On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

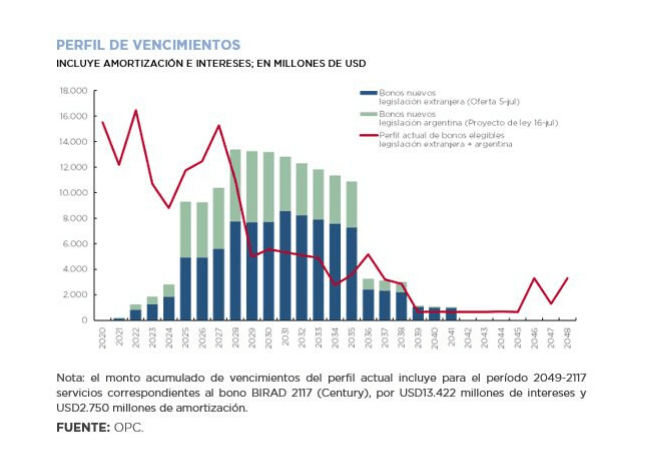

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.