ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – JUNE 2023

Despite the decrease in revenues, in the first six months of the year the National Government recorded a real drop in the economic, primary, and financial deficits.

- The financial deficit for the first half of the year was 14.0% lower in real terms than in the same period of the previous year.

- The primary deficit -which does not include interest payments- fell by 26.2% in real terms.

- Revenues contracted by 5.3% YoY in real terms and total expenses by 7.8% YoY.

- Tax revenues fell 10.1% YoY, partially offset by a 1.6% YoY improvement in social security revenues. However, in June, for the first time in the year, social security contributions fell compared to the same month of last year.

- Primary expenditures fell 9.8% YoY in the accumulated to June, a contraction led by the reduction in energy subsidies (27.3% YoY), in social benefits (10.0% YoY) and in transfers to provinces (25.3% YoY).

- Personnel expenses (8.0% YoY), transfers to universities (8.0% YoY) and subsidies to the transportation sector (15.1%) expanded in the comparison between both half-year periods.

- On a month-on-month basis, primary expenditures showed twelve months of consecutive declines.

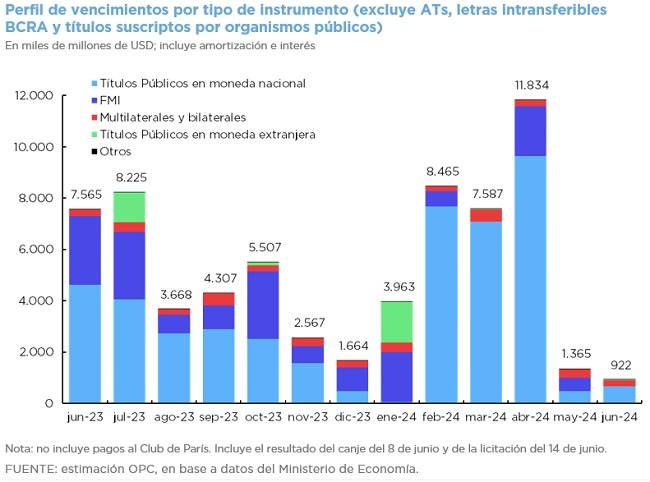

- Debt interest payments rose 18.3% YoY.

- The Progresar student grants and the Acompañar program showed positive real variations, unlike other large social programs.