THE OPC PRESENTED THE LATEST BUDGET EXECUTION REPORT TO LEGISLATORS

The Argentine Congressional Budget Office presented the latest published report on the Analysis of the National Government Budget Execution – January 2024 to national legislators and their advisors.

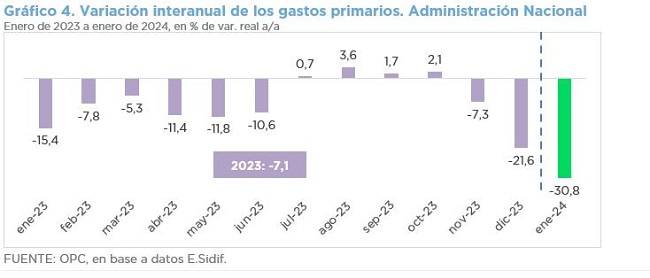

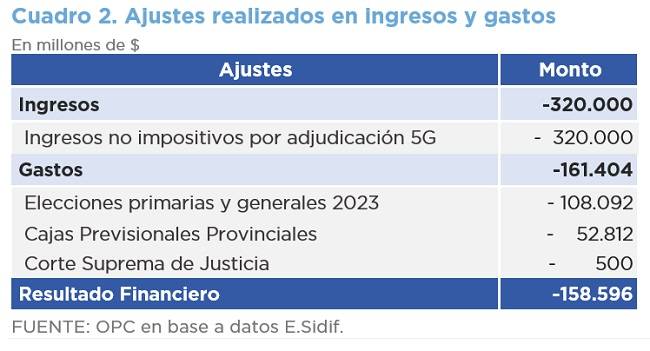

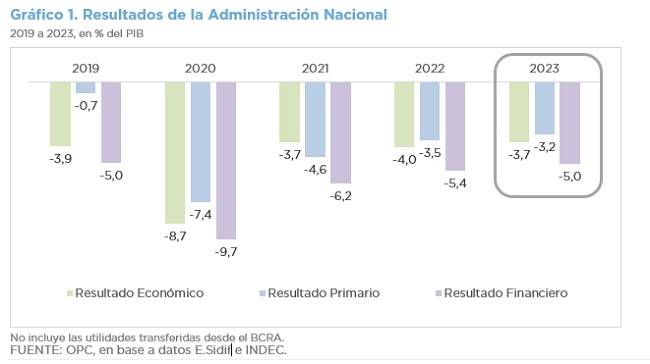

This is one of the periodic works conducted by the OPC with the purpose of monitoring revenues collected and expenditures accrued.

The presentation was given by the OPC Director, Gabriel Esterelles, together with the directors of Sustainability and Public Debt Analysis, Joel Vaisman; of Fiscal and Tax Analysis, Martín López Amorós; of Budget Analysis, Ignacio Lohle, and the analyst of this last directorate, María Laura Cafarelli.

The purpose of the online meeting was to provide members of the Chamber of Deputies and the Senate, as well as their assistants, with technical elements to improve the understanding of the monthly report disseminated through the OPC web page, offering, at the same time, the possibility of clarifying doubts about the methodology used and the results obtained.

The good reception of this new work modality was the basis for the decision to repeat it periodically to consolidate the technical dialogue between the OPC and the National Congress.