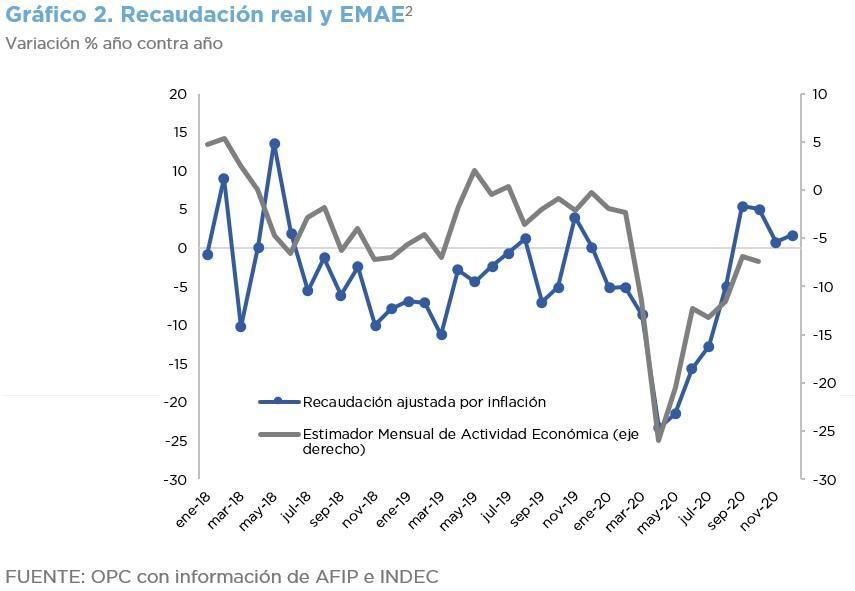

Driven by an incipient economic revival and the increase in Wealth tax rates, tax revenue grew 38% in nominal terms and 1.6% in real terms in December, registering for the fourth consecutive month an increase above inflation. However, in 2020, it suffered a real drop of 7.4% year-on-year, which doubled that recorded in 2019 and completed a cycle of three consecutive years of decline.

- In the last month of last year, VAT revenues grew 11.7% YoY and recorded the first real increase in twenty-six months. But there were falls in Social Security and Export Duties resources since the rise in the exchange rate did not offset the fall in foreign trade.

- The recessionary context, deepened by the pandemic, is the main reason why tax revenue has fallen in 23 of the last 25 months in real terms.

- The annual drop in VAT (17.7%) tripled the drop recorded in 2019 and the Income Tax doubled its decrease (-7.1%).

- The combination of a drop in registered employment and the lag of nominal wages with respect to the general price level makes the rate of expansion of the wage base to be systematically below that of the CPI since June 2018. Social Security resources fell 11.4% in real terms last year.

- The improvement in the exchange rate did not prevent the decline in revenues from Export Duties (29.5%), partly conditioned by the advances in foreign trade operations made by the agro-industrial sector at the end of 2019.

- Despite previous regulatory reforms to strengthen revenue, in the first quarter of last year there was already a real drop in revenues, prior to the beginning of the social isolation caused by the pandemic.

- In April, inflation-adjusted revenues fell 23.7% YoY, the sharpest drop since April 2002, largely due to the decrease in activity caused by the Mandatory Preventive Social Isolation (ASPO).

- Tax relief measures to alleviate the economic effects of COVID19 on taxpayers reduced tax collection by an estimated AR$79.2 billion in the first half of 2020.

- The year ends with four consecutive months of positive variations.