by Nicolas Perez | Sep 9, 2020 | Tax Revenue

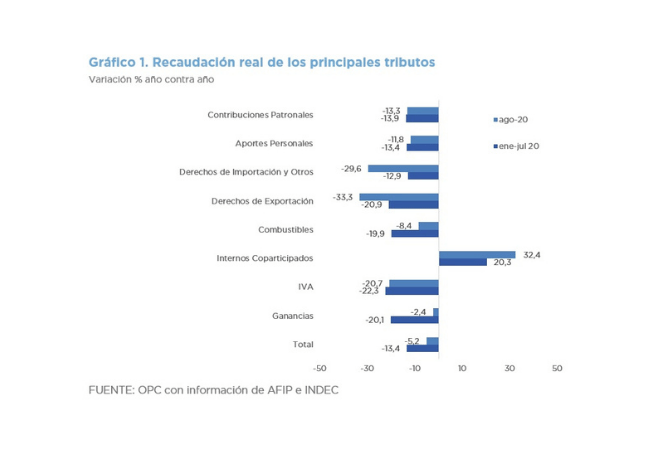

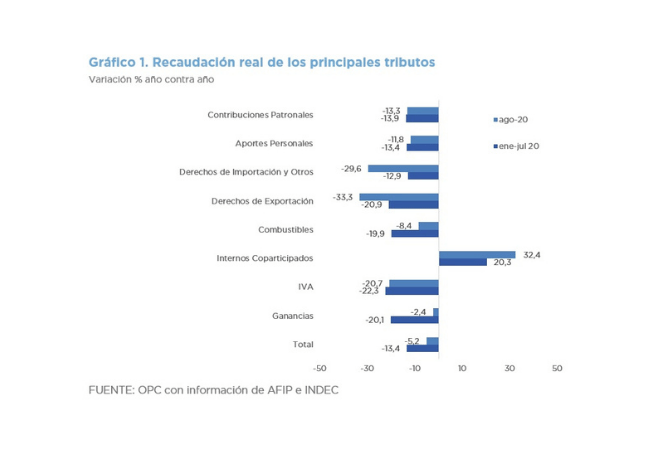

National tax revenue reached AR$612.14 billion in August, which implied a nominal growth of 33.5% year on year (YoY), but a contraction in real terms of 5.2%. This fall was the most moderate since February.

The slowdown in the decline in tax revenue can be explained by the gradual increase in the level of activity due to the partial relaxation of the restrictions imposed in the context of the COVID-19 pandemic. In addition, balances of Income Tax for Individuals and Wealth Tax,

whose original maturity in June was extended to August, were collected. The first advance payment for the year 2020 of the Income Tax for Individuals and Wealth Tax was also collected. PAIS tax reached a collection record, mainly driven by the purchase of foreign currency for hoarding purposes.

The uneven evolution of taxes throughout the year has generated a change in the composition of tax revenue, with a lower weight of the three most important taxes (VAT, Income Tax and Social Security) and an advance of taxes such as Wealth Tax, Co-participated Internal Revenue and PAIS Tax.

Likewise, it is estimated that the resources allocated to the National Administration fell in the first 8 months of the year by 13.6% YoY in real terms, those of Other Non-Financial Public Sector Entities by 16.8% YoY and those of the provinces by 11.5% YoY.

by Nicolas Perez | Aug 10, 2020 | Tax Revenue

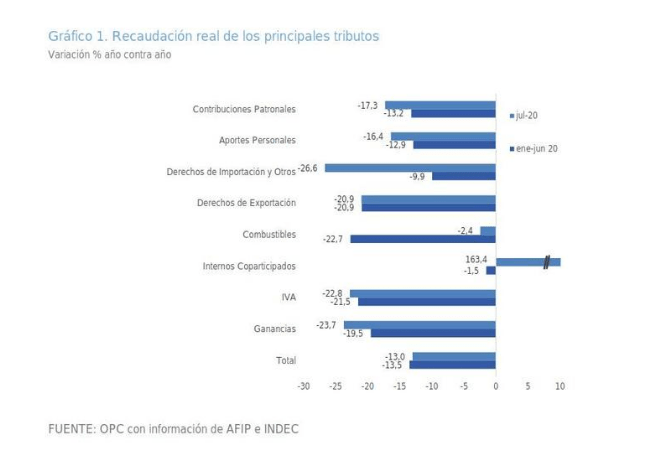

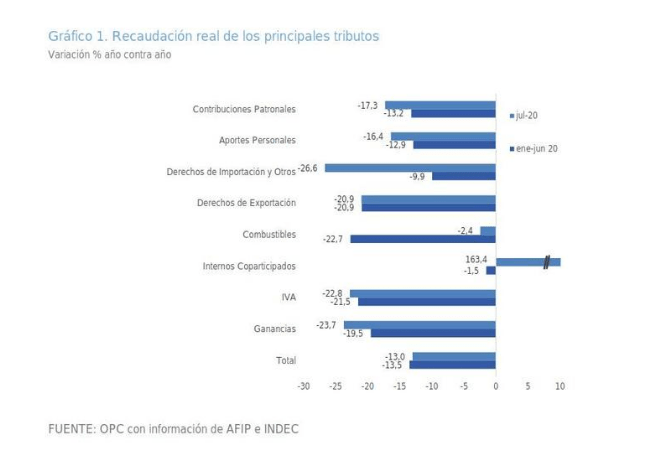

Total tax revenue amounted to AR$559.09 billion in July, which implied a nominal growth of 24% YoY, however, it contracted for the seventh consecutive month when adjusted for inflation, showing a decrease of 13% YoY.

In the first seven months of the year, total collection amounted to AR$3.44 trillion, 26.2% higher than in the same period of last year.

The main factor behind the drop in inflation-adjusted tax revenues was the economic impact of COVID-19. The national tax revenue is strongly linked to the level of activity, so the recessionary context, deepened by the pandemic, is the main factor explaining why tax revenue has decreased in 22 of the last 25 months in real terms.

by Nicolas Perez | Jun 5, 2020 | Tax Revenue

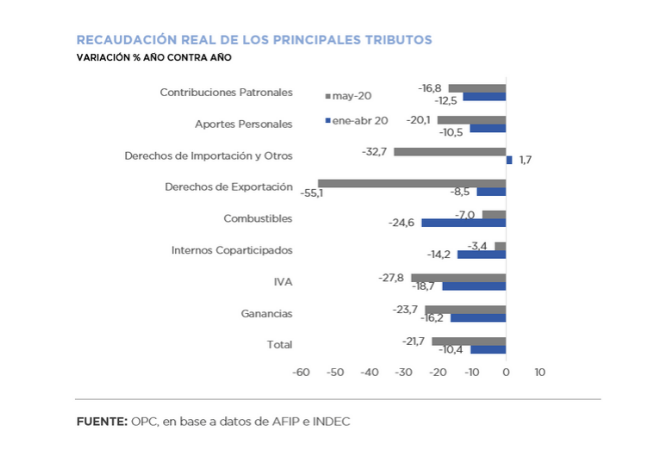

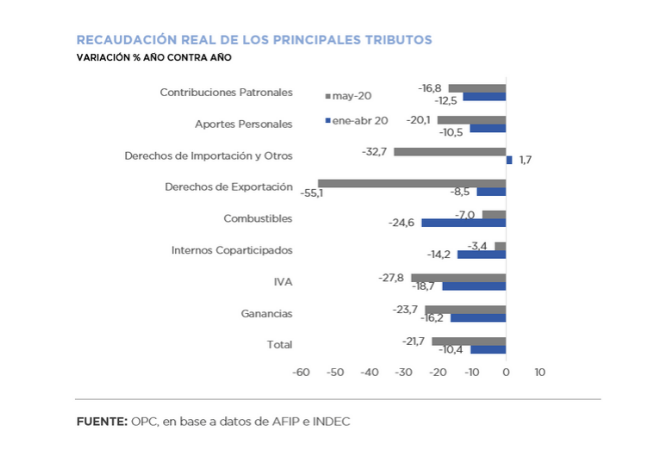

- National tax revenue reached AR$499.53 billion in May, which implied a nominal growth of 12.4% year on year (YoY), but a drop of 21.7% YoY, when adjusted for inflation.

- All taxes shrank in real terms, but the sharpest declines were in taxes related to foreign trade and VAT, with decreases of 49.1% and 27.8%, respectively. Both contractions are the sharpest since the beginning of 2002.

- The decline in tax revenue during May was explained by the adverse macroeconomic context caused by the COVID-19 pandemic and by the fiscal relief measures implemented by the national government.

- There was a record collection of the PAIS Tax (AR$11.9 billion) due to higher purchases of foreign currency.

- Resources for the first five months of the year were 16.3% below OPC’s November estimate, basically because of changes in the economic and regulatory situation.

- Tax relief measures in the framework of the pandemic in the first five months reduced the estimated revenue by AR$75.93 billion.

by Nicolas Perez | May 13, 2020 | Budget Execution

As a result of the increase in primary expenditures to mitigate the effects of the crisis caused by the pandemic and the real drop in tax resources, the primary balance (net of Central Bank’s profits) went from a surplus of AR$10.05 billion in April 2019 to a deficit of AR$263.75 billion in April 2020.

This situation is drastically mitigated by the transfer of Central Bank (BCRA) profits for AR$230 billion, which managed to offset the fall in tax revenues and Social Security resources produced by the economic paralysis caused by the Mandatory Preventive Social Isolation (ASPO). Considering the inflow of profits, the primary deficit is reduced to AR$33.75 billion.

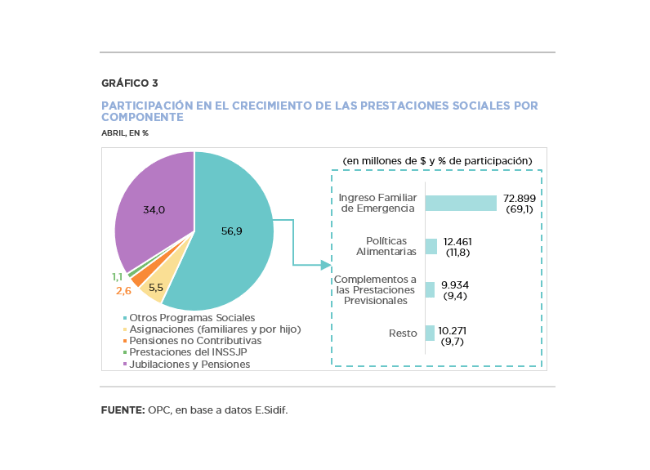

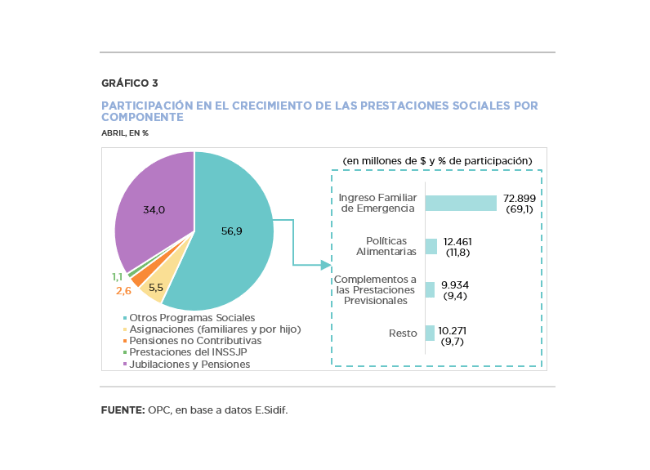

The distinctive feature of April’s implementation was the significant increase in primary expenditures, 54.1% year on year (YoY) in real terms, because of the measures adopted by the national government within the framework of the health emergency, among which the Emergency Family Income (IFE) stands out. However, since interest on debt fell 63.1% YoY, the increase in total expenditure was less pronounced, at 26.9% YoY.

Within tax revenues (AR$171.42 billion), VAT and income tax fell by 16.1% YoY and 32.9% YoY, respectively, not only due to the economic retraction caused by the quarantine but also to regulatory matters, such as the VAT refund for food purchases and the reduction of employer contributions.

During the first four months of the year, the initial appropriation increased by AR$203.11 billion, 91.0% of the increase being concentrated in social benefits (AR$87.82 billion), in transfers to the provinces (AR$73.65 billion) and in other current expenditures (AR$32.52 billion).

by Nicolas Perez | May 11, 2020 | Tax Revenue

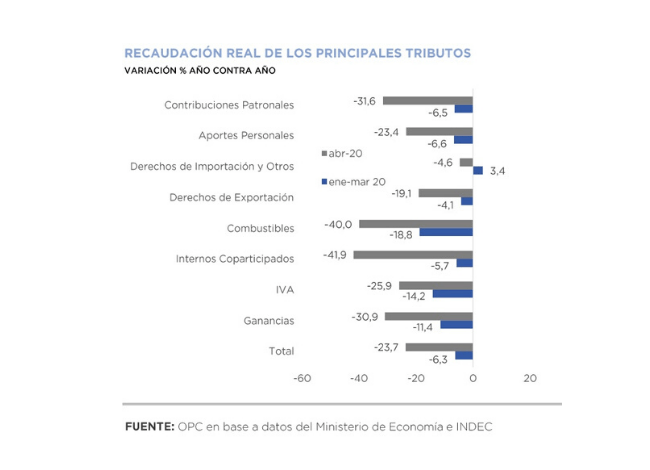

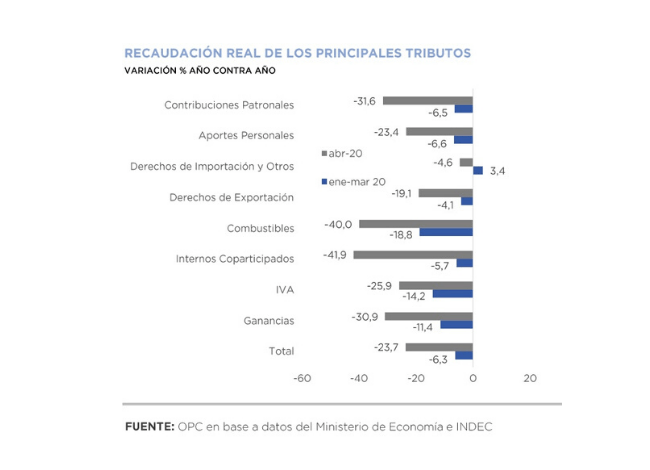

As anticipated, inflation-adjusted tax revenue fell 23.7% year on year (YoY) in April. Beyond some tax measures adopted by the National Executive Power to assist the productive sector in coping with the economic impact of the Mandatory Preventive Social Isolation (ASPO), the fall is explained by the slowdown in economic activity.

Revenues from national taxes totaled AR$398.66 billion, which implied a growth of 11.6% YoY.

The most important taxes had a significant drop in real terms. Income tax collection fell by 30.9% YoY, VAT by 25.9% YoY and Social Security resources contracted by 24.7% YoY. In addition, foreign trade revenues fell 15.2% YoY.

Although the pandemic and the ASPO were the main factors behind the poor collection performance in April, other factors also contributed. From the regulatory point of view, VAT refunds for the purchase of food, the reduction of Employer Contributions for the health sector, the deferral of the SIPA component of Employer Contributions for two months and the freezing of part of the Fuel Taxes in effect during March contributed to the lower inflow of resources. From the macroeconomic point of view, the deterioration of the labor market and the contraction of international trade contributed to the sharp drop in revenues.

May revenues are expected to continue to fall in real terms. Although some economic activities were exempted from the quarantine during April, the impact of the measure on the level of activity remained. On the other hand, measures such as the reduction or deferral of Employer Contributions, the reduction in the rate of the Tax on Debits and Credits to Current Accounts and the VAT refund for dairy products will have an impact on May revenues.

by Juan Fourcaud | Mar 4, 2020 | Tax Policy and Fiscal Federalism

A review of the country’s fiscal federalism reveals the complexity of its parameters and the difficulties to establish a definitive consensus-based regime between the national government and the provinces, a constitutional mandate that has been pending for 23 years.

The federal tax co-participation regime was established by Law No.12,139 of 1935. The regulatory dispersion continued until the integration set forth in Law No.20,221 in force until 1984, recurrently infringed.

Among the decisions that infringed that law was the unilateral transfer of education and health functions to the provinces, without the respective financial allocations. This was the origin of the National Treasury contributions, an arbitrary mechanism to remedy problems as those caused by that discretionality. In 1980 pre-co-participations were introduced when it was decided that a portion of the VAT would be use for Social Security.

At the beginning of 1988, Law No.23,548 established a temporary distribution regime still in force. The secondary distribution scheme is not based on objective criteria and the original primary distribution, which reserved 54% to the provinces, was permanently altered.

The 1994 constitutional reform included co-participation in the National Constitution and provided for the enactment of a framework law before the end of 1996.

This mandate has not yet been accomplished and the most concrete legal approach was the series of fiscal pacts signed since 1992, whose interpretation and implementation led to legal disputes: federalism of concertation in our country lacks legal certainty.