ANALYSIS OF NATIONAL GOVERNMENT BUDGET EXECUTION – AUGUST 2021

Driven by the strong increase in Export Duties, VAT, and Income Tax, in that order, National Government revenues increased by 12.3% in August in real terms year-on-year (YoY).

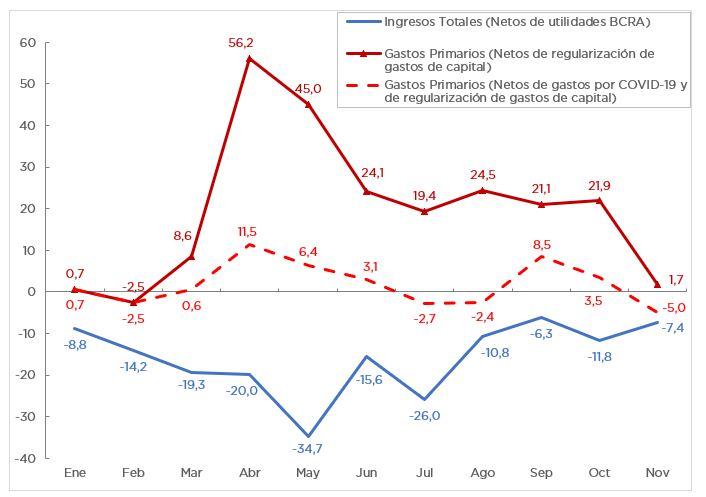

Mainly because of the increase in capital expenditures and energy subsidies, primary expenditures once again grew above inflation for the second time this year, breaking the opposite trend they had shown in the last five months: 5.0% YoY.

The dynamics between revenues and expenditures resulted in an improvement in real terms of the primary, fiscal, and revenue deficits: he year-on-year comparison showed a decrease of 39.3%, 21.7% and 13.3%, respectively.

- Social Security contributions grew 4.2% year-on-year. The number of contributors to the system increased but taxable income grew below inflation.

- Since May, ARS179.285 billion have been collected through the Solidarity and Extraordinary Contribution and ARS65.938 billion have been spent.

- Subsidies to the Compañía Administradora del Mercado Mayorista Eléctrico (CAMMESA) amounted to ARS102.935 billion with an increase of 126.6% YoY because of the gap between the cost of generation and tariffs and the delay in payment by the electricity distributors.

- At the end of August, approximately ARS256.75 billion were executed, equivalent to 61.5% of the current appropriation (ARS417.187 billion) to meet the expenses related to the fight against COVID-19.

- The initial budget for the year was increased by ARS1.015 trillion, with priority being given to social programs, energy subsidies and the procurement and distribution of vaccines.