ANALYSIS OF NATIONAL TAX REVENUE – AUGUST 2021

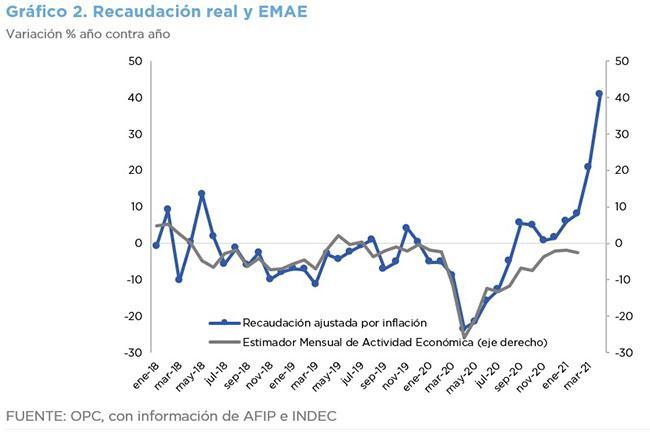

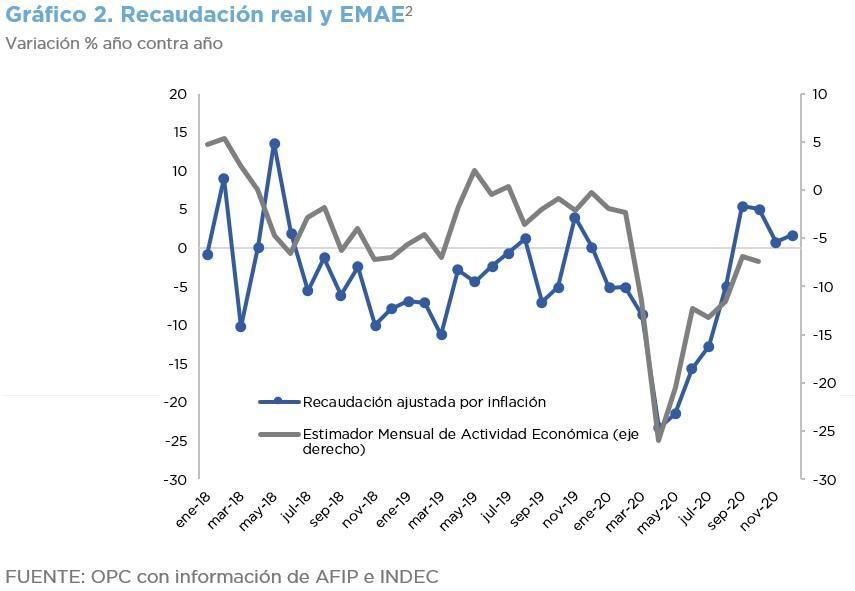

Tax revenue totaled ARS1.005 trillion in August, an increase of 64.2% year-on-year (YoY). Adjusted for inflation, the increase was 8.1% YoY.

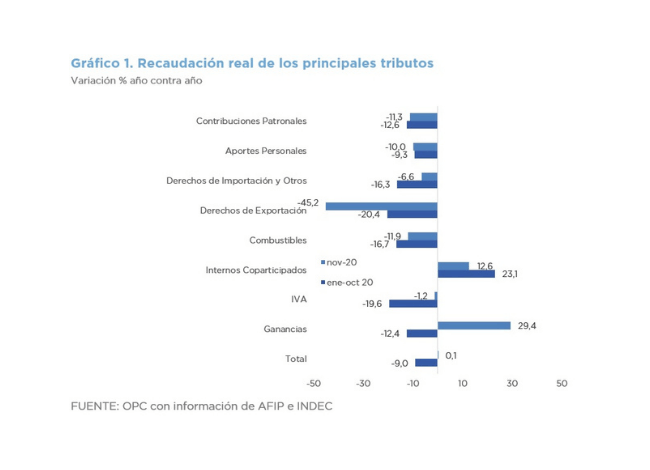

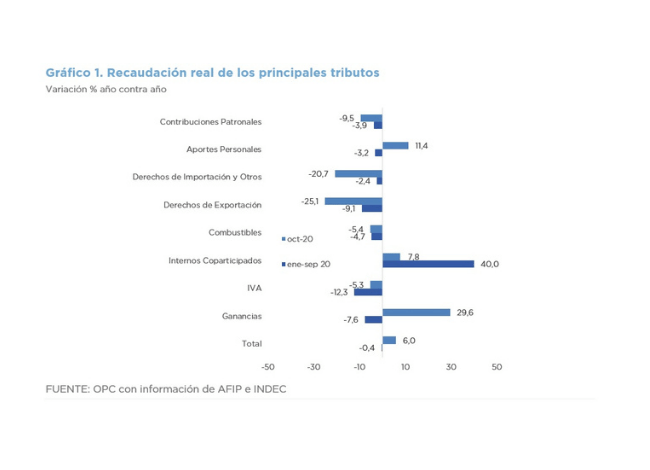

Among the tax resources, the increase in VAT, Tax on Credits and Debits and Profits stand out. Export Duties and Social Security resources continued to show a good performance.

The low comparison base attributable to the economic effects of the Mandatory Preventive Social Isolation (ASPO) that came into force on March 20, 2020, the increase in international prices of raw materials and the increase in the nominal exchange rate (32.6% YoY) contributed favorably to these results, although a deceleration is observed.