by Nicolas Perez | Sep 15, 2020 | Cost Estimates

The purpose of Bill S-1566/20 is to guarantee Internet access to children and adolescents who

are beneficiaries of the AUH (Universal Child Allowance) through the granting of 5GB (mobile

data) per month by the companies providing mobile telephone service for cell phone lines

whose holder is a beneficiary of the AUH.

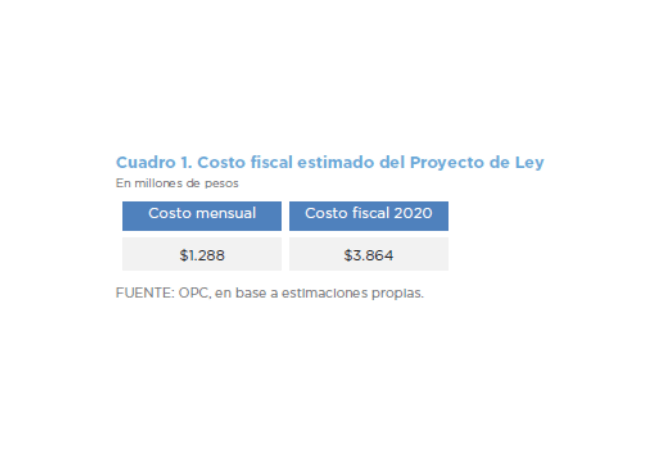

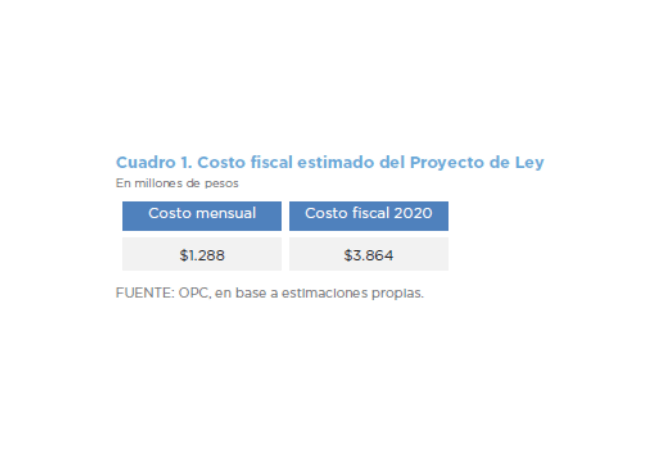

It is estimated that the Bill will have a fiscal cost of AR$1.28 billion per month.

Assuming that the benefit will be effective as from October of the current year and will remain in

force until December 31 (in accordance with the provisions of the Bill), the total cost of the

measure would amount to AR$3.86 billion in 2020.

by Nicolas Perez | Sep 11, 2020 | Cost Estimates

The national scope of the Bill being promoted to establish a Single Electronic Medical Record System (EMR) involves cultural, organizational, technical, and professional challenges to be overcome in the eHealth path in which our country, like most of the countries of the region and the world, finds itself.

The design, development and implementation strategy adopted to carry out this Single EMR System will determine the requirements in terms of human resources, infrastructure, and technological equipment, as well as those related to the management of any necessary

changes within the health institutions, and the population, in their capacity as holders of their Electronic Medical Record.

Once these aspects have been addressed, it will be possible to evaluate the fiscal impact of the Bill being promoted, considering that the experiences in other countries and in some institutions in our country show that guaranteeing sustainability and continuity of the initiative over time represents a great challenge.

by Nicolas Perez | Jul 21, 2020 | Public Debt

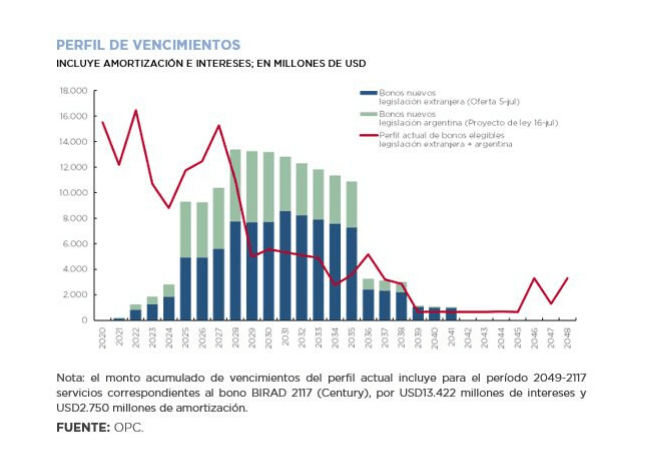

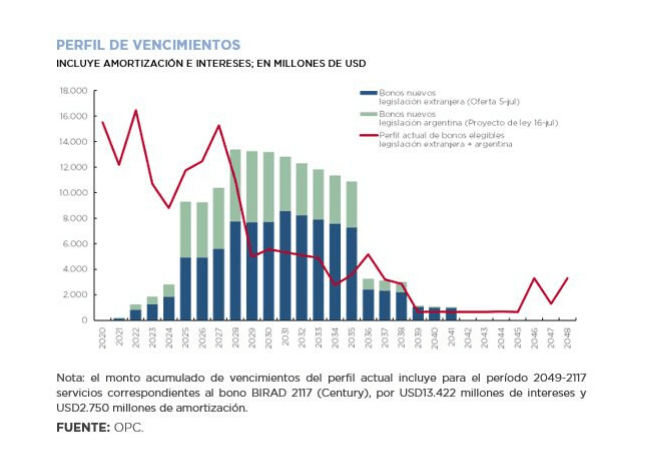

On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.

by Nicolas Perez | Jul 14, 2020 | Public Debt Operations

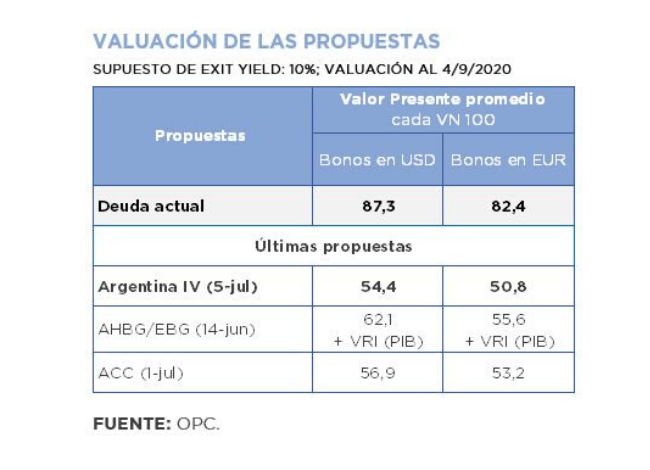

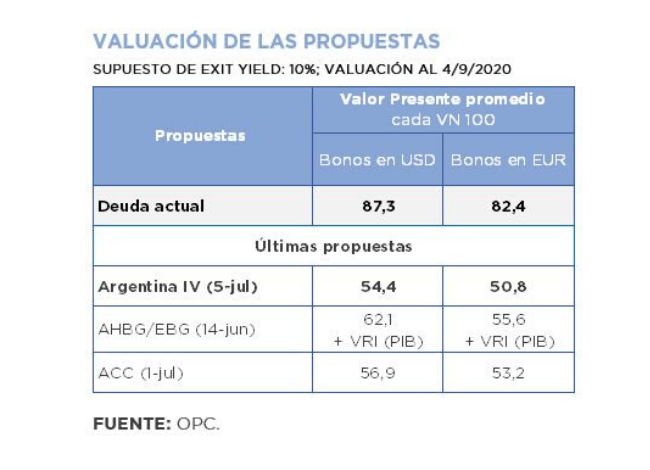

An amendment to the proposal to restructure the bonds issued under foreign legislation was formally submitted on July 7. With respect to the original offer submitted on April 22, principal reductions are lowered, interest accruals are brought forward, coupon rates are increased, the delivery of a bonus in recognition of accrued interest on eligible bonds is added, and the average life of the new bonds is reduced.

In addition, the new bonds maturing in 2038 and 2041 are issued under Indenture 2005, and a minimum participation threshold is introduced as a condition for the effectiveness of the swap. The proposal has an stimated average value of USD54.4 for the dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest creditor proposals are between USD57 and USD62.

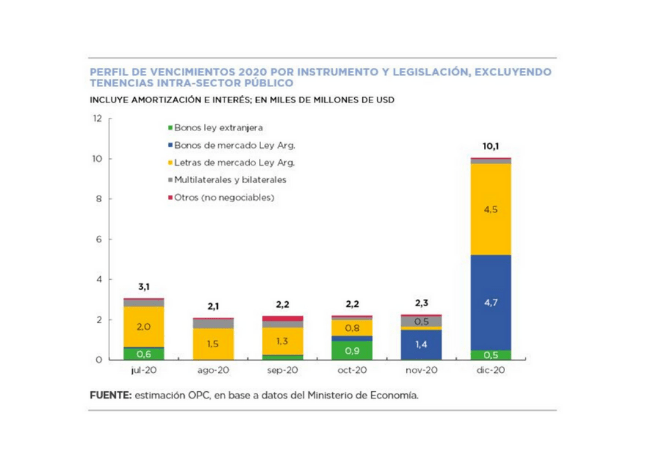

In June, there were placements of securities and loan disbursements for the equivalent of USD5.1 billion, of which AR$221.95 billion (USD3.2 billion) were obtained through marketable securities auctions.

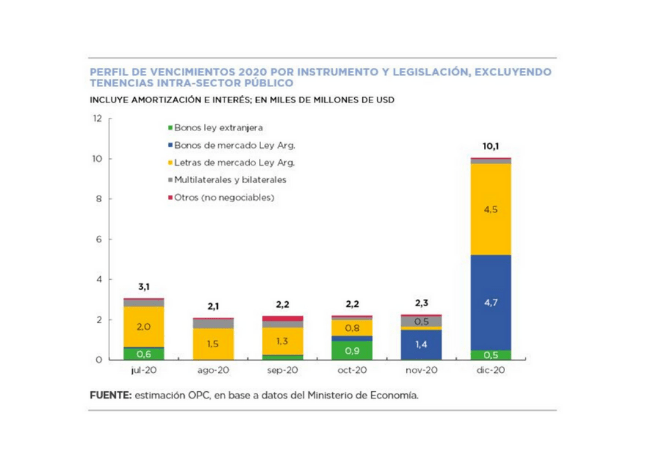

During the month, the payment of interest coupons on the BIRAD 2117 (6/28) and DISCOUNT bonds in dollars under foreign legislation (6/30), for a total of USD328 million, was defaulted.

Debt service payments for the equivalent of US$3.86 billion (US$3.07 billion excluding holdings within the public sector) are expected for July, amounting to US$40.2 billion by the end of the year.

by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.

by Juan Fourcaud | Jun 19, 2020 | Cost Estimates

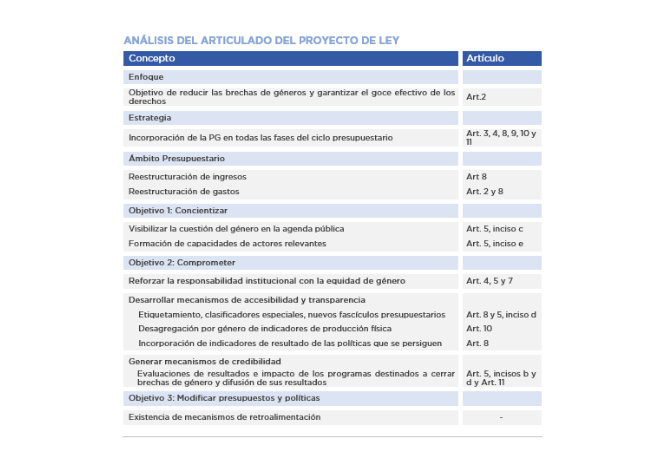

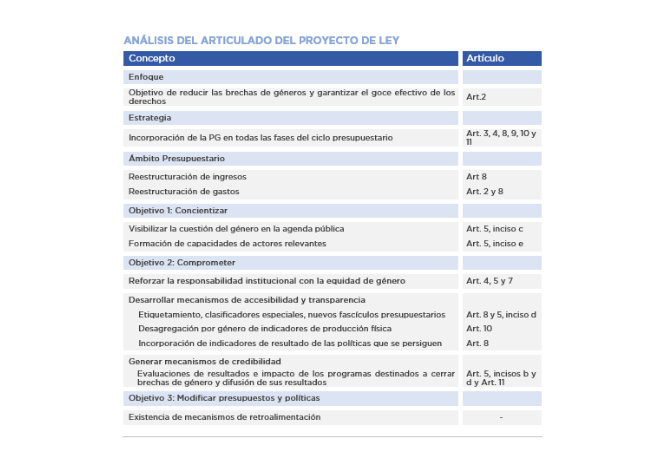

Gender Responsive Budgeting (GRB) provides a vehicle for determining the effect that government policies have on the achievement of gender equality and thus provides valuable information to policymakers.

To that effect, Bill S-0268/2020 provides for the implementation of gender perspective in public budgets. To review the Bill a two-level approach is made: on the one hand, the main conceptual and methodological aspects to be considered when implementing gender perspective in public budgets, and on the other hand, technical suggestions for amendments to Law No. 24,156 on Financial Administration and Control Systems of the National Public Sector.