by Nicolas Perez | Aug 6, 2020 | Public Debt

On August 4, the government announced an agreement with the main groups of creditors to restructure bonds under foreign legislation. Based on the agreement, the terms of the last offer made by Argentina on July 6 are modified.

The modifications include the advancement of some maturities of the new bonds to be delivered, new conditions for the swap for bonds in different currencies and the commitment to introduce some adjustments to the collective action clauses of the new securities that are supported by the international community.

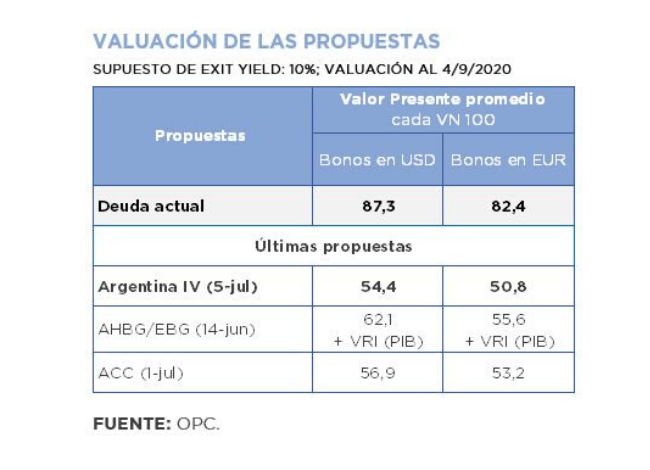

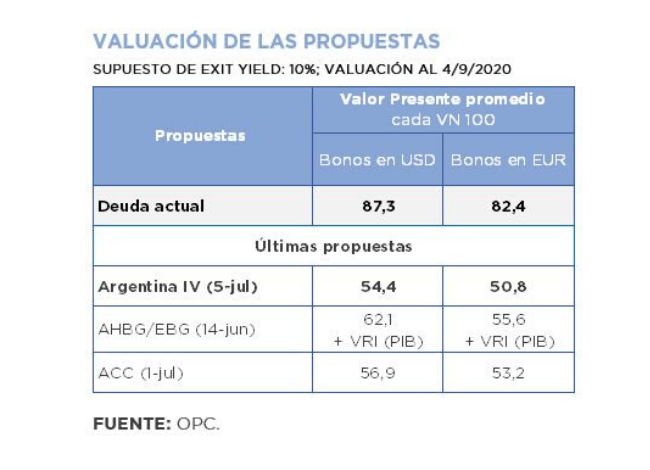

Assuming an exit yield of 10%, the settlement has an estimated average value of USD55.8 per USD100 of eligible face value. The agreement involves an improvement of USD1.4 over the previous official proposal.

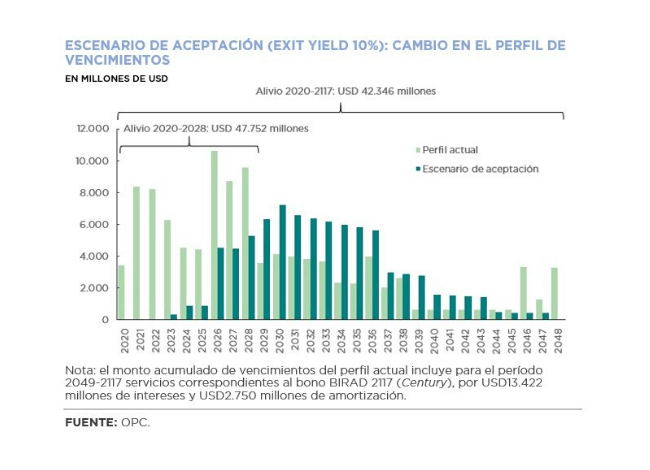

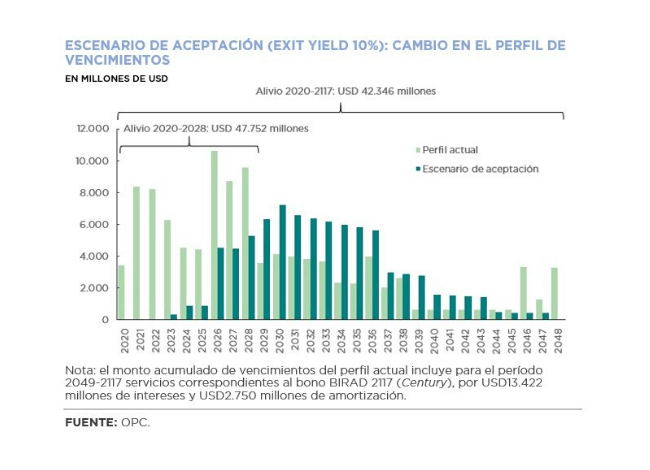

Under the assumption that the full eligible amount is swapped, the new bonds would generate amortization and interest payments of approximately USD4.6 billion in the term 2020-2024 and USD42.7 billion in the term 2020-2030.

The creditor groups that negotiated the agreement, together with other bondholders that would provide support, claimed to hold 60% of the eligible bonds issued under the 2005 indenture and 51% of the 2016 indenture bonds.

According to the current schedule, the creditors have a deadline to accept the proposal until August 24 and, in case of acceptance, the swap transaction would be settled on September 4.

by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.

by Nicolas Perez | Apr 25, 2020 | Public Debt

The Government submitted its proposal for the restructuring of bonds issued under foreign legislation. The swap proposal covers 21 series of bonds, issued under New York and UK legislation, and denominated in dollars, euros, and Swiss francs, totaling USD65.62 billion.

The proposal includes the swap of the eligible bonds for ten new bonds (five in dollars and five in euros), repayable in annual payments, maturing in 2030, 2036, 2039, 2043, and 2047.

Acceptance of the offer would imply a reduction of principal of 5.4%. The stock of bonds issued under foreign legislation would be reduced by USD3.67 billion (from USD65.62 billion to USD61.95 billion).

The maturity schedule would be significantly modified, due to a combination of interest coupon reduction, grace period and maturity extension. The average maturity would increase from 5.9 to 11 years.

Throughout the bonds’ life, the interest burden would be reduced by USD38.67 billion (from USD59.67 billion to USD20.99 billion). By adding the reduction of principal, a net reduction of US$42.34 billion in total servicing would be obtained. The relief would be concentrated in the first years, accumulating USD47.75 billion in the term 2020-2028.