by Juan Fourcaud | Dec 9, 2020 | Tax Revenue

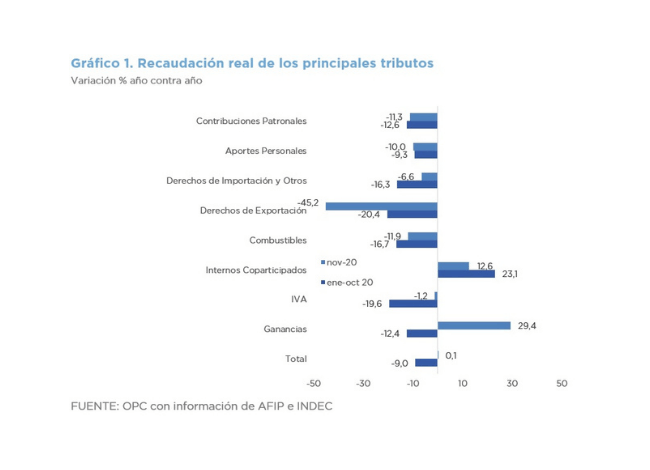

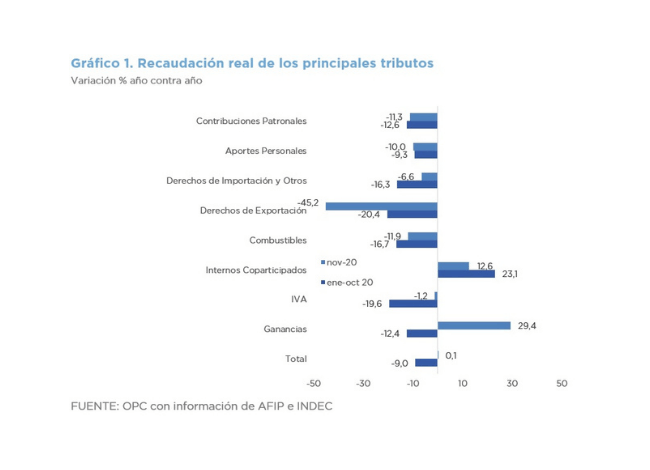

Tax revenue amounted to AR$649 billion in November, a nominal growth of 36.7% YoY, which is explained by the gradual increase in the level of activity, but mainly due to the payment facilities arising from Income Tax and Wealth Tax deadlines that this year took place in August. Revenue from the second income tax collection for transactions subject to PAIS tax also had a positive effect.

The real variation was 0.1% YoY in November, the third registered so far this year, partly due to the modified calendar of tax deadlines, the relaxation of social isolation, and a lower base of comparison with respect to November 2019.

In absolute terms, the taxes that most contributed to the nominal increase in revenue were Income Tax (39%), Value Added Tax (28.6%), Wealth Tax (10.6%) and Social Security resources (12.5%). PAIS Tax decreased its share due to greater restrictions applicable to taxable transactions. For this reason, it contributed only AR$8.5 billion.

by Juan Fourcaud | Nov 6, 2020 | Tax Revenue

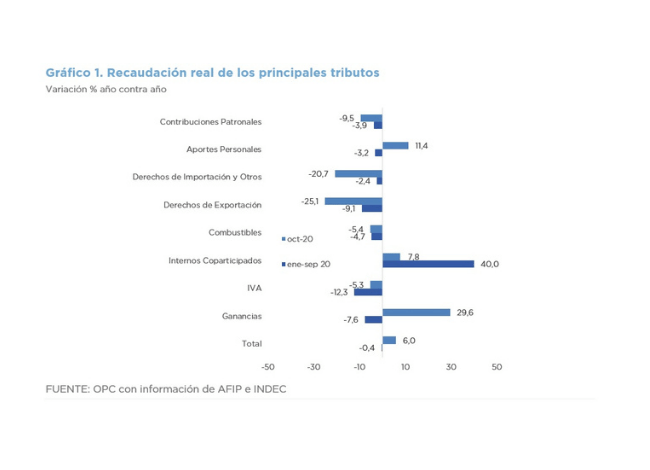

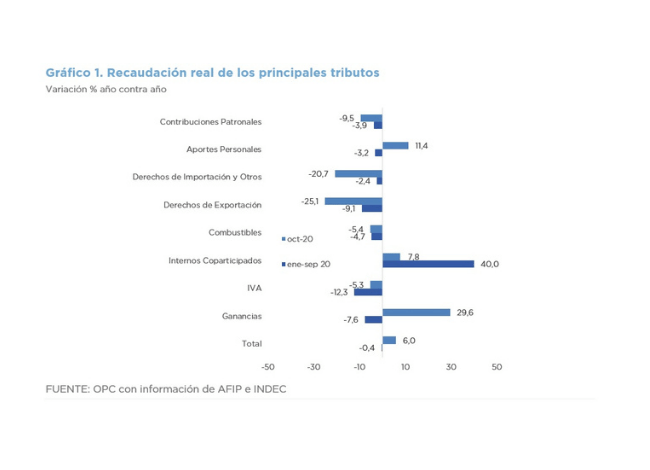

National tax revenue showed a real increase of 6% in October, the second increase recorded so far this year, partly due to adjustments in the tax deadline calendar and the relaxation of social isolation; and the lower comparison base against October 2019.

Total revenues totaled AR$642.1 billion, which implied a nominal growth of 43.9% year on year. This growth in revenue is explained by the gradual increase in the level of activity but mainly by the collection of the second installment of the payment facilities for Income Tax and Wealth Tax, which this year operated in August.

The revenue from the first income tax levied on transactions subject to PAIS tax also had a positive impact.

In absolute terms, the taxes that most contributed to the nominal increase in revenue were Income Tax (31%), Value Added Tax (21.3%), Wealth Tax (17%) and Social Security resources (15.7%). PAIS Tax decreased its share due to greater restrictions applicable to taxable transactions. For this reason, it contributed only AR$8.5 billion.

by Juan Fourcaud | Oct 15, 2020 | Tax Revenue

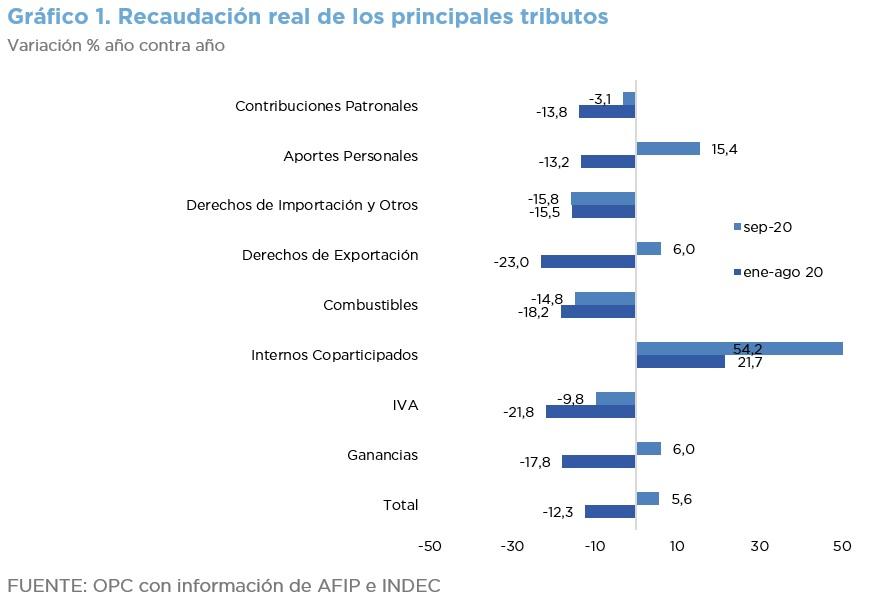

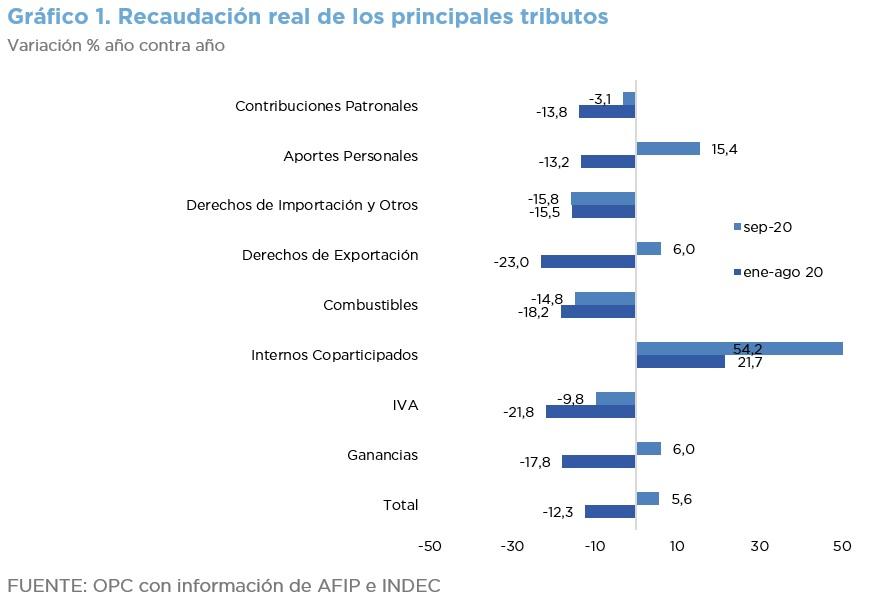

National tax revenue showed a real increase of 5.6% in September, the first increase so far this year, partly due to adjustments in the tax deadline calendar, the relaxation of social isolation, and the lower comparison base against September 2019.

Total revenue amounted to AR$606.5 billion, which implied a nominal growth of 43.7% YoY, and Social Security resources grew for the first time in real terms since April 2018.

This growth in collection is explained by the gradual increase in the level of activity but mainly because last month’s Income Tax and Wealth Tax deadlines, originally scheduled for previous months, became effective.

In absolute terms, the taxes that contributed most to the nominal increase in revenue were Income Tax (20%), Value Added Tax (17.2%), Wealth Tax (11.8%) and PAIS Tax (11.3%).

This last tax obtained a record collection, generating AR$20.8 billion from the purchase of dollars for hoarding purposes.

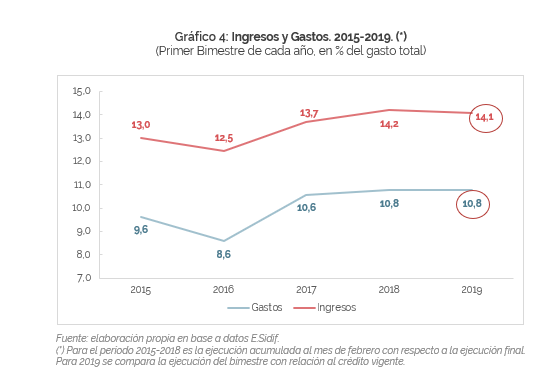

by Nicolas Perez | Mar 13, 2019 | Budget Execution

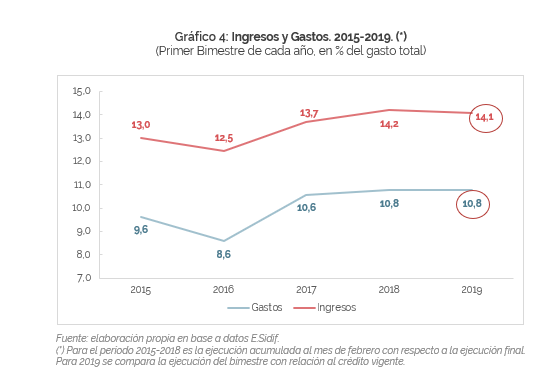

In February, the national government had a primary surplus of AR$14.74 billion, as revenues increased nominally by 43.6%, while expenditures increased by 22.8%, 19 points lower. The financial balance was also positive by AR$1.43 billion, which also implies an improvement in relation to the deficit recorded a year ago.

During the second month of the year, tax resources increased nominally by 39.5% year-on-year (-7.5% YoY real), largely driven by export duties, which increased by 374.7% YoY, because of both amendments to legislation and changes in the exchange rate.

However, in real terms, the total resources of the national government lost against inflation, recording a drop of -7.5%. Although the drop was lower than in the previous two months, Social Security contributions fell -10.9% year-on-year.

Total expenditure amounted to AR$223.97 billion in February, an increase of 20.1% year-on-year. Current expenditures grew 22.8%, while capital expenditures contracted 17.8%.

Property Income was eight times higher than in the same month of the previous year and totaled AR$45.83 billion in the first two months of the year.

The 46% increase in allocations as of March 1 will imply a higher expenditure of AR$16.08 billion, equivalent to 0.1% of GDP in 2019.

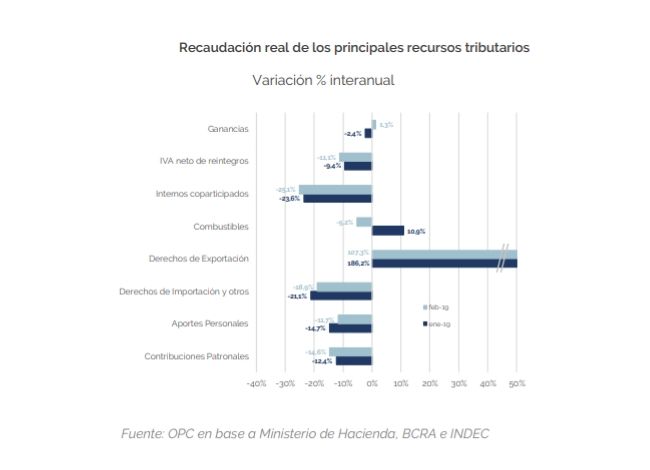

by Nicolas Perez | Mar 12, 2019 | Tax Revenue

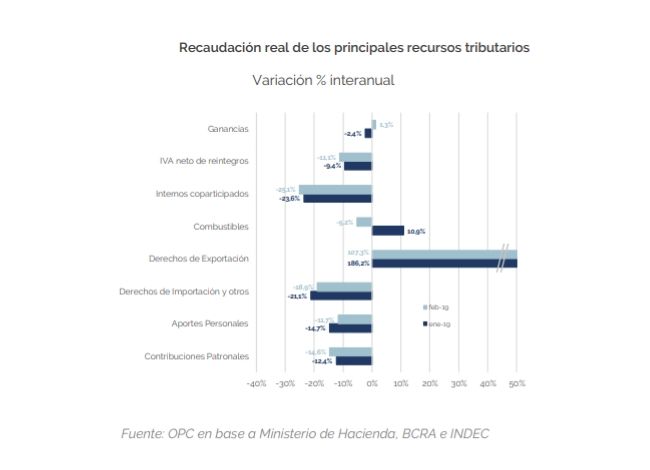

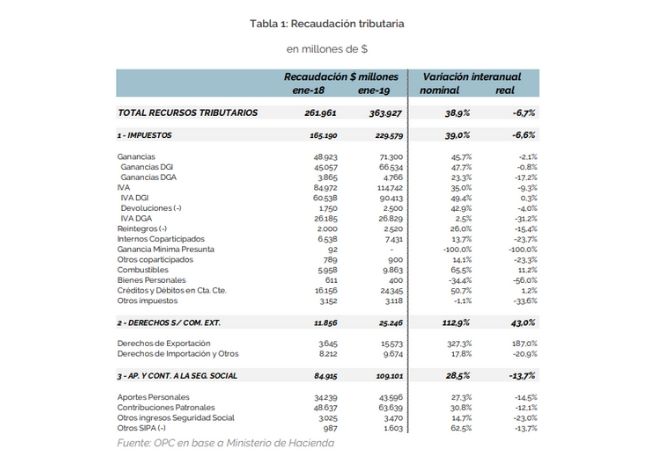

February tax revenue totaled AR$330.89 billion, which implied a nominal year-on-year increase of 40.4% and of 39.6% with respect to the first two months of last year.

In real terms, it declined 6.9% against February 2018, although the fall in inflation-adjusted tax resources was softened as of December.

Income Tax had a real recovery of 1.3%, and together with Wealth Tax and Export Duties, were the ones with the highest year-on-year increase.

Value Added Tax recorded a year-on-year decline of 11.5%, basically due to the fall in imports and the reduction of some taxes on foreign purchases and the lower level of activity.

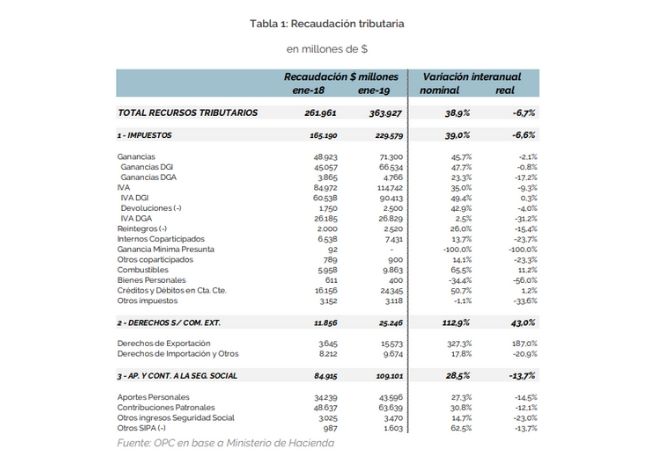

by Nicolas Perez | Feb 7, 2019 | Tax Revenue

This report analyzes tax revenues for the first month of the year and outlines the scenario for the whole of 2019.

National tax revenue in January 2019 totaled AR$363.92 billion, showing a year-on-year increase of 38.9% in nominal terms, which implied a drop of 6.7% in real terms.

As for the projection for the year, after the submission of the 2019 Budget, three regulatory amendments were introduced with a significant impact on the national tax revenue for 2019.

These amendments have an almost neutral net impact on the projected revenue: a reduction of AR$3.83 billion, which is equivalent to 0.1% of the total projected amount.