by Juan Fourcaud | Nov 12, 2020 | Public Debt Operations

Placements of securities were made, and loan disbursements received for the equivalent of USD6.76 billion in October, of which AR$148.24 billion (USD2.09 billion) were for auctions for marketable securities in pesos. For the first time this year, dollar-linked bonds were auctioned, resulting in the placement of new instruments for USD3.43 billion.

On the other hand, the equivalent of USD4.87 billion of principal was canceled, mainly due to maturities of Treasury bills in pesos. There was a net cancellation of BCRA (Central Bank of the Argentine Republic) Temporary Advances for AR$125.78 billion (US$1.6 billion), of which AR$100 billion were a pre-cancellation made in the last week of the month.

Debt service maturities for November and December are estimated at the equivalent of US$13.2 billion, which is reduced to approximately US$7.7 billion if holdings within public sector are excluded.

Following a request from Argentina, talks with the IMF formally began to negotiate a new program to refinance the debt with the IMF for approximately US$45 billion.

by Nicolas Perez | Oct 14, 2020 | Public Debt Operations

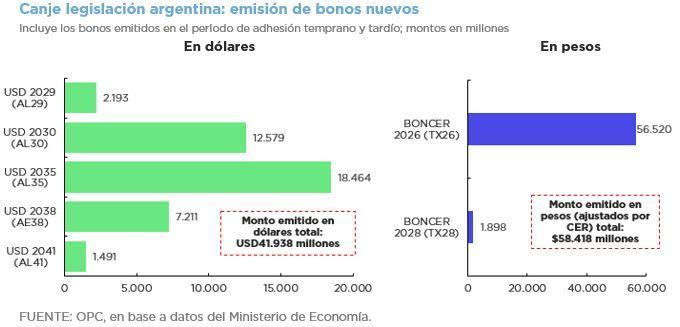

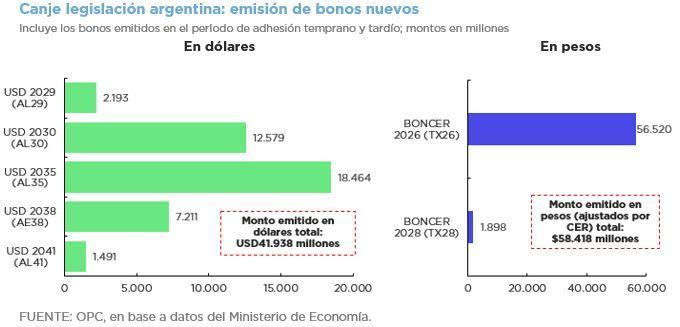

In September, the restructuring operations of foreign currency securities issued under foreign

legislation (Law 27,544) and local legislation (Law 27,556) were settled, which involved

cancellations of eligible securities for USD108.1 billion and placements of new bonds for

USD110.9 billion.

Excluding these operations, there were placements of securities and loan disbursements for the

equivalent of USD4.7 billion, of which AR$252.8 billion (USD3.4 billion) were auctions of

marketable securities in pesos. On the other hand, the equivalent of USD3.1 billion of principal

was paid, mainly due to maturities of Treasury bills in pesos. Likewise, interest payments were

made for the equivalent of USD447 million, of which 76% were in pesos.

Debt service maturities for the equivalent of USD3.86 billion are estimated for October, totaling

USD17.06 billion until the end of the year (approximately USD8.4 billion if holdings within the

public sector are excluded).

by Nicolas Perez | Dec 19, 2019 | Sustainable Development Goals

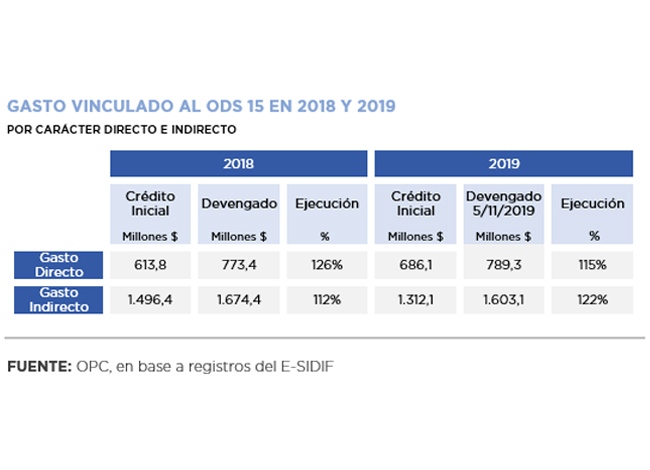

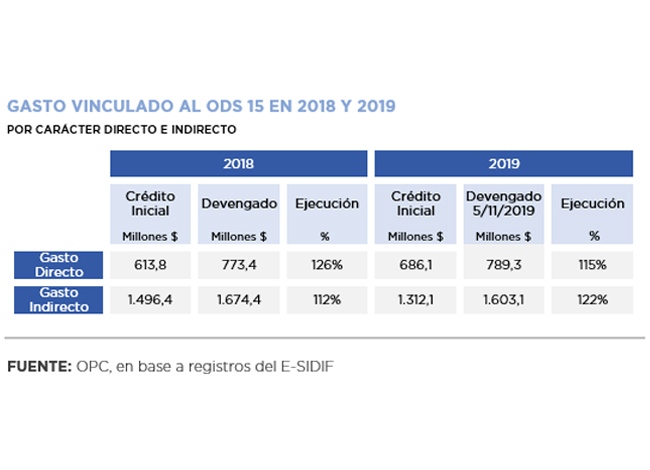

The purpose of this paper is to carry out a budgetary analysis and evaluation of the progress made in Argentina in relation to Sustainable Development Goal 15 (Life of Land): to combat desertification, halt and reverse land degradation and halt biodiversity loss.

This is one of the SDGs set by the United Nations in the framework of the 2030 Agenda, a program to which the country has adhered since 2015 and for which it carried out a process of adaptation of goals and indicators.

To advance with the implementation of the SDG 15, Argentina allocated AR$686 million in direct expenditures as of October (95% for current expenditures and 5% for investments). This amount is 12% higher than that of 2018 in nominal terms and its execution, two months before the closing of the fiscal year, already exceeds 112%. The budgetary significance given to sustainable forest management stands out (91% of direct expenditure related to SDG 15).

The Secretariat of Environment and Sustainable Development is the main agency responsible for its fulfillment, although there are other government agencies involved in the implementation of related programs or sub-programs.

The analysis of their compliance is difficult due to the scarcity of partial and final targets, and in some cases also of baseline. Their budgetary execution is very uneven at the level of programs and activities, ranging from over-execution of more than 300% to activities with no execution at all.

One example is the National Fund for the Enrichment and Conservation of Native Forests (FNECBN), which began to receive specific budget allocations only in 2010. These never covered the minimum amount provided for by Law 26,331 and were even under-executed in most of the fiscal years.

by Nicolas Perez | Dec 12, 2019 | Public Debt Operations

During November, interest payments totaled USD1.35 billion, of which 68% were made in foreign currency. The main disbursements were for the IMF Stand-By credit, a BONAR in dollars and the BONTE in pesos.

There were placements of securities and loan disbursements for the equivalent of USD2.11 billion, of which USD834 million were securities, placed almost entirely with different public sector entities.

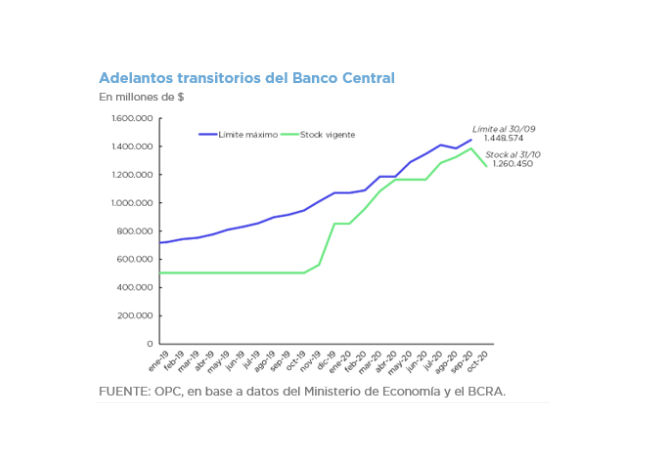

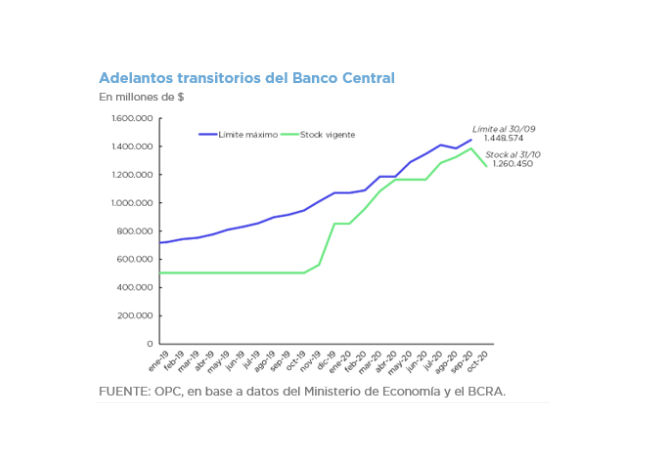

Temporary advances -non-interest-bearing loans from the Central Bank to the Treasury- were made for AR$60 billion, bringing the stock of this instrument to AR$562.73 billion at the end of the month (AR$384.73 billion below the legal ceiling).

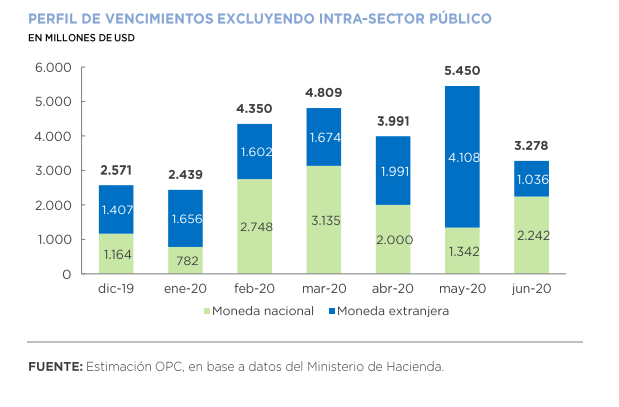

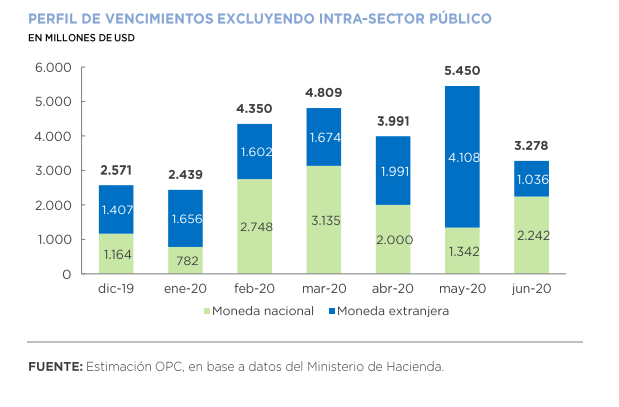

Debt maturities of approximately USD7.3 billion between amortizations (USD4.68 billion) and interest (USD2.62 billion) are to be paid in December.

The debt service maturity profile for the first half of 2020 totals USD45.23 billion. However, when excluding maturities within the public sector, estimated services for the semester are reduced to USD24.31 billion.