by Nicolas Perez | Aug 12, 2020 | Public Debt Operations

Placements of securities and loan disbursements were recorded for the equivalent of USD9.8 billion, of which AR$528.15 billion (USD7.7 billion) consisted of auctions of marketable securities in pesos.

In addition, the equivalent of USD7.37 billion of principal payment was made, mainly due to a voluntary swap of securities in dollars for new instruments in pesos carried out on July 17.

During the month, interest coupons were not paid on several foreign-legislation BIRAD bonds totaling USD584 million. As of July 31, outstanding interest coupons on bonds issued under foreign legislation totaling USD1.67 billion remain unpaid, which are expected to be recognized as part of the restructuring process of such securities currently underway.

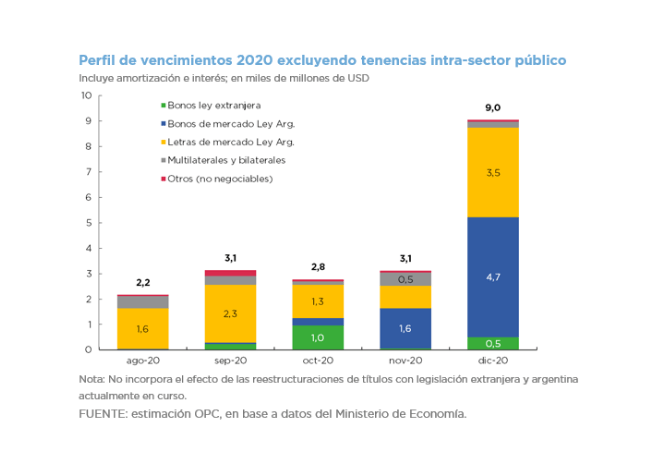

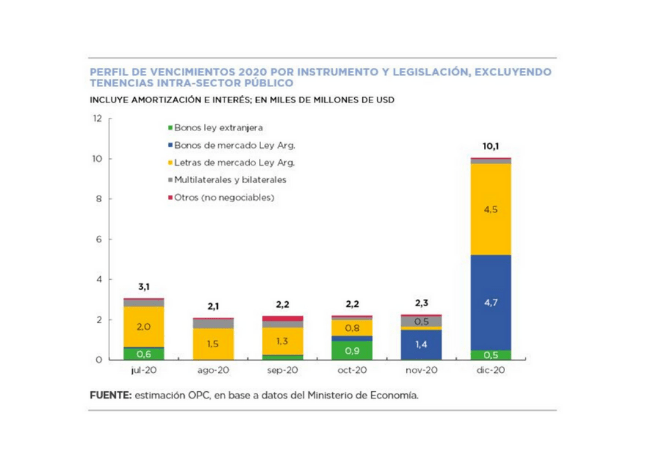

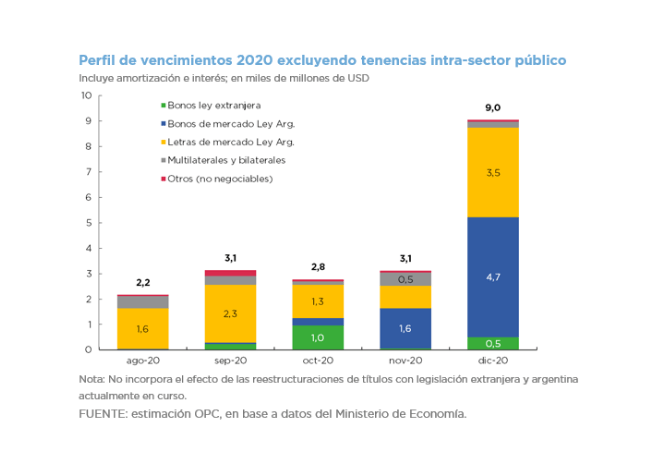

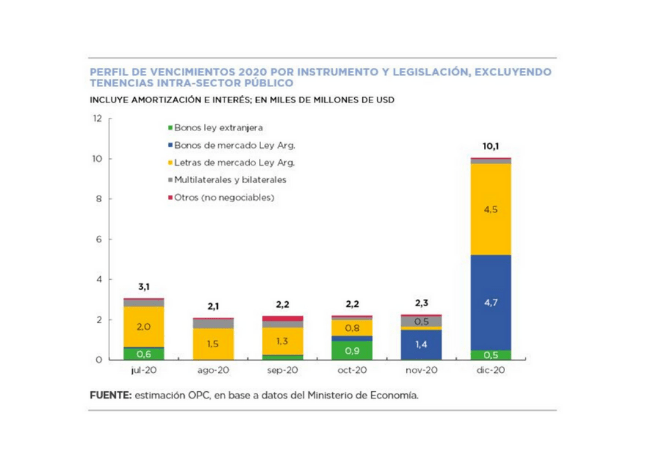

We estimate debt service maturities for the equivalent of USD3.13 billion for August, amounting to USD35.53 billion by the end of the year (approximately USD20.29 billion excluding holdings within the public sector).

On August 4, the government announced an agreement with the main groups of creditors for the restructuring of bonds issued under foreign legislation. The deadline for creditors to accept the revised proposal was extended until August 24, while the settlement date of the transaction is September 4. At the same time, Law 27,556 on the restructuring of government bonds in dollars issued under Argentine legislation with the same conditions as the bonds under foreign legislation was enacted.

by Nicolas Perez | Aug 6, 2020 | Public Debt

On August 4, the government announced an agreement with the main groups of creditors to restructure bonds under foreign legislation. Based on the agreement, the terms of the last offer made by Argentina on July 6 are modified.

The modifications include the advancement of some maturities of the new bonds to be delivered, new conditions for the swap for bonds in different currencies and the commitment to introduce some adjustments to the collective action clauses of the new securities that are supported by the international community.

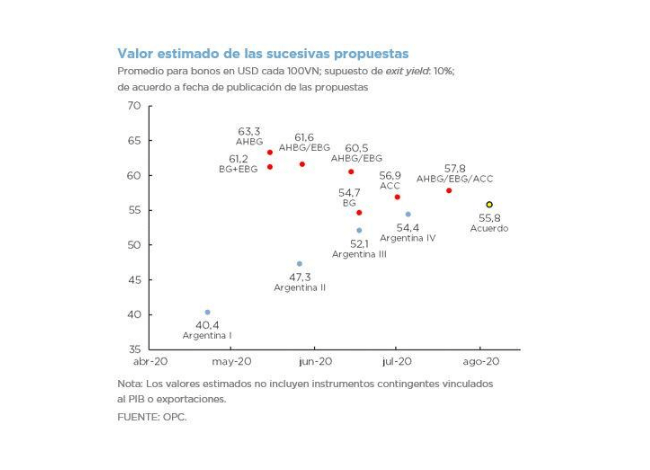

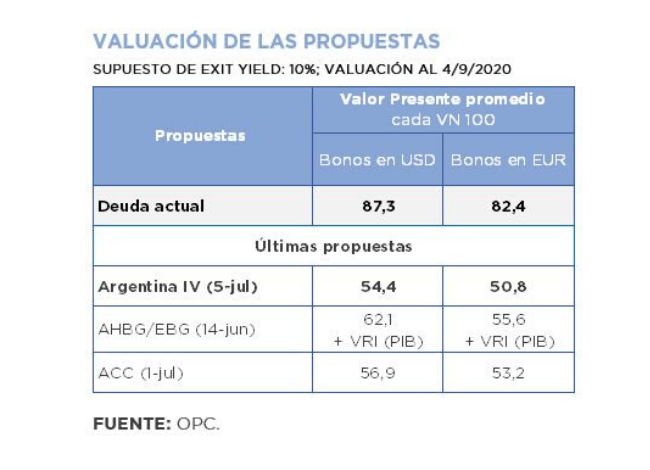

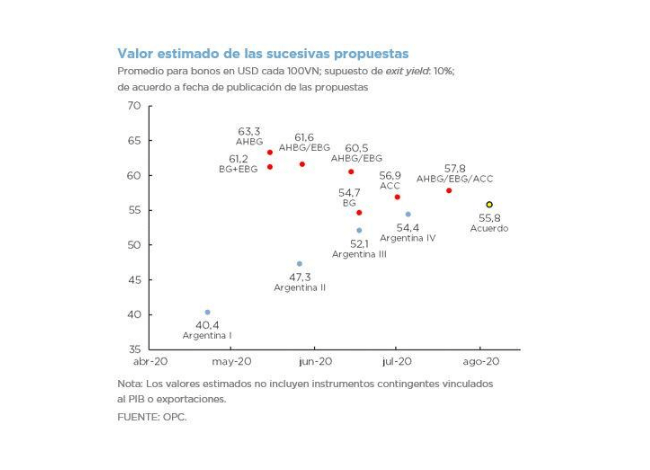

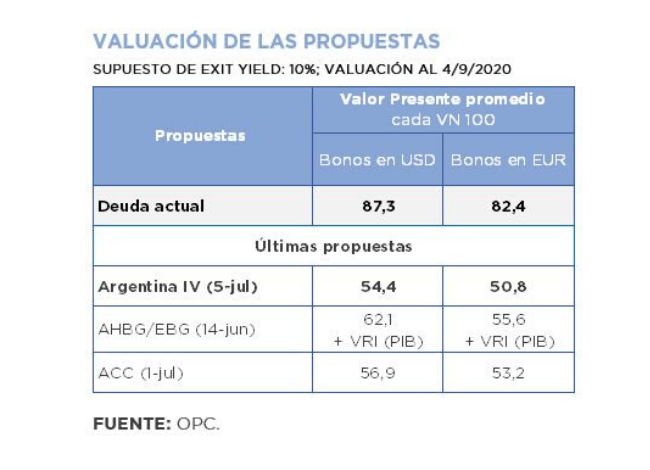

Assuming an exit yield of 10%, the settlement has an estimated average value of USD55.8 per USD100 of eligible face value. The agreement involves an improvement of USD1.4 over the previous official proposal.

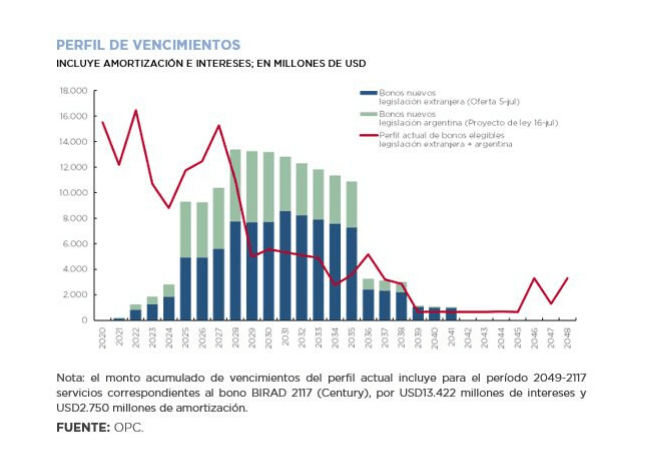

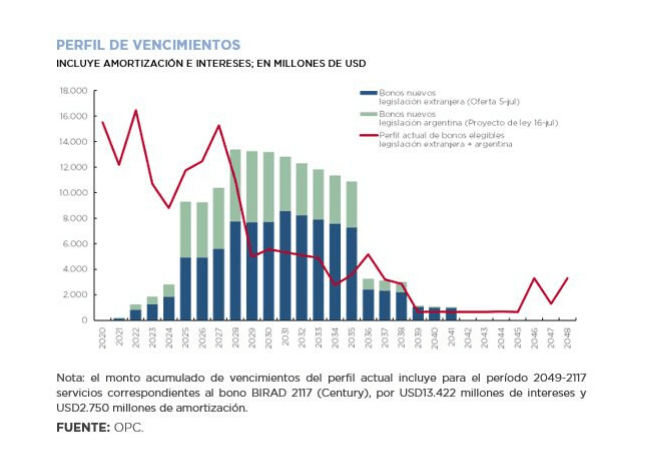

Under the assumption that the full eligible amount is swapped, the new bonds would generate amortization and interest payments of approximately USD4.6 billion in the term 2020-2024 and USD42.7 billion in the term 2020-2030.

The creditor groups that negotiated the agreement, together with other bondholders that would provide support, claimed to hold 60% of the eligible bonds issued under the 2005 indenture and 51% of the 2016 indenture bonds.

According to the current schedule, the creditors have a deadline to accept the proposal until August 24 and, in case of acceptance, the swap transaction would be settled on September 4.

by Nicolas Perez | Jul 21, 2020 | Public Debt

On Thursday, July 16, the Executive Branch sent to Congress a Bill for the restructuring of securities in dollars issued under Argentine legislation. The swap offer covers a set of securities with a total outstanding amount of US$41.7 billion (of which 35% is held by private bondholders). Eligible bonds represent 12.9% of total debt and 12.5% of GDP.

In general terms, the proposed transaction has similar terms to the last offer to restructure bonds under foreign legislation that was submitted at the beginning of the month. As a novelty, for some eligible securities, the alternative of swapping for inflation-adjustable bonds (CER) is included. For securities in dollars payable in pesos (USD linked), the only alternative is the swap for CER bonds.

Under the assumption that all eligible securities are swapped, the new bonds would generate amortization and accrued interest of approximately USD2.2 billion for the term 2020-2024 and USD32.5 billion for 2020-030. Compared to the current maturity profile, this implies a reduction in debt service of approximately US$30.4 billion and US$19.6 billion, respectively.

by Nicolas Perez | Jul 14, 2020 | Public Debt Operations

An amendment to the proposal to restructure the bonds issued under foreign legislation was formally submitted on July 7. With respect to the original offer submitted on April 22, principal reductions are lowered, interest accruals are brought forward, coupon rates are increased, the delivery of a bonus in recognition of accrued interest on eligible bonds is added, and the average life of the new bonds is reduced.

In addition, the new bonds maturing in 2038 and 2041 are issued under Indenture 2005, and a minimum participation threshold is introduced as a condition for the effectiveness of the swap. The proposal has an stimated average value of USD54.4 for the dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest creditor proposals are between USD57 and USD62.

In June, there were placements of securities and loan disbursements for the equivalent of USD5.1 billion, of which AR$221.95 billion (USD3.2 billion) were obtained through marketable securities auctions.

During the month, the payment of interest coupons on the BIRAD 2117 (6/28) and DISCOUNT bonds in dollars under foreign legislation (6/30), for a total of USD328 million, was defaulted.

Debt service payments for the equivalent of US$3.86 billion (US$3.07 billion excluding holdings within the public sector) are expected for July, amounting to US$40.2 billion by the end of the year.

by Nicolas Perez | Jul 7, 2020 | Public Debt

Argentine government announced an improvement in the terms and conditions of its proposal to restructure bonds issued under foreign legislation, whose acceptance deadline is August 4.

The new proposal has an estimated average value of USD54.4 for dollar bonds, about USD14 higher than the original offer, assuming an exit yield of 10%. The latest proposals from creditors are between USD57 and USD62.

Compared to the original offer submitted on April 22, reductions on principal are lowered, interest accrual is brought forward, coupon rates are increased, and the average life is reduced. The new proposal involves amortization and interest payments of approximately USD4 billion in the term 2020-2024 and USD42.4 billion in 2020-2030.

In addition, the original indentures of the eligible securities are maintained, and accrued interest is recognized through the delivery of a bond maturing in 2030. Despite the improvement of the Argentine offer, there are still differences in relation to the financial and legal terms with respect to the position of the main bondholders groups, particularly the last joint proposal of the AHBG and EBG groups. For their part, the investment funds Gramercy and Fintech have publicly announced their support to the new proposal.