by Nicolas Perez | Dec 11, 2019 | Budget Execution

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

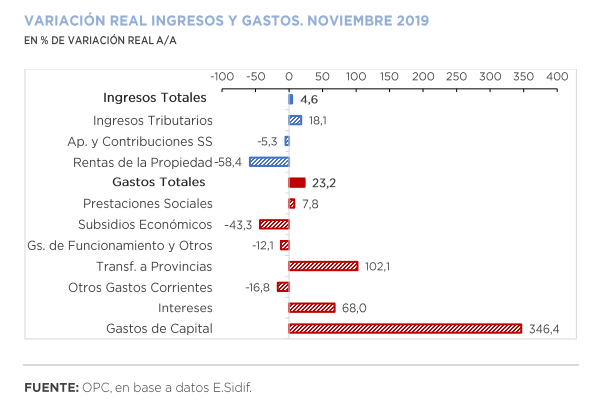

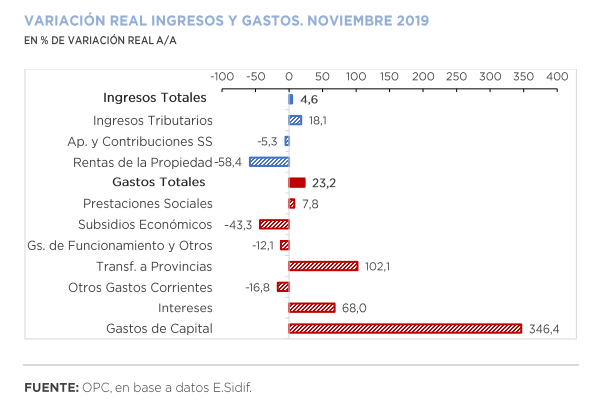

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Jun 13, 2019 | Public Debt Operations

- During May, placements of government securities and loan disbursements totaled USD6.5 billion, mainly through the issuance of treasury bills and bonds.

- As a result of five public auctions, the equivalent of USD5.48 billion in treasury bills and USD131 million in bonds were placed during the month.

- A voluntary swap of BONAR DUAL for new dollar-linked bills (LELINK) for USD964 million was carried out on May 23.

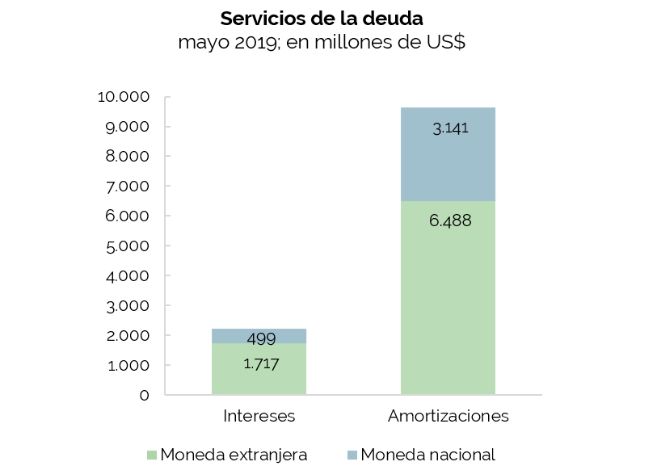

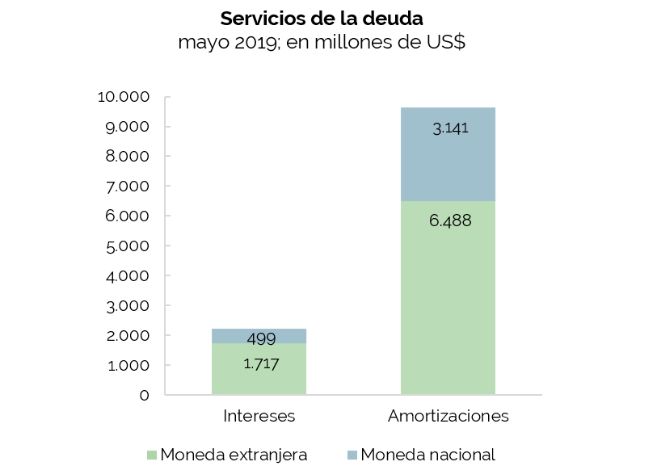

- Debt service for the month totaled the equivalent of USD11.85 billion, of which USD9.63 billion were principal repayments and USD2.21 billion were interest payments.

- At the end of the month, the fifth payment of principal and interest on the loans derived from the 2014 Renegotiation Agreement with the Paris Club was paid. The payment was for USD1.55 billion of principal and USD325 million of interest.

- Main maturities scheduled for the month of June are DISCOUNT bonds, different BONARs in dollars, BONAR Badlar and BOTAPO.

by Nicolas Perez | May 15, 2019 | Public Debt Operations

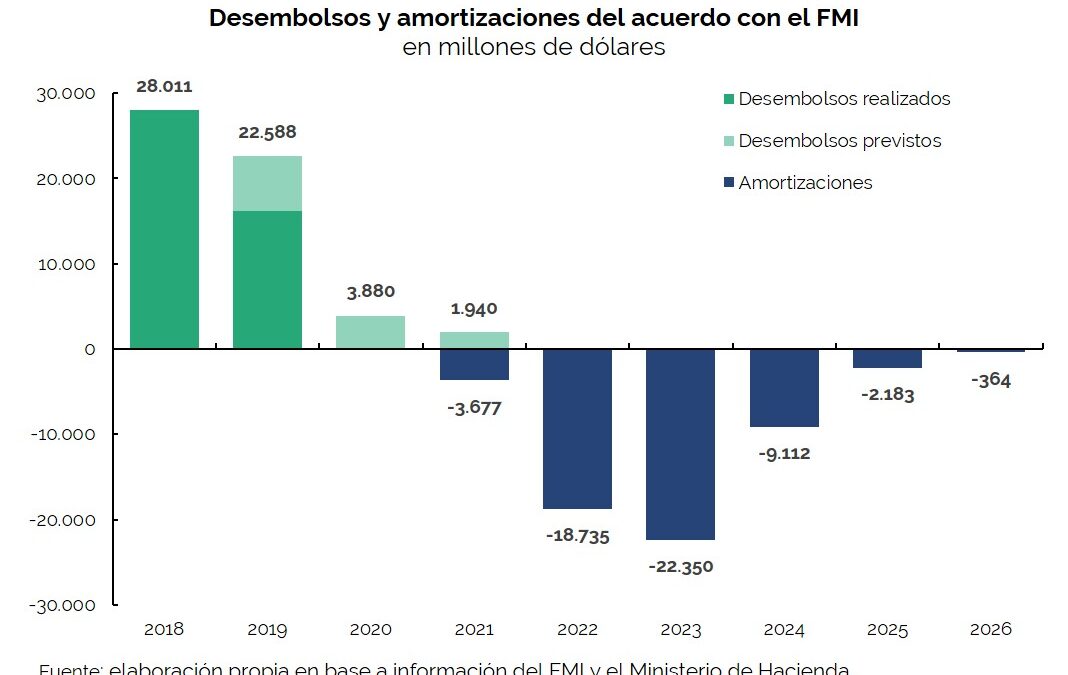

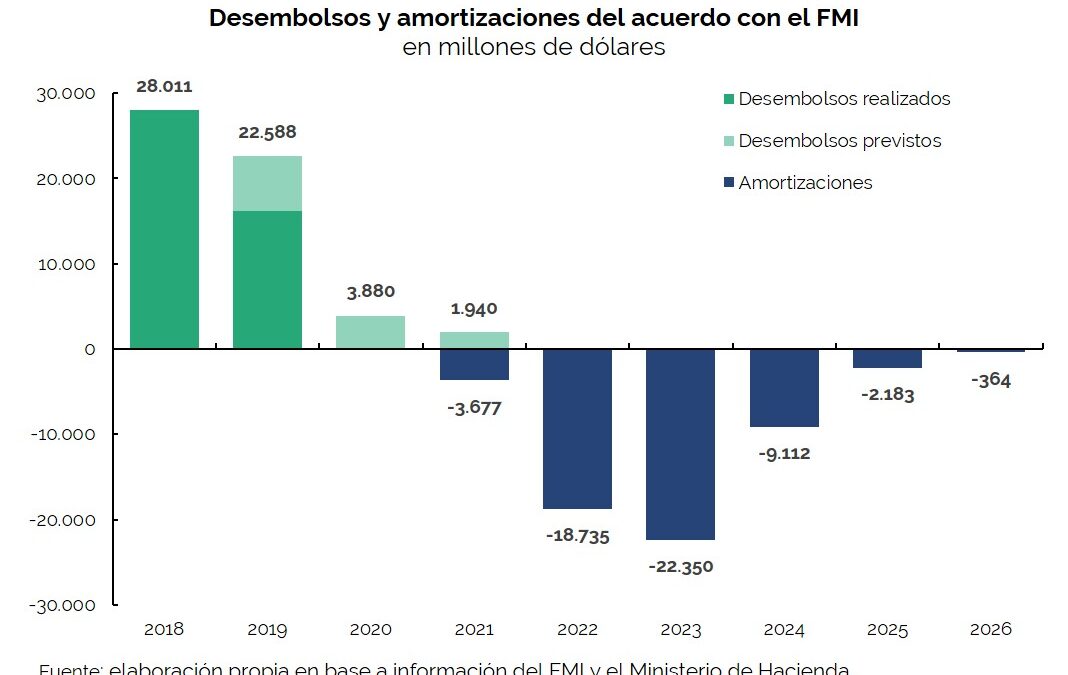

Placements of securities and loan disbursements for USD18.52 billion were recorded during the month of April, of which 58% (USD10.83 billion) consisted of the fourth disbursement from the International Monetary Fund (IMF) within the framework of the Stand-By Arrangement (SBA). Debt service payments during the period totaled USD11.46 billion, of which 82% (USD9.38 billion) were principal payments.

In a context of high volatility, a higher yield was validated in LETES placements, whose refinancing ratio fell to 64% from 87% in April.

During the month, new bonds in dollars for USD1.5 billion were placed to cancel a debt remaining from natural gas production stimulus plans, and securities for USD369 million to satisfy a ICSID arbitration award in favor of the former concessionaire of Aguas Argentinas. On April 22, the first securities issued under the agreement with “holdout” creditors for USD2.75 billion matured.

On May 31, the fifth payment of principal and interest of the loans renegotiated with the Paris Club is due: if the minimum principal established in the agreement is paid, such payment will amount to USD 1.87 billion.