by Nicolas Perez | Sep 14, 2021 | Budget Execution

Driven by the strong increase in Export Duties, VAT, and Income Tax, in that order, National Government revenues increased by 12.3% in August in real terms year-on-year (YoY).

Mainly because of the increase in capital expenditures and energy subsidies, primary expenditures once again grew above inflation for the second time this year, breaking the opposite trend they had shown in the last five months: 5.0% YoY.

The dynamics between revenues and expenditures resulted in an improvement in real terms of the primary, fiscal, and revenue deficits: he year-on-year comparison showed a decrease of 39.3%, 21.7% and 13.3%, respectively.

- Social Security contributions grew 4.2% year-on-year. The number of contributors to the system increased but taxable income grew below inflation.

- Since May, ARS179.285 billion have been collected through the Solidarity and Extraordinary Contribution and ARS65.938 billion have been spent.

- Subsidies to the Compañía Administradora del Mercado Mayorista Eléctrico (CAMMESA) amounted to ARS102.935 billion with an increase of 126.6% YoY because of the gap between the cost of generation and tariffs and the delay in payment by the electricity distributors.

- At the end of August, approximately ARS256.75 billion were executed, equivalent to 61.5% of the current appropriation (ARS417.187 billion) to meet the expenses related to the fight against COVID-19.

- The initial budget for the year was increased by ARS1.015 trillion, with priority being given to social programs, energy subsidies and the procurement and distribution of vaccines.

by Nicolas Perez | Jul 26, 2021 | Budget Law

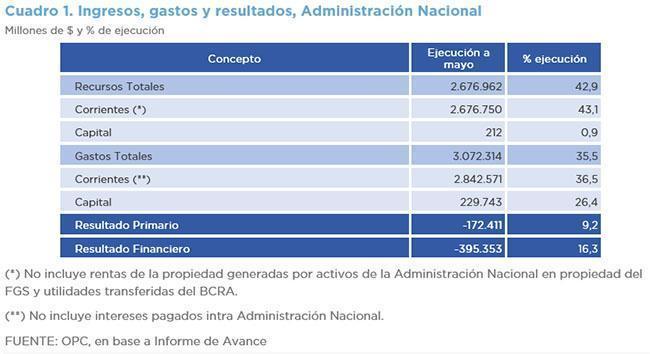

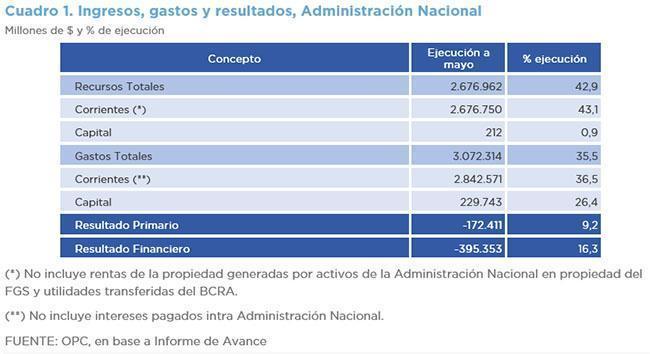

As of May 31, the National Government accumulated a primary deficit of ARS172.41 billion and a financial deficit of ARS395.35 billion, prioritizing spending on social services, which accounted for 69.1% of total expenditure.

These figures are contained in the 2022 Budget Draft Progress Report sent by the Executive Power to the National Congress at the end of June.

The report states that the fiscal and financial measures to alleviate the effects of the pandemic reached a sum equivalent to 6.5% of the Gross Domestic Product (GDP) in 2020, a proportion that would drop to 1.4% this year, with allocations to protect families and specific sectors.

Debt interest for this year is estimated to be equivalent to 1.5% of GDP. Apart from this, the report does not provide projections for 2021 and 2022.

Among the budgetary policy targets for the coming year are the management of the macroeconomy, the development of the country’s infrastructure, the strengthening of production, active social inclusion with a gender perspective, education, health, and public investment.

by Nicolas Perez | Jul 15, 2021 | Budget Execution

Because of a real fall in National Government expenditures, mainly in pensions and government wages, and an increase in the different revenue categories, public accounts improved, and the primary deficit was ARS473.1 billion, 64.0% less than that of the previous year.

- Revenues showed a real expansion of 18.7% year-on-year (YoY), with the Solidarity and Extraordinary Contribution (ARS144.4 billion) and the jump in Export Duties (97.9% YoY) standing out.

- Primary expenditures contracted by 7.3% YoY, mainly due to the negative variations in pensions (9.6% YoY) and government wages (5.0% YoY). On the other hand, there were significant increases in capital expenditures (92.1% YoY) and in energy subsidies (43.9% YoY).

- The level of spending on social programs fell in real terms compared to last year but was three times higher when compared to the same period of 2019.

- The initial budget for the fiscal year increased by ARS273.32 billion, whose priority allocations were social programs (REPRO II, PROGRESAR and PAMI, among others) and the acquisition, logistics and distribution of COVID-19 vaccines.

- As of June, approximately ARS177.33 billion were implemented to address the health crisis, equivalent to 43.3% of the current appropriation (ARS409.6 billion).

- As of June 30, total expenditures amounted to ARS4.21 trillion, equivalent to 48.6% of the current budget appropriation, with government wages accounting for 60.0%.

by Juan Fourcaud | Nov 11, 2020 | Budget Execution

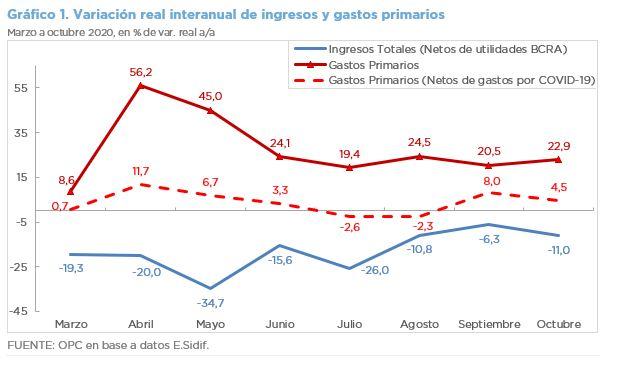

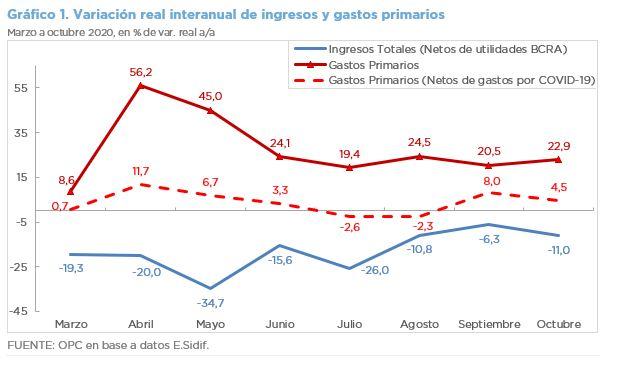

Excluding the profits transferred by the Central Bank to the Treasury, the revenues of the national government fell in October by 11.0% in real terms with respect to the same month of the previous year, while primary expenditures grew by 22.9%, mainly due to the health emergency. The primary deficit totaled AR$75.1 billion.

- The BCRA (Central Bank of Argentina) transferred $30 billion in profits during October, which explains the 5.5% increase in Property Income.

- The national government allocated approximately AR$77 billion to mitigate the economic effects of the COVID-19 crisis in October and for the seventh consecutive month, primary expenditures grew by double digits. Without this allocation, they would have grown at a slower rate of 4.5%.

- Debt interest of AR$31.1 billion was accrued, 73.1% less than last October. This explains why total expenditures only grew by 2.1% in the month.

- The financial balance went from a deficit of AR$54.8 billion in October last year to a deficit of AR$106.2 billion in October this year.

- The slight real improvement of 0.5% YoY in current revenues was driven by Income Tax and Wealth Tax, which partially offset the fall in other taxes.

- Civil service personnel expenditure fell by 9.0% YoY, while pensions increased by 1.9% YoY.

- Energy subsidies totaled AR$24.4 billion, an increase of 42.8% YoY.

- Capital transfers to government-owned companies in the transportation sector had a real growth of 351.9% YoY, basically for the urban railroads and the Belgrano Cargas.

- The initial budget for the year increased by AR$2.7 trillion – 56.5% with respect to the initial appropriation – and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | Nov 12, 2019 | Budget Execution

October’s primary balance was in surplus by AR$23.09 billion, improving previous year’s performance. However, considering the payment of interest on the public debt for AR$39.48 billion, the financial balance was in deficit by AR$16.38 billion.

So far this year, that negative balance amounts to AR$340.55 billion and implies an improvement of 51.6% YoY in real terms compared to the same period of 2018.

To a large extent, this is possible because in the first ten months resources grew at a rate of 57.1% YoY (2.1% YoY real) with respect to 2018, 15.3 percentage points above total expenditures, which grew by 41.9% YoY (-7.8% YoY real).

The item with the highest year-on-year expansion was family allowances, which grew by 26.1% in real terms, mainly due to the increase in the Universal Child Allowance.

National government salaries grew nominally 38.4% YoY, however, they contracted 8.9% YoY in relation to inflation.

In 2019, property income increased its share in total resources, basically due to the resumption of Treasury financing through the transfer of Central Bank profits and the decline in the level of economic activity and the formal labor market as of April 2018, with an impact on tax resources.