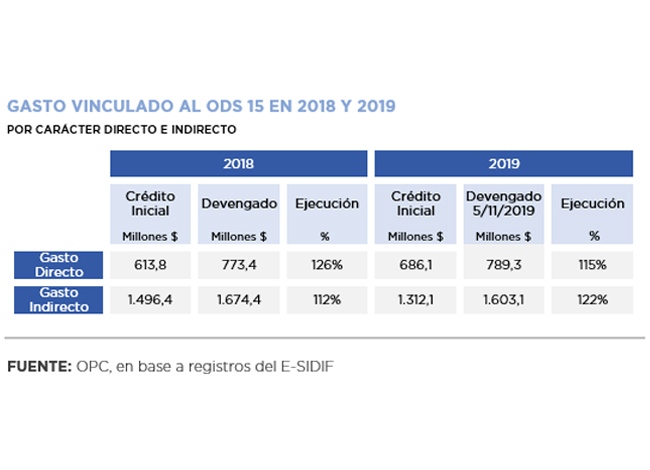

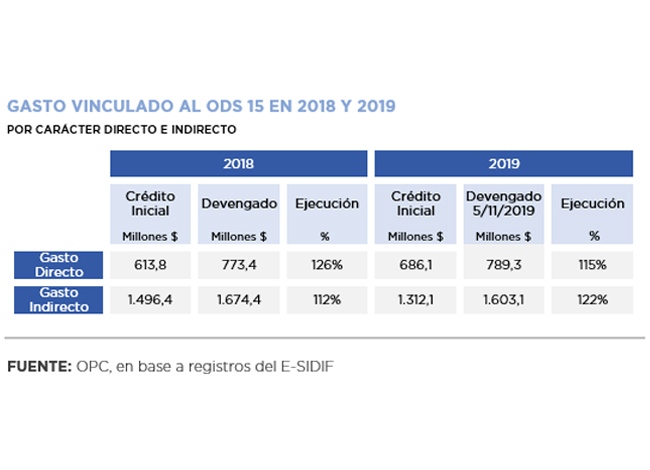

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

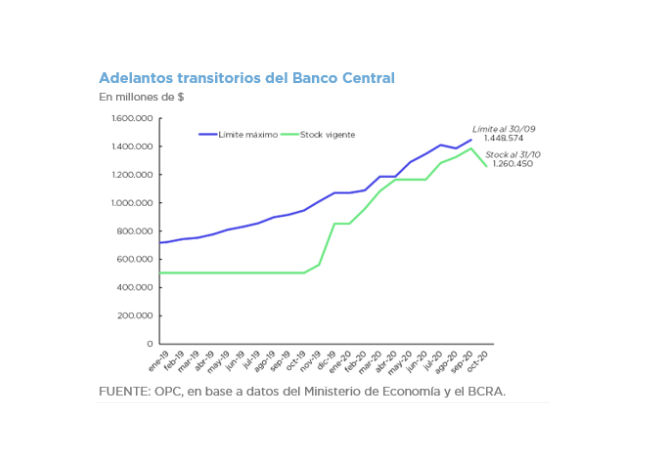

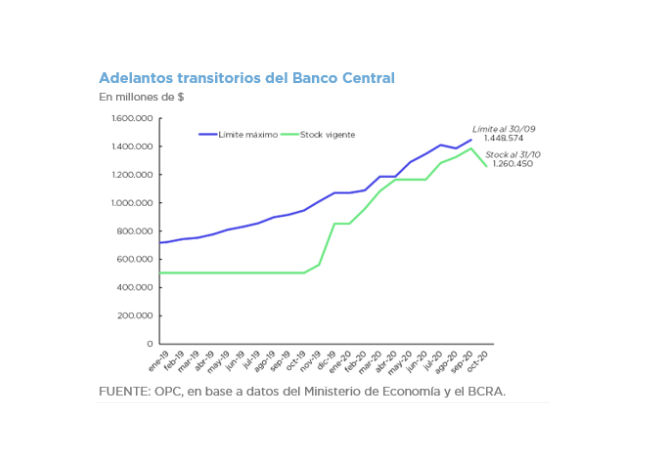

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

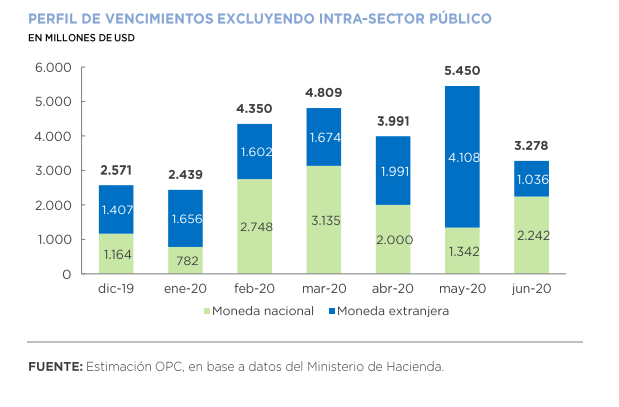

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

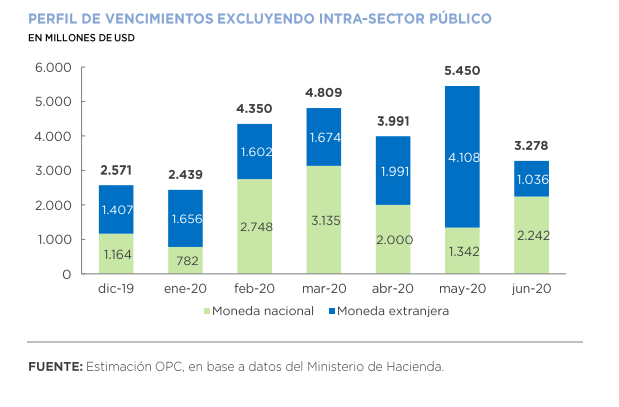

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.