by Juan Fourcaud | Feb 2, 2021 | Budget Execution

In mid-2020, there were 13,151,586 children and adolescents (up to 17 years of age) in Argentina. 57.1% of that universe was poor and 15.8%, indigent, rates much higher than the general average of the population.

- About 4.6 million of children and 2.9 million of adolescents were below the poverty line.

- Poverty and indigence rates in households with children and adolescents were three times higher than those in households without children and adolescents.

- Of households with employed persons in which minors live, 40% were below the poverty line. This means that despite having at least one salary, this income was not enough to cover the family’s basic needs.

- Of children and adolescents in compulsory education age (4 to 17 years of age), 96.9%were in school, most of them attending public schools. For the non-compulsory segment, this percentage drops to 14.5%.

- The incidence of poverty drops significantly if the head of the household completed his or her secondary education. However, one out of every six households headed by a person with university education was below the poverty line.

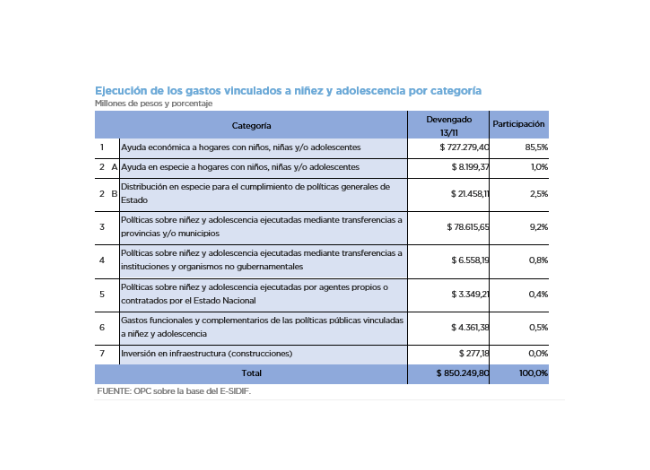

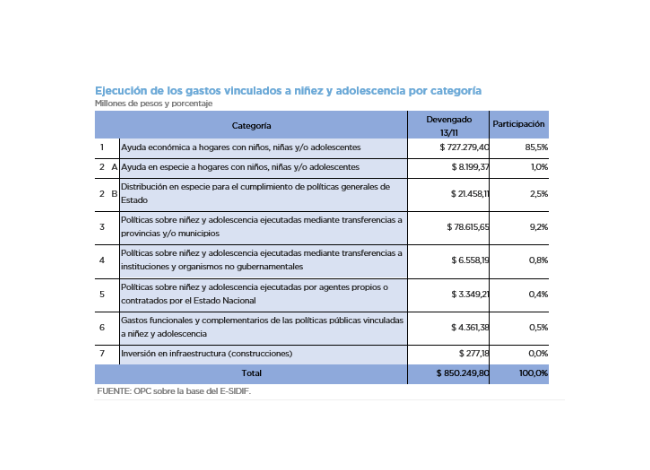

- The actions undertaken by the national government to care for children and adolescents implied a budgetary effort of 3.6% of GDP in 2020, 12.7% of total expenditure.

- Public policy aimed at improving the general conditions of the population, which also have an impact on this segment, required an additional 2.4%.

- State efforts were insufficient to substantially improve the living conditions of this age group, and it is necessary to pay more attention to children and adolescents to guarantee their access to basic rights.

by Nicolas Perez | Oct 14, 2020 | Budget Law

The National Budget Bill for 2021 foresees for next year a decrease in deficits due to the partial

recovery of the economy, with an increase in public investments and a reduction in the payment

of interest on the debt.

- According to the macroeconomic estimates of the Bill, the Gross Domestic Product

(GDP) will suffer a real fall of 12.1% this year, the nominal exchange rate will be AR$81.4

per dollar at the closing of the fiscal year, and the YoY inflation rate will be 32%. Next

year’s GDP is expected to rise 5.5% in real terms, with a nominal exchange rate of

AR$102.4 per dollar in December, and an inflation rate of 29% YoY.

- Resources will increase by 9.7% YoY in real terms and total expenditure will fall by

10.4% YoY.

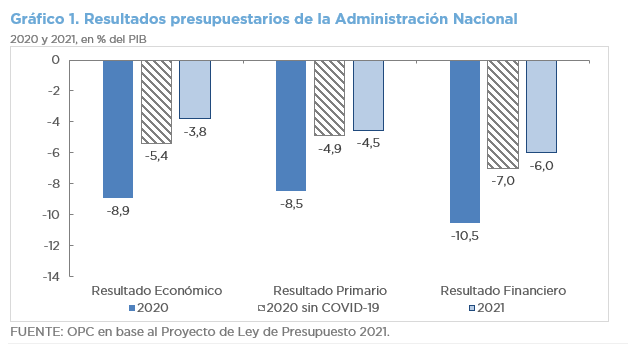

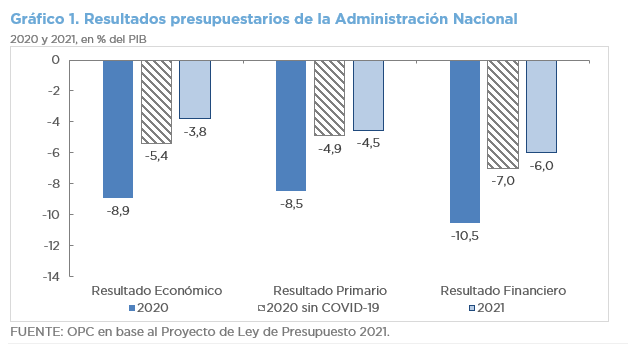

- This dynamic between revenue and spending will lead to an improvement in the primary

balance in 2021, which would go from a deficit of 8.5% of GDP in 2020 to a deficit of

4.5% in 2021. The same applies to the financial balance, which would vary from a deficit

of 10.5% of GDP in 2020 to a deficit of 6.0% in 2021.

- Capital expenditures will have the largest real increase and debt interest the sharpest

decline.

- Gross financing needs in the next fiscal year will be AR$6.4 trillion (17.2% of GDP). The

Central Bank will contribute AR$800 billion to the Treasury, 62.2% less than this year.

- Exports are expected to recover from a 14.2% YoY decline this year to a 10.4% YoY

increase next year.

- The Budget Bill does not provide neither financial allocations for Emergency Family

Income – IFE (Ingreso Familiar de Emergencia) nor for assistance for the payment of

private salaries (ATP), but it does provide a 24.1% increase in resources for vaccines

(AR$45.4 billion), including the purchase of doses against COVID-19 (AR$13.69 billion).

by Nicolas Perez | Dec 11, 2019 | Budget Execution

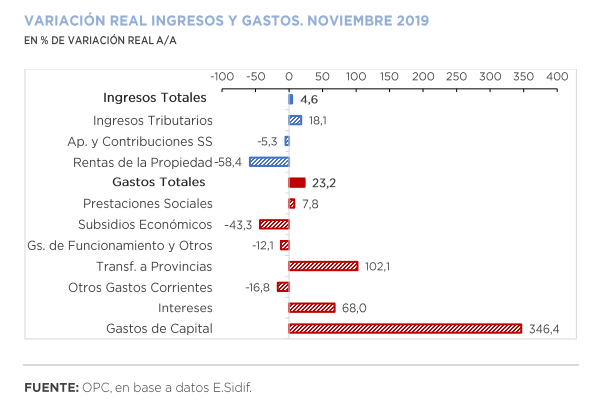

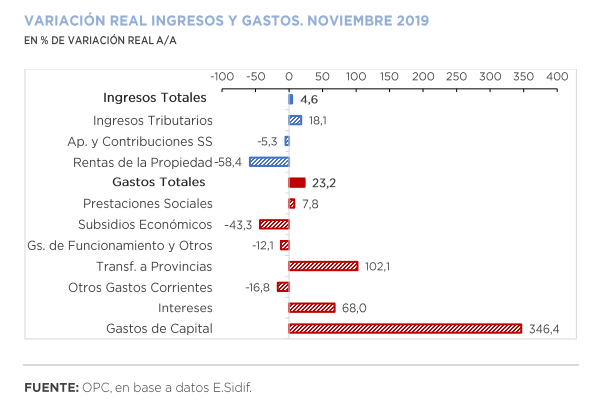

The primary balance for the month of November resulted in a deficit of AR$109.34 billion, the third month of the fiscal year with a negative outcome. Debt interest amounted to AR$124.23 billion, which had an impact on the deficit of AR$233.57 billion in the month and accumulated a disequilibrium of AR$568.49 billion in the eleven months of the current year. Even so, this figure implied a real improvement of 32.9% YoY compared to that recorded in November last year.

National government revenues increased 58.8% year-on-year (YoY), mainly explained by the growth of Export Duties (141.1% YoY in real terms), as the agro-export sector speeded up settlements due to the expectation of an increase in tax rates.

November was the month with the highest year-on-year expansion of total expenditures so far this year (87.2% YoY), mainly driven by the growth of real direct investment (1,302.6% YoY), transfers to provinces (206.9% YoY) and interest on debt (155.1% YoY).

As of November 30, 82.0% of total budget was accrued, with the execution of current transfers to the provinces (86.2%) standing out. During this period, the initial budget approved for the year increased by AR$797.26 billion, which represents 19.1% of the initial appropriation. A total of 88.8% of the amendments were implemented through Necessity and Emergency Decrees, and the remaining 11.2% through Administrative Decisions.

by Nicolas Perez | Jun 10, 2019 | Budget Execution

In May, the national government recorded a primary surplus of AR$23.99 billion but a financial deficit of AR$22.38 billion, within a framework of an acceleration in the fall of revenues in real terms. Expenditures, also in contraction, had the seventh month of decline measured against inflation.

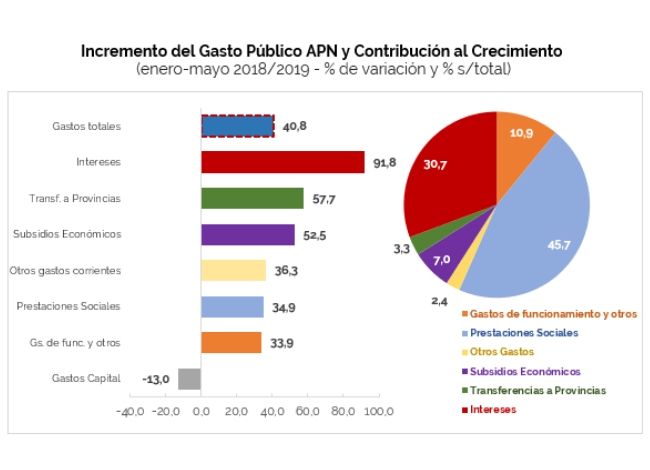

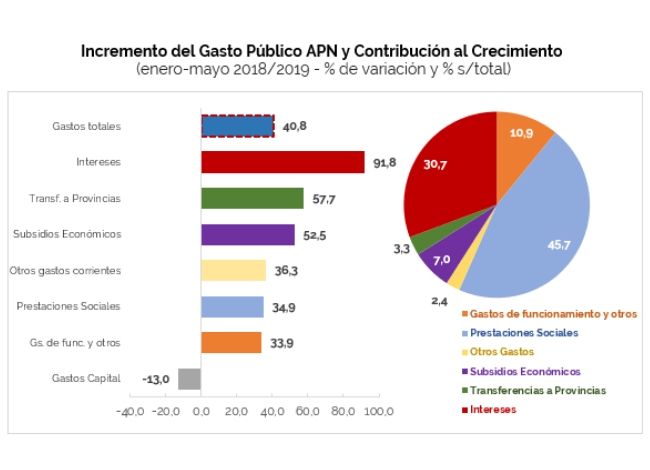

In the term January-May, expenditures increased 40.8% year-on-year. Interest on debt, transfers to provinces and economic subsidies recorded the largest expansions in the period with 91.8%, 57.7% and 52.5% YoY, respectively. Social benefits (34.9% YoY), operating expenses (33.9% YoY) and capital expenditures (-13.0% YoY) were below the increase in total expenditure.

Social benefits account for 45.7% of the increase in total expenditure, while interest payments account for 30.7%. Both explain 76.4% of the increase in expenditure in the period under analysis.

- National government revenues (40.5% YoY) again grew above expenditures (36.9% YoY), although the differential is reduced to 3.6 percentage points (p.p.) (5.2 p.p. in April).

- Personnel expenditure recorded a real fall of 14.6% YoY, in line with the retraction experienced in the salaries of several sectors (SINEP).

- After the first five months of the year, the financial balance is in deficit by AR$180.51 billion, reflecting a real reduction of 17.0% compared to the same period of the previous year.

- So far this year, the expenditure components that grew the most were Debt Interest (91.8% YoY), Transfers to Provinces (57.7% YoY) and Economic Subsidies (52.5% YoY). At the other extreme, capital expenditure contracted 13.0% YoY in nominal terms.

- The 76.3% of national government expenditure is rigid.

- At the end of May, the execution level of total expenditure reached 35.4% with respect to the current appropriation, higher than the level observed during the same period of the previous year, which reached 32.3%.