by Juan Fourcaud | Nov 11, 2020 | Budget Execution

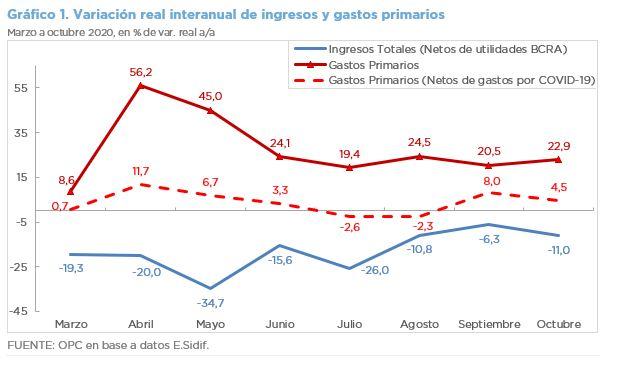

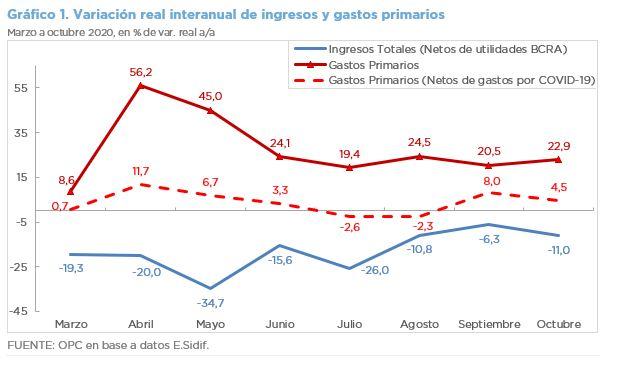

Excluding the profits transferred by the Central Bank to the Treasury, the revenues of the national government fell in October by 11.0% in real terms with respect to the same month of the previous year, while primary expenditures grew by 22.9%, mainly due to the health emergency. The primary deficit totaled AR$75.1 billion.

- The BCRA (Central Bank of Argentina) transferred $30 billion in profits during October, which explains the 5.5% increase in Property Income.

- The national government allocated approximately AR$77 billion to mitigate the economic effects of the COVID-19 crisis in October and for the seventh consecutive month, primary expenditures grew by double digits. Without this allocation, they would have grown at a slower rate of 4.5%.

- Debt interest of AR$31.1 billion was accrued, 73.1% less than last October. This explains why total expenditures only grew by 2.1% in the month.

- The financial balance went from a deficit of AR$54.8 billion in October last year to a deficit of AR$106.2 billion in October this year.

- The slight real improvement of 0.5% YoY in current revenues was driven by Income Tax and Wealth Tax, which partially offset the fall in other taxes.

- Civil service personnel expenditure fell by 9.0% YoY, while pensions increased by 1.9% YoY.

- Energy subsidies totaled AR$24.4 billion, an increase of 42.8% YoY.

- Capital transfers to government-owned companies in the transportation sector had a real growth of 351.9% YoY, basically for the urban railroads and the Belgrano Cargas.

- The initial budget for the year increased by AR$2.7 trillion – 56.5% with respect to the initial appropriation – and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

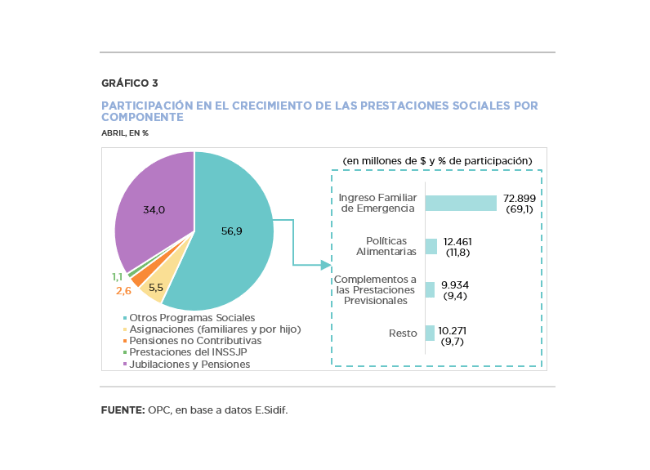

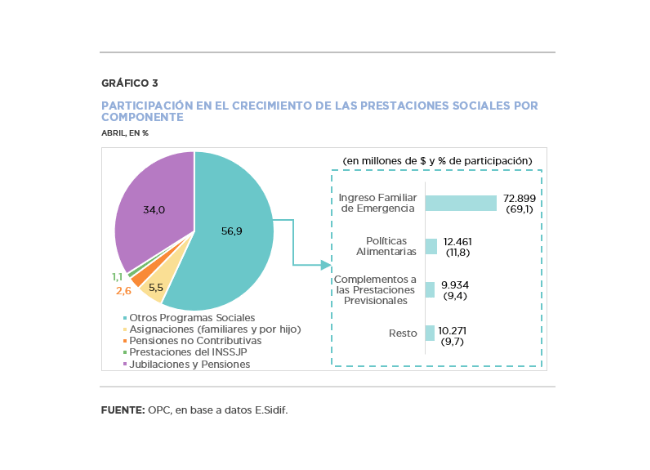

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).

by Nicolas Perez | Feb 14, 2019 | Budget Execution

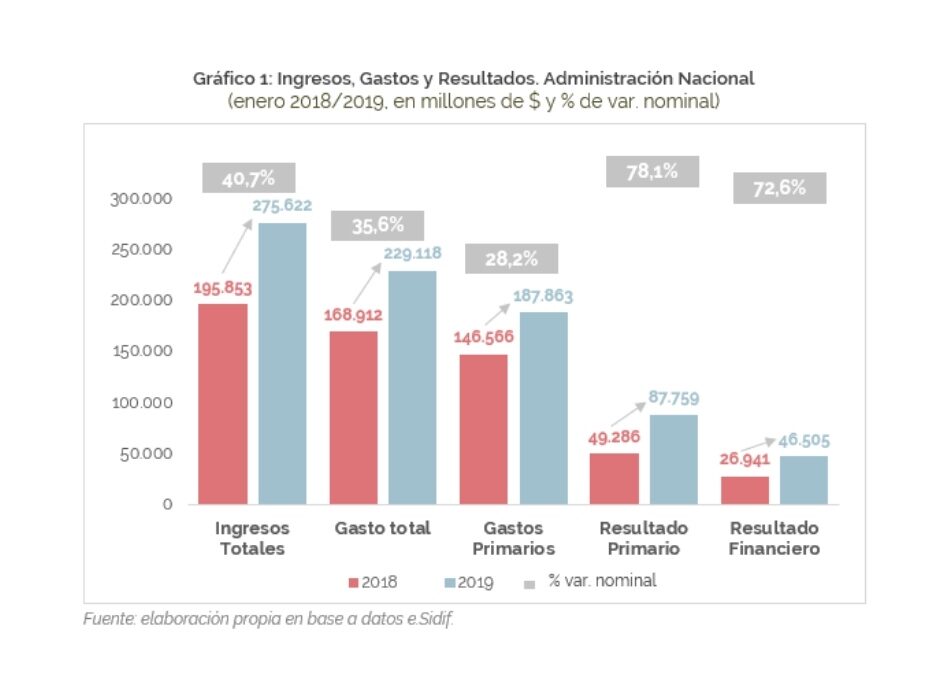

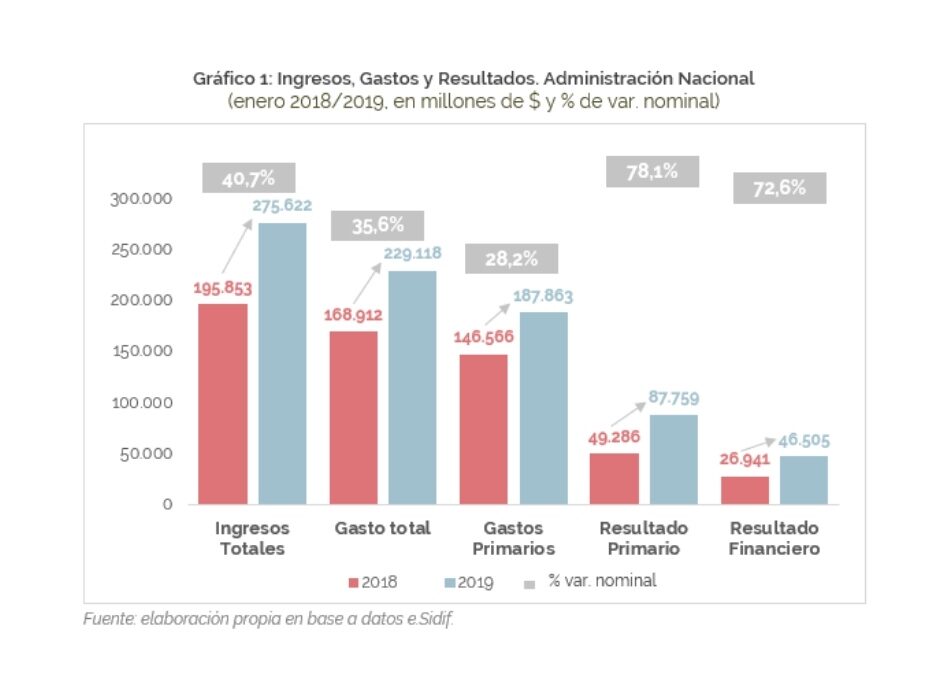

During January, the national government had a financial surplus of AR$87.76 billion, 19.7% higher in real terms than in 2018. Compared to inflation, both total revenues and total expenditures decreased during the month.

Revenues showed a drop -in real terms- in all items, except for property income and capital revenues.

Expenditures showed some exceptions to this pattern. Debt interest payments increased 84.6% YoY (+24.1% in real terms) and economic subsidies grew by 143% (+63.9% YoY in real terms).

Total accrued expenditures accounted for 5.5% of the total item, current expenditures for 5.6% and capital expenditures for 3.0%.