ANALYSIS OF BILL “BASES AND STARTING POINTS FOR THE FREEDOM OF ARGENTINES” – REPORT 6 – CULTURE (SEC. 564, 584, 587-590, AND 599)

This report analyzes budget amendments planned in agencies related to culture. The report includes the following measures:

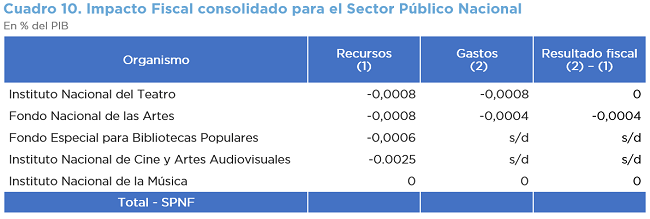

- Repeal of the Law creating the National Theater Institute and reallocation of its resources. The funds that would no longer be received would be compensated with savings in expenses, thus not implying a net fiscal impact.

- Repeal of the Decree-Law creating the National Arts Fund and reallocation of its resources. This could imply a fiscal cost of about 0.0004% of the GDP.

- Repeal of Title V of Law 23,351, which created the Special Fund for Community Libraries. The resources that would no longer be received would represent about 0.0006% of the GDP, being impossible to determine the impact on the expenditure side.

- Modification in the resources received by the National Institute of Cinema and Audiovisual Arts. The tax resources that the agency would no longer receive from the tax on recorded videograms would represent an amount equivalent to 0.0024% of GDP.

- Amendment to the Law of Creation of the National Institute of Music as regards the resources of the Financing Fund, which would be determined by the Secretariat of Culture of the Nation. The measure would not imply a fiscal impact since the specific allocation would remain in force.