by Juan Fourcaud | Nov 11, 2020 | Budget Execution

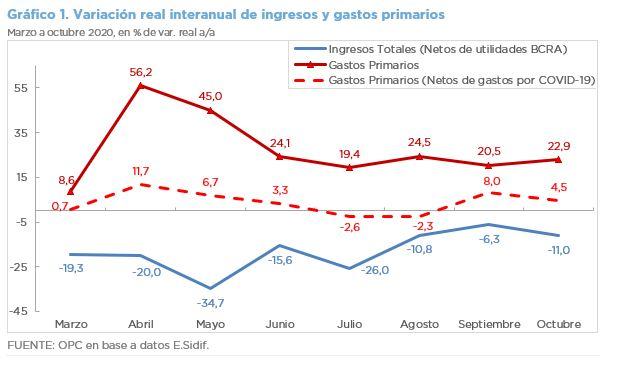

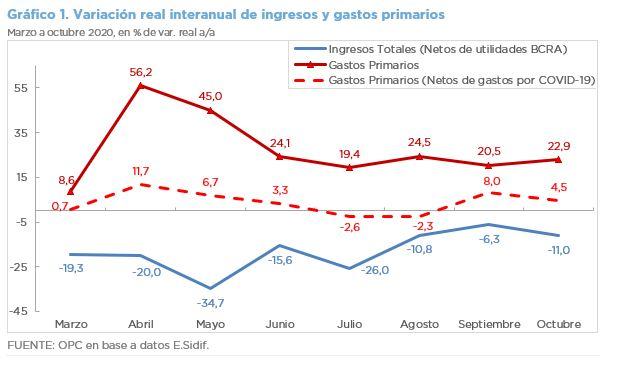

Excluding the profits transferred by the Central Bank to the Treasury, the revenues of the national government fell in October by 11.0% in real terms with respect to the same month of the previous year, while primary expenditures grew by 22.9%, mainly due to the health emergency. The primary deficit totaled AR$75.1 billion.

- The BCRA (Central Bank of Argentina) transferred $30 billion in profits during October, which explains the 5.5% increase in Property Income.

- The national government allocated approximately AR$77 billion to mitigate the economic effects of the COVID-19 crisis in October and for the seventh consecutive month, primary expenditures grew by double digits. Without this allocation, they would have grown at a slower rate of 4.5%.

- Debt interest of AR$31.1 billion was accrued, 73.1% less than last October. This explains why total expenditures only grew by 2.1% in the month.

- The financial balance went from a deficit of AR$54.8 billion in October last year to a deficit of AR$106.2 billion in October this year.

- The slight real improvement of 0.5% YoY in current revenues was driven by Income Tax and Wealth Tax, which partially offset the fall in other taxes.

- Civil service personnel expenditure fell by 9.0% YoY, while pensions increased by 1.9% YoY.

- Energy subsidies totaled AR$24.4 billion, an increase of 42.8% YoY.

- Capital transfers to government-owned companies in the transportation sector had a real growth of 351.9% YoY, basically for the urban railroads and the Belgrano Cargas.

- The initial budget for the year increased by AR$2.7 trillion – 56.5% with respect to the initial appropriation – and 62.7% of this increase was allocated to reinforce social benefits.

by Nicolas Perez | Feb 19, 2020 | Budget Execution

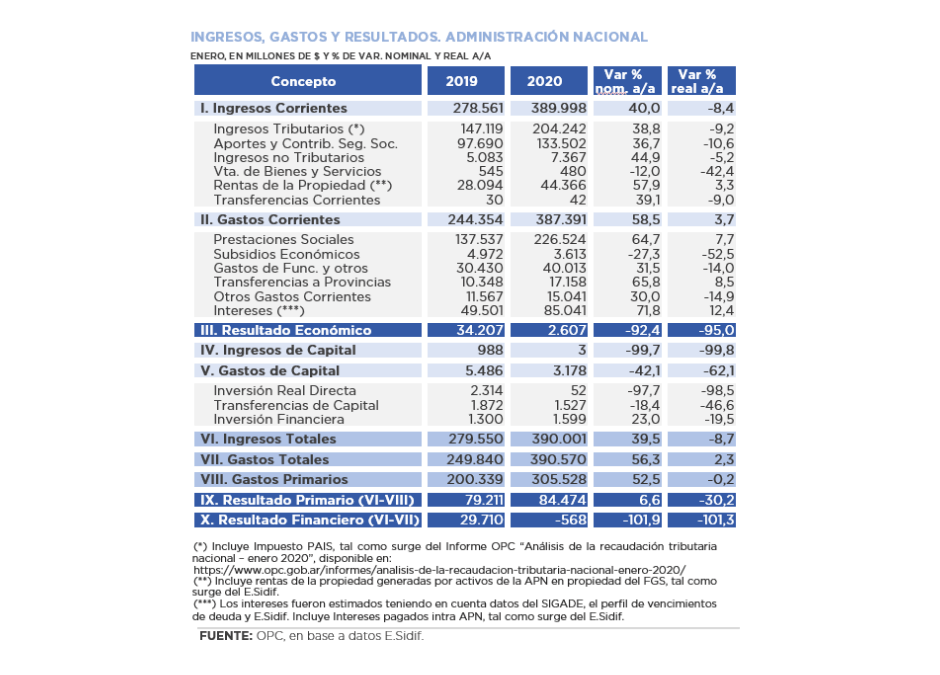

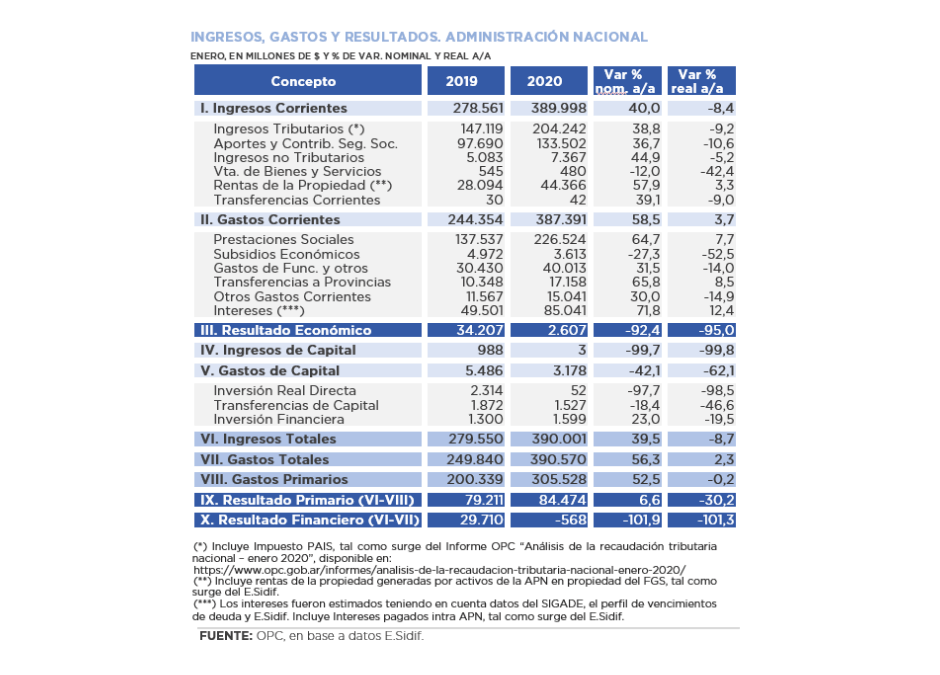

Total revenue recorded a real drop of 8.7% year on year (YoY) in January, while total expenditures had a growth of 2.3% YoY.

This uneven performance resulted in a financial deficit of AR$568 million, which contrasts with the surplus of AR$29.71 billion recorded in January 2019. On the other hand, the primary balance was AR$84.47 billion, 30.2% lower in real terms than in the same month of last year (AR$79,21 billion).

- Tax and social security resources, which together accounted for 86.6% of revenues, showed significant decreases. Income Tax (-18.1% YoY) led the decline mainly due to regulatory issues. The drop is also explained by the legal amendment that reduced the obligation to make contributions on a segment of salaries, in addition to the reduction in the number of contributors last year.

- The distinctive feature of January’s performance was the lower dynamism of Export Duties, which rose only 3.8% in the year-on-year comparison and had been acting as the driving force of the tax collection with sharp increases.

- On the other hand, property income increased, basically due to resources from the Sustainability Guarantee Fund (FGS), which reached AR$42.8 billion, showing a real increase of 7.6% YoY.

- The item Pensions fell 0.6% YoY in real terms. Considering the extraordinary “bonus” of AR$5,000 for the lowest pensions, there was a recovery of 10.3% YoY.

- Economic subsidies (AR$3.61 billion) contracted 52.5% YoY, which is mainly explained by energy subsidies which had registered an execution of AR$2.05 billion in January 2019 and recorded no outlays in January 2020.

- Consumer goods and payment of utilities reflected a real drop of 58.4% YoY, as well as capital expenditures, which fell 62.1% YoY. Debt services, on the other hand, increased by 12.4% YoY compared to January of the previous year.

by Nicolas Perez | Jan 15, 2020 | Budget Execution

Fiscal year 2019 ended with a real increase in resources of 2.1% with respect to the previous year and with a contraction in expenditure of 6.4% YoY, spread across the main components, apart from debt interest, which increased by 10.7% YoY in real terms.

The combination of these behaviors resulted in a financial deficit of AR$845.99 billion, equivalent to 3.9% of the Gross Domestic Product, 1.7 percentage points below that of the previous year. The primary balance showed a surplus of AR$75.49 billion, an improvement compared to 2018.

The evolution of Export Duties was decisive in the increase in tax revenues, which had a real jump of 164.4% year-on-year because of the increase in tax rates, the devaluation of the exchange rate and the higher quantities exported by the soybean sector.

This scenario offset the fall in other tax items and the resources of the social security system, affected by the lower economic activity and the reduction of taxable wages.

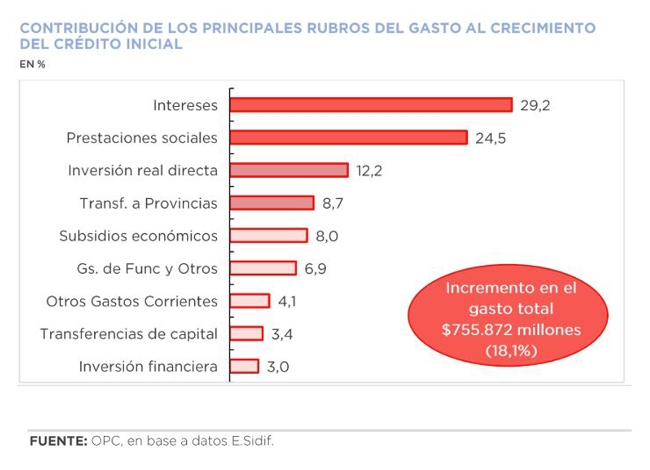

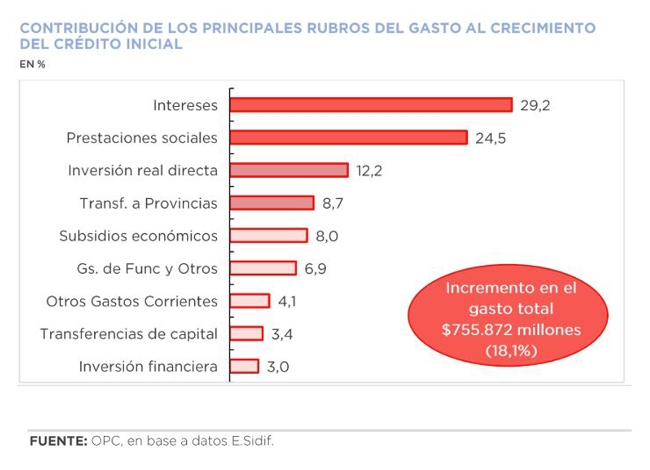

In 2019, national government expenditure reached AR$4.74 trillion, which implies an execution level of 96.2% of the allocated budget. The initial approved appropriation increased by 18.1%, with debt interest being the item that most contributed to such variation (29.2%).

by Nicolas Perez | Dec 19, 2019 | Budget Law

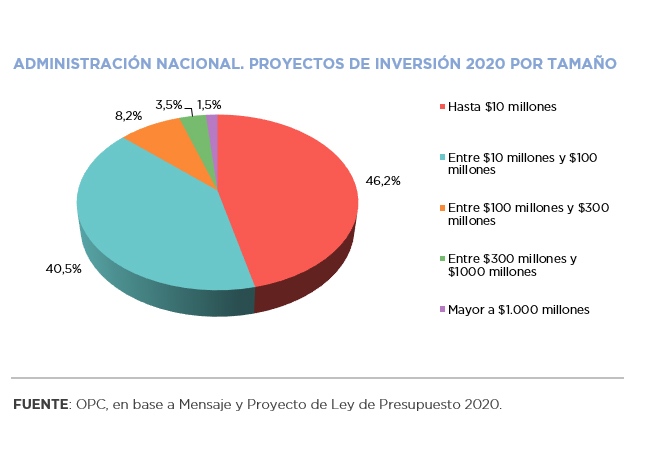

The Budget Bill submitted to Congress in September 2019 estimates a public investment amount for the national government at AR$232.21 billion, with an estimated nominal increase of 19.6% year-on-year with respect to the 2019 closing projection made by the Ministry of Finance.

Public investment of the entire National Public Sector (NPS) -including government-owned companies, trust funds and other entities- would amount to AR$318.02 billion, according to the Message 2020, which is equivalent to 4.9% of the total expenditure of the NPS. This implies a drop of 10.9% year-on-year in relation to what was projected for this year.

The largest increase is in capital transfers made by the national government to other entities or jurisdictions to carry out works or purchase goods, which increased 32.4%. Real direct investment (works projects and equipment acquisition) only increased by 6.1% YoY.

The geographical breakdown of these transfers shows a concentration in the Pampas Region, basically in the Province of Buenos Aires (18%) and in the Autonomous City of Buenos Aires (10.3%), jurisdictions in which half of the real direct investment is concentrated.

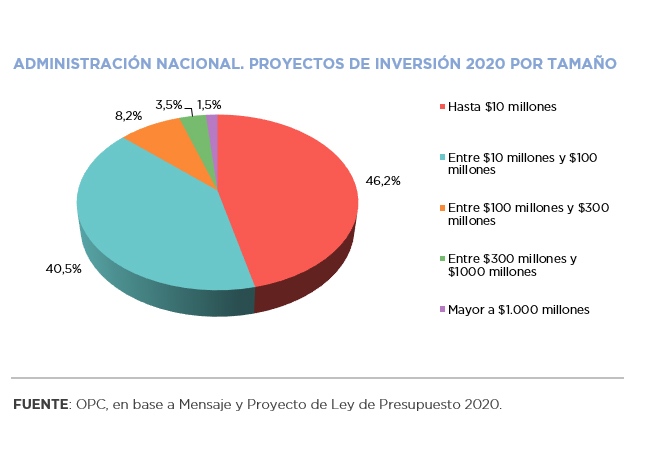

The Bill provides for the execution of 995 projects to be carried out by the national government for an average amount of AR$80 million each. The total amount shows a decline since 2011: from 0.68% of GDP in 2011 to 0.25% in 2020.

The largest amounts are allocated to railway works, such as the improvement of the Belgrano Cargas Railway, which involves several jurisdictions and would demand AR$5 billion, and to the laying of highways, including Route 19 connecting San Francisco with Córdoba or Route 8 connecting Pilar with Pergamino.

In the rest of the Public Sector, the main direct investments would be carried out by government-owned companies: Nucleoeléctrica Argentina S.A. (36.9% of the total), and Integración Energética Argentina S.A. – Ex- ENARSA (30.3%).

by Nicolas Perez | Dec 5, 2019 | Employment and Social Security

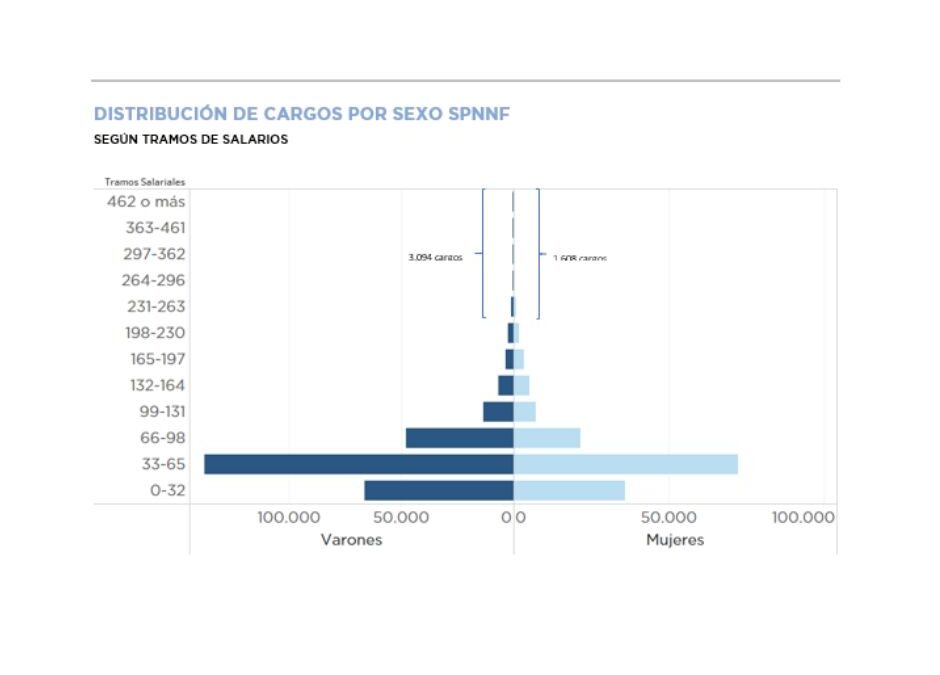

The OPC analysis consists of a description as of April 30, 2019 of government employment in the jurisdictions and entities that make up the National Public Administration (APN), government-owned companies and other entities of the National Non-Financial Public Sector (SPNNF), excluding universities.

This is a universe of 449,797 positions, of which 385,189 belong to APN, 34,239 to Other Entities (non-business but financially autonomous public organizations) and 30,319 to the thirteen government-owned companies for which information is available. Eighty-nine percent are employed by the National Executive Branch. In addition, there are about twenty legal regimes and more than 120 specific scales with different levels of employment.

From a historical viewpoint, while between 2010 and 2015 a sustained growth of employment was identified (with an increase of more than 20% in that term); between 2016 and 2018 the overall trend has been downward, exhibiting a decrease of close to 8% in the National Executive Branch.

Eighty percent comprise the permanent staff, 26% have a university degree -predominantly positioned in decentralized agencies- and the employment is concentrated in two age groups: 20-34 years old and 35-49 years old, both being over 75% of the total.

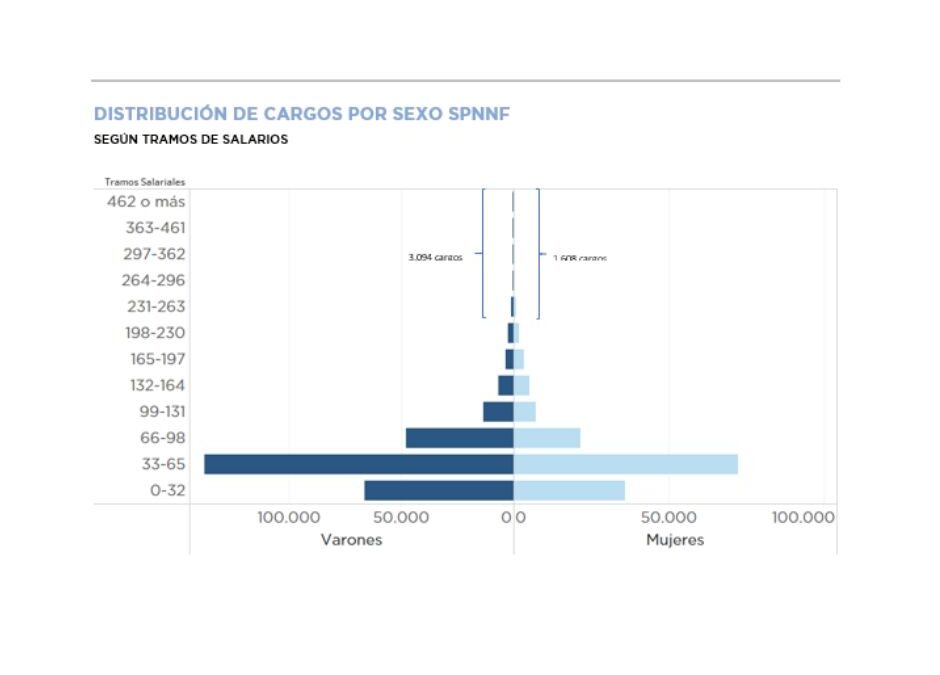

The average gross general salary in this universe is AR$60,748, but most of the employment is below this level (64.2%). In fact, the median of the distribution is AR$48,463. Average salaries are higher in companies and decentralized organizations and contrary to the general level, the Foreign Service of the Nation, the Judiciary and Collective Labor Agreements have a high percentage of their staff with average salaries above AR$66,000.

There is an inverse effect between the level of employment and the average salary. Those regimes with a higher level of employment have average salaries below the general average and those with lower relative employment have salaries above the general average.

An analysis by sex shows that 35.0% of total employment are women and 65.0% are men, a proportion affected by the high relative weight of the armed and security forces. The average salary of women is lower than that of men at all levels of education and, in line with this bias, there is greater representation of men in the higher income segments.

by Nicolas Perez | Nov 8, 2019 | Tax Revenue

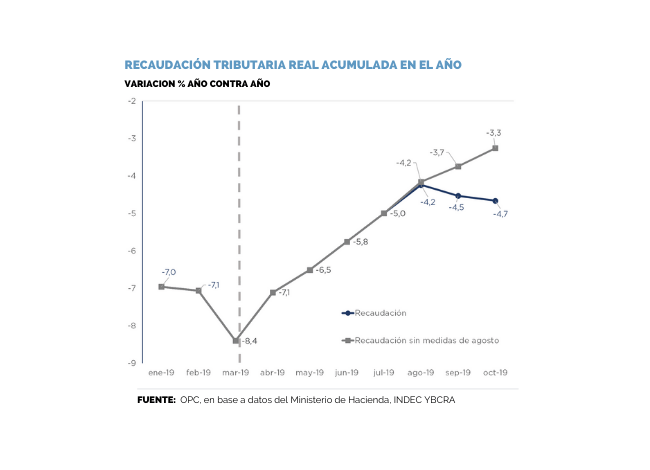

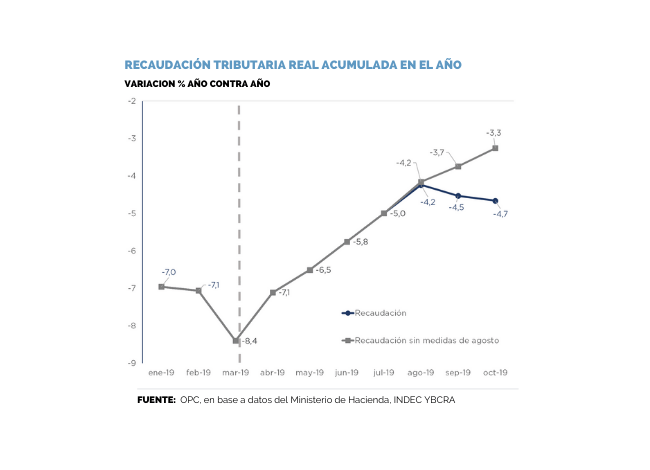

In October, tax revenue totaled AR$446.17 billion, which implied a growth of 42.8% YoY. In the annual cumulative figure as of October, tax resources of the National Public Sector show a 46.8% YoY growth. Revenue decreased by 5.9% YoY in real terms in the tenth month of the year.

October revenues were reduced by the impact of the fiscal stimulus measures announced by the National Executive Power during the month of August. According to OPC estimates, those measures caused a loss of resources of around AR$35 billion last month. Excluding this effect, nominal revenue would have grown 53.9% YoY, and 1.4% YoY in real terms.

The measures mentioned above particularly affected the collection of Income Tax, Social Security and VAT. On the other hand, Export Duties increased in October with respect to the previous month because of a higher number of tons for export.