by Juan Fourcaud | Dec 3, 2020 | Tax Policy and Fiscal Federalism

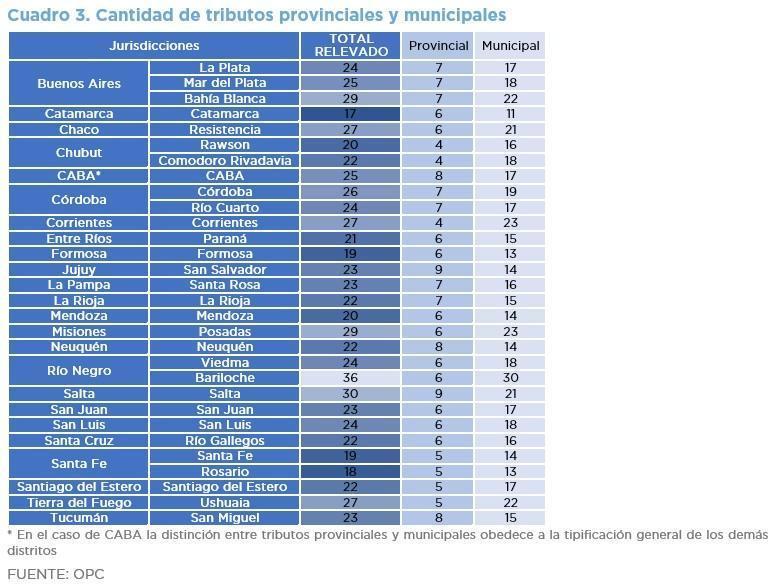

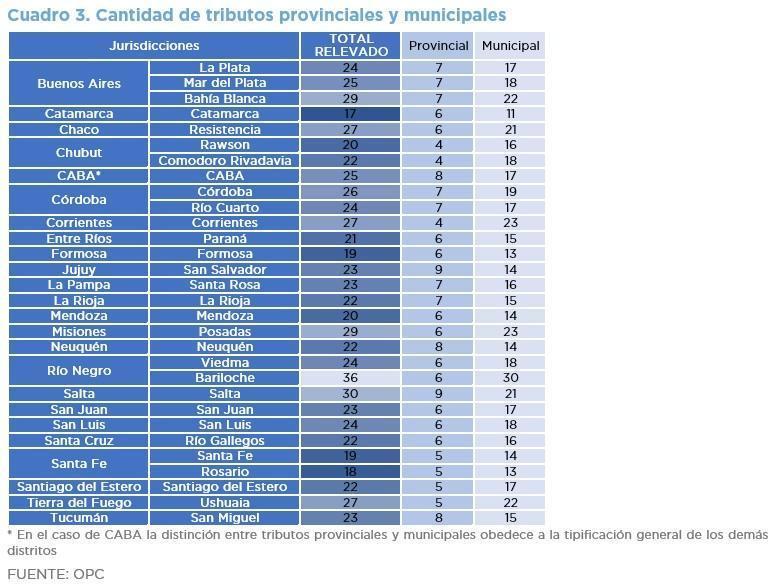

The purpose of this report is to evaluate the consolidated tax burden on the meatpacking, metal-mechanic, supermarket, transportation, and hotel sectors in thirty locations in the country.

Under certain assumptions and without including some taxes such as Fuel Taxes or Export Duties, the average tax burden is equivalent to 12% of the companies’ turnover.

- There is an important tax burden dispersion by activity and location. From a minimum of 7.5% of the total turnover for a meat packing activity carried out by an SME in the city of San Luis, to a maximum of 17.3% for a large hotel in Bariloche.

- There are also differences in the tax burden depending on whether it is a small or large company and between firms in the same industry: from 25% in hotels to 50% in the meat packing sector.

- There is double or triple taxation due to the overlapping of taxes, which makes it difficult to know the real cost that the productive sectors face.

- This study refers to a tax burden baseline and is limited by the lack of information requested from chambers of commerce and municipalities, but which was not provided.

by Nicolas Perez | Oct 14, 2020 | Budget Law

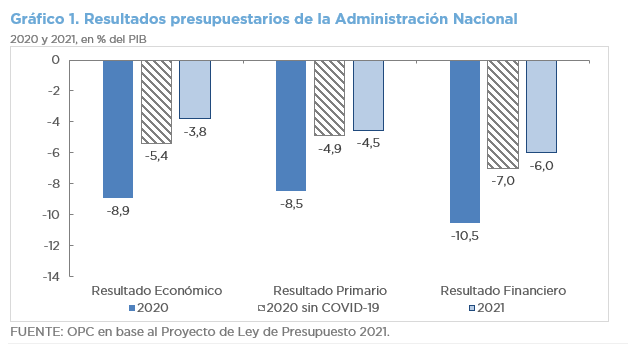

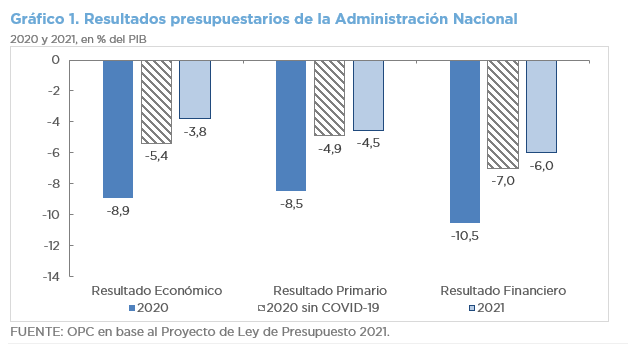

The National Budget Bill for 2021 foresees for next year a decrease in deficits due to the partial

recovery of the economy, with an increase in public investments and a reduction in the payment

of interest on the debt.

- According to the macroeconomic estimates of the Bill, the Gross Domestic Product

(GDP) will suffer a real fall of 12.1% this year, the nominal exchange rate will be AR$81.4

per dollar at the closing of the fiscal year, and the YoY inflation rate will be 32%. Next

year’s GDP is expected to rise 5.5% in real terms, with a nominal exchange rate of

AR$102.4 per dollar in December, and an inflation rate of 29% YoY.

- Resources will increase by 9.7% YoY in real terms and total expenditure will fall by

10.4% YoY.

- This dynamic between revenue and spending will lead to an improvement in the primary

balance in 2021, which would go from a deficit of 8.5% of GDP in 2020 to a deficit of

4.5% in 2021. The same applies to the financial balance, which would vary from a deficit

of 10.5% of GDP in 2020 to a deficit of 6.0% in 2021.

- Capital expenditures will have the largest real increase and debt interest the sharpest

decline.

- Gross financing needs in the next fiscal year will be AR$6.4 trillion (17.2% of GDP). The

Central Bank will contribute AR$800 billion to the Treasury, 62.2% less than this year.

- Exports are expected to recover from a 14.2% YoY decline this year to a 10.4% YoY

increase next year.

- The Budget Bill does not provide neither financial allocations for Emergency Family

Income – IFE (Ingreso Familiar de Emergencia) nor for assistance for the payment of

private salaries (ATP), but it does provide a 24.1% increase in resources for vaccines

(AR$45.4 billion), including the purchase of doses against COVID-19 (AR$13.69 billion).

by Nicolas Perez | Oct 3, 2019 | Tax Policy and Fiscal Federalism

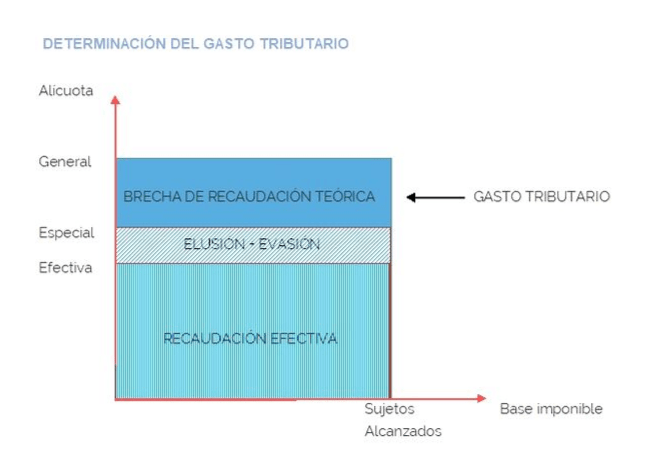

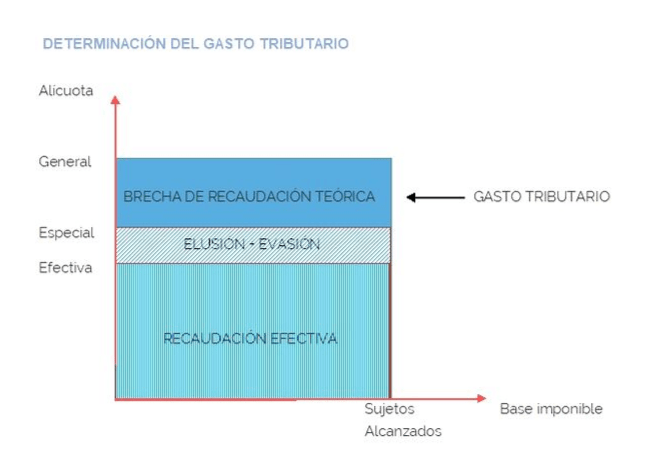

This paper introduces a conceptual discussion aimed at developing a practical methodology for the evaluation of differential tax treatment policies. A two-stage process is proposed; one technical and one political. The first of these stages is the object of study of this paper.

For the development of this evaluation stage, the existing definitions on the concept of tax expenditure, the economic and practical foundations of the use of differential tax treatments as an economic policy tool to the detriment of other instruments are studied, and different methodologies for calculating tax expenditure of an economic measure are described.

Among the mistakes to avoid, the OPC warns against considering that financing public policy through tax expenditure measures is less expensive than financing it through direct expenditure.

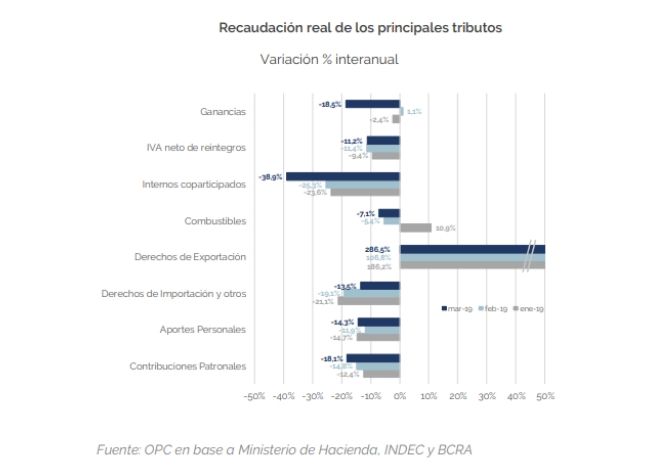

by Nicolas Perez | Apr 11, 2019 | Tax Revenue

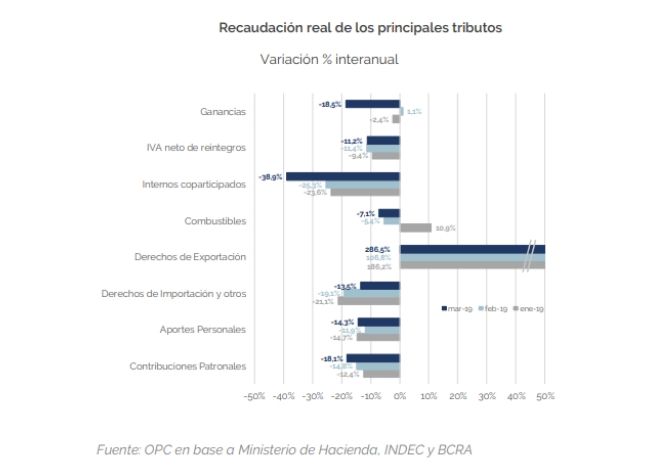

In the third month of the year, national public sector revenues grew by 37.3% in nominal terms compared to the same period of the previous year but fell by 10.5% in real terms. Similar behavior was observed in the first quarter of the year.

This performance also entails a decline compared to previous months and reaffirms that government revenues are strongly linked to the level of economic activity, as shown by the VAT DGI, which fell 7.3%.

Income Tax contracted by 18.5%, partly due to the deferral of some maturities. The significant growth in Export Duties allowed mitigating the fall in the most important taxes of the national tax structure (VAT, Income Tax and Social Security Contributions).